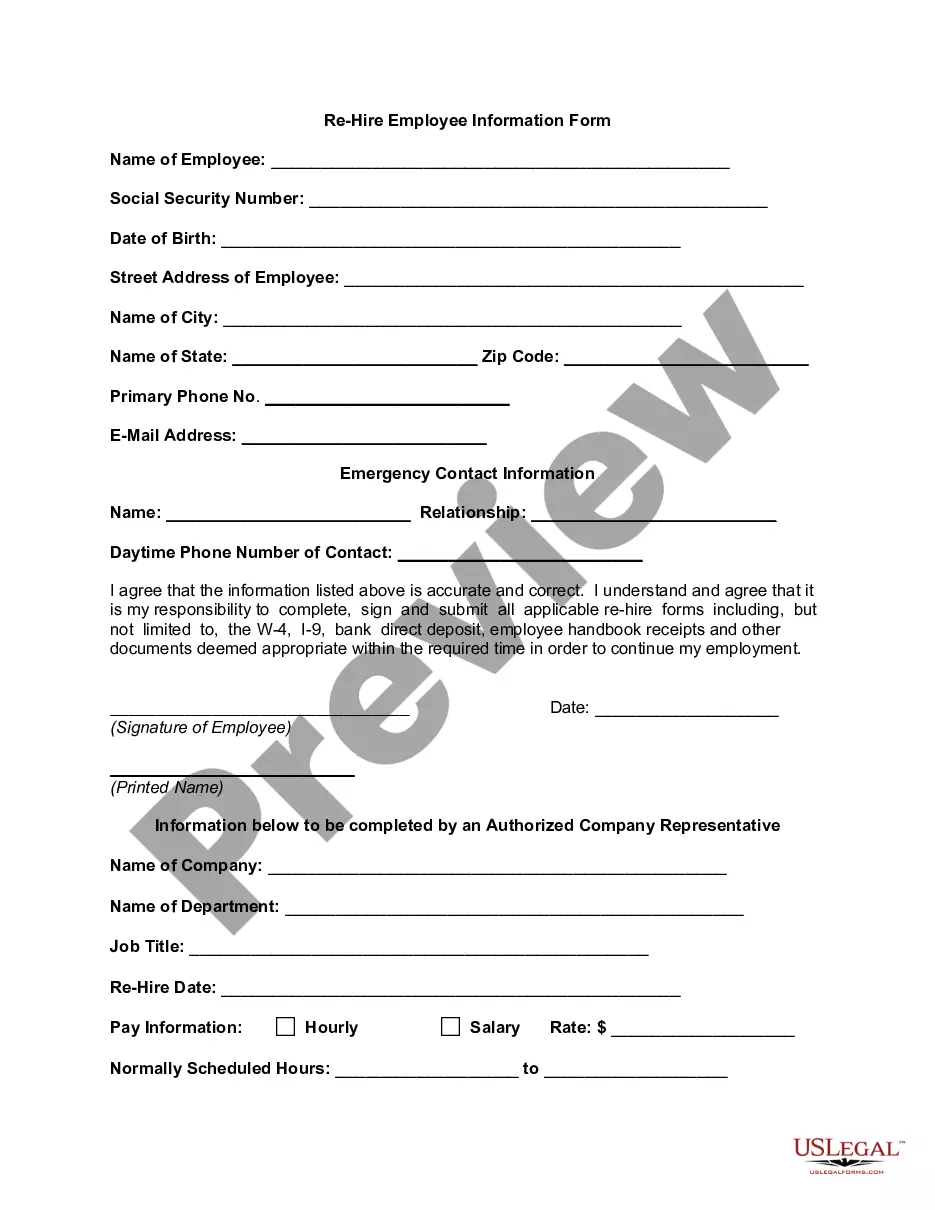

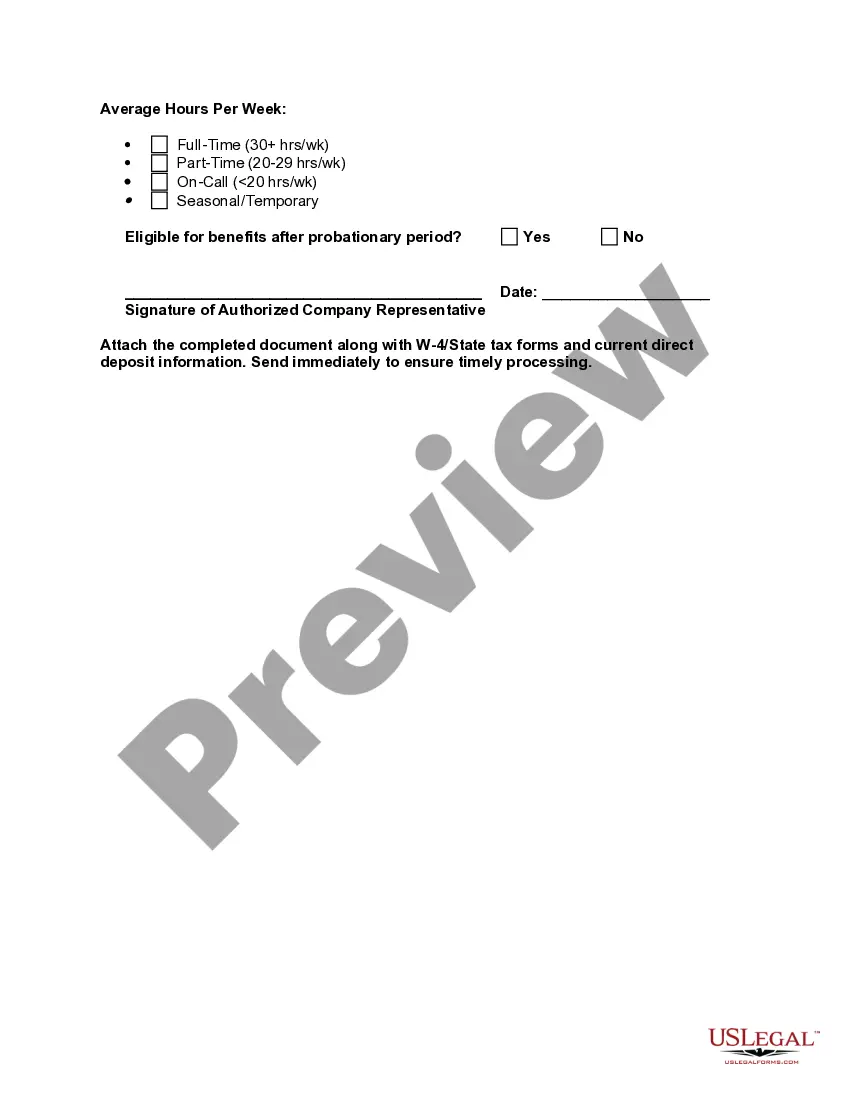

The Maryland Re-Hire Employee Information Form is an essential document used in the state of Maryland when rehiring an employee. It is designed to collect important information about the employee to ensure compliance with legal requirements and to update the company's HR records. This form serves as a comprehensive tool to gather all necessary details from the rehired employee, ensuring the employee's information is accurately recorded. Keywords: Maryland, Re-Hire, Employee Information Form, legal requirements, HR records There are no different types of Maryland Re-Hire Employee Information Forms. However, the form itself may have various sections and fields to gather specific information. The content of the form may vary depending on the organization's specific requirements, but typically it includes the following information: 1. Personal Information: This section collects details such as the employee's full name, address, contact number, email address, and Social Security Number. 2. Employment Information: This section focuses on the employee's previous employment details. It includes fields for the employee's former position within the company, dates of employment, and reasons for leaving. 3. Year-to-Date Information: This section captures the employee's year-to-date earnings and hours worked. This information is crucial for accurately calculating payroll taxes and deductions. 4. Tax Information: This section includes fields for the employee's federal and state tax withholding status, allowing the employer to maintain accurate tax records. 5. Emergency Contact Information: In case of any emergency situation, this section ensures that the employer has up-to-date contact details for the employee's designated emergency contact person. 6. Direct Deposit and Payroll Information: This section collects the employee's banking information, including routing number and account number, to enable direct deposit of wages. 7. Acknowledgment and Signature: The last section of the form requires the employee's signature, certifying that the information provided is accurate and complete. By utilizing the Maryland Re-Hire Employee Information Form, employers can efficiently gather all necessary details and update their records when rehiring an employee. This ensures compliance with legal requirements and promotes accurate HR and payroll processing.

Maryland Re-Hire Employee Information Form

Description

How to fill out Maryland Re-Hire Employee Information Form?

Finding the right legitimate file format could be a have a problem. Naturally, there are a variety of web templates available on the Internet, but how do you find the legitimate form you want? Make use of the US Legal Forms internet site. The support gives a huge number of web templates, for example the Maryland Re-Hire Employee Information Form, which can be used for organization and private requirements. Each of the types are checked out by pros and meet state and federal needs.

If you are presently authorized, log in for your profile and then click the Acquire switch to find the Maryland Re-Hire Employee Information Form. Use your profile to look from the legitimate types you may have purchased in the past. Visit the My Forms tab of your own profile and acquire an additional copy from the file you want.

If you are a fresh end user of US Legal Forms, allow me to share straightforward instructions so that you can stick to:

- Initial, ensure you have chosen the right form for the metropolis/area. It is possible to examine the form using the Preview switch and study the form information to make certain it will be the right one for you.

- In case the form is not going to meet your needs, use the Seach discipline to get the correct form.

- Once you are positive that the form would work, click on the Get now switch to find the form.

- Choose the costs program you need and type in the required info. Create your profile and purchase your order using your PayPal profile or bank card.

- Pick the document formatting and acquire the legitimate file format for your system.

- Complete, revise and print out and sign the attained Maryland Re-Hire Employee Information Form.

US Legal Forms is the largest local library of legitimate types for which you will find numerous file web templates. Make use of the company to acquire skillfully-made documents that stick to express needs.