Maryland Resolution of Meeting of LLC Members to Sell Assets is a legal document that outlines the specific details and procedures regarding the sale of assets by an LLC (Limited Liability Company) in the state of Maryland. This resolution is an essential step for an LLC seeking to transfer or dispose of its assets in a structured and legally compliant manner. The resolution begins by stating the name of the LLC, followed by a clear identification of the specific assets to be sold. It also includes relevant dates, such as the date of the meeting where the resolution is adopted and the effective date of the sale. The resolution further highlights the authority of the members of the LLC to make decisions regarding the sale of assets, emphasizing their power under Maryland law. In addition to these general aspects, there may be different types or variations of the Maryland Resolution of Meeting of LLC Members to Sell Assets based on specific circumstances or requirements. Here are some examples: 1. Resolution for Sale of Tangible Assets: This version of the resolution focuses specifically on the sale of physical assets such as equipment, furniture, or machinery owned by the LLC. It may include additional provisions related to the condition, valuation, or transfer of ownership of these tangible assets. 2. Resolution for Sale of Intangible Assets: This type of resolution deals with the sale or transfer of intangible assets owned by the LLC, such as intellectual property rights, patents, trademarks, copyrights, or licenses. It may include provisions addressing royalty payments, assignment of rights, or restrictions on future use. 3. Resolution for Sale of Real Estate Assets: In cases where an LLC intends to sell off its real estate properties, this resolution is utilized to outline the specific details of the property, the sale price, and any related conditions or restrictions. It may also address matters such as title clearance, transfer taxes, and closing procedures. 4. Resolution for Dissolution and Asset Sale: Sometimes, an LLC may determine that it is necessary to dissolve the company entirely and sell off its assets. In such cases, a specific resolution can be drafted, combining elements of both a resolution of dissolution and a resolution for sale of assets, outlining the process and steps for winding up the LLC's affairs and distributing the proceeds from the sale to the members. It's important to consult with a qualified attorney or legal professional who specializes in business law and understands the specific requirements of the Maryland state statutes to ensure the accurate preparation and execution of the Maryland Resolution of Meeting of LLC Members to Sell Assets.

Maryland Resolution of Meeting of LLC Members to Sell Assets

Description

How to fill out Maryland Resolution Of Meeting Of LLC Members To Sell Assets?

Are you within a situation the place you will need papers for either business or personal reasons nearly every day? There are plenty of authorized record layouts accessible on the Internet, but finding types you can depend on is not easy. US Legal Forms offers thousands of form layouts, much like the Maryland Resolution of Meeting of LLC Members to Sell Assets, which can be published to fulfill federal and state needs.

In case you are currently familiar with US Legal Forms web site and also have an account, basically log in. Next, you are able to obtain the Maryland Resolution of Meeting of LLC Members to Sell Assets template.

If you do not provide an bank account and want to start using US Legal Forms, adopt these measures:

- Find the form you need and make sure it is to the proper metropolis/area.

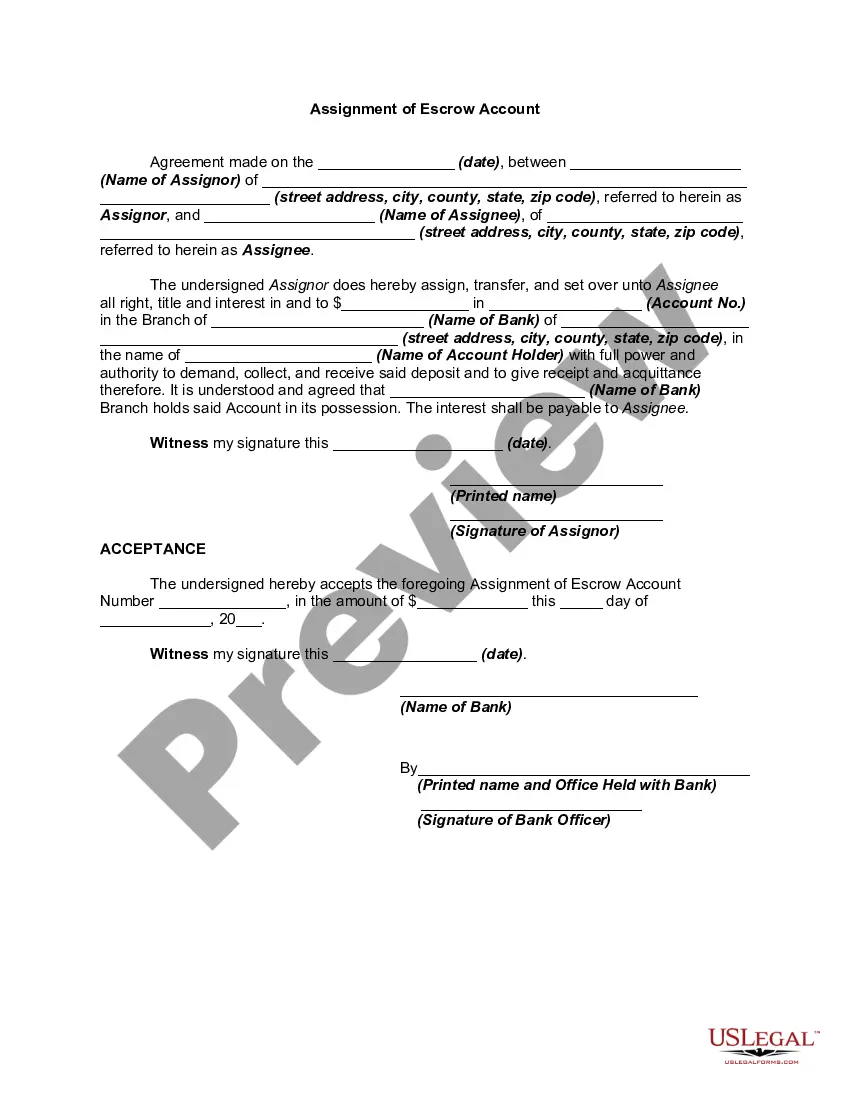

- Take advantage of the Review button to review the shape.

- Browse the outline to ensure that you have selected the appropriate form.

- If the form is not what you are looking for, use the Lookup discipline to discover the form that meets your requirements and needs.

- Once you obtain the proper form, click Purchase now.

- Opt for the prices program you need, fill out the specified information to produce your account, and buy your order utilizing your PayPal or credit card.

- Decide on a practical data file format and obtain your copy.

Discover each of the record layouts you might have purchased in the My Forms food list. You may get a extra copy of Maryland Resolution of Meeting of LLC Members to Sell Assets any time, if necessary. Just select the required form to obtain or print the record template.

Use US Legal Forms, probably the most extensive selection of authorized types, to save lots of efforts and steer clear of faults. The service offers expertly created authorized record layouts which can be used for a variety of reasons. Create an account on US Legal Forms and commence creating your life easier.