Maryland Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance provides a comprehensive framework and a contractual agreement between an insurance agency and a general insurance agency. This agreement grants exclusive representation rights to the general insurance agency for all lines of insurance in the state of Maryland. Under this agreement, the general insurance agency becomes the sole representative of the insurance agency in Maryland, responsible for marketing, promoting, and selling various lines of insurance products on behalf of the insurance agency. The exclusive representation ensures that all business in the specified territory is directed solely to the general insurance agency. There are different types of Maryland Insurance General Agency Agreements with Exclusive Representation for All Lines of Insurance, including: 1. Property and Casualty (P&C) General Agency Agreement: This type of agreement focuses on general insurance lines related to property and casualty coverage. It includes insurance policies such as homeowners insurance, auto insurance, commercial property insurance, liability insurance, and more. 2. Life and Health General Agency Agreement: This agreement covers all aspects of life and health insurance lines. It allows the general insurance agency to represent the insurance agency in selling life insurance, health insurance, disability insurance, long-term care insurance, and other related products. 3. Commercial General Agency Agreement: This specific agreement focuses on providing exclusive representation for commercial insurance lines. It involves selling various commercial policies such as business owners' insurance, commercial auto insurance, workers' compensation insurance, and professional liability insurance. 4. Specialty Lines General Agency Agreement: This agreement is tailored to specific niche insurance lines such as marine insurance, aviation insurance, event insurance, and other specialized types of coverage. The general insurance agency gains exclusive representation in the specified specialty lines. These agreements ensure that the general insurance agency acts as the primary sales and marketing force for the insurance agency in Maryland. They outline the obligations and responsibilities of both parties, including commission rates, term of the agreement, territory boundaries, termination clauses, and any other relevant terms and conditions. By entering into a Maryland Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance, insurance agencies can tap into the expertise and market knowledge of specialized general insurance agencies, allowing them to expand their business presence and increase sales in the state of Maryland.

Maryland Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance

Description

How to fill out Maryland Insurance General Agency Agreement With Exclusive Representation For All Lines Of Insurance?

Are you in a situation where you require documents for various corporate or personal activities nearly every day.

There are numerous legal document templates available online, but finding the trustworthy ones is challenging.

US Legal Forms offers a wide array of form templates, including the Maryland Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance, which are drafted to comply with federal and state regulations.

Once you find the correct form, click Purchase now.

Choose the pricing plan you prefer, fill in the necessary details for the transaction, and complete the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Maryland Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it corresponds to the correct city/county.

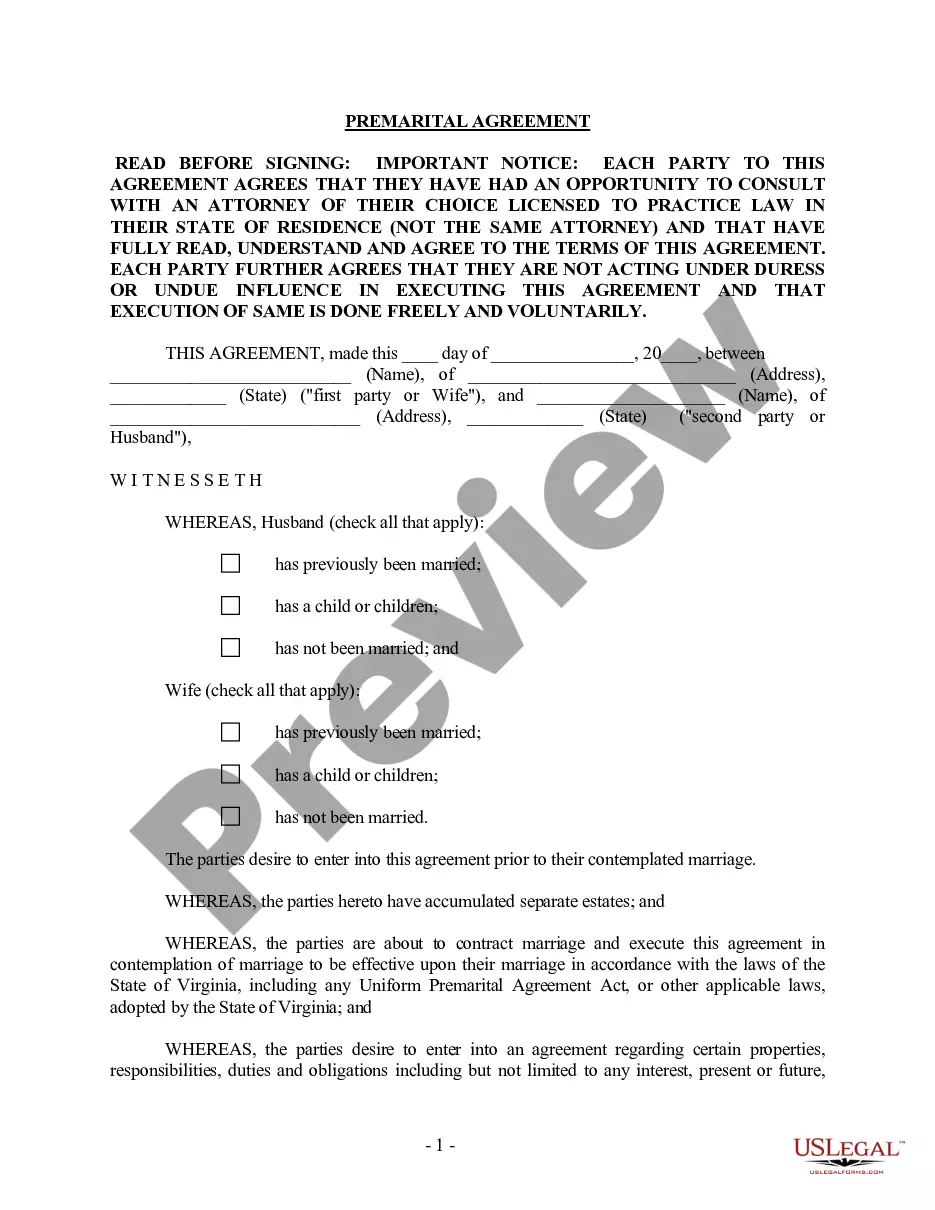

- Utilize the Preview button to examine the form.

- Review the description to confirm that you have selected the right form.

- If the form does not meet your requirements, leverage the Lookup field to find the form that suits your needs.

Form popularity

FAQ

To become a licensed insurance agent in Maryland, follow these steps: complete a state-approved pre-licensing course, pass the relevant insurance exam, and submit your application to the Maryland Insurance Administration along with the required fees. It is advisable to connect with a Maryland Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance to gain insights and support throughout your licensing journey.

The Maryland life insurance exam typically lasts 150 minutes. During this time, candidates must answer a series of questions that assess their knowledge of life insurance principles and state regulations. It is crucial to prepare thoroughly for this exam, as passing it is essential for obtaining your license and working within a Maryland Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance.

The Maryland Insurance Administration examines the records of all admitted insurance to ensure compliance with state regulations, protect consumer interests, and maintain market integrity. By conducting these examinations, the Administration can identify potential issues and enforce industry standards. This scrutiny also supports Maryland’s Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance to uphold high ethical standards.

The difficulty of obtaining an insurance license may vary by individual experience, but many consider the life and health insurance license to be among the most challenging. This license demands a deep understanding of complex regulations and policies. Engaging in a Maryland Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance can offer structured guidance and training, making the process smoother.

To become an insurance agent in Maryland, you must first complete the required pre-licensing education courses. Then, you need to pass the Maryland insurance licensing exam. After passing the exam, you can apply for a license by submitting the necessary documents and fees to the Maryland Insurance Administration. Joining a Maryland Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance can also provide support and resources as you start your career.

An insurance policy can be canceled for various reasons, including nonpayment of premiums, fraud, or a significant change in risk. In Maryland, insurers must provide a minimum of 10 days' advance notice before a cancellation occurs, ensuring policyholders can address the situation. Engaging with the Maryland Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance can help clarify situations of policy cancellation and the necessary communication involved.

Insurers are generally required to provide policyholders with advance notice of at least 10 days before a cancellation takes effect. This notice period allows policyholders to secure their coverage and address any outstanding issues. If you are navigating the Maryland Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance, understanding this requirement is essential for both agents and policyholders.

To obtain an insurance license in Maryland, applicants must complete pre-licensing education, pass the necessary examination, and submit an application to the Maryland Insurance Administration. This thorough process ensures that all licensees have a solid understanding of the insurance industry. Familiarizing oneself with the Maryland Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance can provide critical insight into the responsibilities and advantages of becoming a licensed agent.

Licensees themselves are responsible for notifying the Maryland Insurance Administration about any changes in their name or address. Keeping this information up-to-date is essential for maintaining compliance and ensuring continued communication with the agency. For those involved in the Maryland Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance, understanding these requirements can help uphold professionalism.

For personal auto policies in Maryland, insurance companies must provide at least 10 days' notice before cancellation. This regulation gives policyholders the opportunity to address any issues that may lead to cancellation, such as settling overdue payments. Engaging with the Maryland Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance can clarify cancellation protocols for policyholders.

Interesting Questions

More info

M. — 5 p.m.