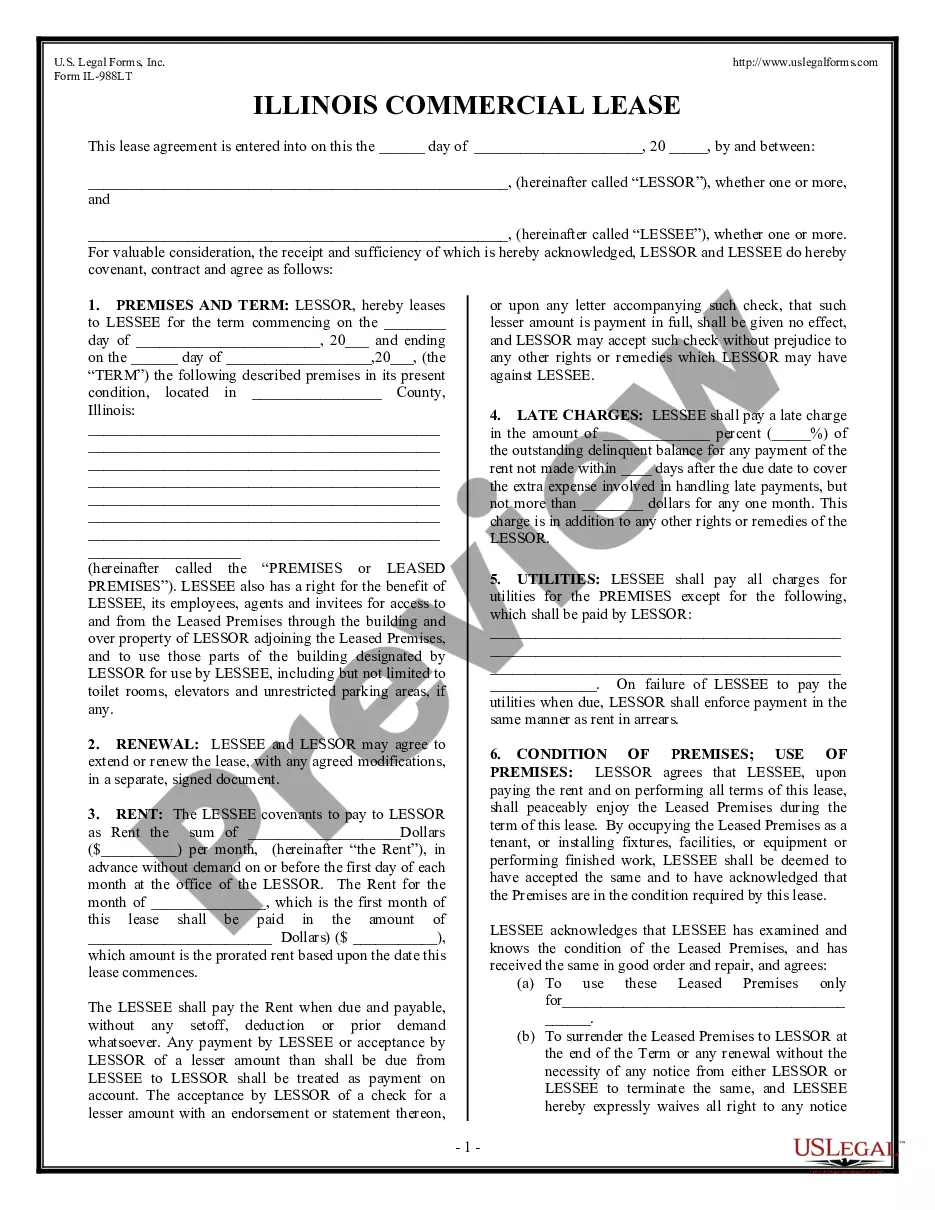

The Maryland Certificate of Borrower regarding Commercial Loan is a legal document that is commonly required by lenders in the state of Maryland when entering into commercial loan agreements. This certificate serves as a declaration made by the borrower, attesting to certain key information, representations, and warranties related to their financial status and the intended use of the loan proceeds. By providing this certificate, borrowers assure lenders that they meet certain eligibility criteria and that the loan will be utilized solely for legitimate commercial purposes. The Maryland Certificate of Borrower regarding Commercial Loan typically includes the following details: 1. Borrower Information: The certificate starts by capturing essential borrower details such as their legal name, business entity type, contact information, and the date of the certificate. 2. Loan Purpose: Borrowers are required to specify the exact purpose for which they are seeking the commercial loan. This could range from funding working capital needs, debt refinancing, equipment purchases, or property acquisition, among other legitimate business uses. 3. Compliance with Laws: The borrower declares that they are in full compliance with all applicable laws, regulations, and licensing requirements necessary to operate their business. This includes confirming they are not involved in any illegal activities that could jeopardize the loan agreement. 4. Representations: Borrowers are required to make certain representations and warranties regarding their financial position and the accuracy of the information provided. This may include assertions about the accuracy of financial statements, tax returns, and other documents submitted to the lender. 5. No Default: The certificate confirms that the borrower is not in default on any existing loans or obligations to third parties. It assures the lender that the borrower has a good financial standing and demonstrates a history of fulfilling their financial commitments. 6. Collateral and Security Interests: If the loan is secured by collateral or personal guarantees, the borrower must provide relevant details about the collateral pledged, such as property addresses, ownership, and descriptions. This section also covers information on any existing liens or encumbrances on the borrower's assets. 7. Indemnification: Borrowers agree to indemnify the lender against any losses or damages caused by their actions or their failure to fulfill the loan obligations. Different types of Maryland Certificates of Borrower regarding Commercial Loan may vary based on the specific requirements of individual lenders or loan programs. These variations may include additional clauses, disclosures, or specific language tailored to different industries or loan types. Therefore, borrowers should carefully review the specific certificate provided by their lender to ensure compliance with their requirements. Overall, the Maryland Certificate of Borrower regarding Commercial Loan is a crucial document that enables the lender to assess the borrower's financial viability, ensure compliance with regulations, and mitigate potential risks associated with the loan.

Maryland Certificate of Borrower regarding Commercial Loan

Description

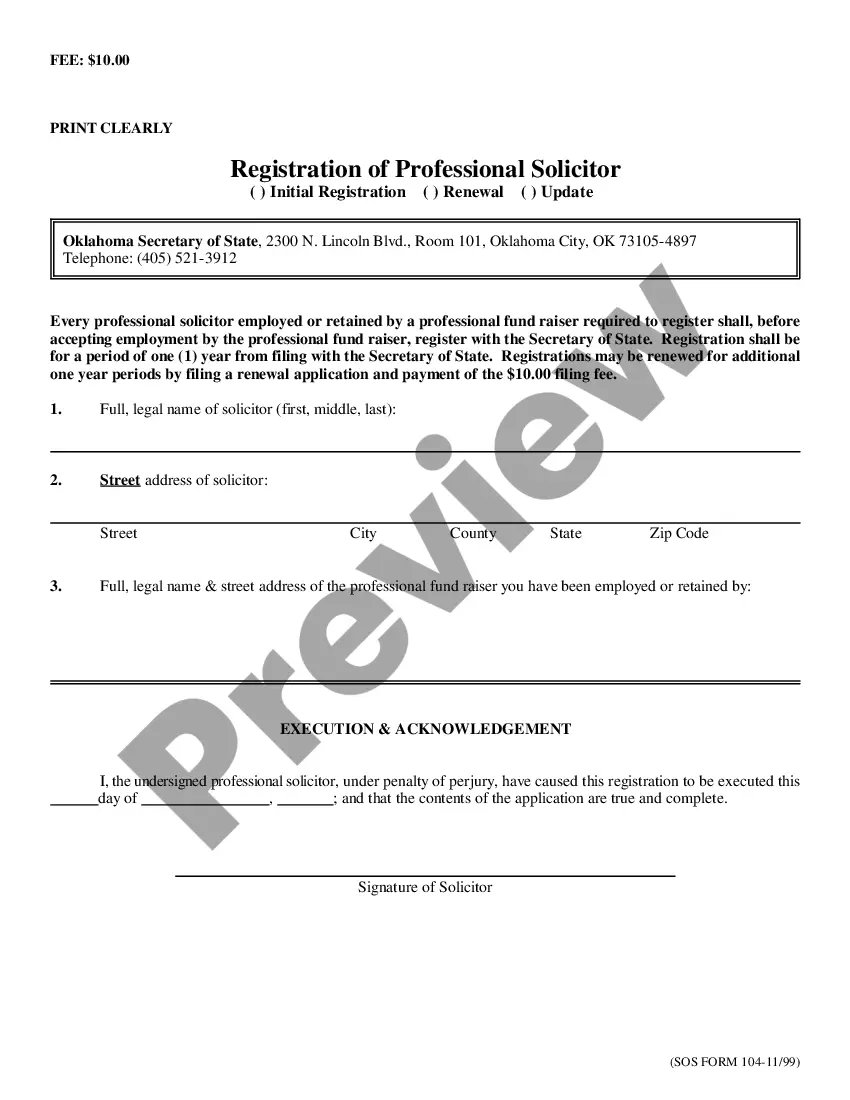

How to fill out Maryland Certificate Of Borrower Regarding Commercial Loan?

Choosing the right authorized file design could be a battle. Obviously, there are plenty of themes available on the net, but how do you obtain the authorized type you will need? Utilize the US Legal Forms website. The support provides a huge number of themes, like the Maryland Certificate of Borrower regarding Commercial Loan, which can be used for enterprise and private demands. All the types are inspected by experts and meet up with federal and state needs.

Should you be presently registered, log in in your profile and click on the Acquire button to obtain the Maryland Certificate of Borrower regarding Commercial Loan. Use your profile to appear throughout the authorized types you may have ordered formerly. Check out the My Forms tab of your respective profile and have one more version of the file you will need.

Should you be a new user of US Legal Forms, listed below are easy instructions so that you can follow:

- Very first, ensure you have chosen the appropriate type for your personal metropolis/county. You can check out the form making use of the Review button and look at the form explanation to ensure this is the right one for you.

- In the event the type does not meet up with your preferences, utilize the Seach industry to get the appropriate type.

- When you are sure that the form is acceptable, go through the Get now button to obtain the type.

- Select the pricing plan you need and enter the needed details. Design your profile and buy your order with your PayPal profile or credit card.

- Choose the submit format and acquire the authorized file design in your gadget.

- Total, edit and print and signal the acquired Maryland Certificate of Borrower regarding Commercial Loan.

US Legal Forms may be the largest local library of authorized types for which you can see different file themes. Utilize the company to acquire professionally-made paperwork that follow status needs.

Form popularity

FAQ

Usury is interest that a lender charges a borrower at a rate above the lawful ceiling on such charges; a contract upon the loan of money with an illegally high interest rate as a condition of the loan.

Code, Com. § 12-102. Except as otherwise provided by law, a person may not charge interest in excess of an effective rate of simple interest of 6 percent per annum on the unpaid principal balance of a loan.

§12?102. Except as otherwise provided by law, a person may not charge interest in excess of an effective rate of simple interest of 6 percent per annum on the unpaid principal balance of a loan.

The legal maximum in Maryland is 6%, but can be 8% under a written contract. There are also some exceptions for mortgage loans and installment contracts for automobiles and other consumer goods.

Borrower Certification means, with respect to any request for a Loan, a certification of the Borrower stating that (i) no Default or Event of Default will occur or be continuing after giving effect to such Loan, and (ii) the proceeds of such Loan will be used solely for Permitted Uses.

When you consider who is exempt from usury laws, the most common loan providers are institutions. Institutions that provide consumer loans are typically exempt from usury laws. Institutions include banks, savings and loans, credit unions, licensed pawnbrokers, licensed finance lenders, and personal property brokers.