Maryland Subordination, Non-Disturbance, and Attornment Agreement of a Lease regarding a Commercial Loan

Description

How to fill out Subordination, Non-Disturbance, And Attornment Agreement Of A Lease Regarding A Commercial Loan?

Are you presently in the place the place you need to have documents for either organization or individual purposes almost every day time? There are plenty of lawful document themes available online, but discovering kinds you can rely isn`t easy. US Legal Forms gives 1000s of develop themes, such as the Maryland Subordination, Non-Disturbance, and Attornment Agreement of a Lease regarding a Commercial Loan, that are written to meet federal and state requirements.

Should you be currently informed about US Legal Forms site and get an account, just log in. Next, it is possible to download the Maryland Subordination, Non-Disturbance, and Attornment Agreement of a Lease regarding a Commercial Loan web template.

Unless you provide an profile and want to begin using US Legal Forms, follow these steps:

- Discover the develop you require and ensure it is for your correct metropolis/county.

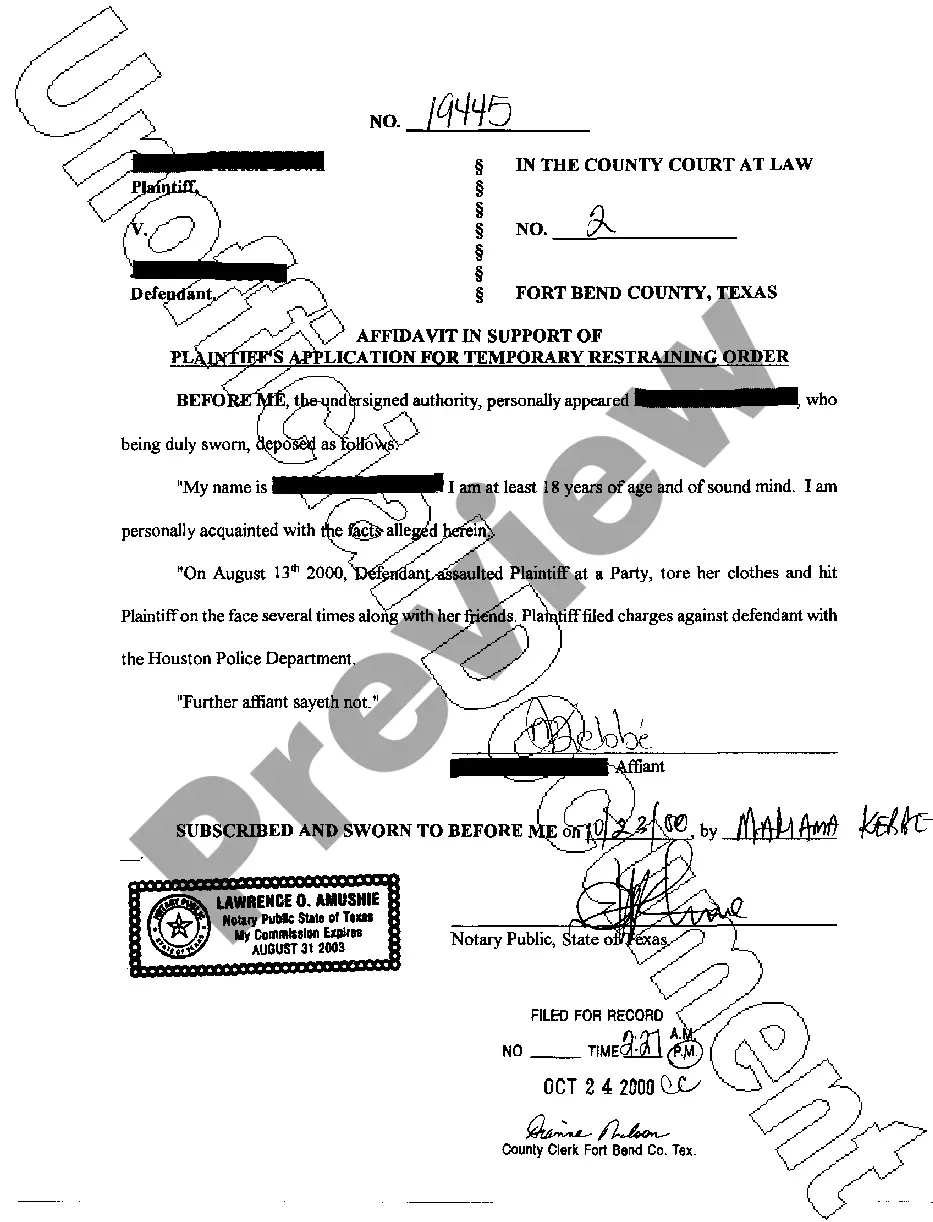

- Make use of the Review button to examine the form.

- See the outline to ensure that you have selected the proper develop.

- In the event the develop isn`t what you are looking for, use the Look for industry to obtain the develop that fits your needs and requirements.

- Once you get the correct develop, just click Acquire now.

- Pick the prices strategy you would like, submit the specified details to generate your money, and buy your order using your PayPal or credit card.

- Decide on a practical document file format and download your version.

Get each of the document themes you might have bought in the My Forms menu. You can get a extra version of Maryland Subordination, Non-Disturbance, and Attornment Agreement of a Lease regarding a Commercial Loan anytime, if required. Just click the essential develop to download or produce the document web template.

Use US Legal Forms, by far the most considerable variety of lawful varieties, to save lots of efforts and steer clear of mistakes. The service gives skillfully created lawful document themes which can be used for a range of purposes. Produce an account on US Legal Forms and start generating your way of life easier.

Form popularity

FAQ

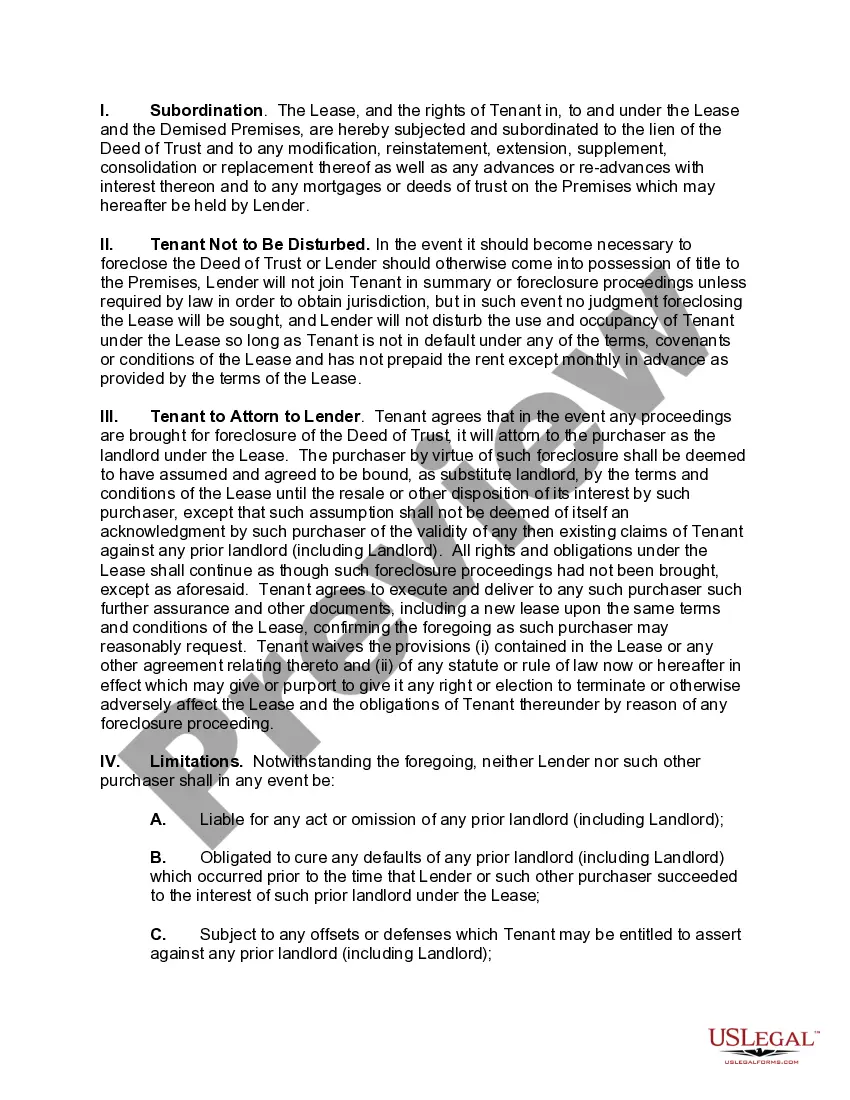

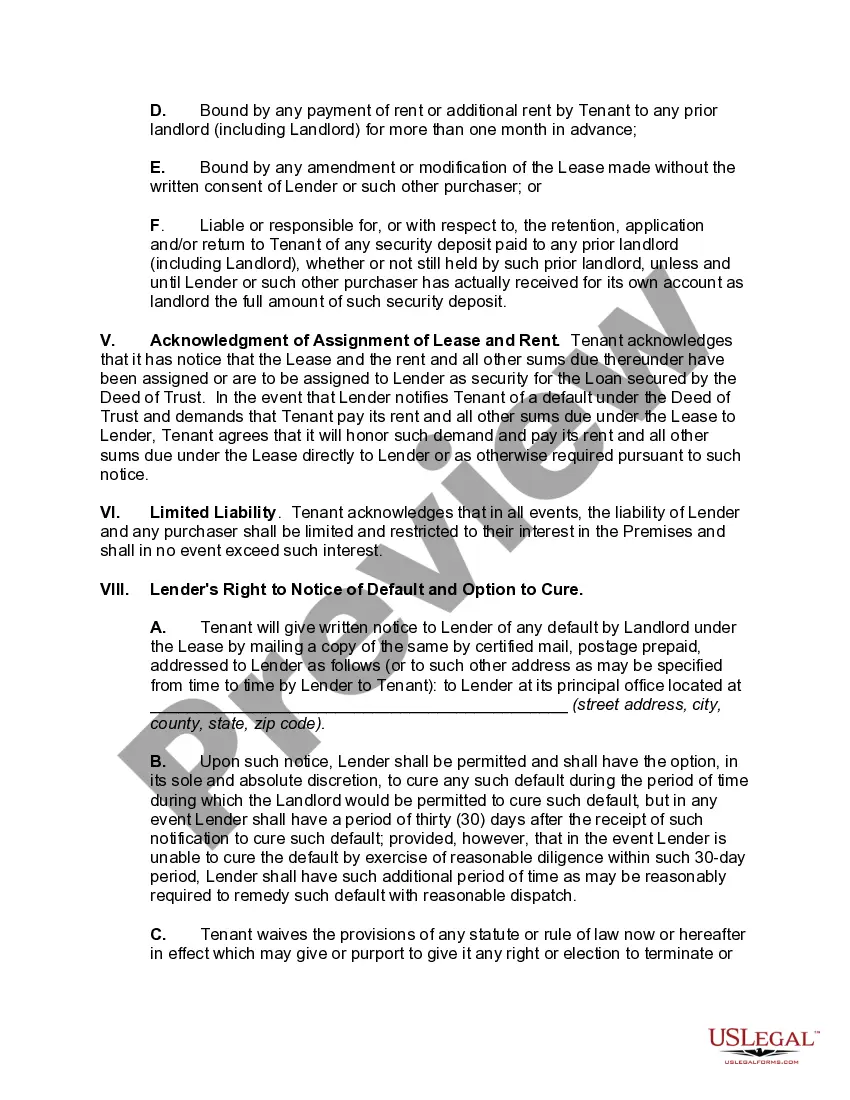

The primary effect of an SNDA is that the tenant agrees to subordinate its lease to the mortgage in exchange for the lender agreeing not to disturb the tenant if the lender forecloses its superior security interest in the real property.

A nondisturbance clause is a provision in a mortgage contract that ensures that a rental agreement between the tenant and the landlord will continue under any circumstances. This is done primarily to protect the renter from eviction by the mortgagor if the property is foreclosed upon by the lender.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit. Signing your agreement is a positive step forward in your refinancing journey.

Subordinate financing is debt financing that is ranked behind that held by secured lenders in terms of the order in which the debt is repaid. "Subordinate" financing implies that the debt ranks behind the first secured lender, and means that the secured lenders will be paid back before subordinate debt holders.

A Subordination Agreement focuses on creditor priorities and security claims, providing legal certainty to creditors when assessing repayment risk. If a credit event (or default) occurs, a subordination agreement provides a senior lender superior repayment rights than the subordinated lender.

A subordination agreement is a legal document that establishes one debt as ranking behind another in priority for collecting repayment from a debtor. The priority of debts can become extremely important when a debtor defaults on their payments or declares bankruptcy.

When you get a mortgage loan, the lender will likely include a subordination clause essentially stating that their lien will take precedence over any other liens placed on the house. A subordination clause serves to protect the lender if a homeowner defaults.

For example, a mortgage lender's form of SNDA will typically provide that after foreclosure the new property owner will not (i) be liable for acts or omissions of the prior landlord, (ii) be liable for return of any security deposit unless actually received by the lender and passed on to the new owner, (iii) be bound ...