Maryland Resolution of Meeting of LLC Members to Sell Assets is a legal document that outlines the specific details and procedures regarding the sale of assets by an LLC (Limited Liability Company) in the state of Maryland. This resolution is an essential step for an LLC seeking to transfer or dispose of its assets in a structured and legally compliant manner. The resolution begins by stating the name of the LLC, followed by a clear identification of the specific assets to be sold. It also includes relevant dates, such as the date of the meeting where the resolution is adopted and the effective date of the sale. The resolution further highlights the authority of the members of the LLC to make decisions regarding the sale of assets, emphasizing their power under Maryland law. In addition to these general aspects, there may be different types or variations of the Maryland Resolution of Meeting of LLC Members to Sell Assets based on specific circumstances or requirements. Here are some examples: 1. Resolution for Sale of Tangible Assets: This version of the resolution focuses specifically on the sale of physical assets such as equipment, furniture, or machinery owned by the LLC. It may include additional provisions related to the condition, valuation, or transfer of ownership of these tangible assets. 2. Resolution for Sale of Intangible Assets: This type of resolution deals with the sale or transfer of intangible assets owned by the LLC, such as intellectual property rights, patents, trademarks, copyrights, or licenses. It may include provisions addressing royalty payments, assignment of rights, or restrictions on future use. 3. Resolution for Sale of Real Estate Assets: In cases where an LLC intends to sell off its real estate properties, this resolution is utilized to outline the specific details of the property, the sale price, and any related conditions or restrictions. It may also address matters such as title clearance, transfer taxes, and closing procedures. 4. Resolution for Dissolution and Asset Sale: Sometimes, an LLC may determine that it is necessary to dissolve the company entirely and sell off its assets. In such cases, a specific resolution can be drafted, combining elements of both a resolution of dissolution and a resolution for sale of assets, outlining the process and steps for winding up the LLC's affairs and distributing the proceeds from the sale to the members. It's important to consult with a qualified attorney or legal professional who specializes in business law and understands the specific requirements of the Maryland state statutes to ensure the accurate preparation and execution of the Maryland Resolution of Meeting of LLC Members to Sell Assets.

Maryland Resolution of Meeting of LLC Members to Sell Assets

Description

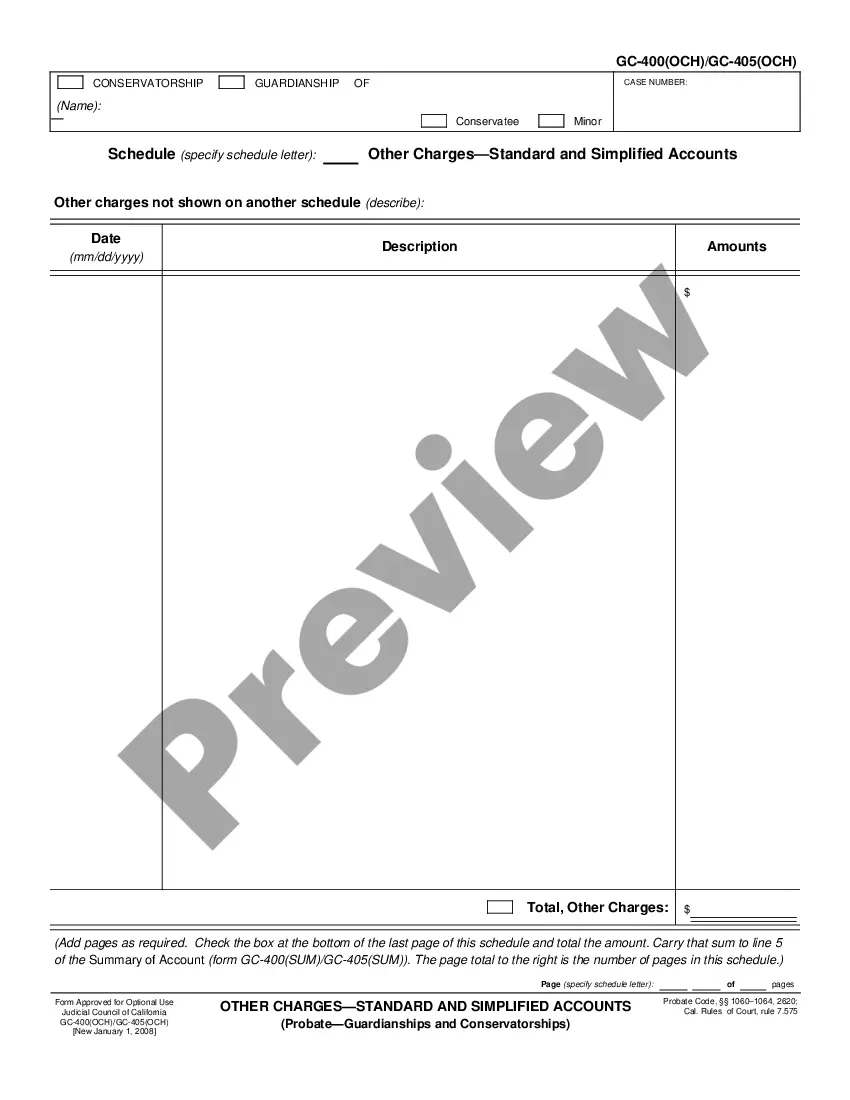

How to fill out Maryland Resolution Of Meeting Of LLC Members To Sell Assets?

Are you within a situation the place you will need papers for either business or personal reasons nearly every day? There are plenty of authorized record layouts accessible on the Internet, but finding types you can depend on is not easy. US Legal Forms offers thousands of form layouts, much like the Maryland Resolution of Meeting of LLC Members to Sell Assets, which can be published to fulfill federal and state needs.

In case you are currently familiar with US Legal Forms web site and also have an account, basically log in. Next, you are able to obtain the Maryland Resolution of Meeting of LLC Members to Sell Assets template.

If you do not provide an bank account and want to start using US Legal Forms, adopt these measures:

- Find the form you need and make sure it is to the proper metropolis/area.

- Take advantage of the Review button to review the shape.

- Browse the outline to ensure that you have selected the appropriate form.

- If the form is not what you are looking for, use the Lookup discipline to discover the form that meets your requirements and needs.

- Once you obtain the proper form, click Purchase now.

- Opt for the prices program you need, fill out the specified information to produce your account, and buy your order utilizing your PayPal or credit card.

- Decide on a practical data file format and obtain your copy.

Discover each of the record layouts you might have purchased in the My Forms food list. You may get a extra copy of Maryland Resolution of Meeting of LLC Members to Sell Assets any time, if necessary. Just select the required form to obtain or print the record template.

Use US Legal Forms, probably the most extensive selection of authorized types, to save lots of efforts and steer clear of faults. The service offers expertly created authorized record layouts which can be used for a variety of reasons. Create an account on US Legal Forms and commence creating your life easier.

Form popularity

FAQ

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

To amend your Maryland limited liability company articles of organization just file Articles of Amendment by mail, in person or by fax with the Maryland State Department of Assessments and Taxation (SDAT). The SDAT LLC amendment form is in fillable format and you have to type on it.

How to Write a ResolutionFormat the resolution by putting the date and resolution number at the top.Form a title of the resolution that speaks to the issue that you want to document.Use formal language in the body of the resolution, beginning each new paragraph with the word, whereas.More items...?16-Jun-2021

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

Any LLC member can propose a resolution, but all members must vote on it. Typically a majority of the members is needed to pass the resolution, but each LLC may have different voting rights. Some LLCs give a different value to each member's vote based on their percentage of interest in the company.

An LLC Corporate Resolution Form is a document that describes the management and decision-making processes of the LLC. While LLCs are generally not required to draft a resolution form, it is highly beneficial and important for all businesses to draft corporate resolutions.

With a SMLLC, you'd only use a resolution to document the most important business matters or actions such as: buying or selling real estate. getting a loan, establishing a bank account, or otherwise working with a financial institution.

An LLC member resolution is the written record of a member vote authorizing a specific business action. Formal resolutions aren't necessary for small, everyday decisions. However, they're useful for granting authority to members to transact significant business actions, such as taking out a loan on behalf of the LLC.

Any LLC member can propose a resolution, but all members must vote on it. Typically a majority of the members is needed to pass the resolution, but each LLC may have different voting rights. Some LLCs give a different value to each member's vote based on their percentage of interest in the company.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...