Maryland Security Agreement Covering Goods, Equipment, Inventory, etc., also known as a security agreement or collateral agreement, is a legal document that outlines the terms and conditions under which a lender provides financing to a borrower. This agreement serves to secure the lender's interest in the borrower's assets in the event of default or non-payment. In Maryland, there are various types of security agreements covering goods, equipment, inventory, etc., depending on the nature of the assets being financed. Here, we will discuss some common types: 1. Maryland Security Agreement for Goods: This type of agreement covers tangible personal property such as vehicles, furniture, appliances, electronics, and other movable assets that a borrower pledges as collateral to secure a loan. The lender obtains a security interest in these goods to ensure repayment. 2. Maryland Security Agreement for Equipment: This type of agreement is specific to equipment, machinery, tools, or other durable assets used in a borrower's business operations. The lender requires a security interest in these items to protect its investment in case of default. 3. Maryland Security Agreement for Inventory: This agreement covers the borrower's current or future inventory, including raw materials, work-in-progress goods, or finished products held for sale. It allows the lender to claim the inventory's value in case the borrower fails to repay the loan. The Maryland Security Agreement Covering Goods, Equipment, Inventory, etc., typically includes the following key elements: a. Identification: The agreement identifies the parties involved, including the borrower (debtor) and the lender (secured party). It also provides a detailed description of the collateral being pledged. b. Security Interest: The agreement states that the borrower grants the lender a security interest in the eligible assets. This interest allows the lender to legally claim the collateral if the borrower defaults on the loan. c. Conditions and Obligations: The agreement outlines the borrower's obligations, including making timely payments, maintaining the collateral, and providing insurance coverage. It also mentions the lender's rights and responsibilities. d. Default and Remedies: The agreement specifies the events that constitute default, such as non-payment or violation of any terms. It also explains the remedies available to the lender, which may include repossession, liquidation, or legal action to recover the outstanding amount. e. Governing Law: The Maryland Security Agreement is governed by the laws of the state of Maryland, ensuring consistency and adherence to relevant legal provisions. In conclusion, a Maryland Security Agreement Covering Goods, Equipment, Inventory, etc., is a crucial document that protects the lender's interest in a borrower's assets. It establishes the terms and conditions of the loan, details the rights and obligations of both parties, and provides a legal framework for resolving any disputes should they arise.

Maryland Security Agreement Covering Goods, Equipment, Inventory, Etc.

Description

How to fill out Maryland Security Agreement Covering Goods, Equipment, Inventory, Etc.?

Are you within a place that you need to have documents for both enterprise or person functions just about every working day? There are a variety of lawful papers templates available on the net, but getting ones you can rely on is not straightforward. US Legal Forms delivers 1000s of form templates, just like the Maryland Security Agreement Covering Goods, Equipment, Inventory, Etc., that are composed to meet federal and state needs.

If you are currently acquainted with US Legal Forms web site and have your account, merely log in. Following that, it is possible to obtain the Maryland Security Agreement Covering Goods, Equipment, Inventory, Etc. format.

Should you not have an accounts and would like to begin using US Legal Forms, adopt these measures:

- Find the form you require and make sure it is for the appropriate area/region.

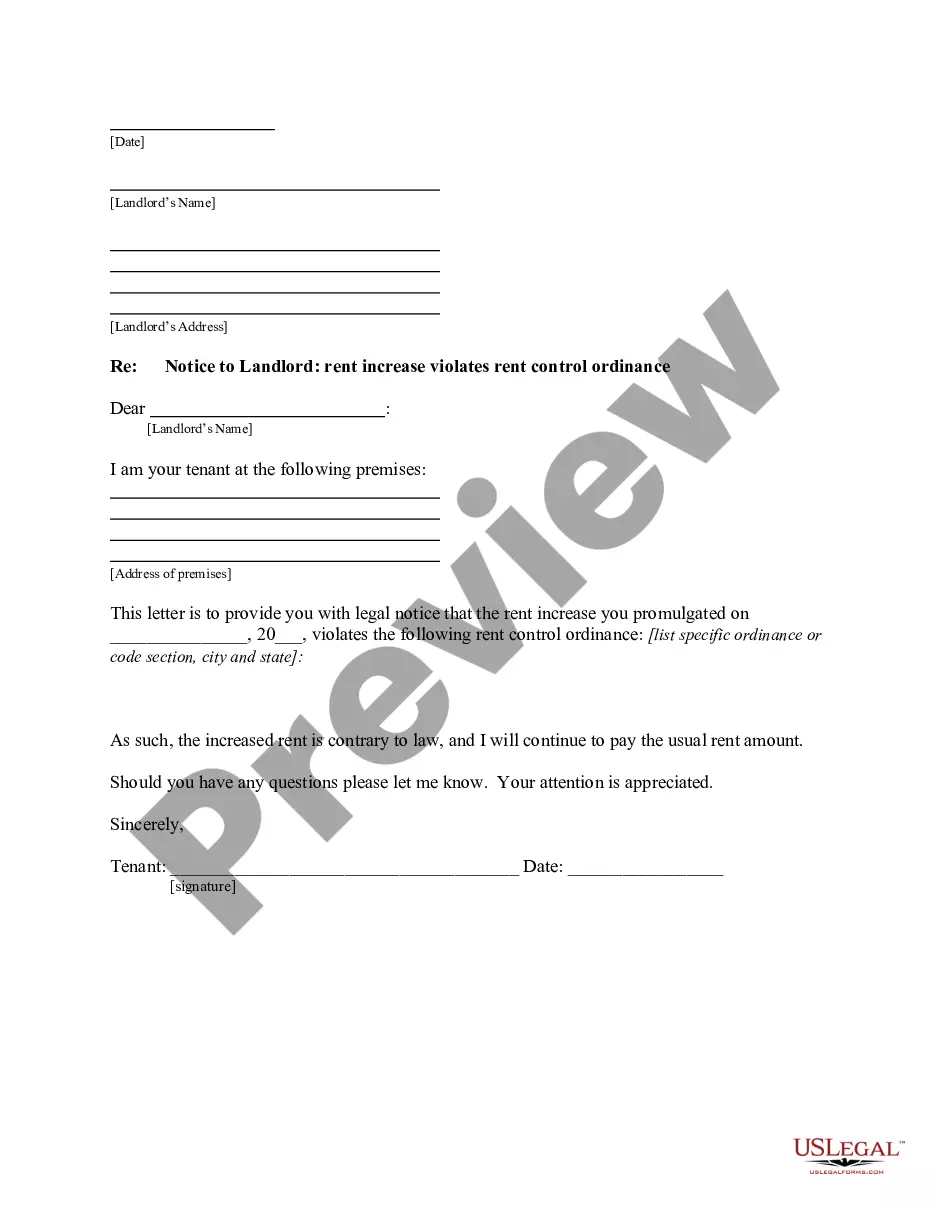

- Utilize the Review button to analyze the form.

- Read the information to actually have chosen the proper form.

- If the form is not what you`re searching for, take advantage of the Look for industry to discover the form that meets your requirements and needs.

- Once you find the appropriate form, just click Purchase now.

- Pick the rates program you want, fill out the specified information and facts to produce your money, and pay money for the order making use of your PayPal or Visa or Mastercard.

- Choose a handy file file format and obtain your duplicate.

Get each of the papers templates you possess purchased in the My Forms menu. You can aquire a further duplicate of Maryland Security Agreement Covering Goods, Equipment, Inventory, Etc. anytime, if required. Just click the necessary form to obtain or printing the papers format.

Use US Legal Forms, by far the most extensive selection of lawful varieties, to save time as well as avoid faults. The assistance delivers skillfully made lawful papers templates which can be used for a range of functions. Make your account on US Legal Forms and initiate generating your lifestyle easier.

Form popularity

FAQ

Document security is the security system used for all of the important documents you create, file, store, back up, deliver, and eventually dispose of when you no longer need them. While the definition is simple, the actual process of keeping your documents secure is quite complex.

A security agreement creates the security interest, making it enforceable between the secured party and the debtor. A UCC-1 financing statement neither creates a security interest nor does it alter its scope; it only gives notice of the security interest to third parties.

The Debtor Authenticates a Security Agreement In other words, the debtor must sign the written agreement that gives the secured party an interest in the collateral. (The UCC uses the term "authenticate" to include the possibility of electronic signatures.)

At a minimum, a valid security agreement consists of a description of the collateral, a statement of the intention of providing security interest, and signatures from all parties involved. Most security agreements, however, go beyond these basic requirements.

What does Security document mean? A generic description of the suite of charges, guarantees and other security taken by a financier in respect of a financing facility.

Currency and passport/visa are the most important security documents that a country issues to its citizens. Other important and valuable security documents include educational documents, property documents, postal documents, employment related documents, bank documents, etc.

Information security documents can also be defined as a liturgy set of an organization's cyber security policies, procedures, guidelines, and standards. This document ensures the confidentiality, integrity, and availability of your client and customer data through effective security management practices and controls.

Document security, or document access security, is the process of safeguarding documents and files from unwanted access or theft. It also refers to procedures carried out to prevent data from being manipulated or reproduced wrongfully.