Maryland Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners

Description

the remaining partners of a business partnership.

How to fill out Settlement Agreement Between The Estate Of A Deceased Partner And The Surviving Partners?

Are you currently inside a position that you need documents for possibly organization or individual functions nearly every day time? There are tons of legal record layouts accessible on the Internet, but getting versions you can rely isn`t straightforward. US Legal Forms offers a huge number of develop layouts, just like the Maryland Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners, which can be published to satisfy state and federal needs.

In case you are presently familiar with US Legal Forms website and get an account, just log in. Following that, you are able to down load the Maryland Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners template.

Should you not provide an accounts and wish to start using US Legal Forms, follow these steps:

- Find the develop you want and make sure it is for the right town/region.

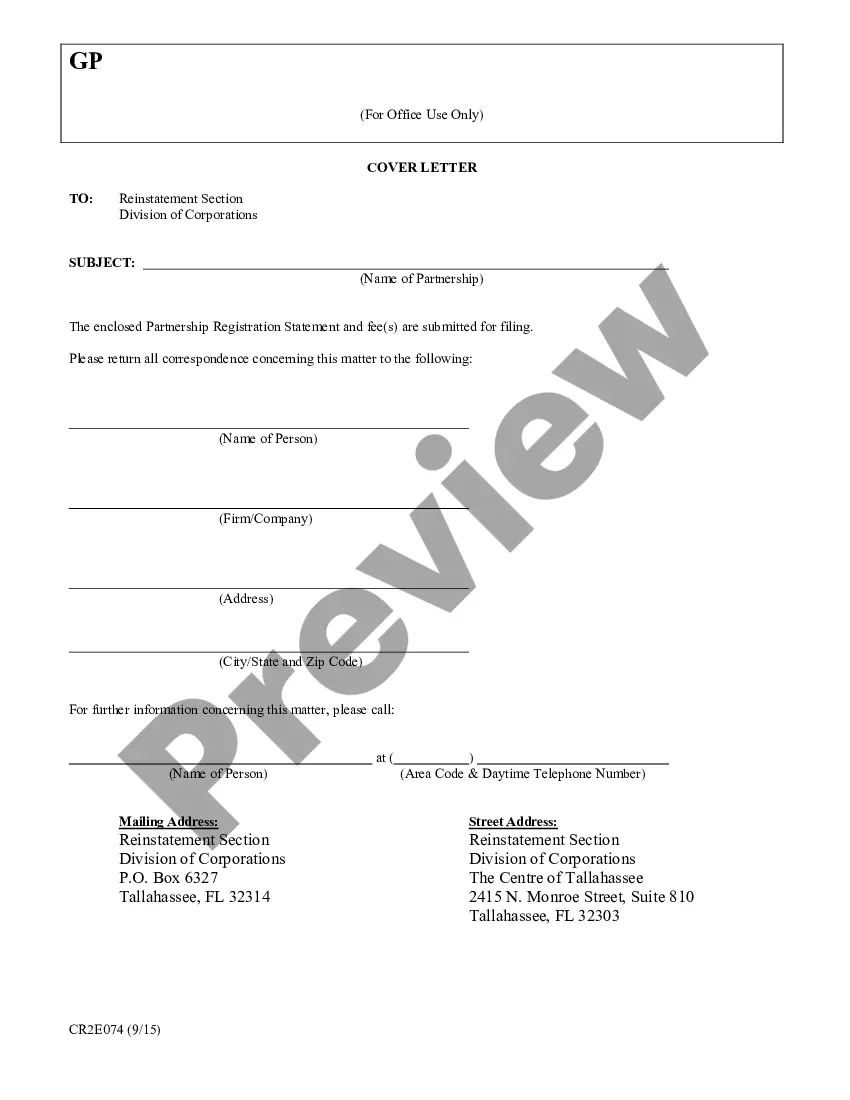

- Take advantage of the Review switch to analyze the form.

- Read the outline to actually have selected the appropriate develop.

- When the develop isn`t what you`re trying to find, utilize the Search industry to find the develop that meets your requirements and needs.

- Whenever you get the right develop, click on Purchase now.

- Opt for the pricing program you need, fill out the desired information to generate your money, and pay for an order utilizing your PayPal or charge card.

- Select a handy document format and down load your version.

Locate all the record layouts you might have bought in the My Forms menu. You can obtain a further version of Maryland Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners anytime, if possible. Just select the required develop to down load or produce the record template.

Use US Legal Forms, by far the most comprehensive collection of legal types, to save efforts and stay away from blunders. The services offers appropriately made legal record layouts that you can use for an array of functions. Generate an account on US Legal Forms and begin making your lifestyle easier.

Form popularity

FAQ

Simply put, if you have a legally binding will when you pass away then the dictates of that document will determine what happens to your assets- so if you have listed your spouse as sole beneficiary, they will receive everything, or exactly how much you have given to them in the will.

Sexting and other forms of electronically recorded erotic behavior sometimes is alleged by a person against his or her spouse in a divorce case as evidence of adultery. This kind of evidence, as hurtful and offensive as it is, may not rise to the level required to prove adultery.

Anything that is jointly owned by you and your spouse will pass to the surviving partner automatically, but you can allocate any solely owned property to whomever you choose.

Under Hindu Law: the wife has a right to inherit the property of her husband only after his death if he dies intestate. Hindu Succession Act, 1956 describes legal heirs of a male dying intestate and the wife is included in the Class I heirs, and she inherits equally with other legal heirs.

If you are married and plan to leave your estate to someone other than your spouse (such as your children from a prior marriage), your estate plan may need an update. You cannot disinherit your spouse. This is the policy underlying the law in Maryland and most other states in America.

Maryland law protects spouses from being disinherited by the other. The rule of law called the elective share gives the surviving spouse the right to receive a fixed amount of the deceased spouse's estate.

The surviving spouse generally stands to inherit first, followed by the decedent's children, their parents, their siblings and so forth. Under certain circumstances, stepchildren may have priority to inherit over other heirs.

If the partners were beneficial joint tenants at the time of the death, when the first partner dies, the surviving partner will automatically inherit the other partner's share of the property. However, if the partners are tenants in common, the surviving partner does not automatically inherit the other person's share.

If the Decedent has spouse but no living parents or children: Spouse inherits everything.