Maryland Investment Management Agreement for Separate Account Clients is a legal document that outlines the terms and conditions governing the professional relationship between an investment management firm based in Maryland and its clients who hold separate accounts. This agreement serves as a crucial foundation for defining the scope of services offered, the responsibilities of both parties, and the investment objectives for each separate account. The Maryland Investment Management Agreement typically covers various aspects, including portfolio management, fee structure, risk tolerance, investment strategies, and reporting requirements. The agreement ensures transparency and accountability between the investment management firm and its clients by explicitly stating the rights and obligations of each party involved. While there may not be specific types of Maryland Investment Management Agreements for separate account clients, the document can be customized based on the unique needs and preferences of individual clients. Some clients may require a more conservative investment approach to preserve capital, while others may seek a higher-risk strategy to maximize potential returns. The agreement will outline the investment management firm's responsibilities, such as conducting thorough research, formulating investment strategies, monitoring market conditions, and making investment decisions on behalf of the client's separate account. It will also specify the frequency of client communication, including regular reports summarizing investment performance, account activity, and any changes in investment strategies. Moreover, the Maryland Investment Management Agreement will address crucial details regarding fees and compensation. It will specify whether the firm charges a fixed fee, a percentage of assets under management (AUM), or a performance-based fee structure. Additionally, the agreement may cover any potential additional expenses, such as transaction costs or custodial fees. Clients need to carefully review the Maryland Investment Management Agreement before signing to ensure they fully understand the terms and conditions outlined. They should consider factors such as the firm's track record, investment philosophy, and any restrictions or limitations on investment decisions. It is also advisable for clients to seek professional advice from legal or financial experts to ensure their best interests are protected. In conclusion, the Maryland Investment Management Agreement for Separate Account Clients is a comprehensive document that establishes a legal and professional framework between an investment management firm in Maryland and its clients. While there may not be specific types of such agreements, they can be tailored to accommodate the specific investment objectives and risk preferences of individual clients. By clearly defining the expectations and responsibilities of both parties, the agreement promotes transparency, trust, and a mutually beneficial relationship between the investment management firm and its separate account clients.

Maryland Investment Management Agreement for Separate Account Clients

Description

How to fill out Maryland Investment Management Agreement For Separate Account Clients?

Discovering the right authorized record format can be a have difficulties. Needless to say, there are tons of web templates accessible on the Internet, but how do you obtain the authorized form you want? Take advantage of the US Legal Forms internet site. The services offers a large number of web templates, such as the Maryland Investment Management Agreement for Separate Account Clients, that you can use for business and personal needs. All the forms are inspected by professionals and meet up with federal and state needs.

When you are presently authorized, log in for your account and click on the Down load switch to obtain the Maryland Investment Management Agreement for Separate Account Clients. Make use of your account to check throughout the authorized forms you possess purchased in the past. Visit the My Forms tab of your own account and have an additional version from the record you want.

When you are a brand new consumer of US Legal Forms, allow me to share straightforward guidelines so that you can stick to:

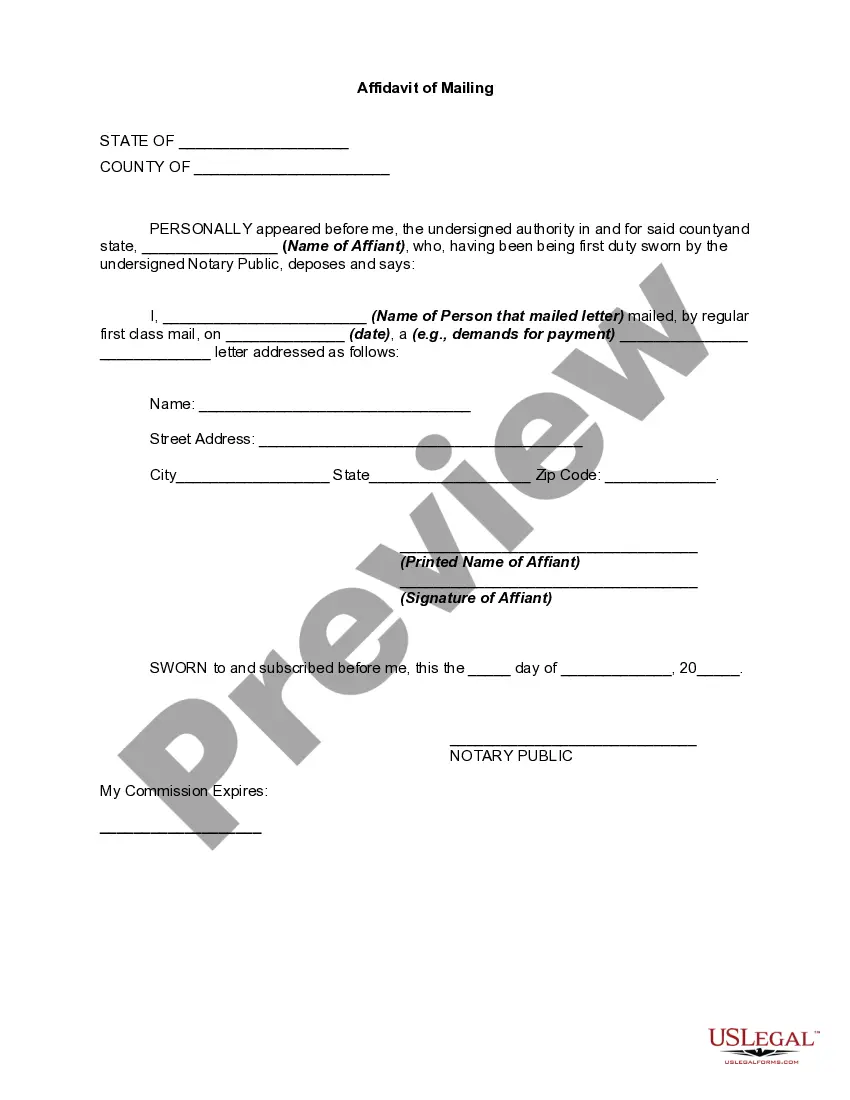

- First, make certain you have chosen the right form for your city/area. It is possible to check out the form utilizing the Preview switch and study the form outline to ensure this is basically the best for you.

- In the event the form is not going to meet up with your needs, make use of the Seach discipline to find the right form.

- When you are certain the form is proper, select the Buy now switch to obtain the form.

- Select the prices prepare you want and enter the essential information. Design your account and purchase an order utilizing your PayPal account or Visa or Mastercard.

- Pick the submit formatting and acquire the authorized record format for your product.

- Full, change and produce and indicator the obtained Maryland Investment Management Agreement for Separate Account Clients.

US Legal Forms is the largest catalogue of authorized forms for which you can discover various record web templates. Take advantage of the company to acquire appropriately-manufactured papers that stick to state needs.