A Maryland Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property is a legally binding document that outlines how the spouses' business assets and properties will be treated in the event of divorce. This type of agreement is essential for couples where one spouse operates a business and wants to protect their ownership interests, while also acknowledging the community property laws in Maryland. One type of Maryland Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property is the "Business Protection Prenup." This agreement focuses on protecting the spouse who operates the business by clearly defining the business as separate property. It outlines that any profits, losses, or other financial aspects of the business will not be considered community property but will remain the sole responsibility of the operating spouse. Another type is the "Asset Division Prenup," which addresses the equitable distribution of assets and properties associated with the business. This agreement ensures that the non-operating spouse will be entitled to a fair share of the business's value, taking into consideration factors like contributions made during the marriage, investments, and other relevant aspects agreed upon by the couple. A comprehensive Maryland Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property should include various key components. Firstly, it should clearly define the business as separate property owned solely by the operating spouse, ensuring that the non-operating spouse understands and acknowledges this arrangement. Secondly, the agreement should specify the division of profits and losses generated by the business during the marriage, determining whether they will be considered community property or remain separate. This clarification prevents any confusion or disputes regarding the ownership and distribution of the business's financial outcomes. Additionally, the agreement may address the issue of marital contributions to the business. It can outline whether the non-operating spouse's contributions, such as direct involvement in the business or financial support, will entitle them to a share of the business's value, and if so, to what extent. Furthermore, the document may address the potential scenario of a divorce, providing guidelines on the valuation process of the business, potential buyout options, or any other relevant provisions to ensure a smooth transition and fair resolution in case of separation. In conclusion, a Maryland Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property is a vital legal instrument for couples when one spouse operates a business. It protects the business assets and properties, while also adhering to the community property laws in Maryland. By clearly defining the ownership, financial aspects, and potential division of the business in case of divorce, this agreement provides clarity and security for both spouses involved.

Maryland Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property

Description

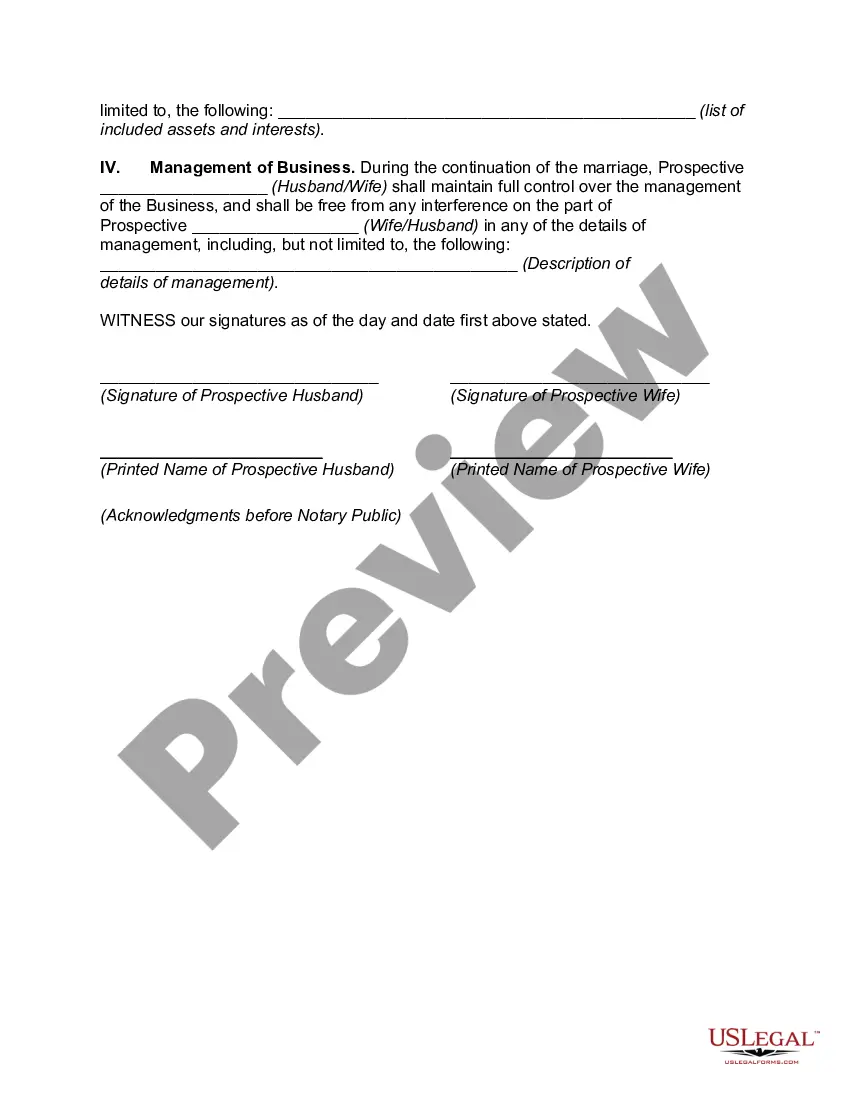

How to fill out Maryland Prenuptial Property Agreement With Business Operated By Spouse Designated To Be Community Property?

If you want to total, obtain, or printing lawful document layouts, use US Legal Forms, the largest assortment of lawful types, that can be found online. Utilize the site`s simple and practical lookup to discover the files you require. Numerous layouts for company and specific purposes are categorized by types and suggests, or keywords and phrases. Use US Legal Forms to discover the Maryland Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property within a handful of clicks.

If you are currently a US Legal Forms client, log in to the bank account and click the Acquire switch to get the Maryland Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property. Also you can accessibility types you in the past delivered electronically in the My Forms tab of your respective bank account.

If you are using US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the shape for the proper city/country.

- Step 2. Take advantage of the Preview solution to look through the form`s content material. Don`t neglect to read through the description.

- Step 3. If you are not satisfied with all the type, take advantage of the Research industry at the top of the screen to get other models from the lawful type format.

- Step 4. Once you have discovered the shape you require, select the Buy now switch. Select the prices prepare you favor and include your references to sign up for the bank account.

- Step 5. Process the financial transaction. You should use your charge card or PayPal bank account to perform the financial transaction.

- Step 6. Select the formatting from the lawful type and obtain it in your gadget.

- Step 7. Comprehensive, edit and printing or signal the Maryland Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property.

Each lawful document format you buy is your own property permanently. You have acces to every type you delivered electronically inside your acccount. Go through the My Forms area and select a type to printing or obtain once more.

Contend and obtain, and printing the Maryland Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property with US Legal Forms. There are many specialist and express-certain types you may use for the company or specific requirements.

Form popularity

FAQ

The only asset that may be excluded from the joint estate is an inheritance.

Assets that were inherited by one spouse or assets that were earned prior to marriage are considered separate property. If you owned a thriving business prior to getting married, the business is your separate property and will be treated as such in a divorce proceeding.

Yes, a prenuptial agreement can protect future assets. Those are common provisions you would put in to a prenuptial agreement. If there's the possibility of divorce I advise my clients to make that prenuptial agreement as ironclad as possible. You want to keep premarital accounts separate.

Every state prohibits you from including anything illegal in your prenuptial agreement. In fact, doing so can put the whole prenuptial document or parts of it at risk of being set aside. A prenup cannot include child support or child custody issues. The court has the final say in calculating child support.

The legal definition of an asset in a divorce is anything that has a real value. Assets can include tangible items that can be bought and sold such as cars, properties, furniture, or jewelry. Collectables, art, and memorabilia are frequently over looked assets because their value is often hard to ascertain.

In most cases, any business interest acquired during the marriage is considered marital property. As such, the business interest is subject to division during divorce.

5 Things You Cannot Include in Your Prenuptial Agreement Nonfinancial Rules. Anything Illegal. Terms Involving Child Custody or Support. Unfair or Unreasonable Terms. Incentive for Divorce.

Can a California divorce affect my business? In California, businesses are considered assets and will be divided based on whether or not the business is separate or community property.

The agreement was procured by fraud a prenup is valid only if it is entered into after full disclosure by both parties as to their income, assets, and liabilities. If one spouse provides the other with information that is not accurate or truthful, the agreement is invalid.

A prenuptial agreement cannot include personal preferences, such as who has what chores, whose name to use, where to spend the holidays, information on child-rearing, or what relationship to have with specific relatives. Premarital agreements are meant to address monetary issues.