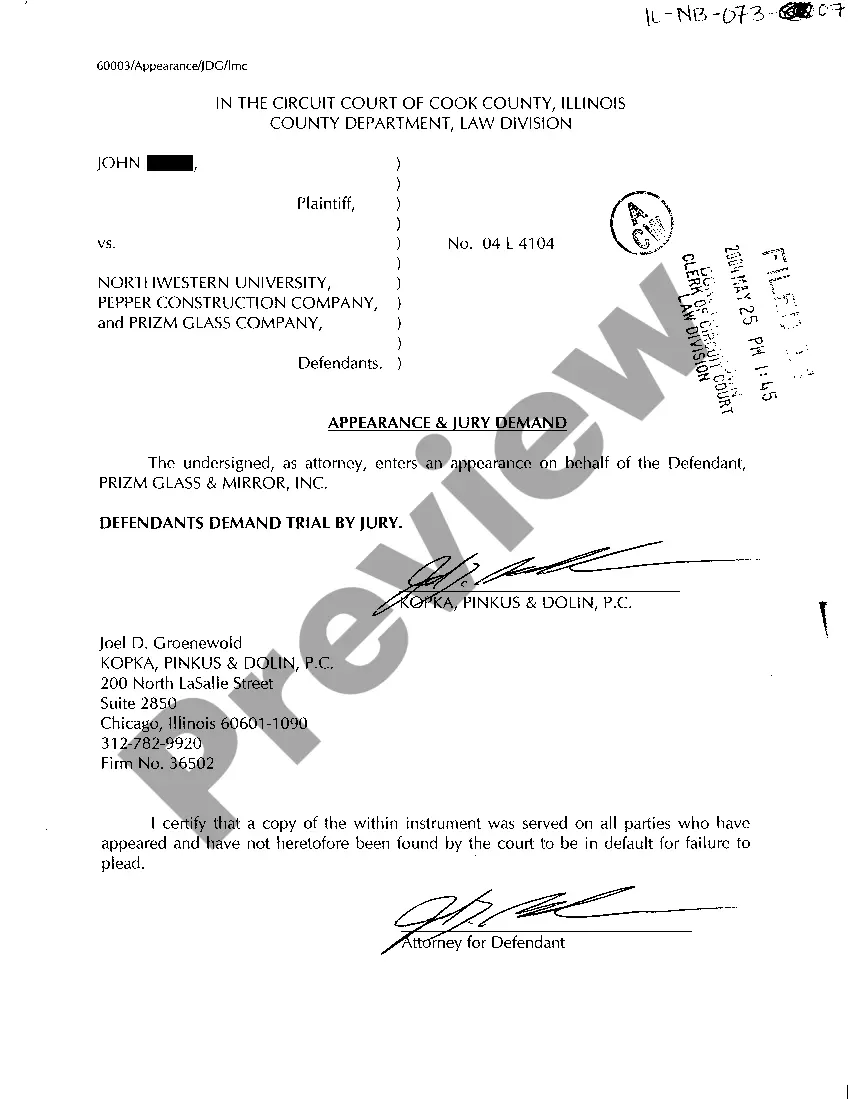

Maryland Final Notice of Past Due Account

Description

How to fill out Final Notice Of Past Due Account?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a variety of legal form templates that you can download or print.

While navigating the website, you can find thousands of forms for business and personal purposes, sorted by categories, states, or keywords. You can quickly locate the latest versions of forms such as the Maryland Final Notice of Past Due Account.

If you have a subscription, Log In and download the Maryland Final Notice of Past Due Account from your US Legal Forms library. The Download button will be visible on each form you view. You can access all previously saved forms within the My documents tab of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the form's content.

- Read the form description to confirm you have selected the right form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, choose the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

If you paid too little in withholding then you may owe additional tax. If you live in a state that assesses income tax, then you'll need to file a state return along with your federal return. This return determines what you owe in state income taxes, based on your income and which tax deductions or credits you claim.

You filed your Maryland tax return, but you may have received an income tax notice from the Comptroller's Office if: You did not pay the full amount due with your return. A correction was made to your return when it was processed which resulted in additional tax due.

If you have not paid your taxes due in full, or have not filed a Maryland return that we believe you should have, you will receive an income tax notice from the Comptroller of Maryland. If you do not respond to the first notice, an assessment notice will be issued.

Your business received a tax notice from the Comptroller of Maryland. Notices are sent from our offices to business taxpayers for a variety of reasons. It could be a missing return, an error on a return. It could be that your IRS return doesn't match your Maryland return.

Maryland State Tax Refund Status Information - OnLine Taxes. You can use Maryland's online services to check the status of your tax refund or to find out if they have had trouble delivering your refund by clicking below. You may also check your refund status by calling (800) 218-8160 or 410-260-7701 in Central Maryland

During the e-filing your return process on eFile.com, you can pay your taxes owed via electronic fund withdrawal or EFW from a bank account (direct debit) or check/money order. You can only submit tax payments for the current tax year, not previous or future tax years.

Go to Maryland Case Search to search for court judgments against the property's owner. Unpaid taxes on the property may result in a lien. Visit your local county or city's finance office to find property tax or other municipal liens.

You can access your federal tax account through a secure login at IRS.gov/account. Once in your account, you can view the amount you owe along with details of your balance, view 18 months of payment history, access Get Transcript, and view key information from your current year tax return.

The only way to get a tax lien released is to pay your Maryland tax balance. After doing so, you can visit the applicable circuit court to obtain a certified copy of the lien release. This can be submitted to the three major credit agencies so your credit report will reflect the lien release.

Penalty and Interest Charges Your assessment will depend on the amount of taxes that we believe you owe. Maryland law requires us to charge interest at the annual rate of 11% during calendar year 2019, 10.5% during calendar year 2020, 10% during calendar year 2021, and 9.5% during calendar year 2022.