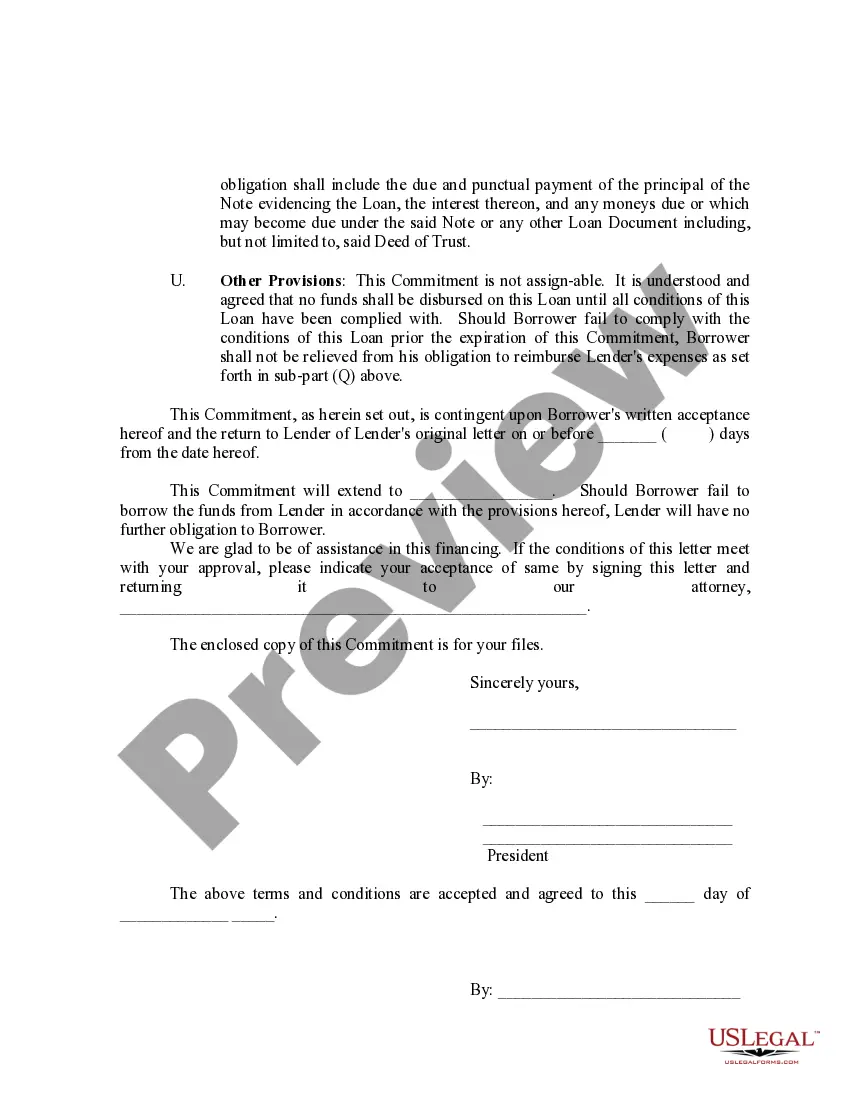

Maryland Loan Commitment Agreement Letter

Description

How to fill out Loan Commitment Agreement Letter?

If you need to total, acquire, or print out legitimate record templates, use US Legal Forms, the largest assortment of legitimate varieties, which can be found on the web. Use the site`s simple and convenient search to get the papers you require. A variety of templates for company and personal purposes are categorized by categories and suggests, or keywords. Use US Legal Forms to get the Maryland Loan Commitment Agreement Letter within a handful of mouse clicks.

When you are currently a US Legal Forms customer, log in for your bank account and click on the Obtain option to have the Maryland Loan Commitment Agreement Letter. You can also accessibility varieties you previously saved from the My Forms tab of your own bank account.

If you work with US Legal Forms for the first time, refer to the instructions under:

- Step 1. Be sure you have selected the shape to the right area/land.

- Step 2. Utilize the Preview choice to look through the form`s content. Never overlook to read the information.

- Step 3. When you are unhappy together with the develop, utilize the Look for discipline on top of the display screen to locate other versions of your legitimate develop design.

- Step 4. Once you have discovered the shape you require, click on the Get now option. Opt for the rates prepare you favor and add your accreditations to sign up for an bank account.

- Step 5. Method the purchase. You can utilize your Мisa or Ьastercard or PayPal bank account to accomplish the purchase.

- Step 6. Select the structure of your legitimate develop and acquire it on your own system.

- Step 7. Complete, modify and print out or signal the Maryland Loan Commitment Agreement Letter.

Each legitimate record design you buy is your own property eternally. You have acces to every develop you saved inside your acccount. Click the My Forms segment and select a develop to print out or acquire once again.

Contend and acquire, and print out the Maryland Loan Commitment Agreement Letter with US Legal Forms. There are many expert and status-specific varieties you can use for your company or personal demands.

Form popularity

FAQ

A mortgage commitment letter includes the amount being borrowed, the interest rate, and the length of the loan. There will also be conditions attached, such as the requirement to carry homeowner's insurance. A lender can still deny a loan at closing if these conditions have not been met.

Because commitment letters are legally binding agreements, terms should be precise and detailed and include all material terms. Any ambiguity in the terms outlined in the commitment letter will often be construed against the lender.

This final letter typically contains the following: The lender's name. The borrower's name. A statement of approval for the loan. The type of loan. The loan amount. The term. The interest rate. The date of commitment.

Write clearly. Ensure that the letter is straightforward and the parties cannot interpret it differently. To achieve clarity, include as many details as possible to avoid any misunderstandings. Only include the terms that both parties have agreed on.

Two examples of open-end secured loan commitments for consumers are a secured credit card?where money in a bank account serves as collateral?and a home equity line of credit (HELOC)?in which the equity in a home is used as collateral.

A mortgage commitment letter is a formal document from your lender stating that you're approved for the loan. Lenders issue a mortgage commitment letter after an applicant successfully completes the preapproval process.

To obtain a conditional or final commitment letter, you'll need to go through your chosen lender's mortgage preapproval process. Doing so may require you to provide documentation such as pay stubs, bank statements, and other materials that provide proof of employment and earnings.

We can define a commitment letter as a formal and legally binding document that a lender issues to a loan applicant. The commitment letter indicates that a loan applicant has passed the various underwriting guidelines and that their loan agreement or mortgage note has been approved.