A Maryland Performance Bond is a type of surety bond that guarantees the satisfactory completion of a project or contract according to its terms and conditions. It provides financial security to the project owner (known as the obliged) in case the contractor (known as the principal) fails to fulfill their contractual obligations. The bond ensures that the project owner is protected from potential financial losses or damages caused by the contractor's non-performance. The purpose of a Maryland Performance Bond is to ensure that the contractor adheres to all the contract specifications, completes the project within the agreed-upon timeframe, and meets quality and safety standards. It serves as a reassurance for the project owner that they will be compensated or the project will be completed as per the contract terms, even if the contractor defaults. In Maryland, there are different types of Performance Bonds depending on the nature of the project or contract. Some common types include: 1. Construction Performance Bond: This bond is specifically designed for construction projects in Maryland, ensuring that contractors fulfill their contractual obligations, such as completing the project as per plans and specifications, meeting quality standards, and addressing any defects or deficiencies. 2. Subcontractor Performance Bond: This bond is executed between a contractor and their subcontractor(s). It guarantees the subcontractor's performance and ensures they fulfill their obligations as stated in their contract with the contractor. 3. State or Government Performance Bond: These bonds are required for contractors bidding on state or government-funded projects. They guarantee that the contractor will meet all contractual requirements, including project completion, compliance with regulations, and payment of subcontractors and suppliers. 4. Payment and Performance Bond: This type of bond combines both payment and performance obligations. It ensures that the contractor not only completes the project but also pays all subcontractors, suppliers, and other parties involved in the project. 5. Maintenance Bond: In some cases, a Maryland Performance Bond may also include a maintenance period, commonly known as a maintenance bond. It guarantees that the contractor will address any defects or issues that arise during the warranty or maintenance period following the project's completion. Overall, a Maryland Performance Bond acts as a safeguard for project owners by providing financial protection and assurance that the contractor will fulfill their obligations. It offers peace of mind to all parties involved in a project and encourages accountability, professionalism, and adherence to contractual obligations in the construction and other industries.

Maryland Performance Bond

Description

How to fill out Maryland Performance Bond?

US Legal Forms - among the largest libraries of legitimate kinds in the USA - provides a variety of legitimate file themes it is possible to acquire or printing. Using the site, you may get 1000s of kinds for company and personal purposes, sorted by classes, claims, or keywords and phrases.You will discover the newest types of kinds like the Maryland Performance Bond within minutes.

If you have a registration, log in and acquire Maryland Performance Bond from the US Legal Forms catalogue. The Down load key can look on each kind you look at. You get access to all in the past acquired kinds in the My Forms tab of your accounts.

If you want to use US Legal Forms initially, here are easy instructions to obtain started off:

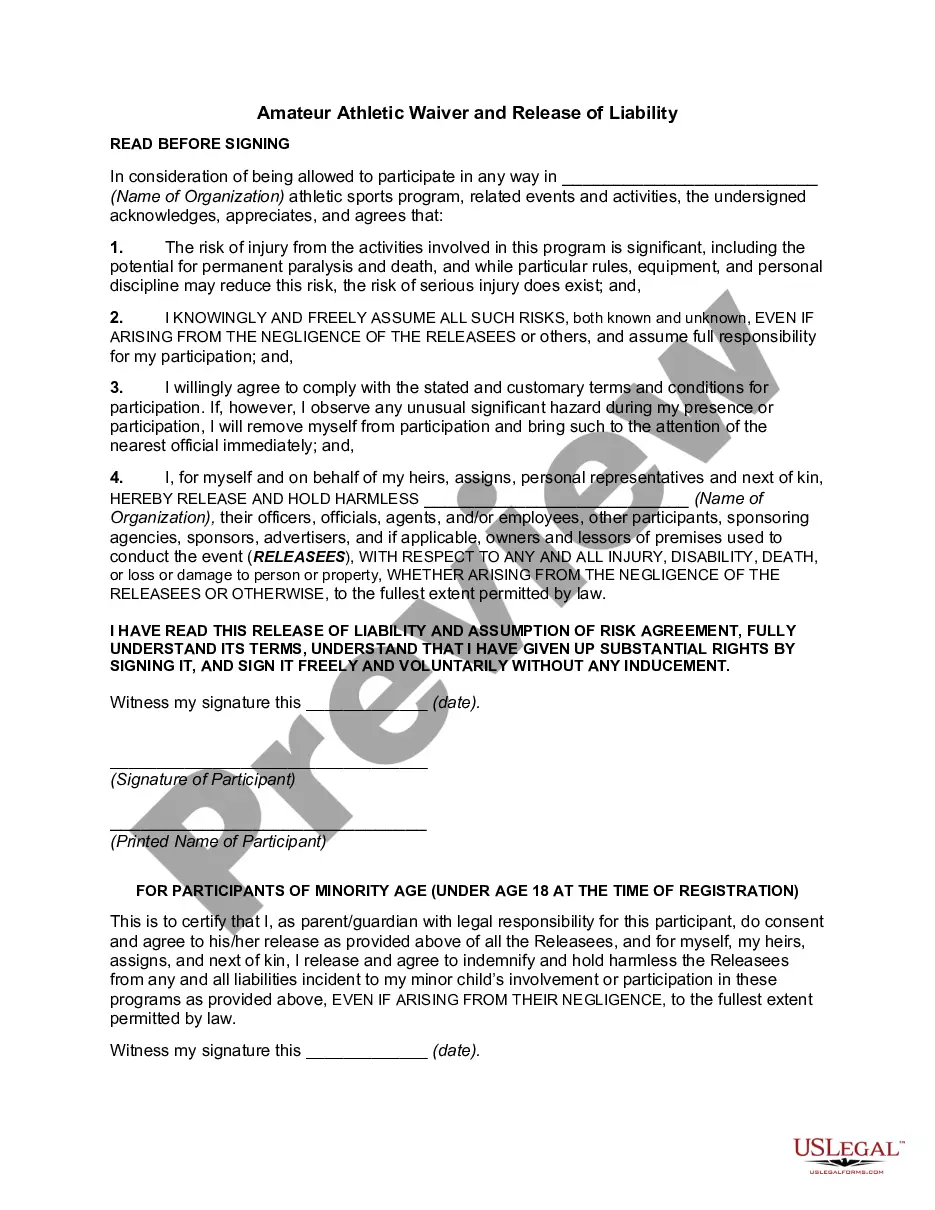

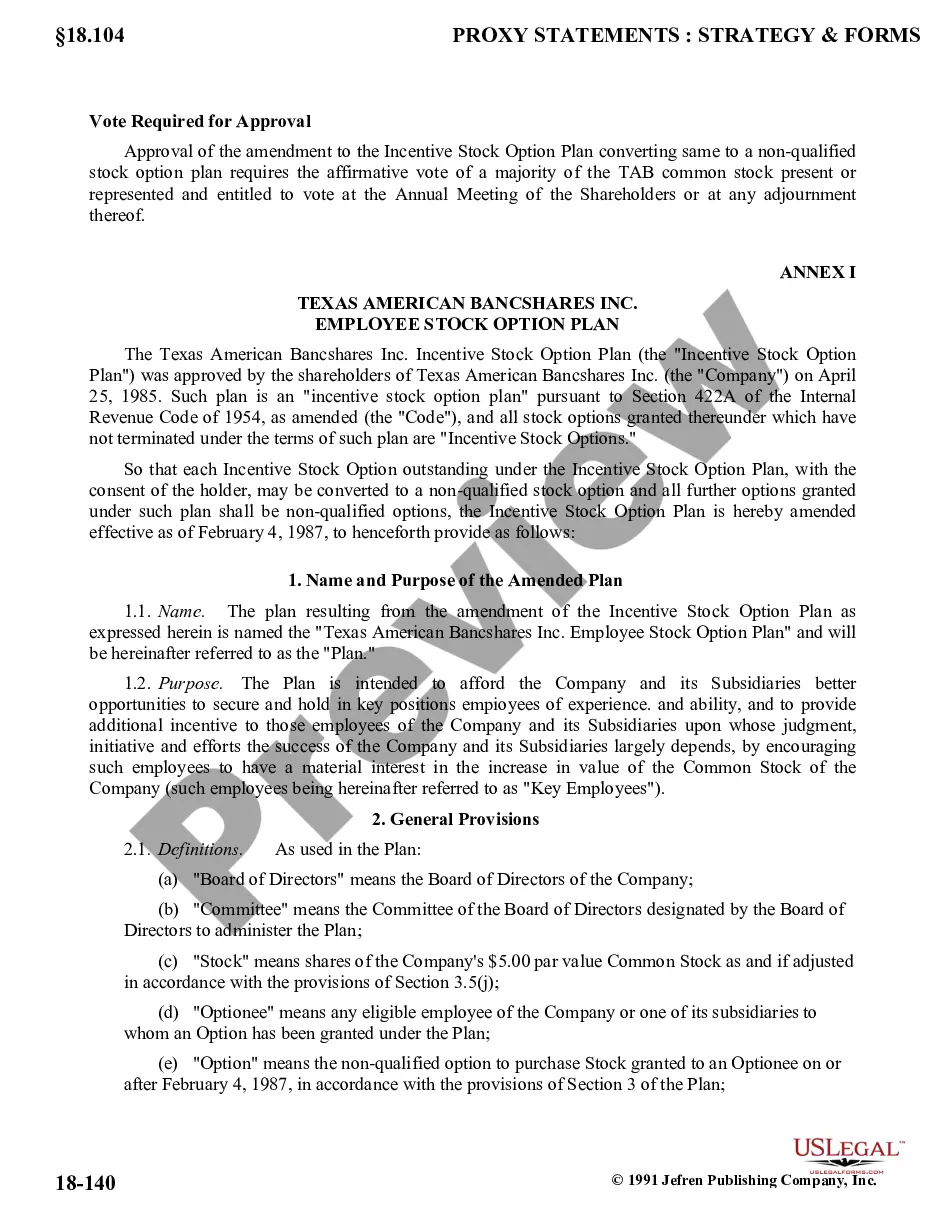

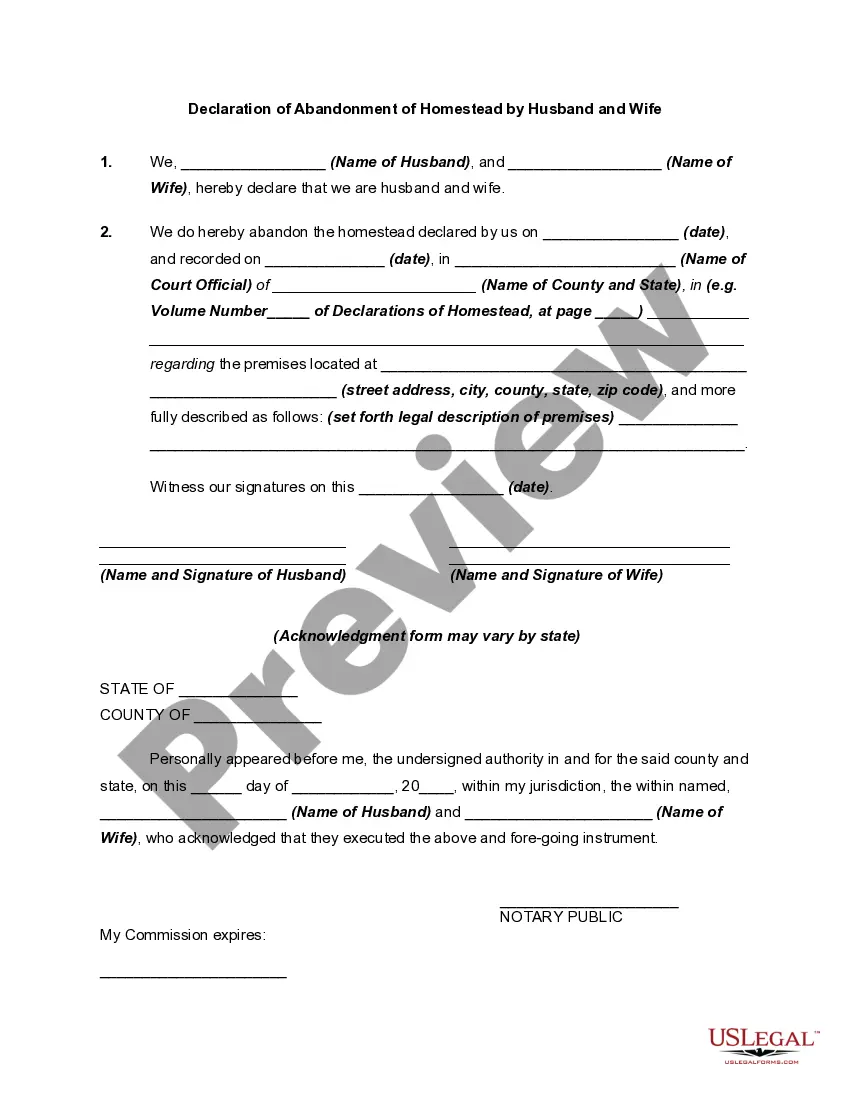

- Be sure you have picked out the right kind to your town/state. Select the Preview key to examine the form`s content material. See the kind explanation to actually have chosen the proper kind.

- When the kind doesn`t fit your demands, make use of the Lookup industry near the top of the monitor to get the one that does.

- In case you are satisfied with the form, validate your decision by clicking on the Acquire now key. Then, select the costs plan you want and give your accreditations to register for an accounts.

- Method the purchase. Make use of bank card or PayPal accounts to finish the purchase.

- Select the format and acquire the form on your product.

- Make modifications. Fill up, modify and printing and indication the acquired Maryland Performance Bond.

Every format you put into your account lacks an expiry particular date and is also yours forever. So, if you want to acquire or printing yet another backup, just go to the My Forms area and click on in the kind you need.

Get access to the Maryland Performance Bond with US Legal Forms, probably the most extensive catalogue of legitimate file themes. Use 1000s of professional and express-distinct themes that fulfill your organization or personal requirements and demands.

Form popularity

FAQ

A performance bond issued by a financial institution guarantees the fulfillment of a contract. If the U.S. exporter fails to "perform" as agreed, the buyer is compensated. A bid bond - often required in a bid selection process - guarantees the foreign buyer that the U.S. exporter will execute the contract if selected.

Maryland requires a surety bond amount between $5,000 and $25,000, which can be obtained for a premium as low as $100 annually (based on a $5,000 liability).

The state of Maryland Department of Labor requires mortgage lenders to post a surety bond in the amount of $50,000, $100,000, or $150,000 depending upon your business's annual loan volume.

You need to provide a surety bond as a part of the process in an amount between $50,000 and $150,000, depending on your yearly volume of business. The bond ensures your compliance with the Maryland Mortgage Lender Law.

Performance bonds are a subset of contract bonds and guarantee that a contractor will fulfill the terms of the contract. If they fail to do so, the Surety company is responsible for completing the contract obligations, either by securing a new contractor to complete the job or by financial compensation.

You can get a surety bond from an insurance agency or a surety bond agency. Many people choose to get their Marland bond through a surety bond agency because of better rates. Many surety bond companies allow you to apply online for your bond. Browse available Maryland bonds.

A surety bond protects you against the costs of claims about shoddy, incomplete work as well as theft and fraud. You may need to purchase a bond as a means of getting a business license or permit.

One key difference between performance bonds and surety bonds is the scope of their coverage. Performance bonds only cover a specific project, while surety bonds can cover multiple projects or ongoing business activities. Another difference is the party responsible for paying the bond premium.