Maryland Jury Instruction - 1.9.4.2 Joint Employers

Description

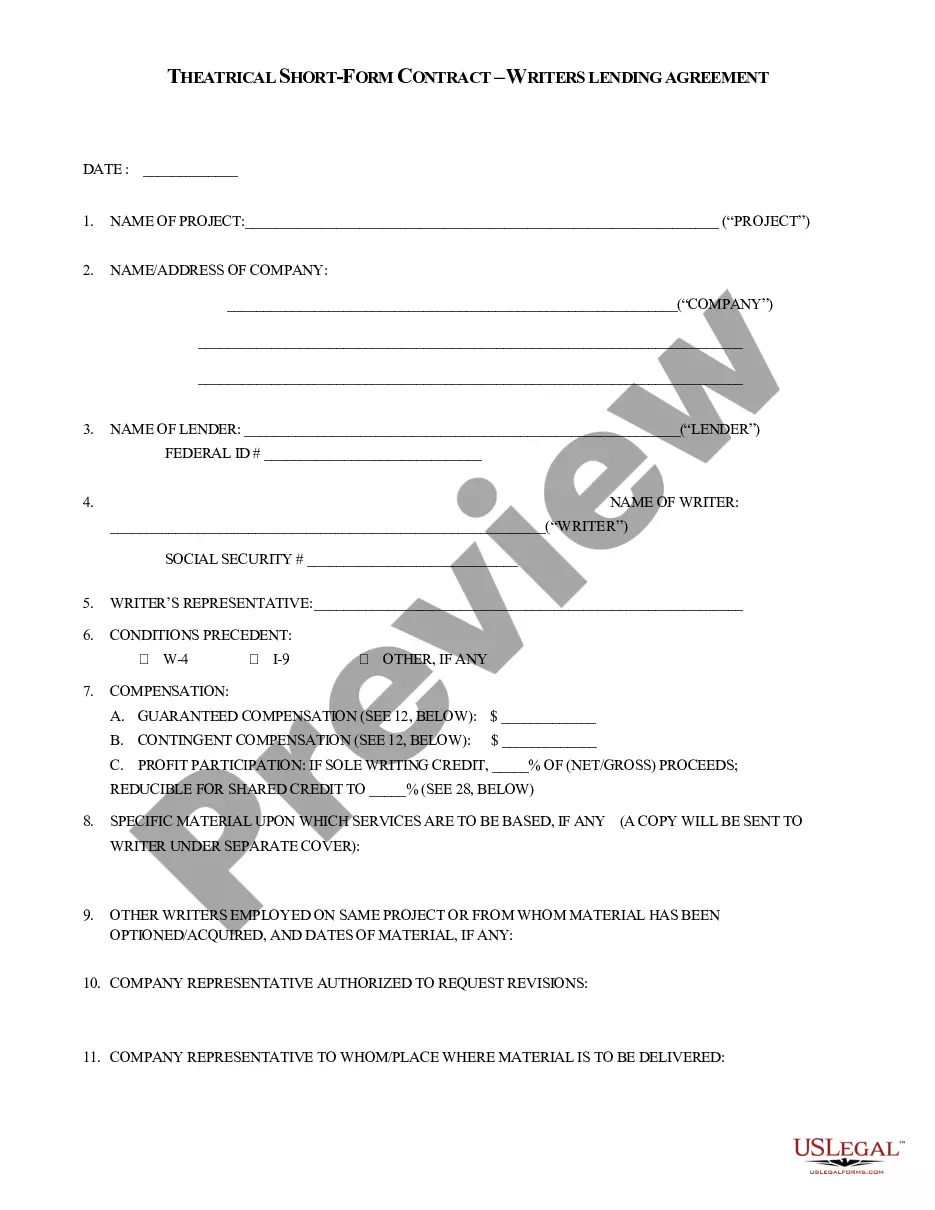

How to fill out Jury Instruction - 1.9.4.2 Joint Employers?

US Legal Forms - one of several largest libraries of legitimate types in America - offers a variety of legitimate record web templates you are able to obtain or print. Using the web site, you can find a large number of types for business and personal reasons, categorized by classes, suggests, or key phrases.You can get the newest types of types such as the Maryland Jury Instruction - 1.9.4.2 Joint Employers in seconds.

If you already have a subscription, log in and obtain Maryland Jury Instruction - 1.9.4.2 Joint Employers from your US Legal Forms catalogue. The Download button will show up on every type you perspective. You have access to all formerly delivered electronically types within the My Forms tab of your respective profile.

In order to use US Legal Forms the first time, here are simple instructions to get you started:

- Be sure you have picked the correct type for your personal metropolis/state. Select the Review button to examine the form`s information. See the type information to ensure that you have chosen the appropriate type.

- In case the type does not match your requirements, utilize the Look for area near the top of the screen to get the one that does.

- Should you be pleased with the shape, affirm your choice by clicking the Buy now button. Then, opt for the costs plan you favor and supply your credentials to register for an profile.

- Process the purchase. Make use of your bank card or PayPal profile to finish the purchase.

- Choose the format and obtain the shape on the device.

- Make modifications. Fill out, edit and print and indicator the delivered electronically Maryland Jury Instruction - 1.9.4.2 Joint Employers.

Every template you included with your money does not have an expiry date and it is the one you have eternally. So, if you wish to obtain or print another backup, just visit the My Forms segment and click on about the type you will need.

Get access to the Maryland Jury Instruction - 1.9.4.2 Joint Employers with US Legal Forms, by far the most extensive catalogue of legitimate record web templates. Use a large number of specialist and state-particular web templates that satisfy your small business or personal needs and requirements.