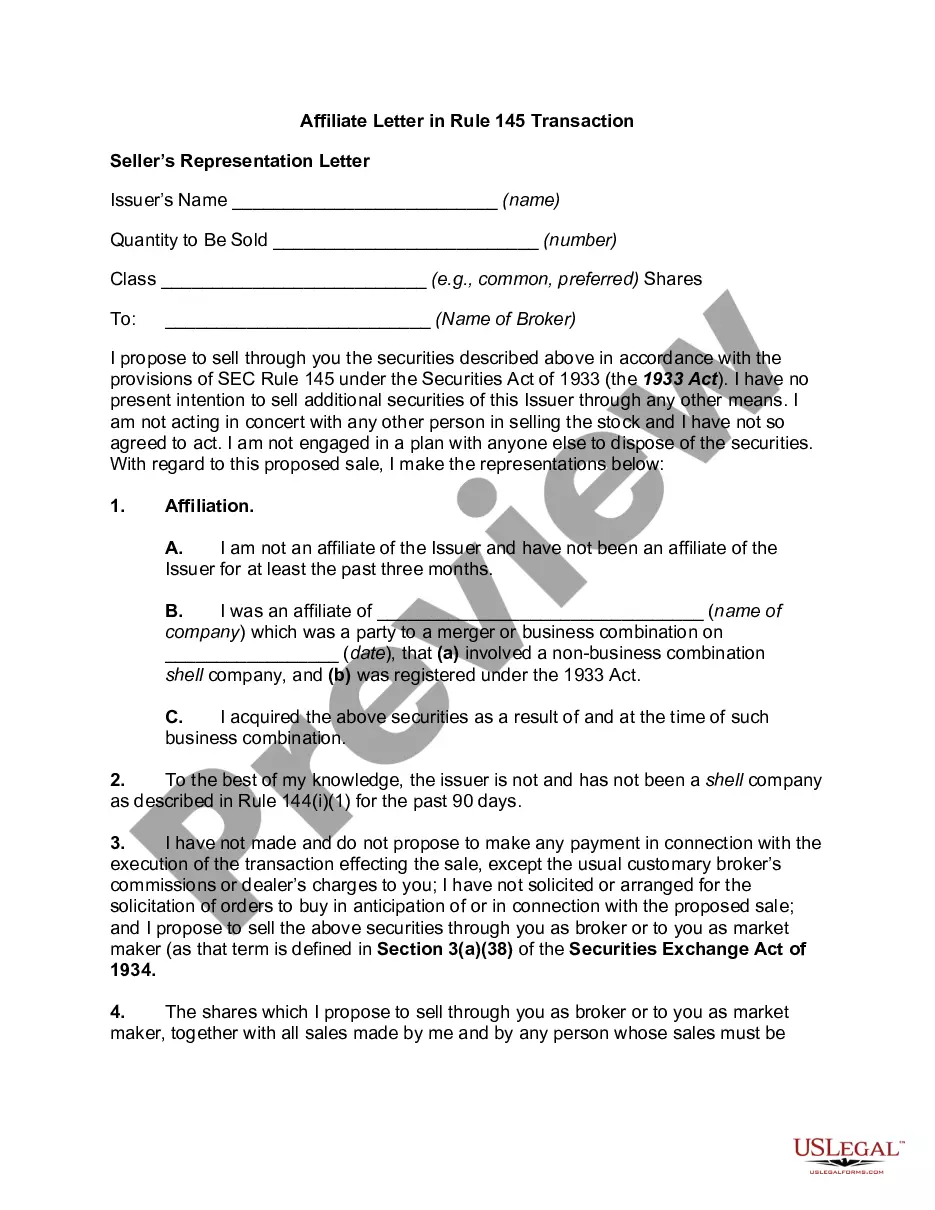

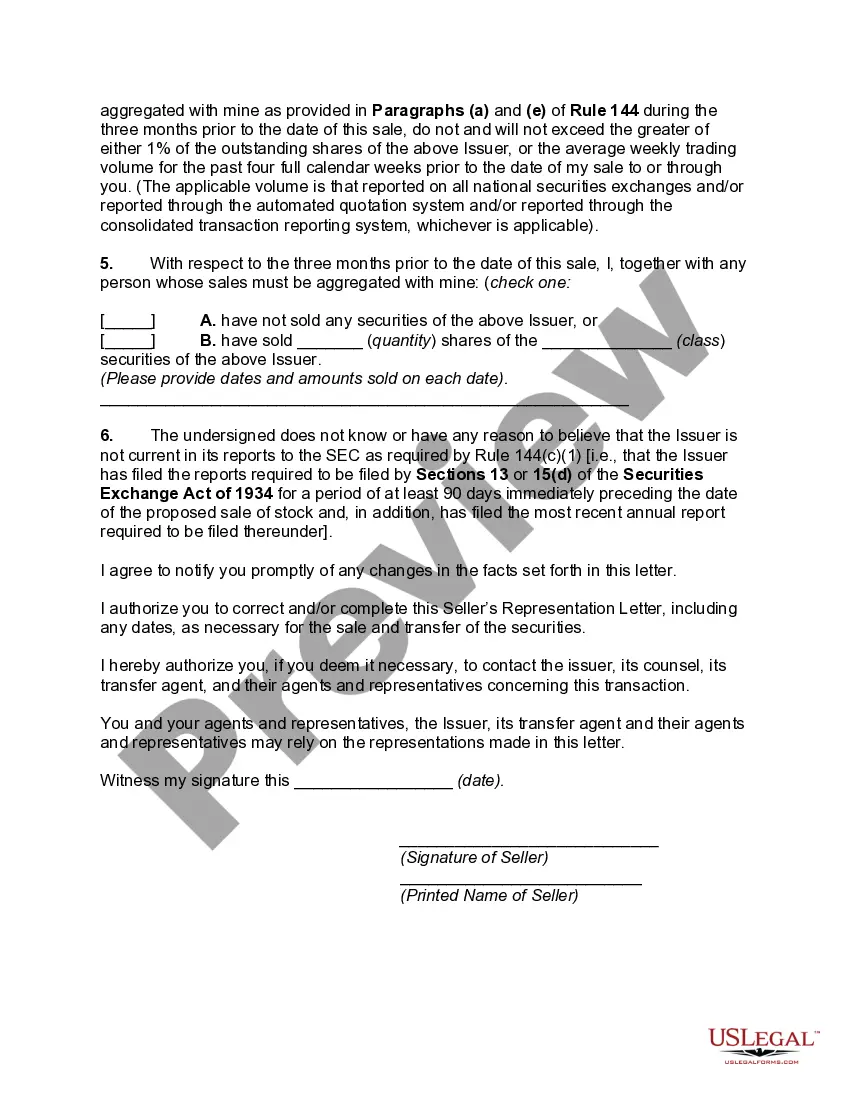

Maryland Affiliate Letter is an important component of Rule 145 Transactions, specifically in Maryland. In such transactions, a company aims to reclassify its securities to merge with another company or undergo a change in its structure. This detailed description will shed light on the purpose, requirements, and types of Maryland Affiliate Letters in Rule 145 Transactions. The Maryland Affiliate Letter in a Rule 145 Transaction is a legal document required by the Maryland Department of Assessments and Taxation (SEAT) as part of the approval process for the reclassification of securities. It serves as a written confirmation by an affiliate of the company involved, stating their intent to comply with certain provisions and regulations during and after the transaction. The purpose of the Maryland Affiliate Letter is to ensure transparency, protect the interests of the shareholders, and maintain compliance with state laws. It provides a guarantee that the affiliate will adhere to specific restrictions, limitations, and rights that may impact the securities being reclassified. This document aims to safeguard the interests of all parties involved and prevent any potential misuse or violation of securities laws. There can be different types of Maryland Affiliate Letters in Rule 145 Transactions, depending on the nature and details of the transaction. Some common types include: 1. Affiliate's Ownership Interest: This letter confirms that the affiliate holds valid ownership interest in the company and agrees to maintain it during and after the reclassification process. It outlines the number and type of securities owned by the affiliate. 2. Voting Rights: This type of Maryland Affiliate Letter specifies the affiliate's agreement to exercise their voting rights in accordance with the company's bylaws and guidelines. It ensures that the affiliate will support the necessary resolutions and decisions related to the reclassification. 3. Non-Disclosure of Material Information: This letter ensures that the affiliate will not disclose any material non-public information about the company, its business operations, or the transaction to unauthorized parties. It helps maintain confidentiality and prevents potential insider trading. 4. Post-Transaction Intentions: Some Maryland Affiliate Letters outline the post-transaction intentions of the affiliate. It may confirm the affiliate's commitment to holding the reclassified securities for a certain period or their intent to sell them within specific limitations. 5. Compliance with State Laws: This type of letter assures compliance with Maryland state laws and regulations during and after the Rule 145 Transaction. It may cover aspects such as reporting requirements, tax obligations, and restrictions on transferring the reclassified securities. In conclusion, the Maryland Affiliate Letter is a vital component of Rule 145 Transactions taking place in Maryland. It is a written confirmation by an affiliate that they will comply with specific provisions and regulations related to the transaction. The letter ensures transparency, protects shareholder interests, and upholds compliance with state laws. Various types of Maryland Affiliate Letters exist, ranging from ownership confirmation to post-transaction intentions and compliance with state laws. These letters play a crucial role in facilitating the smooth execution of Rule 145 Transactions in Maryland.

Maryland Affiliate Letter in Rule 145 Transaction

Description

How to fill out Maryland Affiliate Letter In Rule 145 Transaction?

Are you currently within a place in which you will need papers for sometimes business or personal reasons almost every working day? There are a variety of legal file layouts available on the net, but locating kinds you can rely is not effortless. US Legal Forms offers a large number of kind layouts, like the Maryland Affiliate Letter in Rule 145 Transaction, which can be published to meet state and federal specifications.

Should you be previously informed about US Legal Forms web site and have a merchant account, merely log in. Following that, you may download the Maryland Affiliate Letter in Rule 145 Transaction format.

Unless you come with an bank account and wish to start using US Legal Forms, adopt these measures:

- Obtain the kind you require and make sure it is for that correct city/region.

- Make use of the Review switch to check the form.

- Browse the description to actually have chosen the proper kind.

- In the event the kind is not what you are searching for, make use of the Lookup field to obtain the kind that suits you and specifications.

- Whenever you get the correct kind, simply click Purchase now.

- Opt for the prices program you need, complete the specified details to generate your account, and buy the order making use of your PayPal or credit card.

- Choose a practical document structure and download your duplicate.

Locate every one of the file layouts you possess purchased in the My Forms menu. You can aquire a more duplicate of Maryland Affiliate Letter in Rule 145 Transaction at any time, if necessary. Just select the essential kind to download or print the file format.

Use US Legal Forms, by far the most comprehensive collection of legal varieties, to save efforts and steer clear of blunders. The assistance offers professionally manufactured legal file layouts which can be used for an array of reasons. Create a merchant account on US Legal Forms and begin producing your daily life a little easier.

Form popularity

FAQ

Rule 145 is an SEC rule that allows companies to sell certain securities without first having to register the securities with the SEC. This specifically refers to stocks that an investor has received because of a merger, acquisition, or reclassification.

Rule 147, as amended, has the following requirements: the company must be organized in the state where it offers and sells securities. the company must have its principal place of business in-state and satisfy at least one doing business requirement that demonstrates the in-state nature of the company's business.

The Commission raised the Form 144 filing thresholds so that affiliates must file Form 144 if their proposed sales in reliance on Rule 144 within a three-month period exceed 5,000 shares or $50,000. Non-affiliates no longer need to file Form 144.

The term affiliate is defined in Rule 405 under the Act as a person that directly, or indirectly through one or more intermediaries, controls, is controlled by, or is under common control with, an issuer.

Rule 144 at (a)(1) defines an affiliate of an issuing company as a person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, such issuer.

Rule 144 at (a)(1) defines an affiliate of an issuing company as a person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, such issuer.

Rule 144 provides an exemption and permits the public resale of restricted or control securities if a number of conditions are met, including how long the securities are held, the way in which they are sold, and the amount that can be sold at any one time.

For purposes of this calculation, the Company does not currently consider any of its shareholders who are not directors or executive officers of the Company, including any such shareholders owning 10% or more of the Company's common stock, to be affiliates of the Company.

Rule 144(a)(3) identifies what sales produce restricted securities. Control securities are those held by an affiliate of the issuing company. An affiliate is a person, such as an executive officer, a director or large shareholder, in a relationship of control with the issuer.

The term affiliate is defined in Rule 405 under the Act as a person that directly, or indirectly through one or more intermediaries, controls, is controlled by, or is under common control with, an issuer.