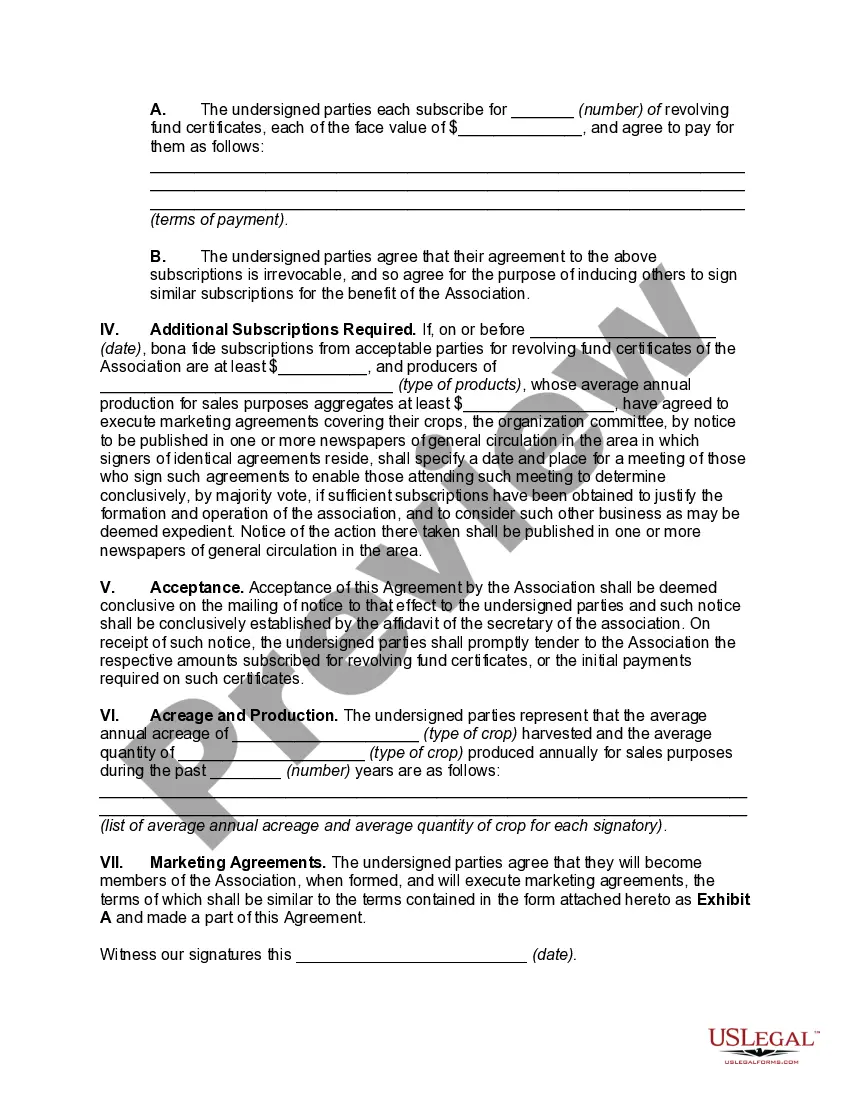

Maryland Pre-incorporation Agreement of Farmers' Non-stock Cooperative Association

Description

How to fill out Pre-incorporation Agreement Of Farmers' Non-stock Cooperative Association?

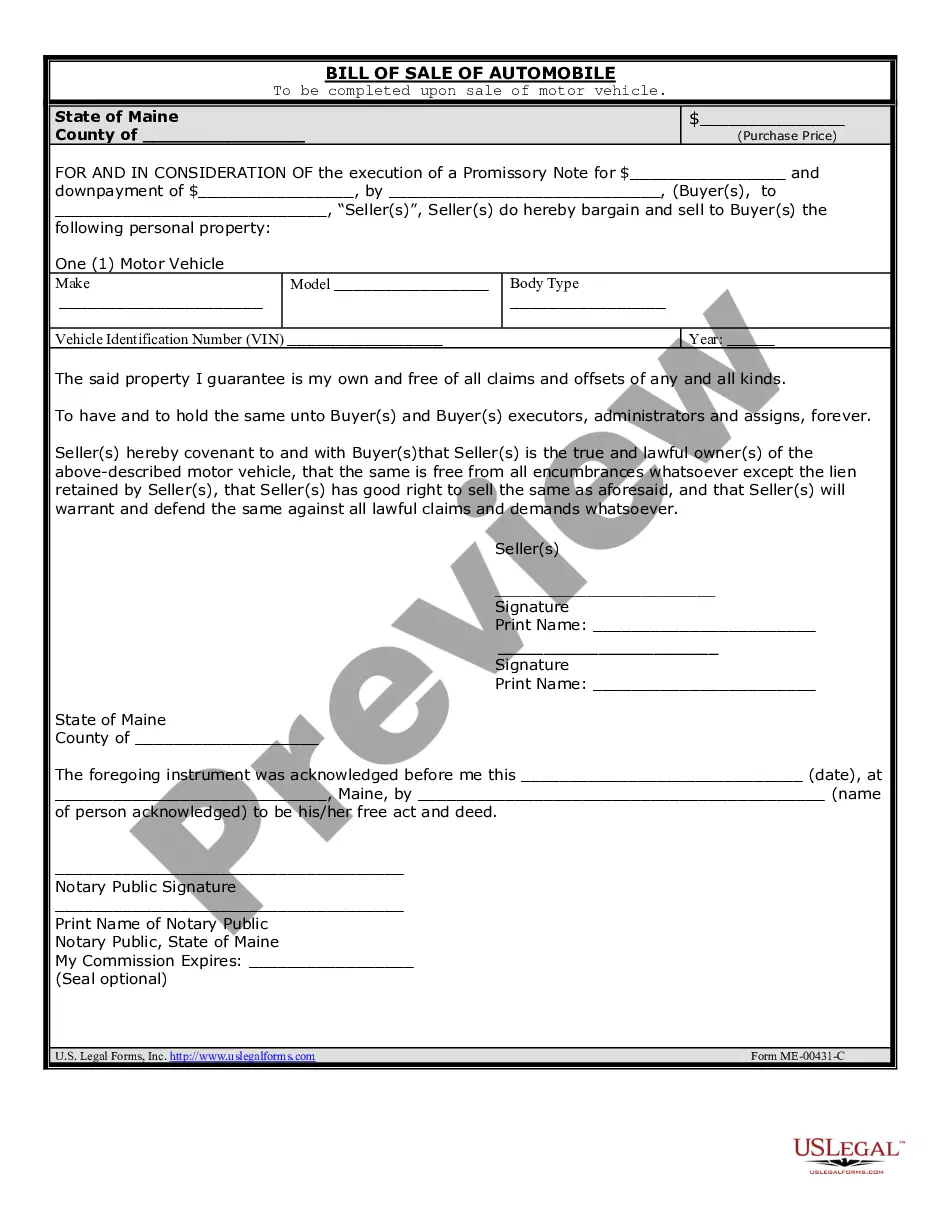

If you need to total, download, or produce legitimate papers templates, use US Legal Forms, the largest variety of legitimate kinds, which can be found online. Take advantage of the site`s easy and convenient research to find the papers you want. Different templates for company and individual purposes are sorted by classes and states, or key phrases. Use US Legal Forms to find the Maryland Pre-incorporation Agreement of Farmers' Non-stock Cooperative Association in a couple of mouse clicks.

If you are presently a US Legal Forms buyer, log in in your bank account and click the Obtain switch to find the Maryland Pre-incorporation Agreement of Farmers' Non-stock Cooperative Association. You can even access kinds you formerly saved inside the My Forms tab of your bank account.

If you work with US Legal Forms initially, refer to the instructions under:

- Step 1. Ensure you have chosen the form for that correct area/country.

- Step 2. Take advantage of the Preview solution to look over the form`s articles. Never forget about to read the description.

- Step 3. If you are unsatisfied with the form, use the Look for area on top of the monitor to get other models from the legitimate form template.

- Step 4. When you have identified the form you want, go through the Purchase now switch. Select the pricing prepare you choose and put your qualifications to register on an bank account.

- Step 5. Process the deal. You may use your charge card or PayPal bank account to perform the deal.

- Step 6. Find the file format from the legitimate form and download it on your gadget.

- Step 7. Comprehensive, revise and produce or indicator the Maryland Pre-incorporation Agreement of Farmers' Non-stock Cooperative Association.

Each legitimate papers template you buy is your own permanently. You have acces to every single form you saved inside your acccount. Go through the My Forms portion and pick a form to produce or download yet again.

Contend and download, and produce the Maryland Pre-incorporation Agreement of Farmers' Non-stock Cooperative Association with US Legal Forms. There are thousands of skilled and status-specific kinds you may use for the company or individual needs.