The Maryland Agreement for Sale of Assets of Corporation is a legal contract that outlines the terms and conditions for the sale of assets of a corporation located in the state of Maryland. This agreement is crucial when a corporation decides to sell its assets to another party, ensuring a smooth and legally-binding transaction. The agreement typically includes specific details regarding the nature and scope of the assets being sold. This can encompass various types of assets such as real estate properties, equipment, intellectual property rights, customer contracts, inventory, and other tangible and intangible assets that hold value for the corporation. Key elements covered in the Maryland Agreement for Sale of Assets of Corporation include: 1. Parties involved: The agreement identifies the parties involved, representing both the seller (the corporation) and the buyer. 2. Purchase price: The agreement clearly states the agreed-upon purchase price for the assets being sold. This includes any deposit or down payment made by the buyer to secure the sale. 3. Asset description: A detailed list of the assets being sold along with their respective descriptions is included. This helps both parties to have a clear understanding of what is being transferred. 4. Representations and warranties: The agreement includes statements made by both parties regarding the accuracy of information provided, nonexistence of undisclosed liabilities, and legal compliance of the corporation. 5. Due diligence: The buyer's access to the corporation's financial records, contracts, licenses, and other relevant documentation is stipulated. This allows the buyer to evaluate the assets and potential risks involved. 6. Assumption of liabilities: Any liabilities, such as debts, contracts, or pending lawsuits, are addressed in the agreement. The buyer and seller should negotiate who will take responsibility for these liabilities. 7. Conditions precedent: The agreement may include certain conditions that need to be fulfilled before the sale can be completed. For instance, obtaining necessary approvals from third parties or regulatory authorities. 8. Closing and transfer of ownership: The closing date of the transaction is specified, along with the agreed-upon method of transferring ownership of the assets. 9. Confidentiality and non-compete clauses: Both parties may include provisions for maintaining confidentiality regarding the transaction and non-compete agreements to protect their respective interests. Different types of Maryland Agreement for Sale of Assets of Corporation might include specific variations based on the nature of assets being sold, the parties involved (e.g., individual seller, multiple sellers, or subsidiaries), or the particular industry or sector in which the corporation operates (e.g., technology, manufacturing, healthcare). It is essential for parties involved in the sale of assets to consult with legal professionals experienced in Maryland corporate law to ensure that the agreement complies with all necessary regulations and safeguards their interests.

Maryland Agreement for Sale of Assets of Corporation

Description

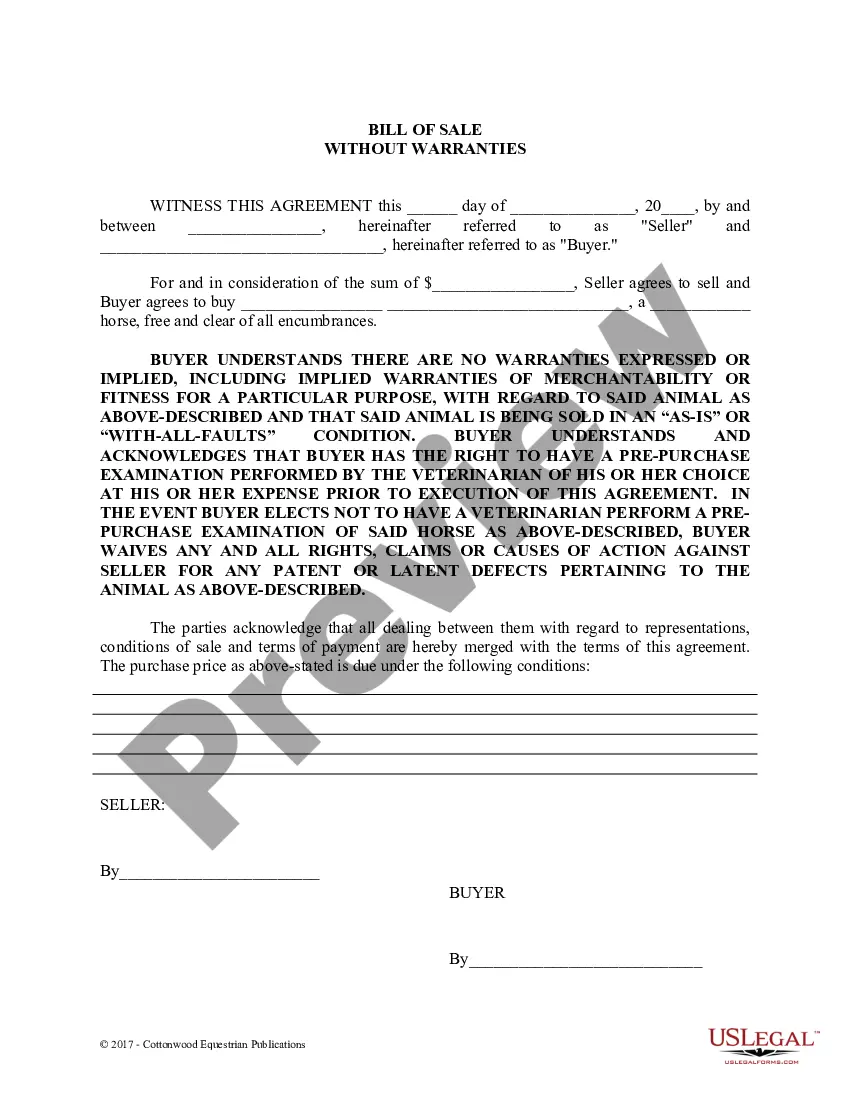

How to fill out Maryland Agreement For Sale Of Assets Of Corporation?

Finding the right authorized papers format can be a battle. Of course, there are tons of layouts available on the net, but how can you find the authorized type you want? Use the US Legal Forms web site. The support gives a large number of layouts, such as the Maryland Agreement for Sale of Assets of Corporation, that can be used for enterprise and personal requirements. All of the kinds are inspected by professionals and satisfy federal and state specifications.

If you are presently authorized, log in to the profile and then click the Download key to get the Maryland Agreement for Sale of Assets of Corporation. Use your profile to check through the authorized kinds you may have bought previously. Visit the My Forms tab of your respective profile and get another version in the papers you want.

If you are a fresh user of US Legal Forms, here are easy instructions that you should comply with:

- Very first, be sure you have chosen the appropriate type for your personal area/state. You may look through the form using the Review key and look at the form information to guarantee this is basically the best for you.

- When the type does not satisfy your needs, make use of the Seach area to obtain the appropriate type.

- Once you are certain the form is suitable, go through the Purchase now key to get the type.

- Choose the costs prepare you want and type in the essential details. Build your profile and pay money for the order using your PayPal profile or charge card.

- Choose the data file format and download the authorized papers format to the device.

- Full, edit and produce and indicator the received Maryland Agreement for Sale of Assets of Corporation.

US Legal Forms is definitely the most significant catalogue of authorized kinds in which you can discover various papers layouts. Use the company to download professionally-made documents that comply with express specifications.