Maryland Letter to Creditor Requesting a Temporary Payment Reduction

Description

How to fill out Letter To Creditor Requesting A Temporary Payment Reduction?

If you need to acquire comprehensive, download, or print authorized document templates, utilize US Legal Forms, the largest repository of official forms, which can be accessed online.

Utilize the website's straightforward and easy-to-navigate search to obtain the documents you need.

Various templates for business and personal purposes are categorized by types and states, or by keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Step 4. Once you have located the form you need, click the Get now button. Choose the payment plan you prefer and enter your details to register for the account.

- Employ US Legal Forms to obtain the Maryland Letter to Creditor Requesting a Temporary Payment Reduction with just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click the Download button to find the Maryland Letter to Creditor Requesting a Temporary Payment Reduction.

- You can also access forms you have previously saved from the My documents tab within your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have selected the form for the correct city/state.

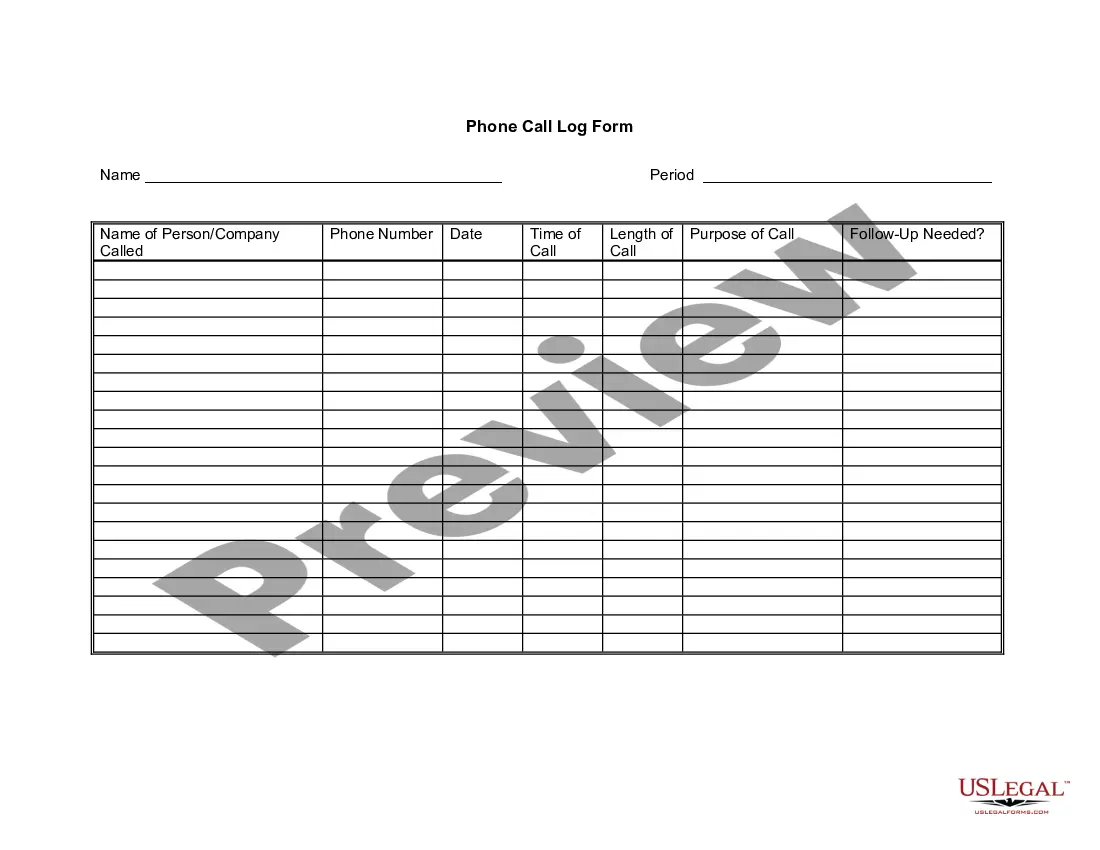

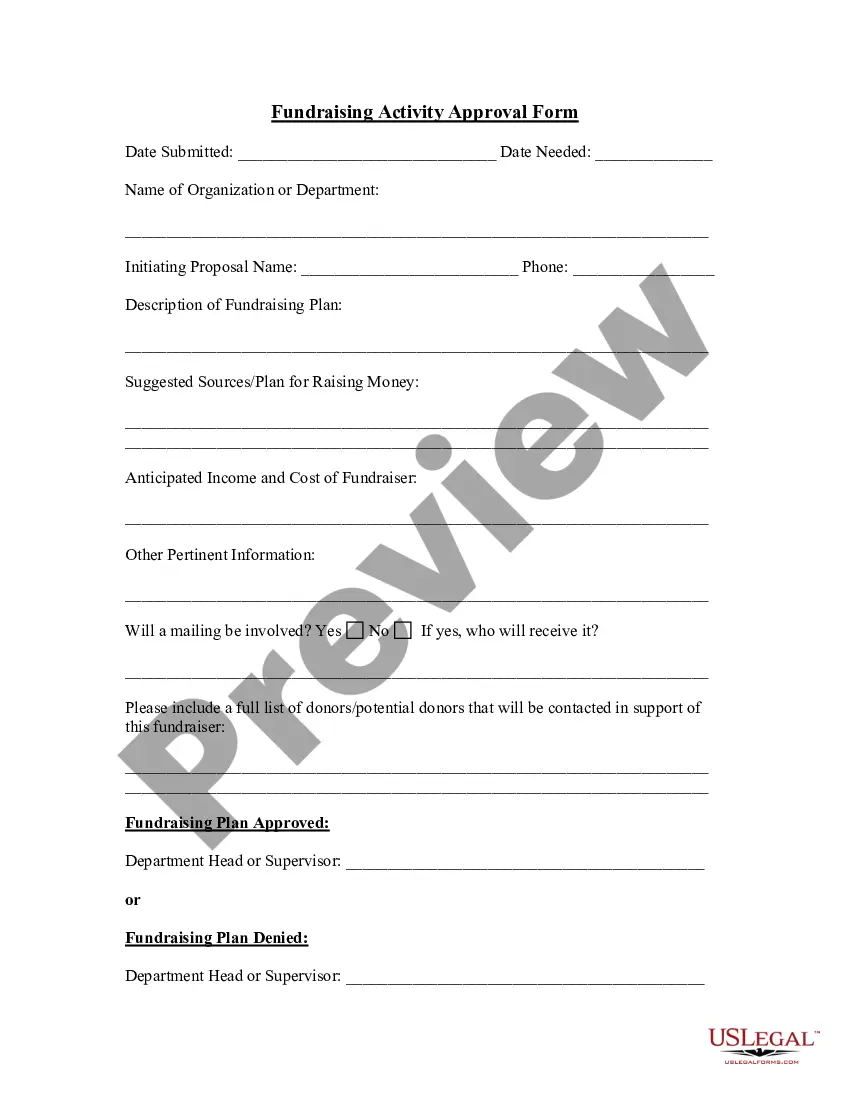

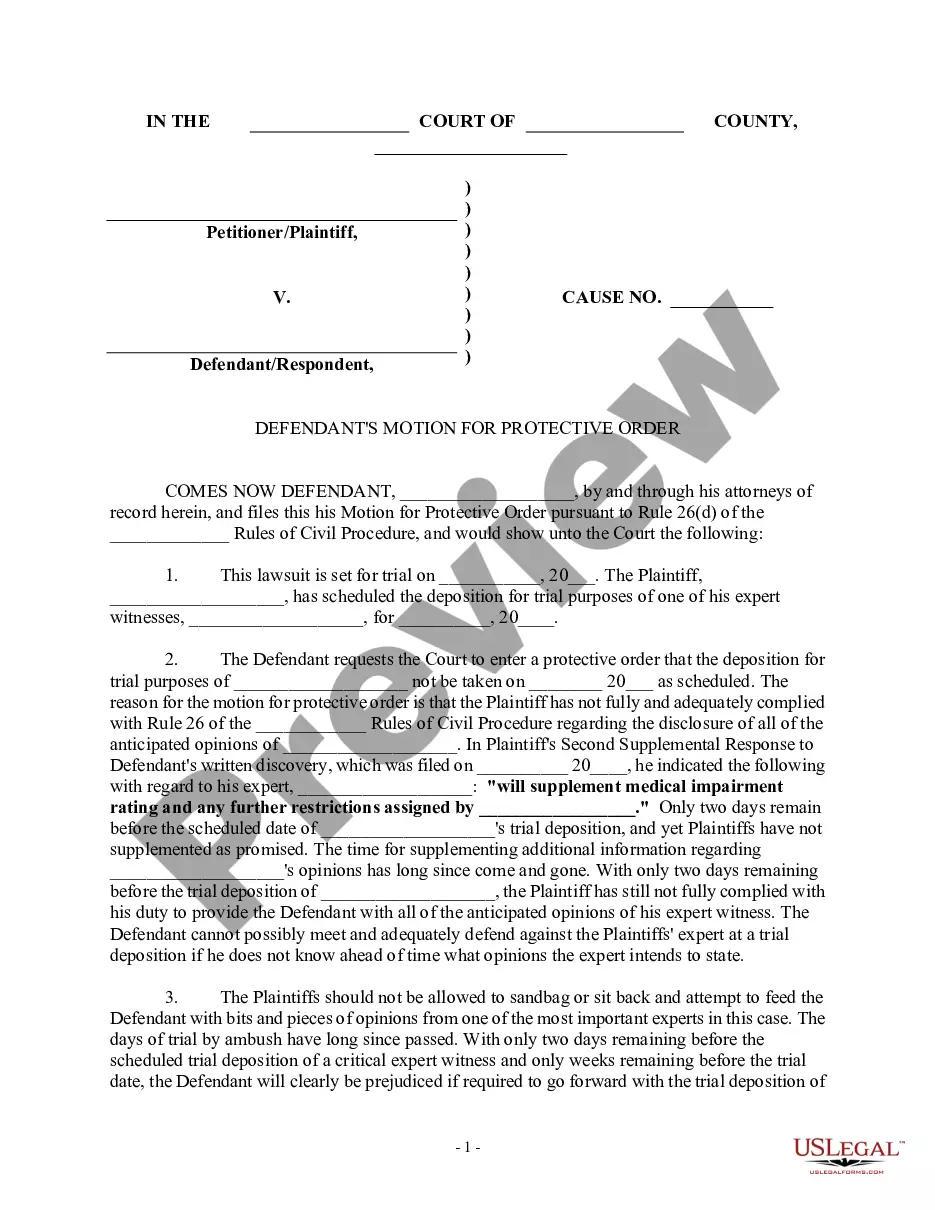

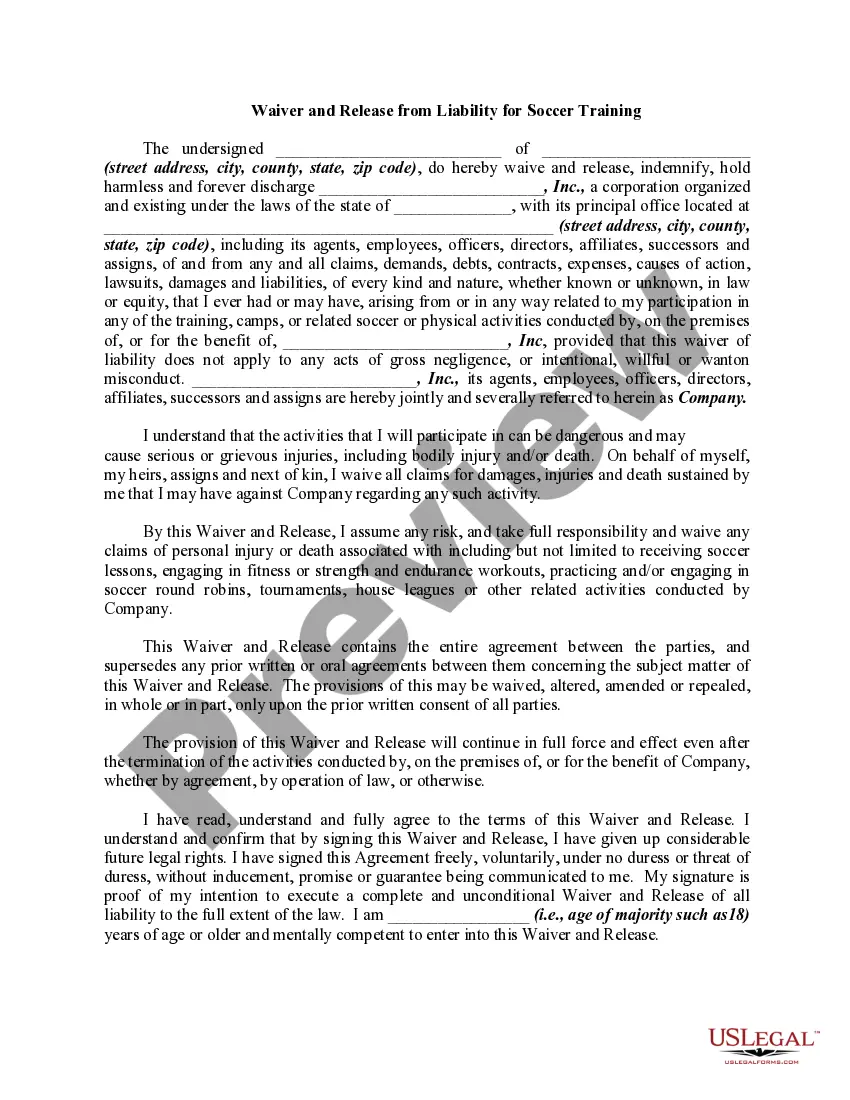

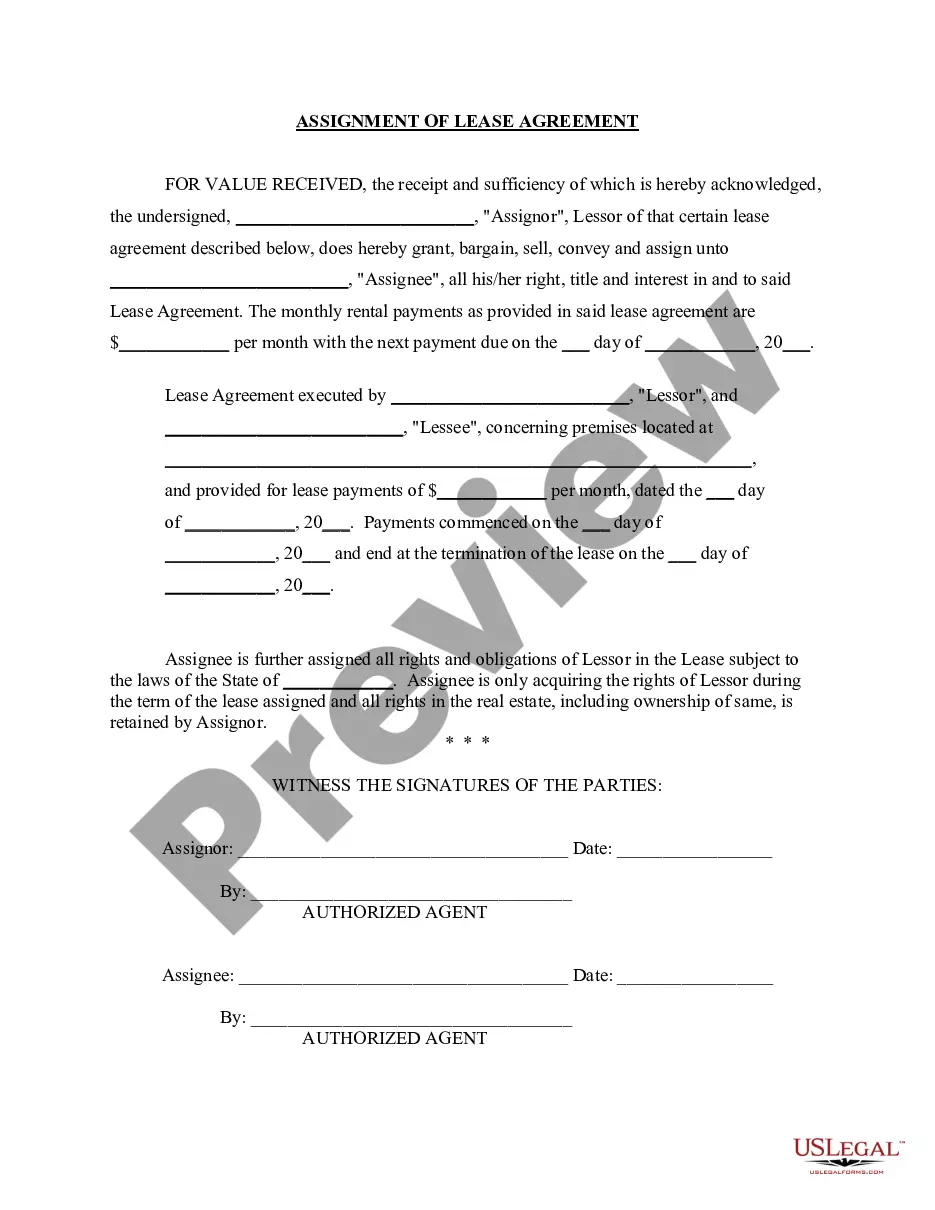

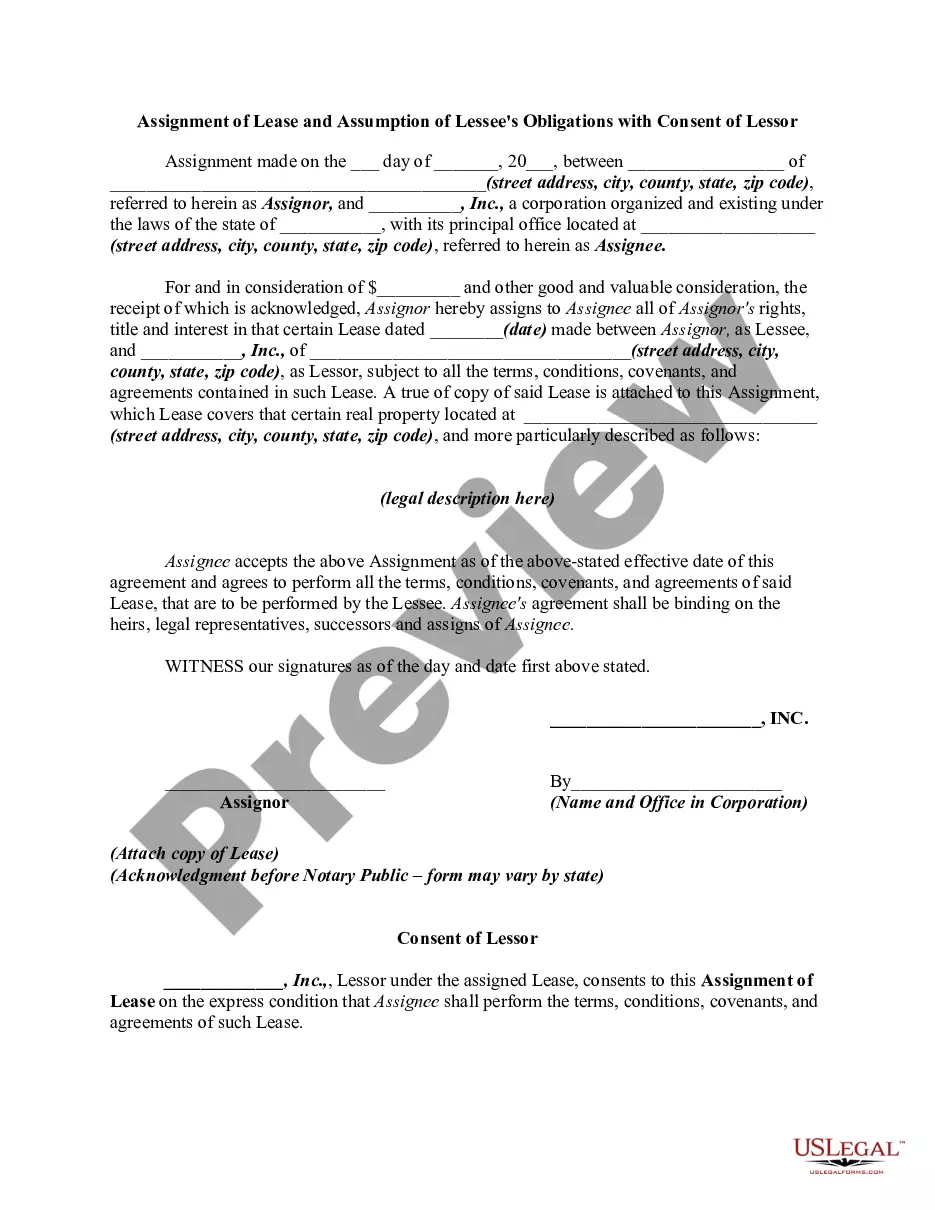

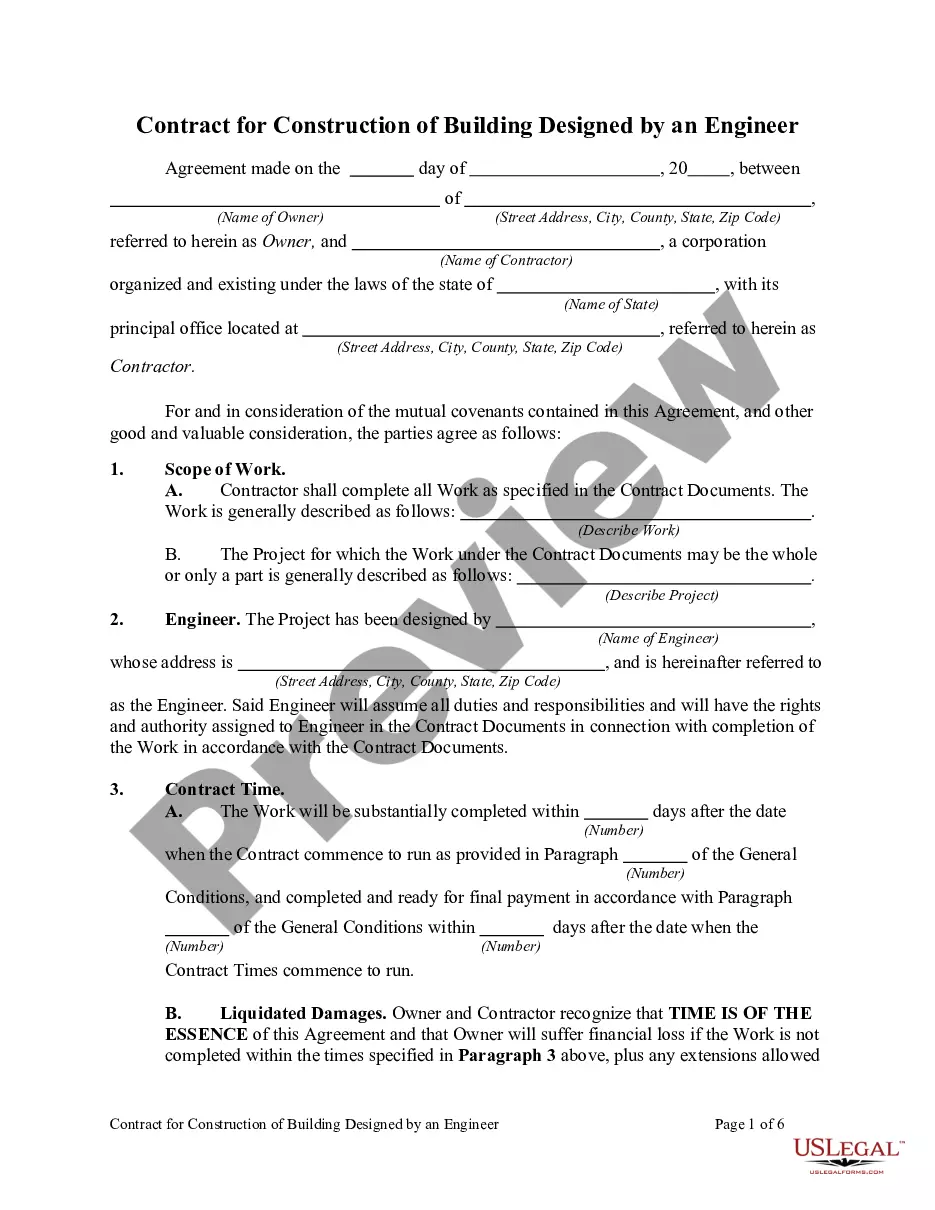

- Step 2. Utilize the Preview option to review the content of the form. Remember to read the instructions carefully.

Form popularity

FAQ

Explain the reasons for your hardship clearly and concisely. Include any supporting documentation that you have (e.g., copy of your unemployment awards letter). Be specific about the remedy you are seeking, and don't promise to send more money than you can reasonably afford.

I respectfully request that you forgive my alleged debt, as my condition precludes any employment, and my current and future income does not support any debt repayment. Please respond to my request in writing to the address below at your earliest convenience. Thank you in advance for your understanding of my situation.

To forgive your debt, a debt settlement specialist negotiates with your creditors with the goal of getting them to sign off on a settlement offer, where they agree to reduce your principal so you only pay a portion of the original amount.

Dear Sir/ Madam, This is in with reference to the purchase of (Product/ Service/ Project) against your purchase order no. (order number) dated // (Date). We would like to request you for changing payment terms to (mention new terms).

Tips for Writing a Hardship LetterKeep it original.Be honest.Keep it concise.Don't cast blame or shirk responsibility.Don't use jargon or fancy words.Keep your objectives in mind.Provide the creditor an action plan.Talk to a Financial Couch.

Tips for Writing a Hardship LetterKeep it original.Be honest.Keep it concise.Don't cast blame or shirk responsibility.Don't use jargon or fancy words.Keep your objectives in mind.Provide the creditor an action plan.Talk to a Financial Couch.

Write a debt settlement letter to your creditor. Explain your current situation and how much you can pay. Also, provide them with a clear description of what you expect in return, such as removal of missed payments or the account shown as paid in full on your report.

Call the credit card customer service number. Tell the representative that you want to take care of the credit card debt, but are in financially difficult times. Ask the representative what can be done; depending on how long you have been delinquent, the representative may offer you a payoff amount.

Dear Creditor: Due to a layoff, I am temporarily out of work and am experiencing financial difficulty. Due to my financial hardship and in order to meet necessary household expenses plus credit payments, I am asking each creditor to accept a reduced payment for the next (#) months on my debt.

Dear Sir/Madam, I have obtained a car/home/personal loan from your esteemed bank as per the following details. I would like to humbly request you to lower the interest rate on the loan amount as it is becoming extremely difficult for me to pay the loan installments. a) Loan account number: .