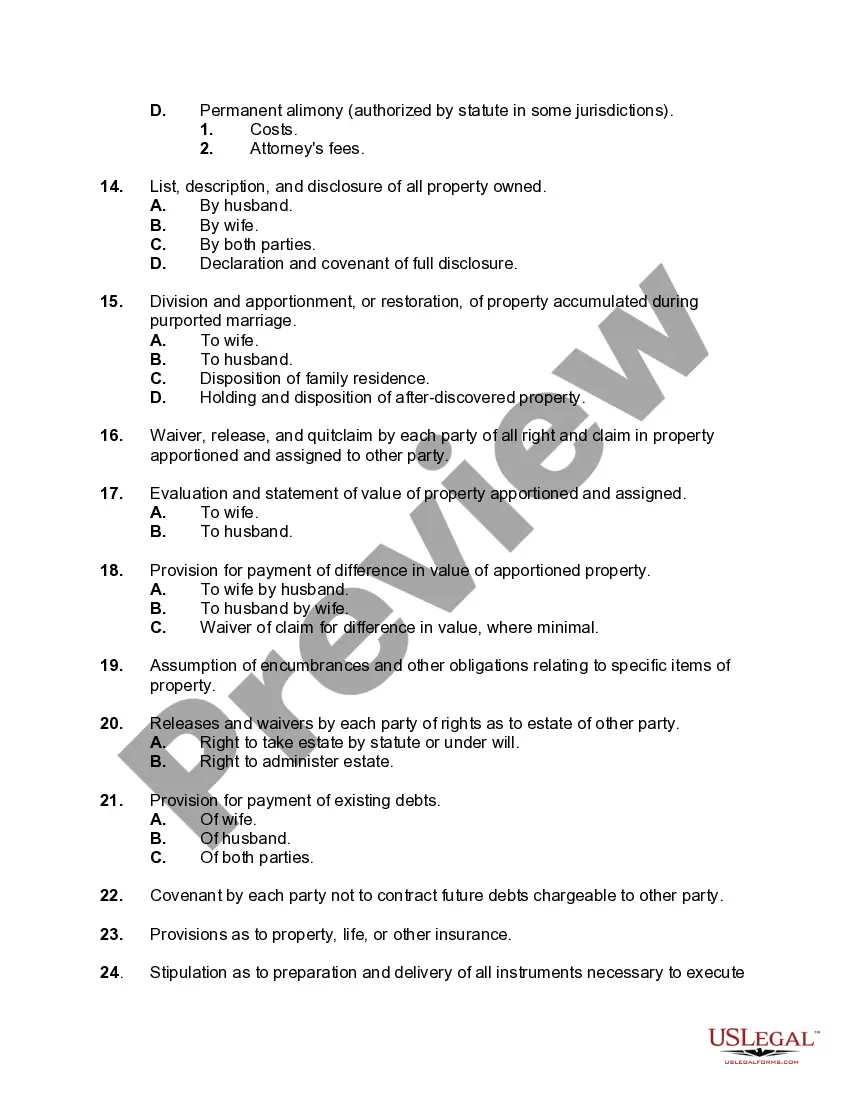

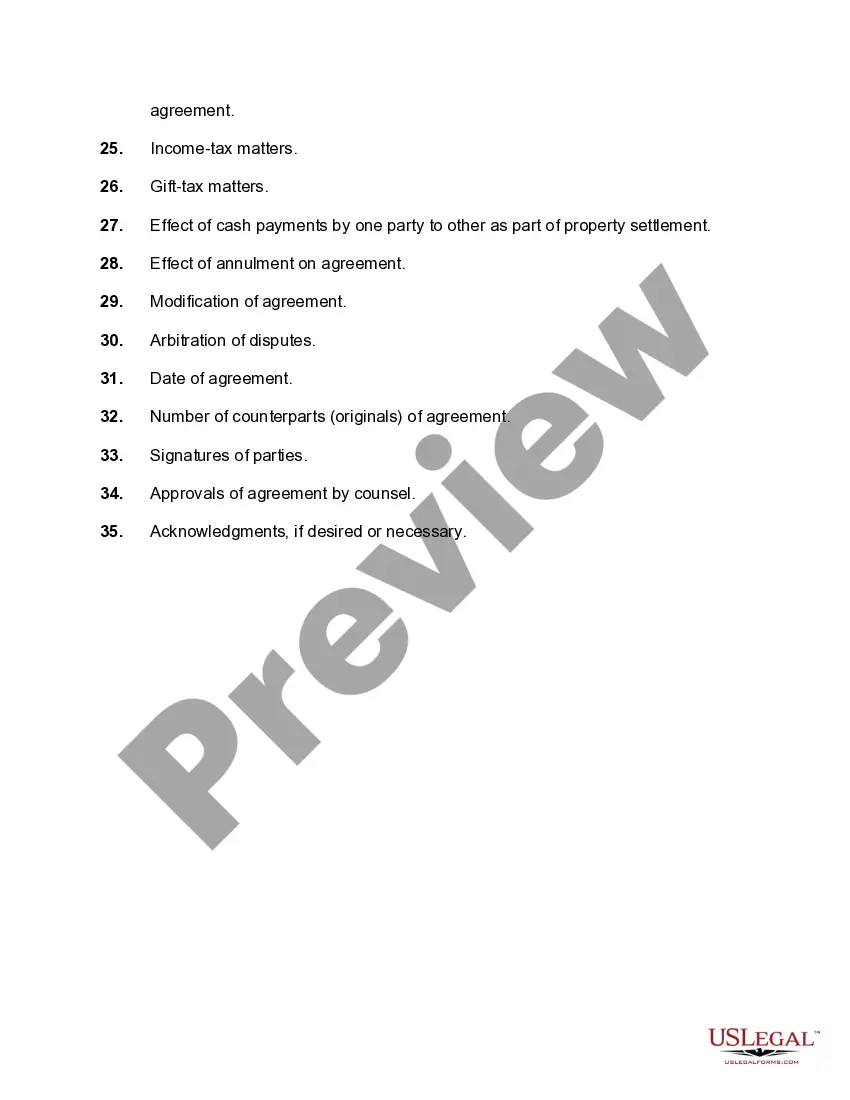

Maryland's Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage is an important tool to ensure a fair and equitable distribution of assets and liabilities between the involved parties. When going through an annulment of a marriage in Maryland, it is crucial to understand and address the following key aspects: 1. Real Property: The agreement should stipulate how any real estate properties, such as marital home or rental properties, will be divided or restored in light of the annulment. 2. Personal Property: This refers to tangible assets like furniture, vehicles, jewelry, appliances, and electronics. Clearly outlining how these items will be allocated is essential to avoid any disputes or confusion. 3. Financial Assets: Consideration should be given to all monetary assets, including bank accounts, retirement accounts, investments, stocks, and bonds. Specifying how these assets will be divided or restored is crucial for a smooth process. 4. Debt and Liabilities: The agreement should address any financial obligations or liabilities, such as mortgages, loans, credit card debt, or tax debts. Determining how these will be distributed is important to avoid future disputes. 5. Spousal Support: If either party is seeking spousal support, the agreement should outline the terms and conditions for such support, including the duration and amount, if applicable. 6. Business Ventures: In cases where the couple has jointly owned or operated a business, the agreement should consider the division or restoration of business assets, partnership interests, or ongoing operation arrangements. 7. Insurance Policies: Insurance policies, including health, life, or vehicle insurance, should be reviewed to determine if any changes are necessary due to the annulment. The agreement should address who will retain coverage and who will be responsible for related expenses. 8. Retirement and Pension Plans: The agreement should consider any retirement or pension plans held by either party and determine how they will be divided or restored, including the evaluation of future benefits. 9. Child Custody and Support: While the checklist specifically focuses on property division and restoration, child custody and support matters should also be addressed. It is essential to refer to relevant custody and support guidelines to ensure a comprehensive agreement. Different types of Maryland Checklists for Division or Restoration of Property in Connection with a Proceeding for Annulment may vary depending on the specific circumstances of the case. However, the general considerations mentioned above form the foundation of any comprehensive checklist. It is recommended to seek professional legal advice to ensure compliance with Maryland's laws and regulations for a valid and enforceable agreement.

Maryland Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage

Description

How to fill out Maryland Checklist Of Matters To Be Considered In Drafting An Agreement For Division Or Restoration Of Property In Connection With A Proceeding For Annulment Of A Marriage?

Are you presently inside a situation the place you need to have paperwork for sometimes business or specific reasons virtually every day? There are a lot of legal file web templates available on the Internet, but locating versions you can trust is not effortless. US Legal Forms gives 1000s of kind web templates, much like the Maryland Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage, which can be composed to fulfill federal and state needs.

When you are presently acquainted with US Legal Forms web site and possess a merchant account, basically log in. Following that, it is possible to obtain the Maryland Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage template.

If you do not come with an bank account and need to begin to use US Legal Forms, abide by these steps:

- Obtain the kind you need and ensure it is for your right area/area.

- Utilize the Review option to analyze the form.

- Look at the information to ensure that you have chosen the correct kind.

- When the kind is not what you`re seeking, use the Look for industry to obtain the kind that meets your requirements and needs.

- If you discover the right kind, click Get now.

- Select the prices prepare you desire, complete the required information and facts to make your account, and pay for an order utilizing your PayPal or Visa or Mastercard.

- Choose a hassle-free document file format and obtain your version.

Get all the file web templates you may have purchased in the My Forms menus. You may get a further version of Maryland Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage any time, if required. Just select the essential kind to obtain or print the file template.

Use US Legal Forms, the most extensive collection of legal varieties, to conserve time as well as stay away from errors. The support gives professionally made legal file web templates which can be used for a selection of reasons. Produce a merchant account on US Legal Forms and start making your lifestyle easier.