Maryland Demand for a Shareholders Meeting

Description

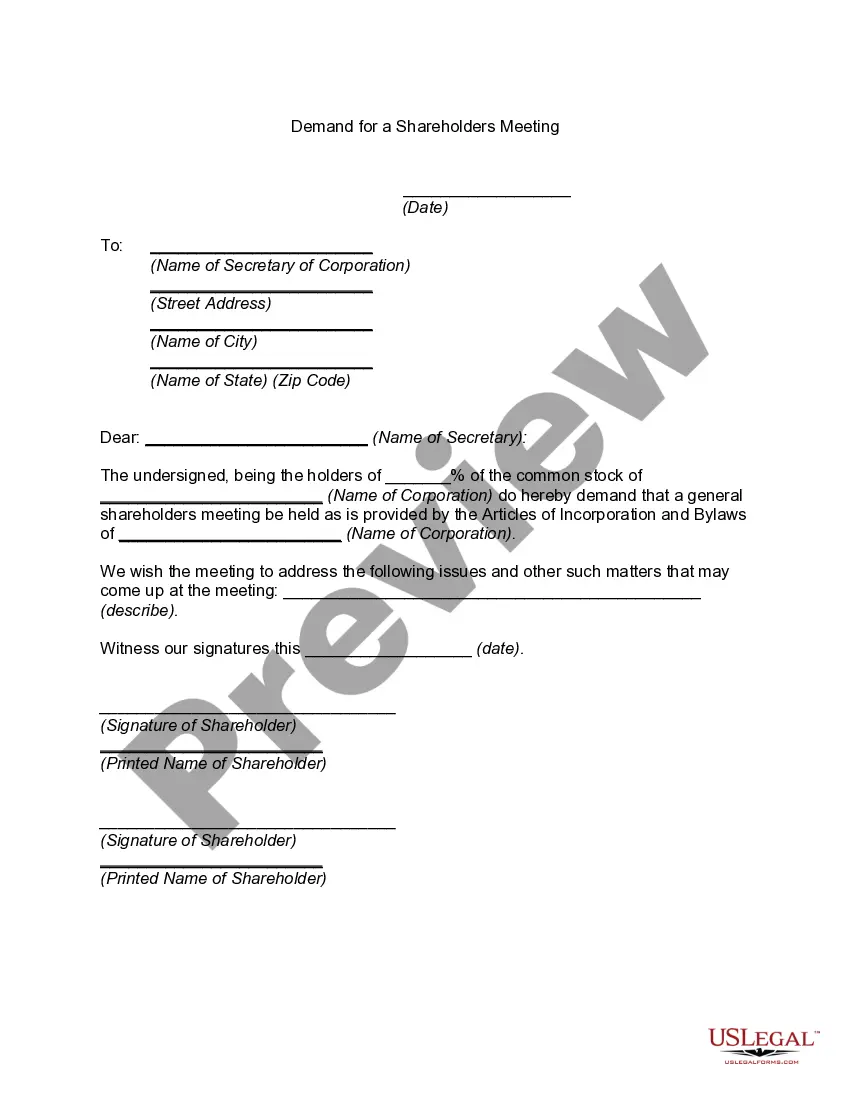

How to fill out Demand For A Shareholders Meeting?

If you seek to be thorough, obtain, or print certified document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Leverage the site’s user-friendly and efficient search to locate the documents you require.

A range of templates for business and personal purposes are organized by categories, states, or keywords.

Step 4. Once you have found the form you require, click the Buy Now button. Choose the payment plan you prefer and provide your credentials to register for an account.

Step 5. Process the transaction. You may use your Visa, Mastercard, or PayPal account to complete the purchase. Step 6. Select the format of your legal form and download it to your device. Step 7. Complete, amend, and print or sign the Maryland Demand for a Shareholders Meeting. Every legal document template you purchase is yours indefinitely. You will have access to every form you acquired in your account. Navigate to the My documents section and select a form to print or download again. Compete and obtain, and print the Maryland Demand for a Shareholders Meeting with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to acquire the Maryland Demand for a Shareholders Meeting with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to retrieve the Maryland Demand for a Shareholders Meeting.

- You can also access forms you have previously purchased from the My documents section of your account.

- If this is your initial experience with US Legal Forms, follow the steps below.

- Step 1. Confirm that you have selected the form for the correct city/county.

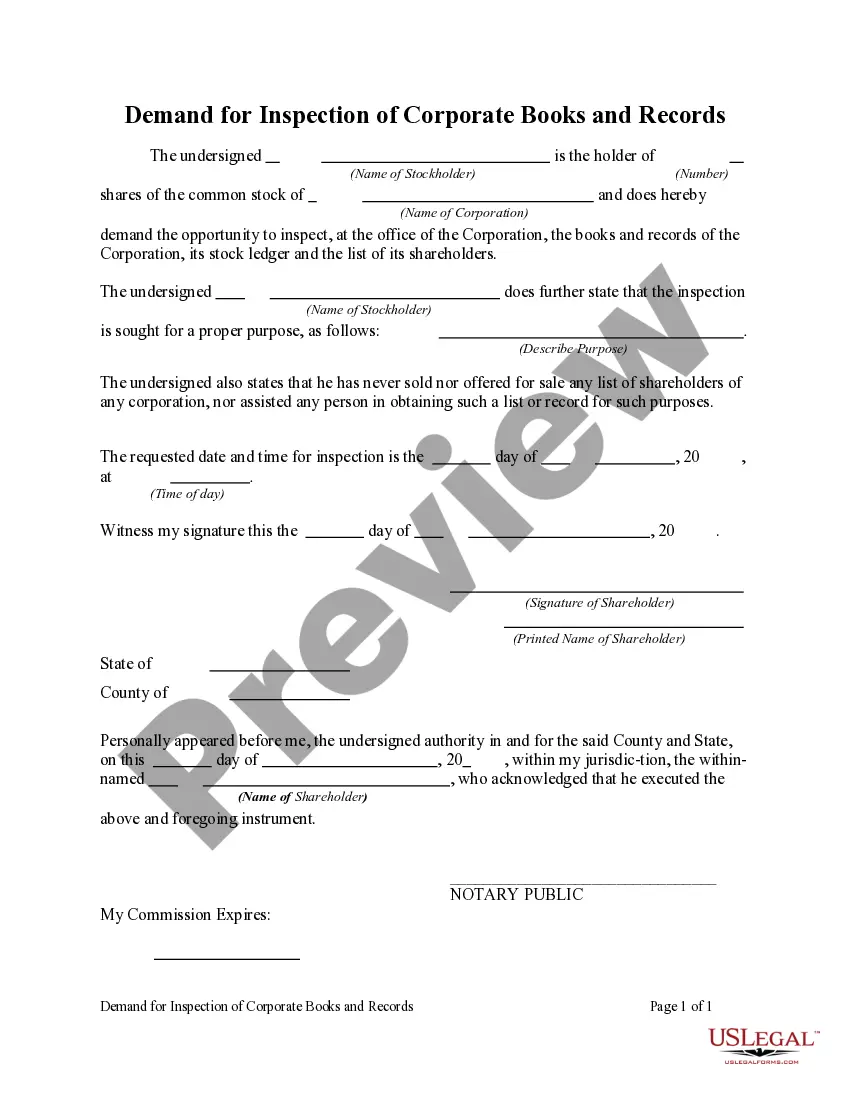

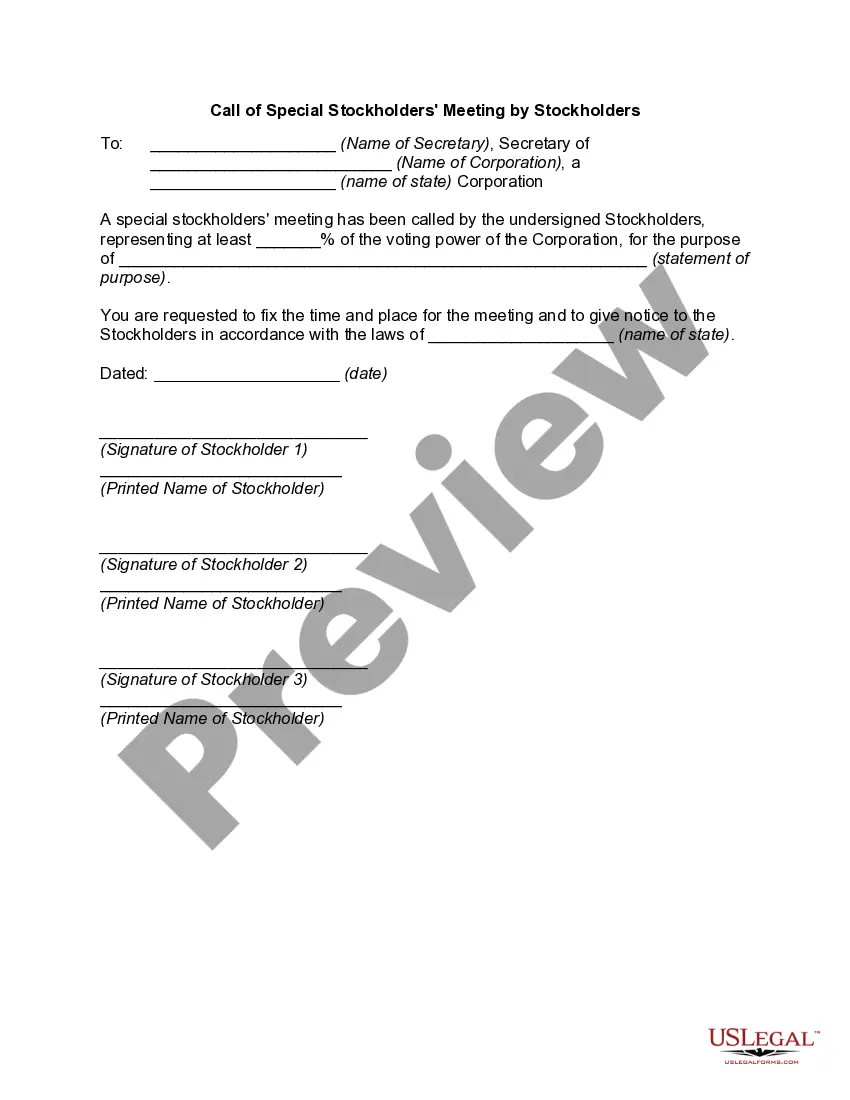

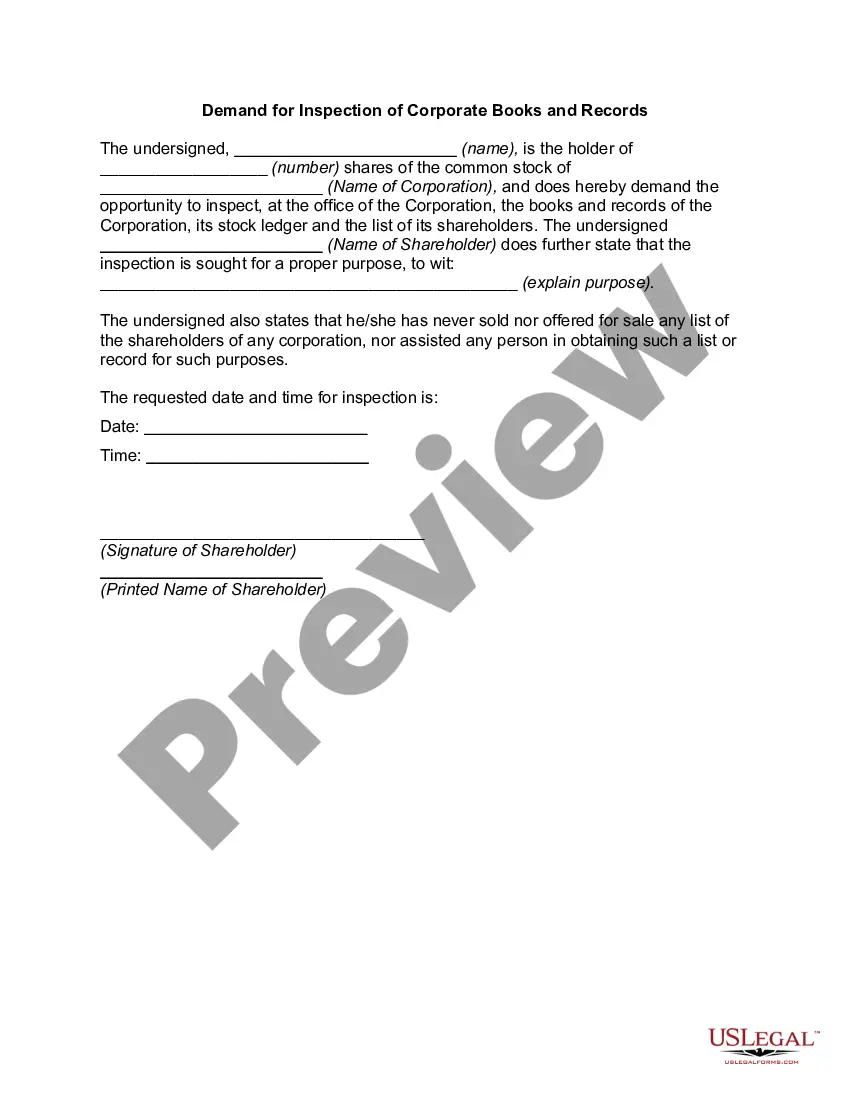

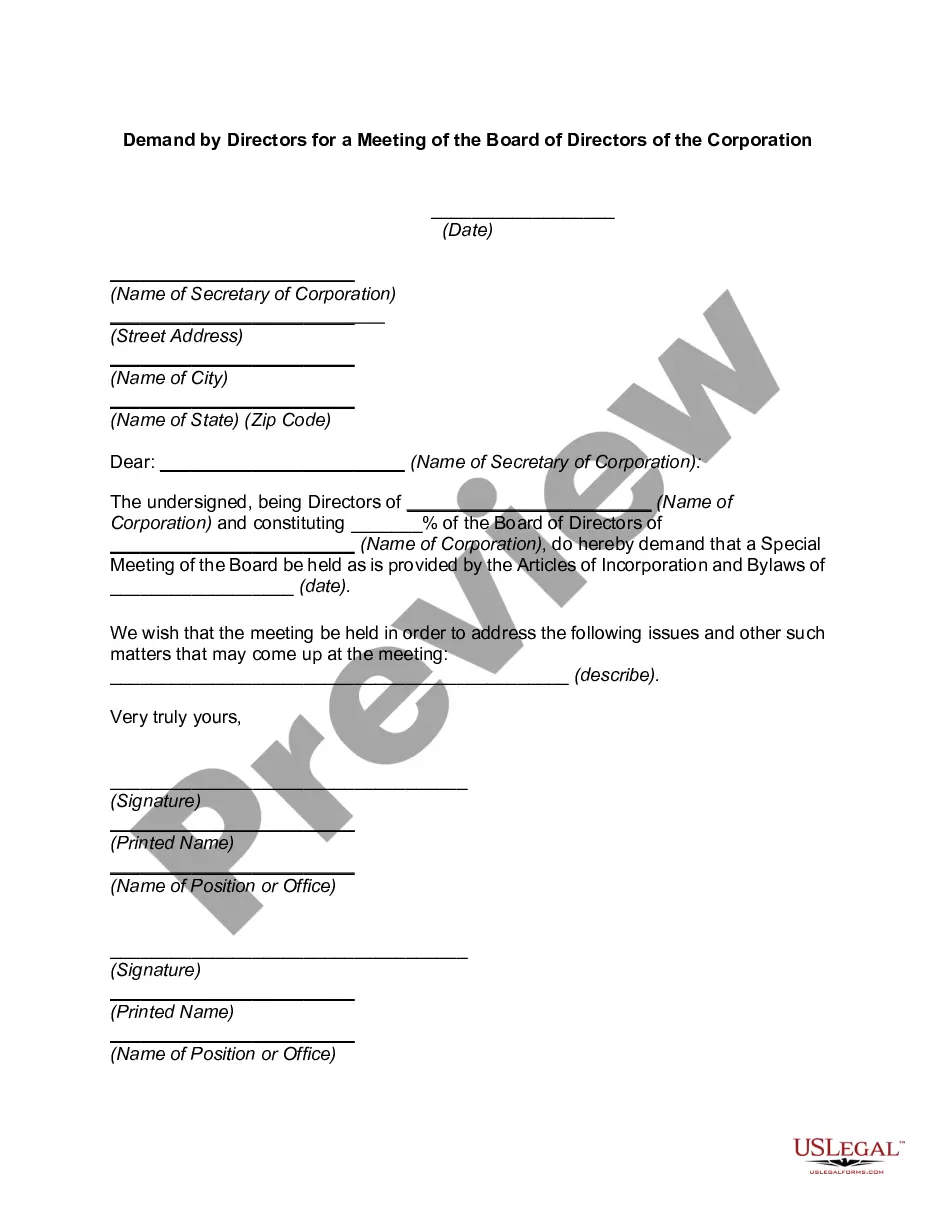

- Step 2. Use the Review option to examine the contents of the form. Always remember to read the guidelines.

- Step 3. If you are dissatisfied with the form, utilize the Search area at the top of the page to find other variations of your legal form template.

Form popularity

FAQ

Shareholder meetings are a regulatory requirement which means most public and private companies must hold them. Notification of the meeting's date and time is often accompanied by the meeting's agenda.

In general, however, most corporations are required to have at least one shareholders' meeting per year. Corporations are also required to prepare and retain minutes of these meeting. There is often a legally based recordkeeping requirement for meeting minutes, but the exact length of time will vary by state.

The corporation can allow others to call a special meeting, such as the BoD Chair, CEO, or yes, shareholders.

Shareholder meetings are a regulatory requirement which means most public and private companies must hold them. Notification of the meeting's date and time is often accompanied by the meeting's agenda.

Scheduled meetings Your business should hold at least one annual shareholders' meeting. You can have more than one per year, but one per year is often the required minimum. An annual board of directors meeting is often also held in conjunction with the shareholders' meeting as well.

If the Board fails to cause such a meeting to be called and held as required by this Section, the shareholder or shareholders making the demand may call the meeting by giving notice as provided in Section 1.04 at the expense of the corporation.

When should I hold a shareholder meeting? An annual shareholder meeting is typically scheduled just after the end of the fiscal year. This allows for the previous year's financial performance to be fully assessed and discussed.

Also, while a company's board can only call an AGM, an EGM can also be called by the board on the requisition of shareholders, requisitionist, or tribunal.

Notice to Shareholders Most states require notice of any shareholder meeting be mailed to all shareholders at least 10 days prior to the meeting. The notice should contain the date, time and location of the meeting as well as an agenda or explanation of the topics to be discussed.

Every company must hold an annual meeting of shareholders once in each calendar year. The meeting must be no later than 6 months after the company's balance date and no later than 15 months after the previous annual meeting.