Maryland Insurance Organizer

Instant download

Description

This document organizer contain information regarding the type of insurance policy, the policy number, the face amount of the policy, the issuance date, the maturity date, the insured person, the policy owner, the beneficiaries, date premium is due, how frequently, the name and address of the insurance company, the name and address of the insurance company, and the name and address of the insurance agent.

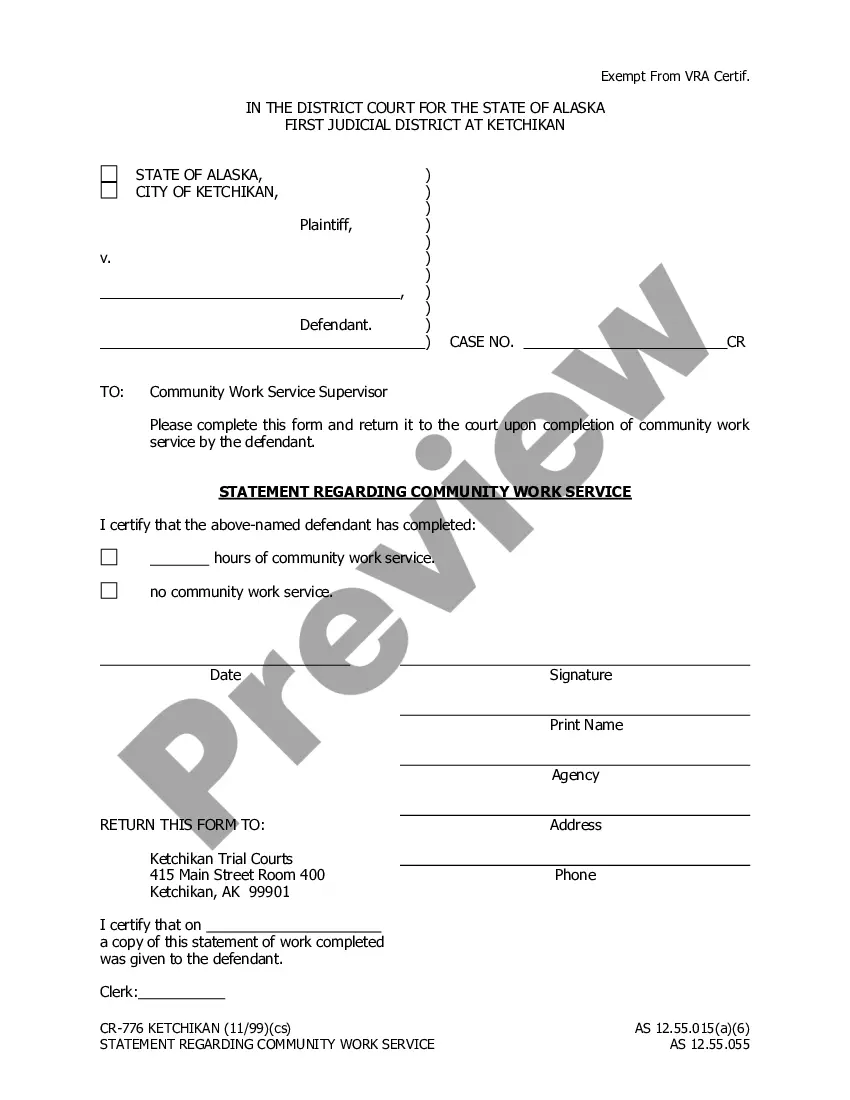

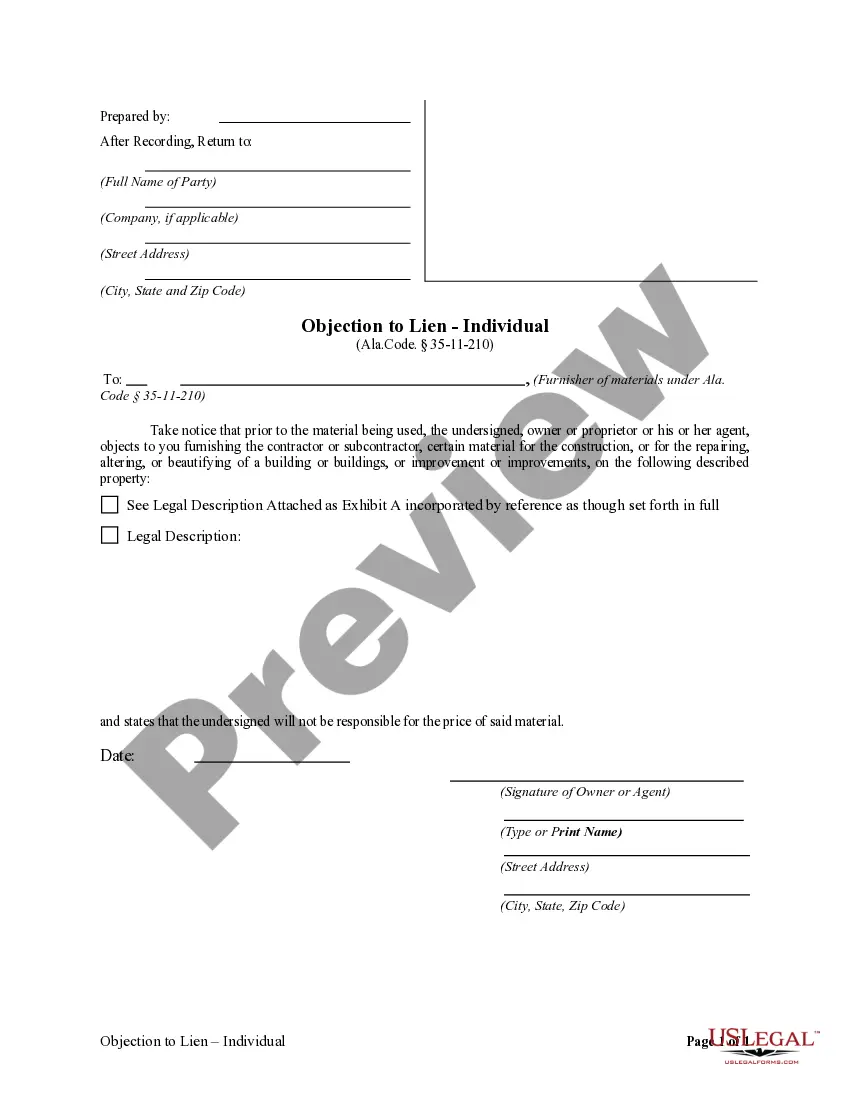

Free preview

How to fill out Insurance Organizer?

Selecting the appropriate legal document format can be quite challenging.

Of course, there are many templates accessible online, but how can you find the specific legal type you require.

Utilize the US Legal Forms website. The service offers a vast array of templates, such as the Maryland Insurance Organizer, which can cater to both organizational and personal needs.

You can review the form using the Preview button and check the form details to confirm it is the right one for you.

- All templates are reviewed by experts and adhere to federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to acquire the Maryland Insurance Organizer.

- Use your account to access the legal forms you have previously purchased.

- Navigate to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the right form for your city/area.