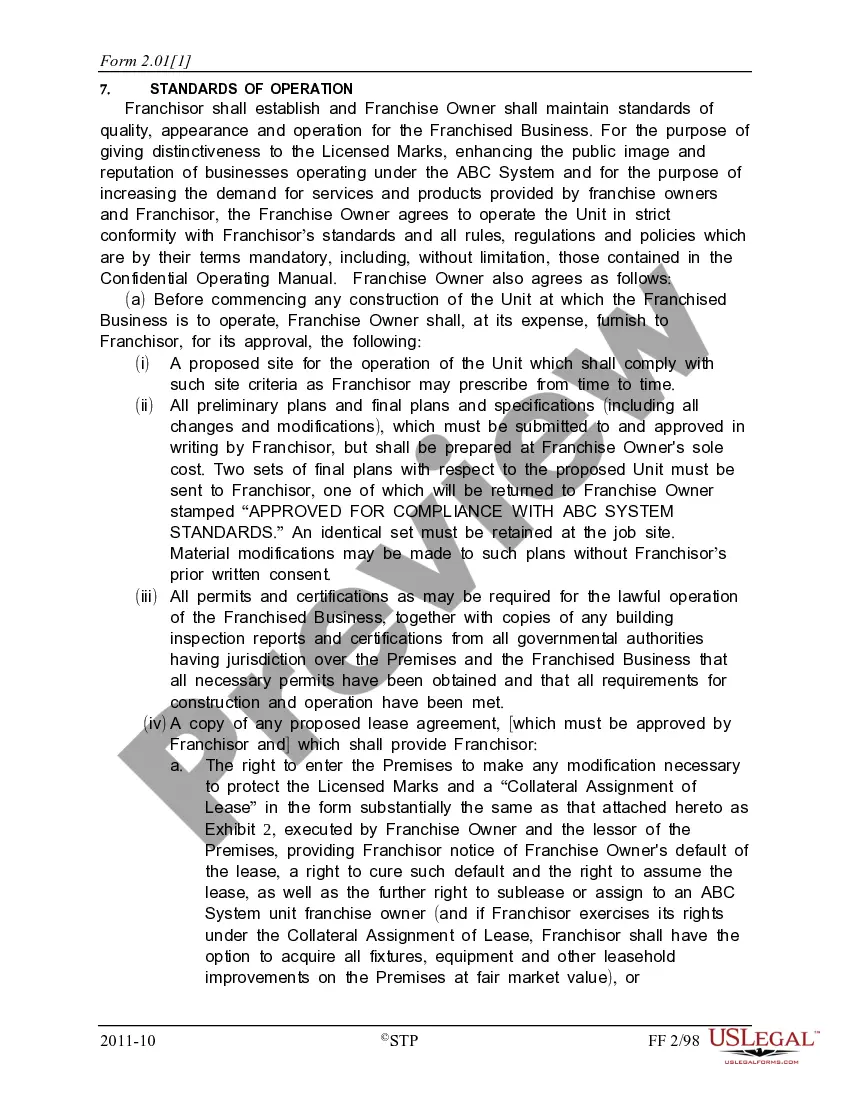

Maryland Franchise Agreement - Single Location, with Form of Personal Guaranty and Collateral Assignment of Lease

Description

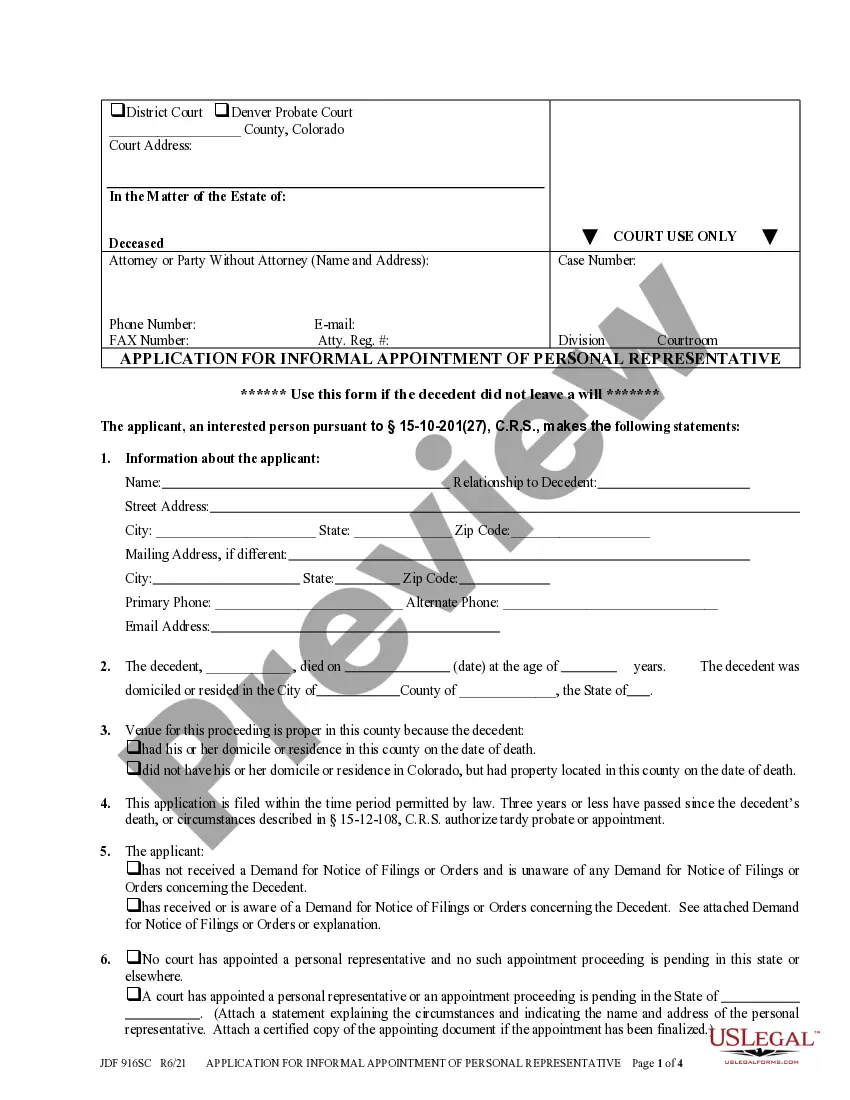

How to fill out Franchise Agreement - Single Location, With Form Of Personal Guaranty And Collateral Assignment Of Lease?

You are able to invest several hours on the web trying to find the legitimate papers format that suits the state and federal requirements you require. US Legal Forms gives thousands of legitimate types which are reviewed by pros. You can actually obtain or produce the Maryland Franchise Agreement - Single Location, with Form of Personal Guaranty and Collateral Assignment of Lease from our service.

If you have a US Legal Forms accounts, you can log in and click on the Acquire option. After that, you can total, revise, produce, or indicator the Maryland Franchise Agreement - Single Location, with Form of Personal Guaranty and Collateral Assignment of Lease. Every legitimate papers format you purchase is the one you have eternally. To get another copy associated with a bought form, visit the My Forms tab and click on the related option.

If you use the US Legal Forms internet site for the first time, keep to the easy instructions below:

- First, make certain you have chosen the right papers format to the region/town of your liking. See the form information to make sure you have picked out the correct form. If readily available, take advantage of the Review option to check through the papers format also.

- If you wish to locate another version of your form, take advantage of the Lookup industry to get the format that suits you and requirements.

- Once you have discovered the format you want, click Purchase now to move forward.

- Select the prices program you want, type your credentials, and register for a free account on US Legal Forms.

- Comprehensive the purchase. You can utilize your Visa or Mastercard or PayPal accounts to pay for the legitimate form.

- Select the file format of your papers and obtain it for your gadget.

- Make adjustments for your papers if necessary. You are able to total, revise and indicator and produce Maryland Franchise Agreement - Single Location, with Form of Personal Guaranty and Collateral Assignment of Lease.

Acquire and produce thousands of papers web templates making use of the US Legal Forms site, that offers the biggest variety of legitimate types. Use specialist and status-specific web templates to deal with your company or personal needs.

Form popularity

FAQ

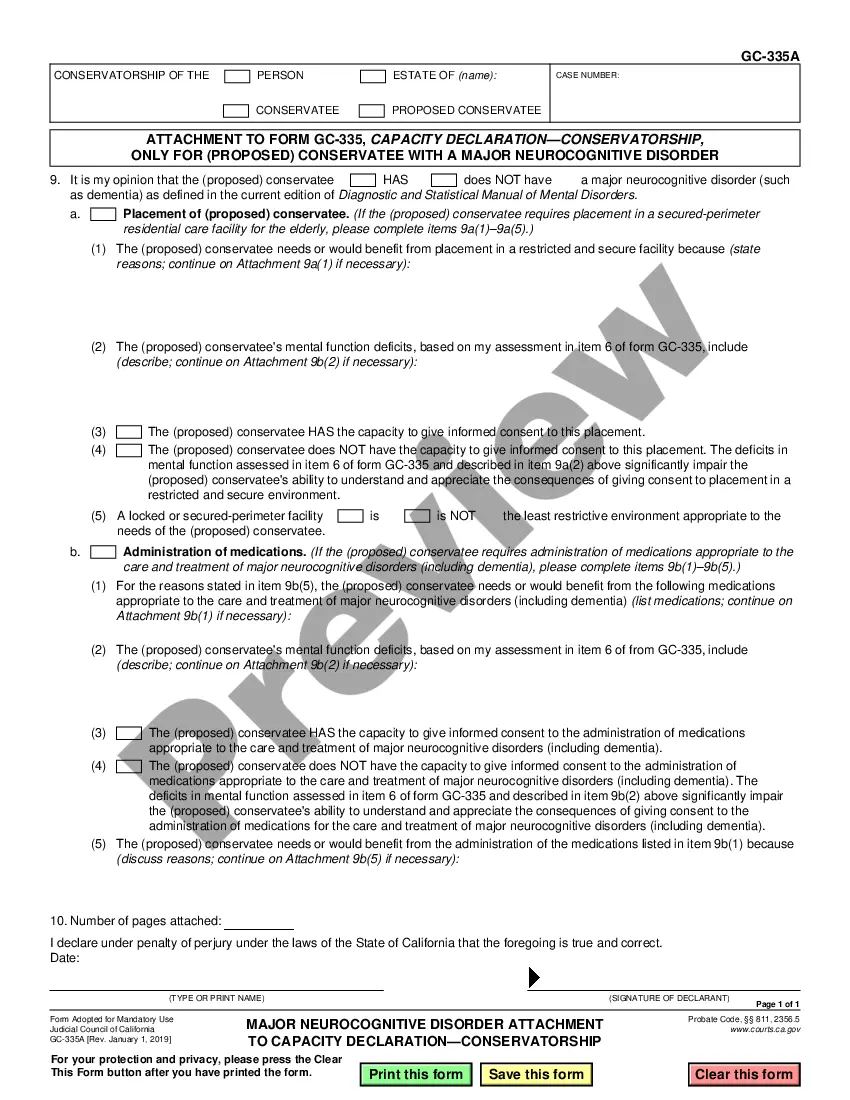

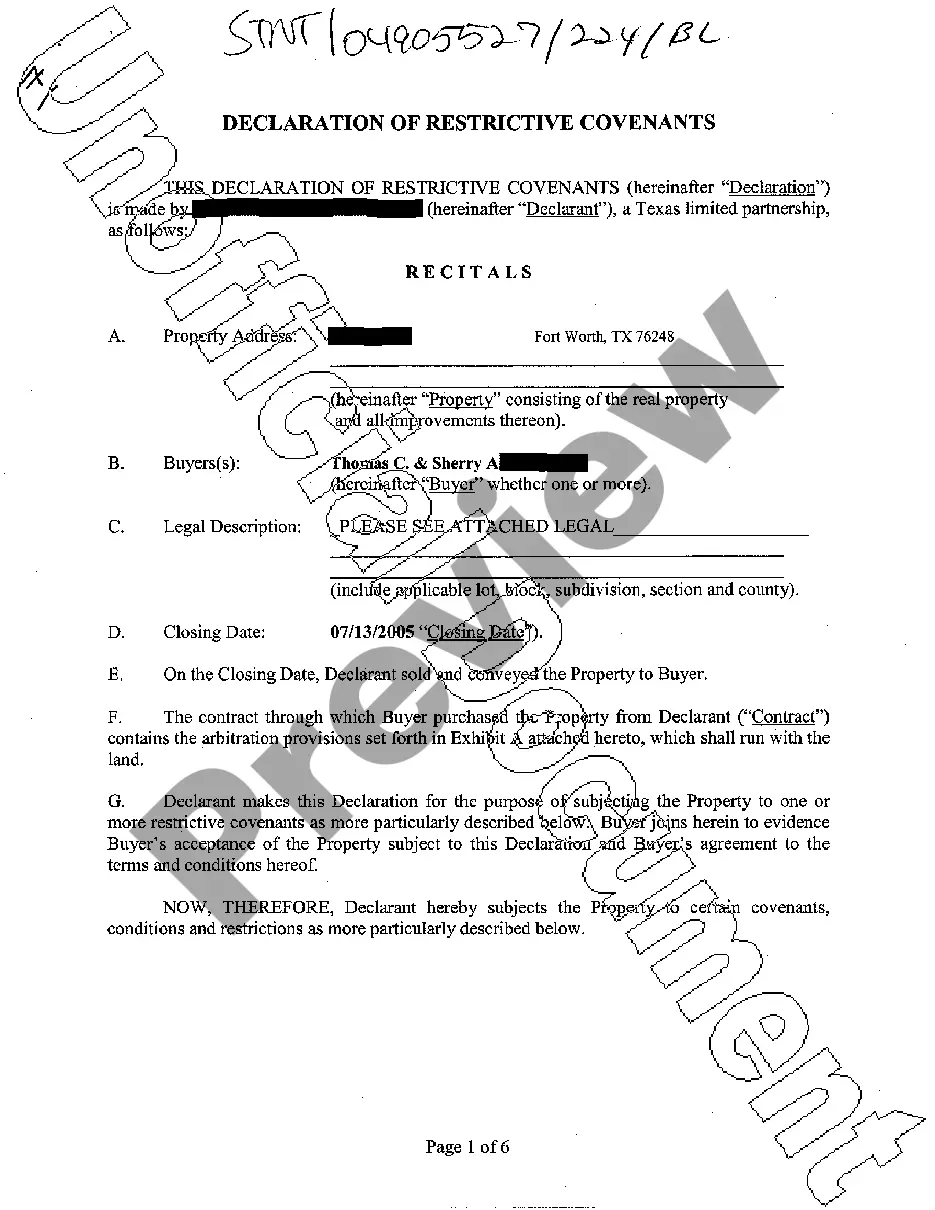

With an absolute assignment, the entire ownership of the policy would be transferred to the assignee, or the lender. Then, the lender would be entitled to the full death benefit. With a collateral assignment, the lender is only entitled to the balance of the outstanding loan.

The key elements of a franchise agreement generally include: Territory rights. ... Minimum performance standards. ... Franchisors services requirements. ... Franchisee payments. ... Trademark use. ... Advertising standards. ... Exclusivity clause. ... Insurance requirements.

The difference between a master franchise relationship and an area representative is that the master franchisee signs an agreement with each sub-franchisee, while the area representative does not. The area representative also does not need to create or register their own Franchise Disclosure Document.

Collateral assignment of life insurance is a method of providing a lender with collateral when you apply for a loan. In this case, the collateral is your life insurance policy's face value, which could be used to pay back the amount you owe in case you die while in debt.

A collateral agreement transfers all or some of the rights of the owner of personal property (including a life insurance policy) to another party (the assignee) as security for the repayment of an indebtedness.

Collateral assignment concerns allocating a property's ownership privileges, or a specific interest, to a lender as loan collateral. The lender retains a security interest in the asset until the borrower entirely settles the loan.

A few franchise agreements don't allow you to assign or transfer but most do, provided you meet certain conditions. The conditions can vary depending on the type of franchise and the franchisor but usually require: Notice of your intent to transfer.

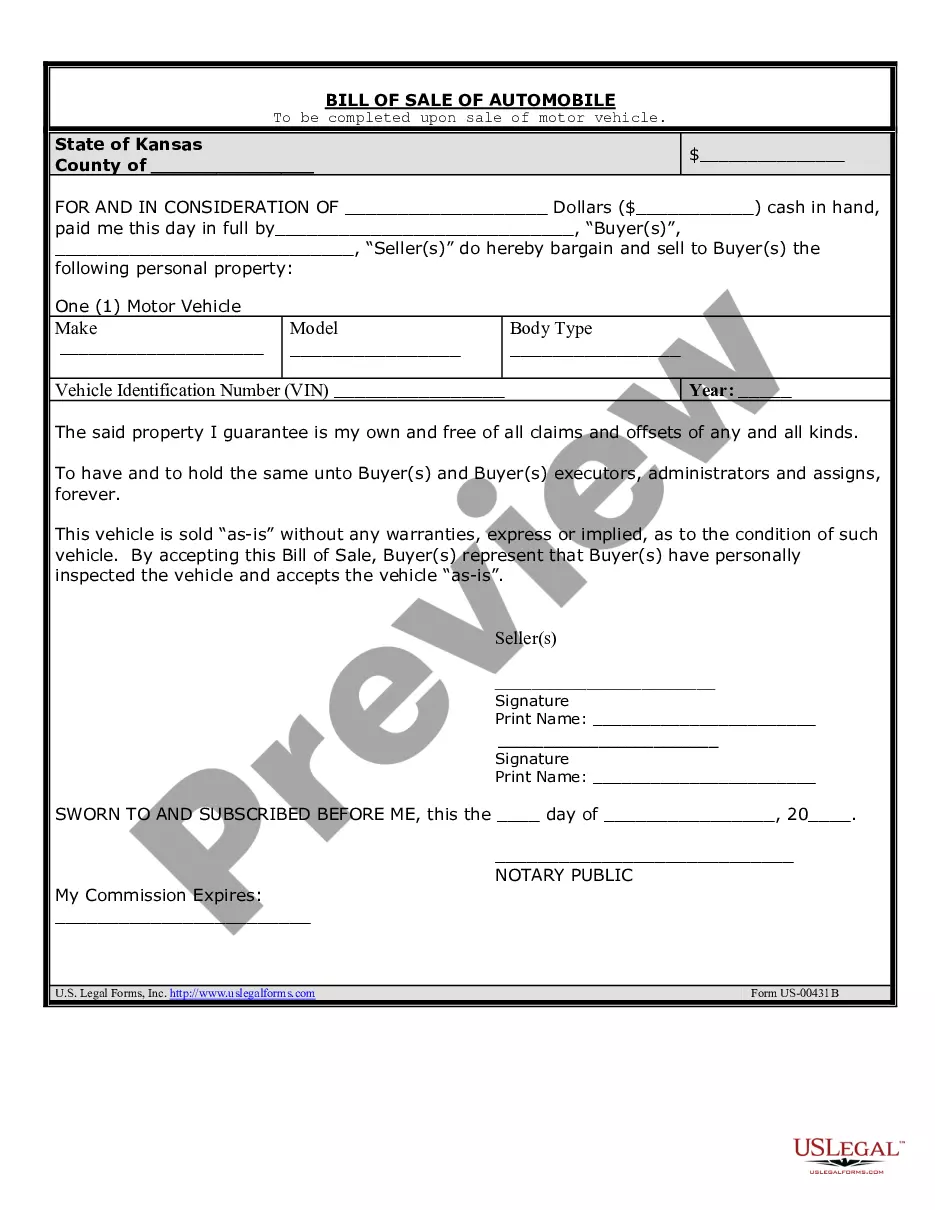

Collateral is an item of value pledged to secure a loan. Collateral reduces the risk for lenders. If a borrower defaults on the loan, the lender can seize the collateral and sell it to recoup its losses. Mortgages and car loans are two types of collateralized loans.