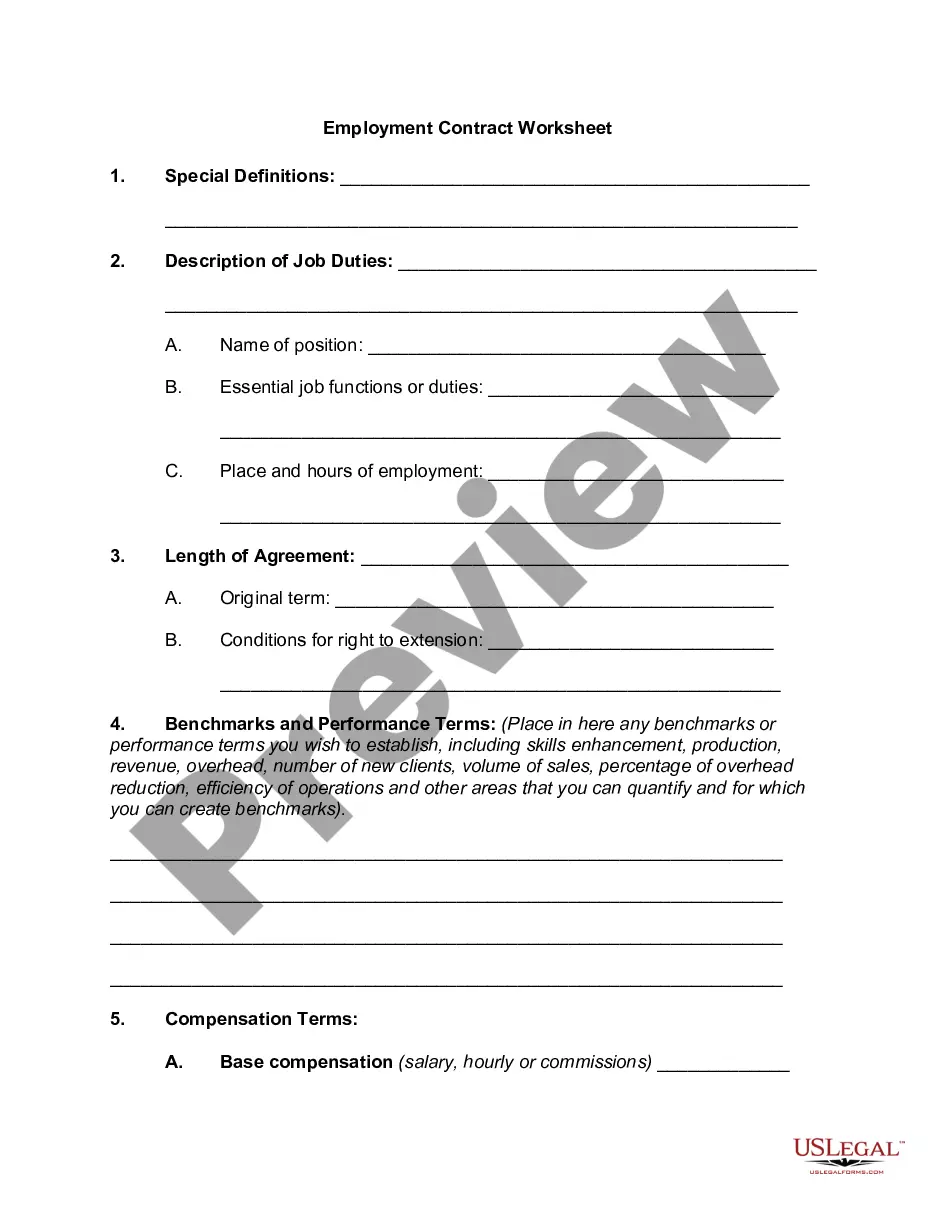

Maryland Worksheet for Job Requirements

Description

How to fill out Worksheet For Job Requirements?

Selecting the appropriate legal document template can be a challenge.

Certainly, there are numerous templates available online, but how do you find the legal form you require.

Utilize the US Legal Forms website.

For new users of US Legal Forms, here are some simple guidelines to follow: First, ensure that you have selected the right form for your city/state. You can review the form using the Review button and read the form description to confirm it is suitable for you. If the form doesn’t fit your needs, utilize the Search area to find the correct form. Once you are confident that the form is appropriate, click on the Purchase now button to obtain the form. Choose the pricing plan that you prefer and enter the required information. Create your account and pay for your order using your PayPal account or credit card. Select the file format and download the legal document template onto your device. Fill out, modify, print, and sign the acquired Maryland Worksheet for Job Requirements. US Legal Forms is the largest collection of legal forms where you can find various document templates. Use the service to obtain professionally crafted documents that comply with state regulations.

- The service offers thousands of templates, including the Maryland Worksheet for Job Requirements, which can serve both business and personal purposes.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are already a registered user, Log Into your account and click the Acquire button to obtain the Maryland Worksheet for Job Requirements.

- Use your account to browse the legal forms you have previously obtained.

- Go to the My documents tab in your account and get another copy of the document you need.

Form popularity

FAQ

NOTE: Standard deduction allowance is 15% of Maryland adjusted gross income with a minimum of $1,500 and a maximum of $2,000 for each taxpayer. spouse - An additional $1,000 may be claimed if the taxpayer and/or spouse is at least 65 years of age and/ or blind on the last day of the tax year.

Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay. Consider completing a new Form MW507 each year and when your personal or financial situation changes.

You'll most likely get a tax refund if you claim no allowances or 1 allowance. If you want to get close to withholding your exact tax obligation, claim 2 allowances for yourself and an allowance for however many dependents you have (so claim 3 allowances if you have one dependent).

MW507. Employee's Maryland Withholding Exemption Certificate. Form used by individuals to direct their employer to withhold Maryland income tax from their pay.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

The Maryland Form MW 507, Employee's Maryland Withholding Exemption Certificate, must be completed so that you know how much state income tax to withhold from your new employee's wages.

Worksheet A is used if a parent has less than 25% of the annual overnights with the child or children and Worksheet B is used if a parent has 25% or more of annual overnights with the child or children. Worksheet B modifies child support downward.

Claiming fewer allowances on Form w-4 will result in more tax being withheld from your paychecks and less take-home pay. This might result in a larger tax refund. On the other hand, claiming too many allowances could mean that not enough tax is withheld during the year.

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.