Maryland Notice of Disputed Account

Description

How to fill out Notice Of Disputed Account?

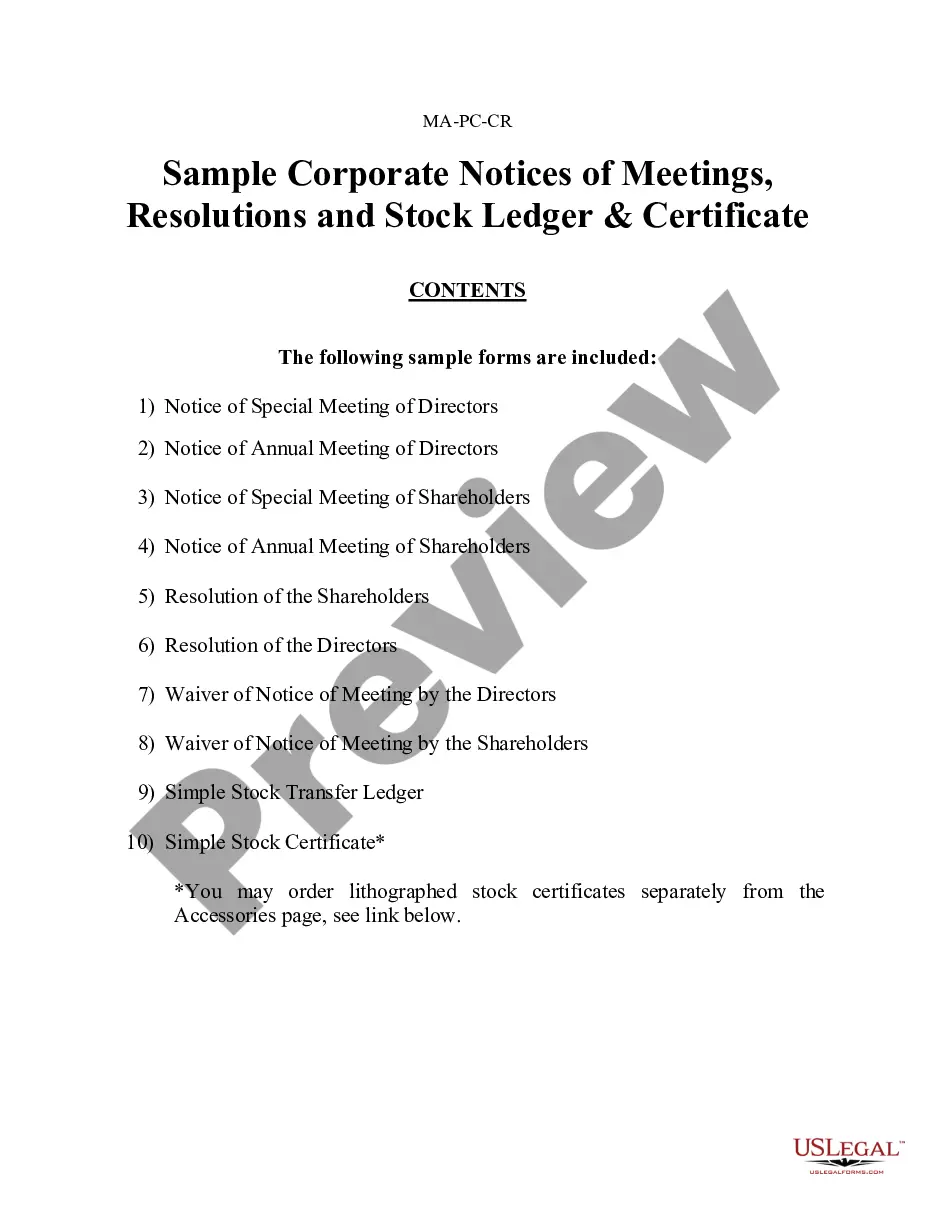

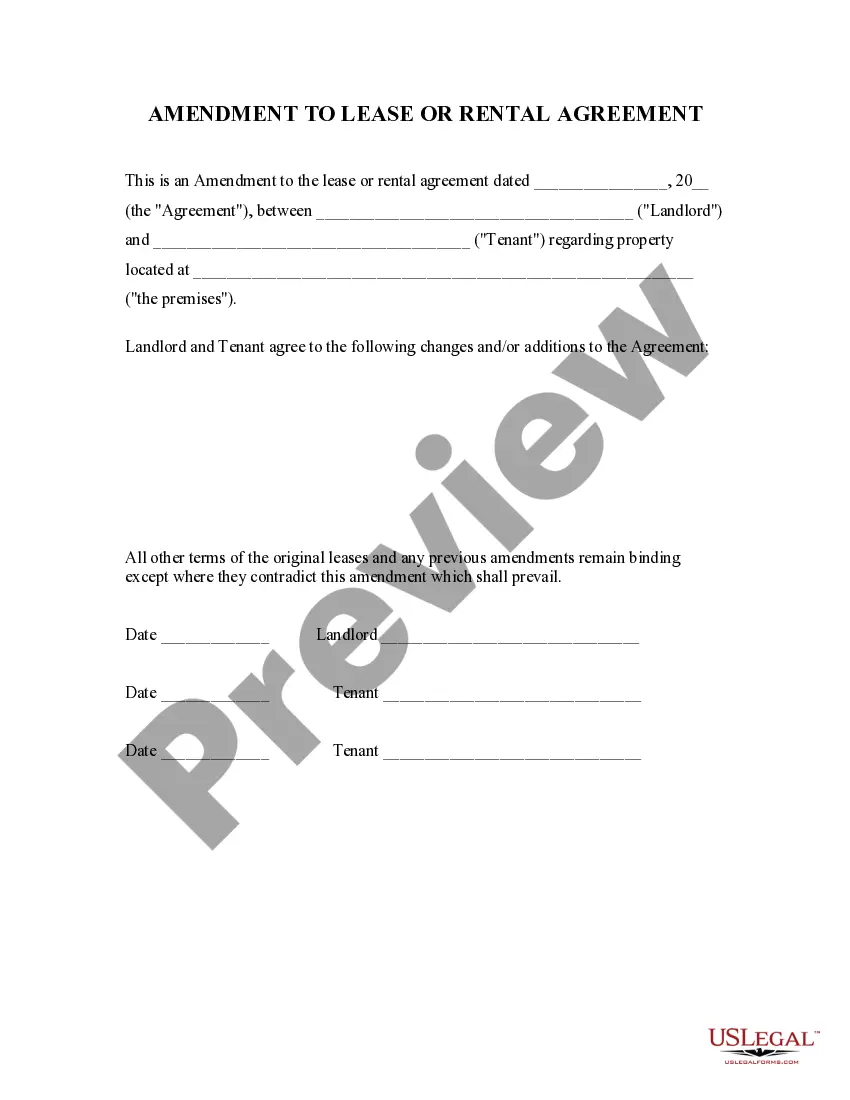

You can allocate time online looking for the appropriate legal document template that meets the federal and state requirements you need.

US Legal Forms provides a wide array of legal forms that are evaluated by experts.

You can obtain or print the Maryland Notice of Disputed Account from our service.

If available, use the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click on the Obtain button.

- After that, you can complete, edit, print, or sign the Maryland Notice of Disputed Account.

- Every legal document template you purchase is yours to keep permanently.

- To retrieve another copy of any purchased form, visit the My documents tab and click on the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure that you have selected the correct document template for your area or city.

- Review the form description to confirm you have chosen the correct form.

Form popularity

FAQ

A letter from the state controller often addresses financial matters related to your account with the state, including the Maryland Notice of Disputed Account. It serves as a notification regarding any issues or updates that may affect your tax obligations. By responding to this letter, you can clarify discrepancies and maintain good standing with the state. For further help in managing these inquiries, consider using uSLegalForms to ensure you are well-informed and prepared.

A tax compliance letter is a document issued by the state which confirms your tax standing or outlines any discrepancies with your account. It often addresses issues related to your Maryland Notice of Disputed Account, advising you on any necessary actions to remain compliant. Receiving this letter can prompt you to resolve outstanding tax matters swiftly to avoid penalties. If you have questions regarding your compliance, you can find useful resources on platforms like uSLegalForms.

The amount of Maryland state tax withheld varies based on several factors, including your income level and filing status. Generally, your employer processes your withholding using the information you provide on your W-4 form. Understanding your Maryland Notice of Disputed Account can help in ensuring that the correct amount is withheld and that there are no surprises during tax season. If you need assistance in calculating these amounts, consider using uSLegalForms for precise guidance.

You might receive a letter from the Comptroller of Maryland regarding your Maryland Notice of Disputed Account if there are discrepancies in your tax records. This communication is usually a prompt for you to review any potential errors or outstanding issues. It serves as an important notice to ensure that you are compliant with Maryland tax regulations. Addressing it promptly can help resolve any disputes and avoid further complications.

Filing a complaint against a business in Maryland online is straightforward. Start by visiting the Maryland Attorney General's website, where you can find a user-friendly complaint form. Fill out the form, detailing your grievances clearly. If your issue involves financial disputes, consider mentioning a Maryland Notice of Disputed Account to strengthen your complaint.

You can contact the Maryland Comptroller's office by visiting their official website and using their provided contact information. They offer telephone support, email assistance, and even in-person visits if necessary. Be prepared to provide details about your inquiry, particularly if it relates to a Maryland Notice of Disputed Account or other tax concerns. Their staff is equipped to assist you effectively.

If you need to complain about a tax preparer in Maryland, begin by documenting your concerns and any interactions you had. Complaints can be submitted to the Maryland State Board of Public Accountancy or the appropriate regulatory body. Provide as much detail as possible about your experience. This information can be crucial should you also decide to file a Maryland Notice of Disputed Account regarding your taxes.

To file an appeal with the Comptroller of Maryland, start by completing the official appeal form available on their website. Submit your completed form along with any relevant documentation to support your case. Ensure that you meet the deadlines for appeals to avoid delays. If needed, consider using the Maryland Notice of Disputed Account as part of your appeal strategy.

Filing a complaint against a Maryland comptroller involves gathering your documentation and clearly outlining your concerns. You can submit your complaint via email or mail to the office of the Maryland Comptroller. Make sure to include your contact information and any supporting documents for context. A Maryland Notice of Disputed Account may also be applicable if your complaint involves tax disputes.

To dispute Maryland taxes, you should first review your tax assessment documents. If you believe there’s an error, file a Maryland Notice of Disputed Account with the appropriate state agency. Collect relevant evidence to support your claim, such as receipts and financial records. Additionally, consider reaching out to a tax professional for guidance throughout the process.