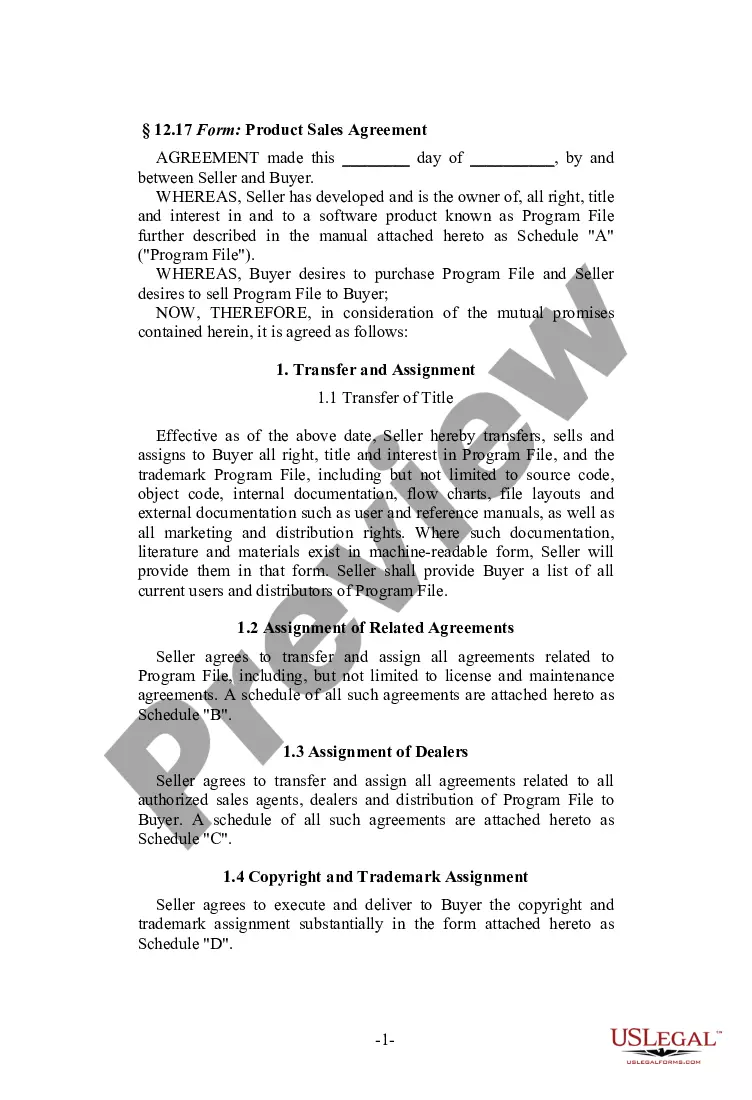

Maryland Software Product Sales Agreement

Description

How to fill out Software Product Sales Agreement?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal form templates you can download or create.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms like the Maryland Software Product Sales Agreement within a matter of minutes.

Check the form's description to ensure you have picked the right form.

If the form does not suit your requirements, utilize the Search field at the top of the screen to find the one that fits.

- If you have an account, Log In and download the Maryland Software Product Sales Agreement from the US Legal Forms library.

- The Download button will be visible on each form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the form's content.

Form popularity

FAQ

This includes food, clothing, jewelry, vehicles, furniture, and art. However, there are exceptions, including: Agricultural Products Items sold/bought are not taxed if they are bought by a farmer and are being used for an agricultural purpose. Read the Law: Md.

In other words, Software-as-a-Service as a cloud-computing program that is only accessed remotely without delivery of a tangible media and does not include the user taking possession of the program is not subject to sales or use tax.

Some goods are exempt from sales tax under Maryland law. Examples include most non-prepared food items, prescription and over-the-counter medicines, and medical supplies.

In the state of Maryland, the software is considered to be exempt so long as all of the transaction does not include the transfer of any tangible personal property. Sales of custom software - delivered on tangible media are exempt from the sales tax in Maryland.

In Maryland, professional services are generally not subject to sales tax.

The hottest topic in the State & Local Tax community has been the emergence of tax laws surrounding the taxability of Software as a Service or more commonly known as SaaS. In March 2021, Maryland's Office of the Comptroller issued guidance on digital products and streaming tax, declaring that SaaS is taxable.

A 6% tax rate applies to most goods and services....These services include, but are not limited to:Manufacturing or producing personal property;Transportation of electricity or natural gas;Commercial cleaning and janitorial services;Certain telecommunications services;Credit reporting;Security services; and.More items...

In the state of Maryland, the software is considered to be exempt so long as all of the transaction does not include the transfer of any tangible personal property. Sales of custom software - delivered on tangible media are exempt from the sales tax in Maryland.

In the state of Maryland, services are not usually taxable.

Effective March 14, 2021, Maryland's 6% sales and use tax on digital goods now applies to the following (non-exclusive) digital products if obtained or delivered by electronic means: E-books, newspapers, magazines, periodicals, or any other publication.