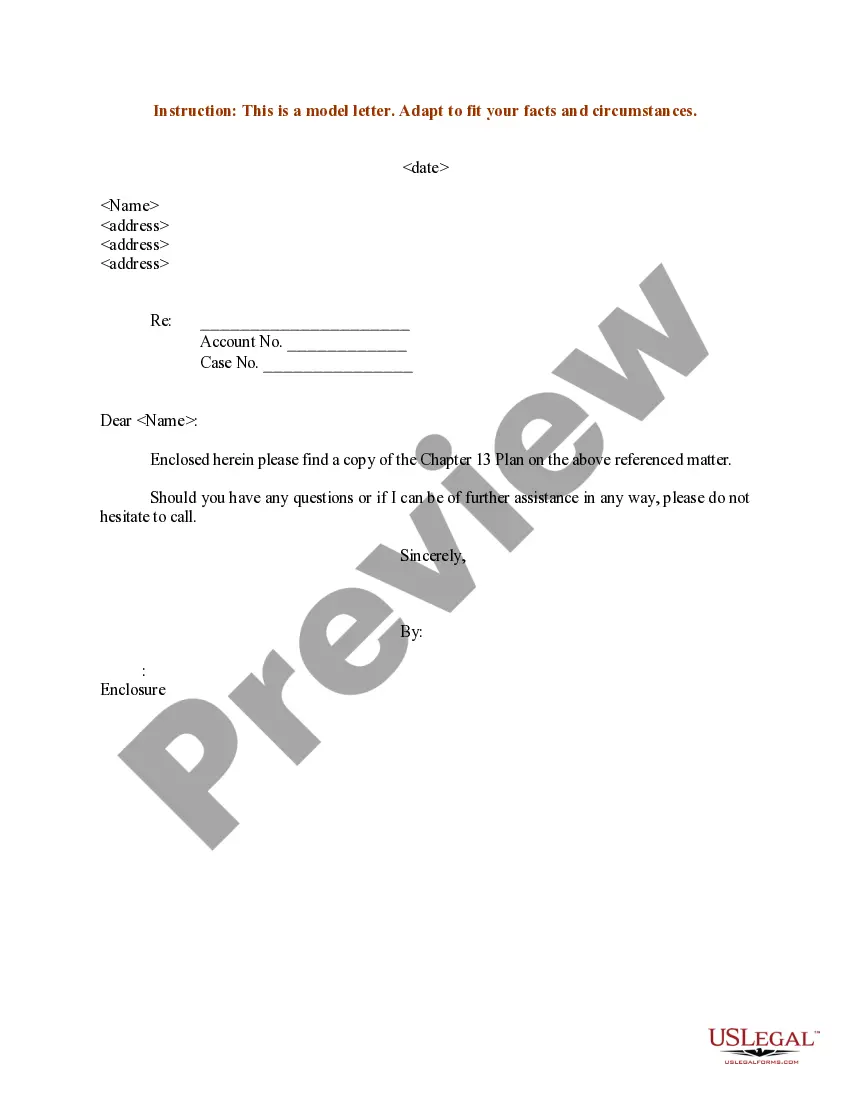

Maryland Sample Letter regarding Chapter 13 Plan

Description

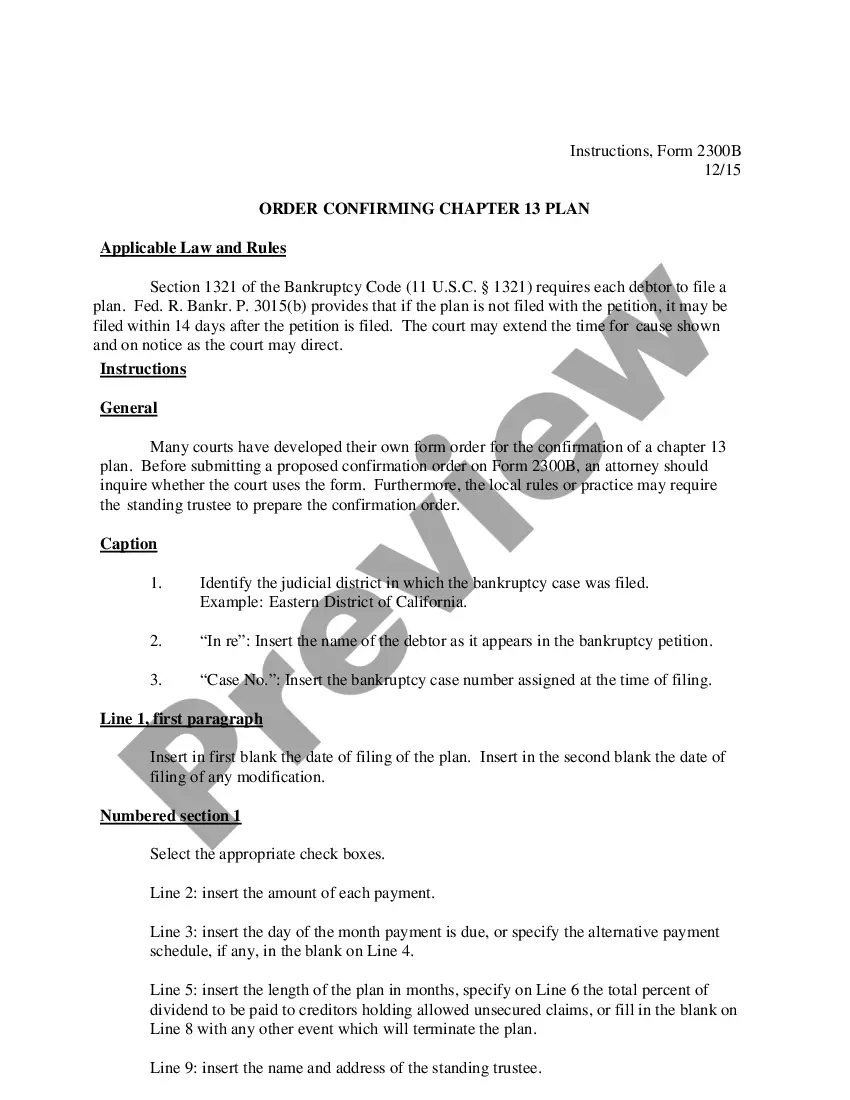

How to fill out Sample Letter Regarding Chapter 13 Plan?

If you need to complete, obtain, or print out legal record templates, use US Legal Forms, the biggest collection of legal forms, which can be found on-line. Make use of the site`s simple and easy hassle-free search to find the papers you will need. Different templates for organization and personal reasons are sorted by categories and says, or key phrases. Use US Legal Forms to find the Maryland Sample Letter regarding Chapter 13 Plan with a couple of mouse clicks.

When you are previously a US Legal Forms customer, log in in your account and click the Acquire switch to find the Maryland Sample Letter regarding Chapter 13 Plan. You can even gain access to forms you previously delivered electronically in the My Forms tab of your own account.

If you are using US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have selected the shape for that proper city/region.

- Step 2. Make use of the Review choice to look over the form`s content material. Don`t overlook to read through the description.

- Step 3. When you are unhappy with the kind, take advantage of the Search field towards the top of the display screen to find other models of the legal kind design.

- Step 4. Upon having located the shape you will need, go through the Get now switch. Choose the rates strategy you like and add your references to sign up to have an account.

- Step 5. Procedure the deal. You can use your bank card or PayPal account to complete the deal.

- Step 6. Select the format of the legal kind and obtain it in your product.

- Step 7. Complete, revise and print out or sign the Maryland Sample Letter regarding Chapter 13 Plan.

Every legal record design you buy is the one you have eternally. You may have acces to every single kind you delivered electronically inside your acccount. Select the My Forms portion and pick a kind to print out or obtain once again.

Be competitive and obtain, and print out the Maryland Sample Letter regarding Chapter 13 Plan with US Legal Forms. There are many skilled and express-specific forms you can utilize for the organization or personal requirements.

Form popularity

FAQ

You may make payments by wage order, by mail or by TFS Bill Pay. We DO NOT accept cash. A wage order directs your employer to deduct your Chapter 13 plan payment from your wages and send it directly to the Chapter 13 Trustee. Historically, debtors with wage orders have the highest likelihood of success.

The Minimum Percentage of Debt Repayments In A Chapter 13 Bankruptcy Is 8 To 10 Percent.

In a Chapter 13, an objection to confirmation is basically a written statement from the Chapter 13 Trustee or a creditor of the debtor that there is something wrong with the case that needs to be fixed before the confirmation hearing.

Also called a wage earner's plan, Chapter 13 enables individuals with regular income to develop a plan to repay all or part of their debts. Under Chapter 13, you work with the court on a repayment plan to make installments to creditors over 3 to 5 years.

To calculate your monthly payment amount in a Chapter 13 bankruptcy, calculate your income for the six months before your bankruptcy filing. Deduct allowable expenses to determine your disposable income. Pay your priority debtors and any secured debts that you want to keep after the bankruptcy.

If the court declines to confirm the plan or the modified plan and instead dismisses the case, the court may authorize the trustee to keep some funds for costs, but the trustee must return all remaining funds to the debtor (other than funds already disbursed or due to creditors). 11 U.S.C. § 1326(a)(2).

Under Chapter 13, you will propose a specific payment plan that works for you, and you will be making monthly payments to pay your debt within a three to five year period. The duration of your repayment plan will depend on your monthly income.

3. Creating a Repayment Plan. After disposable income is reported to the court, the bankruptcy trustee will develop a repayment plan based on the debtor's income and debt obligations. If a debtor's income is below the median income in their state, their repayment plan will last for three years.