Maryland Gift of Stock to Spouse for Life with Remainder to Children is a type of estate planning tool that allows individuals in Maryland to transfer their stock assets to their spouse for their lifetime, with the remainder going to their children after the spouse's passing. This arrangement ensures that both the spouse and the children are provided for in the future. The Gift of Stock to Spouse for Life with Remainder to Children is a legal strategy specifically designed for Maryland residents. It provides a way for individuals to transfer their stock holdings to their spouse during their lifetime, ensuring the spouse's financial security. This type of gift includes a remainder interest that entitles the children to receive the stock assets upon the spouse's death. This estate planning tool is particularly useful for individuals who want to provide ongoing financial support for their spouse while also ensuring that their children receive an inheritance. By transferring the stock assets to the spouse, they can benefit from any income or dividends generated from the stocks during their lifetime. This can offer them financial stability and peace of mind. The Gift of Stock to Spouse for Life with Remainder to Children arrangement can come in different variations to suit individual preferences and circumstances. These variations include: 1. Maryland Gift of Specific Stock to Spouse for Life with Remainder to Children: In this type, specific stocks are designated to be transferred to the spouse for their lifetime, with the remainder going to the children upon the spouse's death. 2. Equal and Proportional Gift of Stock to Spouse for Life with Remainder to Children: This variant involves dividing the stock assets into equal or proportional shares, with each share benefiting the spouse during their lifetime and transferring to the children after the spouse's passing. 3. Maryland Qualified Terminable Interest Property (TIP) Trust: This type of trust allows the transfer of stock assets to a trust, which provides income to the surviving spouse for their lifetime. After the spouse's death, the remaining assets are distributed to the children. This option provides more control over the distribution of assets and can offer certain tax benefits. In conclusion, the Maryland Gift of Stock to Spouse for Life with Remainder to Children is an effective estate planning tool that ensures both the spouse and the children are provided for in the future. It offers various options to suit individual preferences and needs, providing financial security and peace of mind to the entire family.

Maryland Gift of Stock to Spouse for Life with Remainder to Children

Description

How to fill out Maryland Gift Of Stock To Spouse For Life With Remainder To Children?

It is possible to devote hours on-line attempting to find the legitimate file format that meets the federal and state demands you want. US Legal Forms provides 1000s of legitimate varieties that happen to be examined by pros. You can easily obtain or print the Maryland Gift of Stock to Spouse for Life with Remainder to Children from my services.

If you have a US Legal Forms bank account, you may log in and click on the Download option. Afterward, you may complete, revise, print, or indication the Maryland Gift of Stock to Spouse for Life with Remainder to Children. Each legitimate file format you purchase is your own property eternally. To acquire yet another version of the purchased develop, check out the My Forms tab and click on the corresponding option.

Should you use the US Legal Forms web site the very first time, keep to the easy recommendations under:

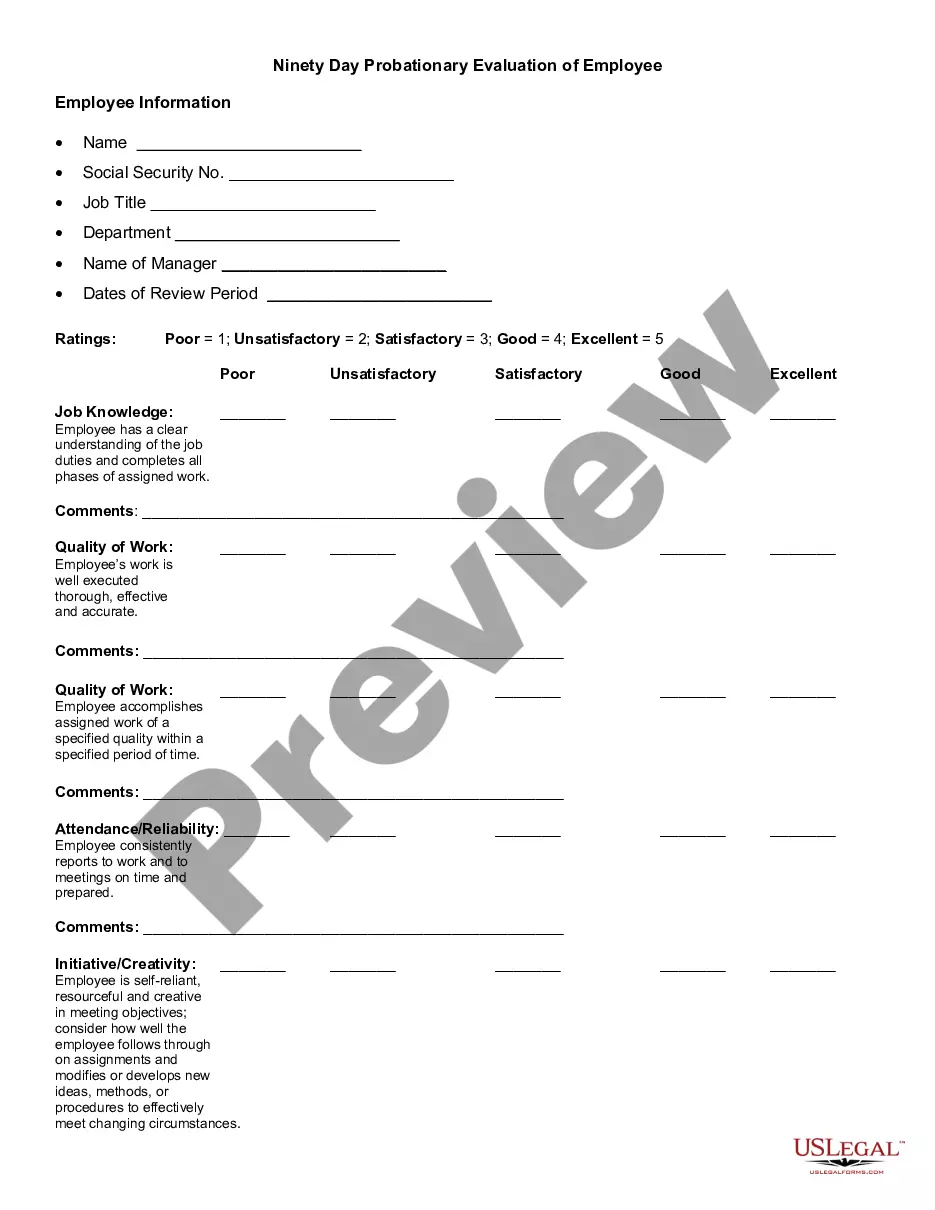

- Very first, make certain you have selected the correct file format for your state/metropolis of your liking. Look at the develop outline to make sure you have picked the appropriate develop. If readily available, utilize the Review option to look from the file format too.

- If you wish to discover yet another version of the develop, utilize the Look for field to get the format that meets your needs and demands.

- Upon having found the format you desire, simply click Buy now to carry on.

- Choose the costs prepare you desire, type your credentials, and register for a free account on US Legal Forms.

- Full the purchase. You may use your credit card or PayPal bank account to pay for the legitimate develop.

- Choose the formatting of the file and obtain it in your system.

- Make alterations in your file if necessary. It is possible to complete, revise and indication and print Maryland Gift of Stock to Spouse for Life with Remainder to Children.

Download and print 1000s of file web templates while using US Legal Forms site, which offers the largest selection of legitimate varieties. Use expert and status-specific web templates to deal with your business or personal requires.

Form popularity

FAQ

You can start the process online in your own brokerage account by opting to gift shares or securities you own; if you can't find that option, contact your brokerage firm directly. If you want to gift a stock you don't already own, you'll have to purchase it in your account, then transfer it to the recipient.

Simply transferring the shares to your spouse in order to realize the capital gain will not work due to the income attribution rules. However, there is a strategy that may work. This strategy involves giving half of the shares to your spouse, then selling the other half to your spouse at fair market value.

If you are married and plan to leave your estate to someone other than your spouse (such as your children from a prior marriage), your estate plan may need an update. You cannot disinherit your spouse. This is the policy underlying the law in Maryland and most other states in America.

Maryland law protects spouses from being disinherited by the other. The rule of law called the elective share gives the surviving spouse the right to receive a fixed amount of the deceased spouse's estate.

Simply put, if you have a legally binding will when you pass away then the dictates of that document will determine what happens to your assets- so if you have listed your spouse as sole beneficiary, they will receive everything, or exactly how much you have given to them in the will.

Most Transfers Between Spouses & Former Spouses Are Not Taxable. The general rule is that property and funds transfers between spouses during marriage and in divorce are not taxable, except for post-divorce alimony. Gifts between spouses during marriage are usually not taxable, regardless of the amount.

Stocks can be given to a recipient as a gift whereby the recipient benefits from any gains in the stock's price. Gifting stock from an existing brokerage account involves an electronic transfer of the shares to the recipients' brokerage account.

If one dies, the other partner will automatically inherit the whole of the money. Property and money that the surviving partner inherits does not count as part of the estate of the person who has died when it is being valued for the intestacy rules.

Gifting Stock When you make a non-cash gift such as a stock, house, or even a business, the person receiving the gift assumes your cost basis in the assets. They do not receive a step-up in basis at the time the gift is made.

If the Decedent has spouse but no living parents or children: Spouse inherits everything.