Maryland Agreement between Co-lessees as to Payment of Rent and Taxes

Description

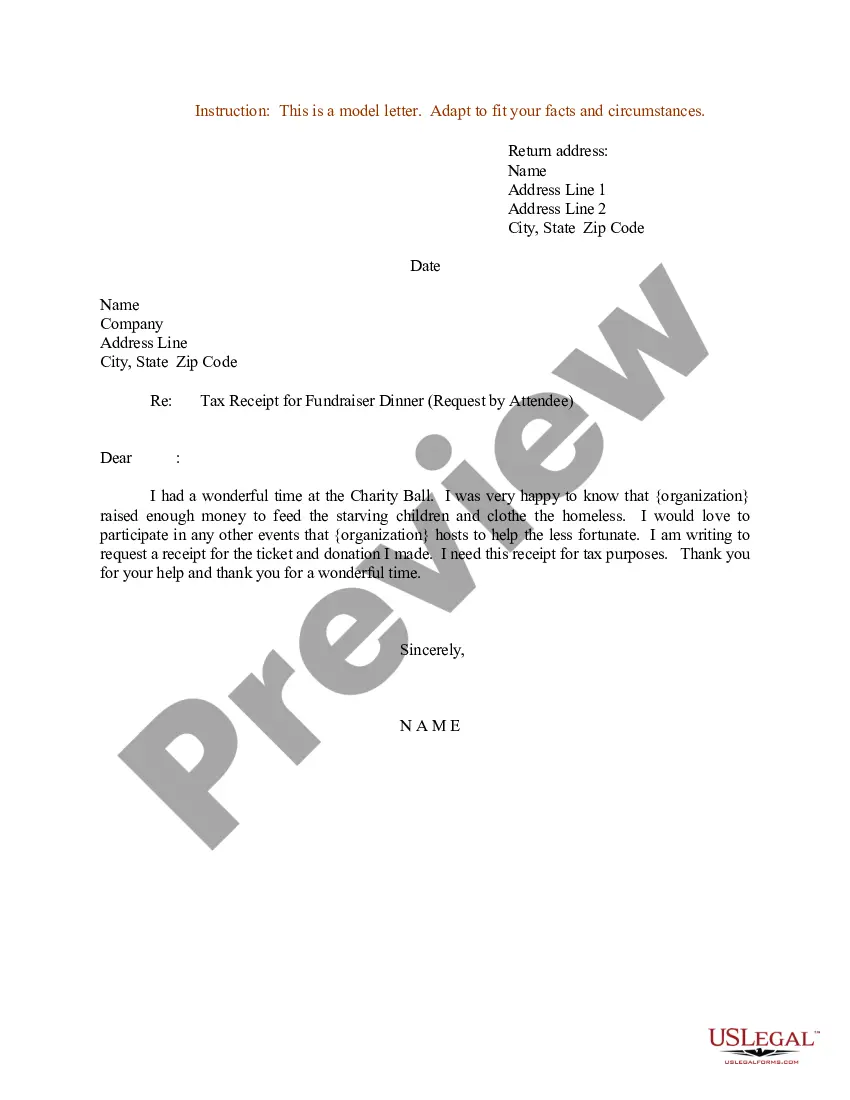

How to fill out Agreement Between Co-lessees As To Payment Of Rent And Taxes?

If you need to comprehensive, obtain, or produce lawful papers layouts, use US Legal Forms, the greatest variety of lawful types, that can be found online. Make use of the site`s easy and handy research to find the documents you will need. A variety of layouts for enterprise and specific reasons are categorized by groups and suggests, or keywords and phrases. Use US Legal Forms to find the Maryland Agreement between Co-lessees as to Payment of Rent and Taxes with a number of click throughs.

Should you be previously a US Legal Forms client, log in to the profile and then click the Acquire switch to find the Maryland Agreement between Co-lessees as to Payment of Rent and Taxes. Also you can access types you previously saved within the My Forms tab of your profile.

If you work with US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Ensure you have chosen the form for the appropriate city/nation.

- Step 2. Take advantage of the Review method to look through the form`s information. Do not overlook to see the description.

- Step 3. Should you be not happy with the type, utilize the Search industry on top of the screen to locate other versions in the lawful type format.

- Step 4. After you have identified the form you will need, go through the Purchase now switch. Opt for the costs program you choose and include your references to register on an profile.

- Step 5. Method the financial transaction. You may use your charge card or PayPal profile to accomplish the financial transaction.

- Step 6. Pick the format in the lawful type and obtain it on the product.

- Step 7. Total, edit and produce or sign the Maryland Agreement between Co-lessees as to Payment of Rent and Taxes.

Every single lawful papers format you buy is the one you have eternally. You might have acces to every type you saved inside your acccount. Click the My Forms segment and pick a type to produce or obtain once again.

Remain competitive and obtain, and produce the Maryland Agreement between Co-lessees as to Payment of Rent and Taxes with US Legal Forms. There are many expert and condition-distinct types you can use for your personal enterprise or specific requirements.

Form popularity

FAQ

A triple net lease (triple-net or NNN) is a lease agreement on a property whereby the tenant or lessee promises to pay all the expenses of the property, including real estate taxes, building insurance, and maintenance.

Triple net lease (NNN) is normally a commercial lease where the lessee pays rent and utilities as well as three other types of property expenses: insurance, maintenance, and taxes.

Renters Rights to Withhold Rent For renters to withhold rent or refuse to continue paying their landlord rent, the conditions must constitute a threat to their health, life, or safety, meaning far beyond normal wear and tear.

A lease agreement is an arrangement between two parties ? lessor and lessee, by which the lessor allows the lessee the right to use a property owned or managed by the lessor for a specified period of time, in exchange for periodic payment of rentals. The agreement does not provide ownership rights to the lessee.

net, or netnetnet, lease requires the tenant to pay a prorated portion of ALL the operating expenses for the property. Once again, a triplenet lease includes rent, property taxes, insurance, and maintenance expenses.

Double Net Lease Example A double net lease structure requires tenants to bear the burden of paying monthly rent, property taxes, and insurance. Suppose building insurance costs $28,800 annually, which is a monthly charge of $2,400. With one tenant leasing the building, they are responsible for the monthly payment.

Net leases require tenants to pay expenses such as taxes or insurance in addition to a monthly rent payment. Rents are generally lower with net leases than traditional leases.

Lessors and lessees enter into a binding contract, known as the lease agreement, that spells out the terms of their arrangement. While any sort of property can be leased, the practice is most commonly associated with residential or commercial real estate?a home or office.