A Maryland Job Invoice — Short is a document that serves as a concise summary of work performed by a service provider for a client. This invoice is specifically designed for businesses operating in Maryland and complies with the state's requirements for billing and record-keeping. It is an essential tool for maintaining accurate financial records and facilitating smooth business transactions. Keywords: Maryland, job invoice, short, service provider, client, billing, record-keeping, financial records, business transactions. There are different types of Maryland Job Invoices — Short, each catering to specific industries or business needs. Some commonly used variants include: 1. Construction Job Invoice — Short: This specific type of job invoice is tailored for construction companies and contractors providing services such as remodeling, home building, or renovations. It includes essential details such as project description, labor costs, equipment charges, and materials used. 2. Creative Services Job Invoice — Short: Aimed at professionals in the creative industry, such as graphic designers, writers, photographers, or marketing agencies, this invoice captures details related to creative work performed, such as design concepts, copywriting services, photography sessions, or campaign development. It includes itemized charges for each service and any additional fees, such as licensing or usage rights. 3. Maintenance and Repair Job Invoice — Short: This invoice is suitable for businesses specializing in maintenance and repair services, such as HVAC technicians, plumbers, or electricians. It allows for quick and efficient billing by including fields for labor time, parts or materials used, travel costs, and any applicable taxes or fees. 4. Professional Services Job Invoice — Short: Designed for consultants, lawyers, accountants, and other professional service providers, this invoice captures details of services rendered, hourly rates, billable hours, and any additional expenses incurred on behalf of the client, such as travel or research expenses. 5. IT Services Job Invoice — Short: Tailored for technology companies, IT consultants, or computer repair specialists, this invoice incorporates relevant fields for services like software development, network setup, troubleshooting, or system upgrades. It also allows for the inclusion of detailed descriptions of work performed and any associated charges. Regardless of the specific type, a Maryland Job Invoice — Short must include the essential components required by the state, such as the business name and address, client information, invoice number, date, a detailed breakdown of services provided, rates or prices, subtotal, taxes, if applicable, and the total amount due. By using these invoices, businesses in Maryland can effectively track transactions, ensuring accurate record-keeping and smooth financial operations.

Maryland Job Invoice - Short

Description

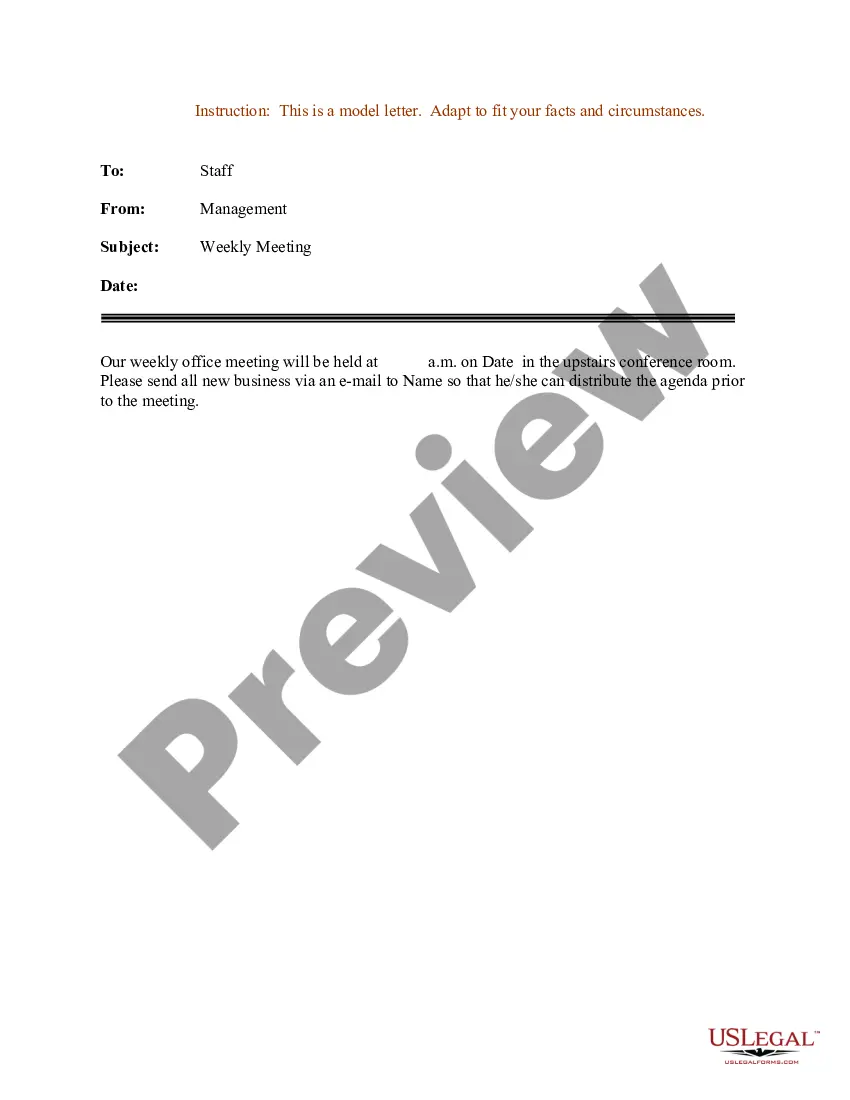

How to fill out Maryland Job Invoice - Short?

US Legal Forms - one of many greatest libraries of legitimate types in the States - delivers an array of legitimate record layouts it is possible to down load or produce. Using the website, you can get thousands of types for company and specific uses, categorized by classes, suggests, or key phrases.You can get the newest variations of types such as the Maryland Job Invoice - Short within minutes.

If you already have a membership, log in and down load Maryland Job Invoice - Short from your US Legal Forms local library. The Down load key will appear on each type you perspective. You gain access to all formerly acquired types within the My Forms tab of the accounts.

If you want to use US Legal Forms the very first time, here are basic directions to help you started off:

- Be sure to have selected the best type for your personal metropolis/area. Select the Review key to analyze the form`s content material. Look at the type description to actually have selected the proper type.

- In case the type doesn`t fit your needs, take advantage of the Search discipline near the top of the screen to find the one that does.

- In case you are content with the form, confirm your selection by clicking on the Purchase now key. Then, select the costs plan you prefer and supply your qualifications to register for the accounts.

- Procedure the deal. Make use of your Visa or Mastercard or PayPal accounts to perform the deal.

- Choose the format and down load the form on the product.

- Make adjustments. Complete, revise and produce and sign the acquired Maryland Job Invoice - Short.

Every template you included in your money lacks an expiry day and it is your own forever. So, if you would like down load or produce an additional copy, just check out the My Forms area and click on around the type you require.

Gain access to the Maryland Job Invoice - Short with US Legal Forms, probably the most extensive local library of legitimate record layouts. Use thousands of specialist and status-specific layouts that satisfy your business or specific requires and needs.