The Maryland Application for Work or Employment is a comprehensive document designed for individuals seeking positions in various job classifications, including Clerical, Exempt, Executive, or Nonexempt positions within the state of Maryland. This application serves as an essential tool for both employers and job seekers, facilitating a smooth and standardized evaluation process. Clerical positions play a vital role in organizations, providing administrative support and handling tasks such as data entry, record keeping, and correspondence management. The Maryland Application for Work or Employment — Clerical Position is tailored to gather relevant information specific to this role. It requests details related to an applicant's clerical experience, knowledge of software applications, ability to handle multiple tasks efficiently, and aptitude for maintaining organizational systems. Exempt positions encompass jobs that are exempt from certain wage and hour laws, usually due to the nature of work or the salary amount. If you are applying for an Exempt Position, the Maryland Application for Work or Employment — Exempt Position will require applicants to provide a comprehensive work history, highlighting their expertise in their respective field, leadership abilities, managerial experience, and any specialized training or certifications that directly relate to the desired role. For individuals aspiring to executive-level positions with leadership responsibilities, the Maryland Application for Work or Employment — Executive Position is specifically designed to capture an applicant's extensive professional background and managerial capabilities. This application will delve into an individual's strategic thinking, ability to develop and execute organizational goals, financial acumen, and experience in leading and motivating teams. Nonexempt positions refer to those roles that are not exempt from wage and hour laws, typically involving hourly paid work or jobs that require specific skills or qualifications. To apply for a Nonexempt Position, candidates must complete the Maryland Application for Work or Employment — Nonexempt Position, providing essential details about their prior work experience, relevant qualifications, and ability to perform assigned tasks efficiently. Overall, the Maryland Application for Work or Employment caters to the diverse range of job classifications within the state, ensuring that employers receive comprehensive and relevant information necessary to make informed hiring decisions. It helps streamline the application process, standardize applicant evaluation, and ensure fair consideration for all candidates. By utilizing this application, both employers and job seekers can ensure a transparent and efficient recruitment process, fostering a positive and productive work environment.

Maryland Application for Work or Employment - Clerical, Exempt, Executive, or Nonexempt Position

Description

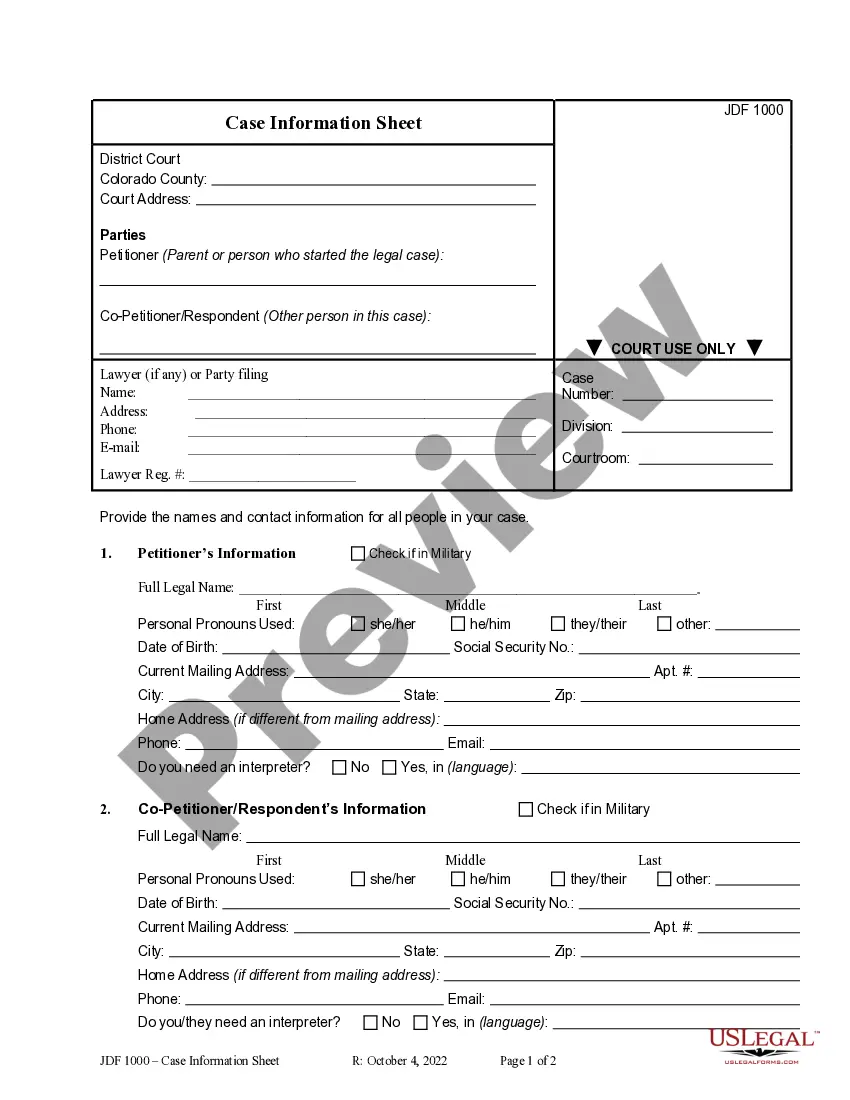

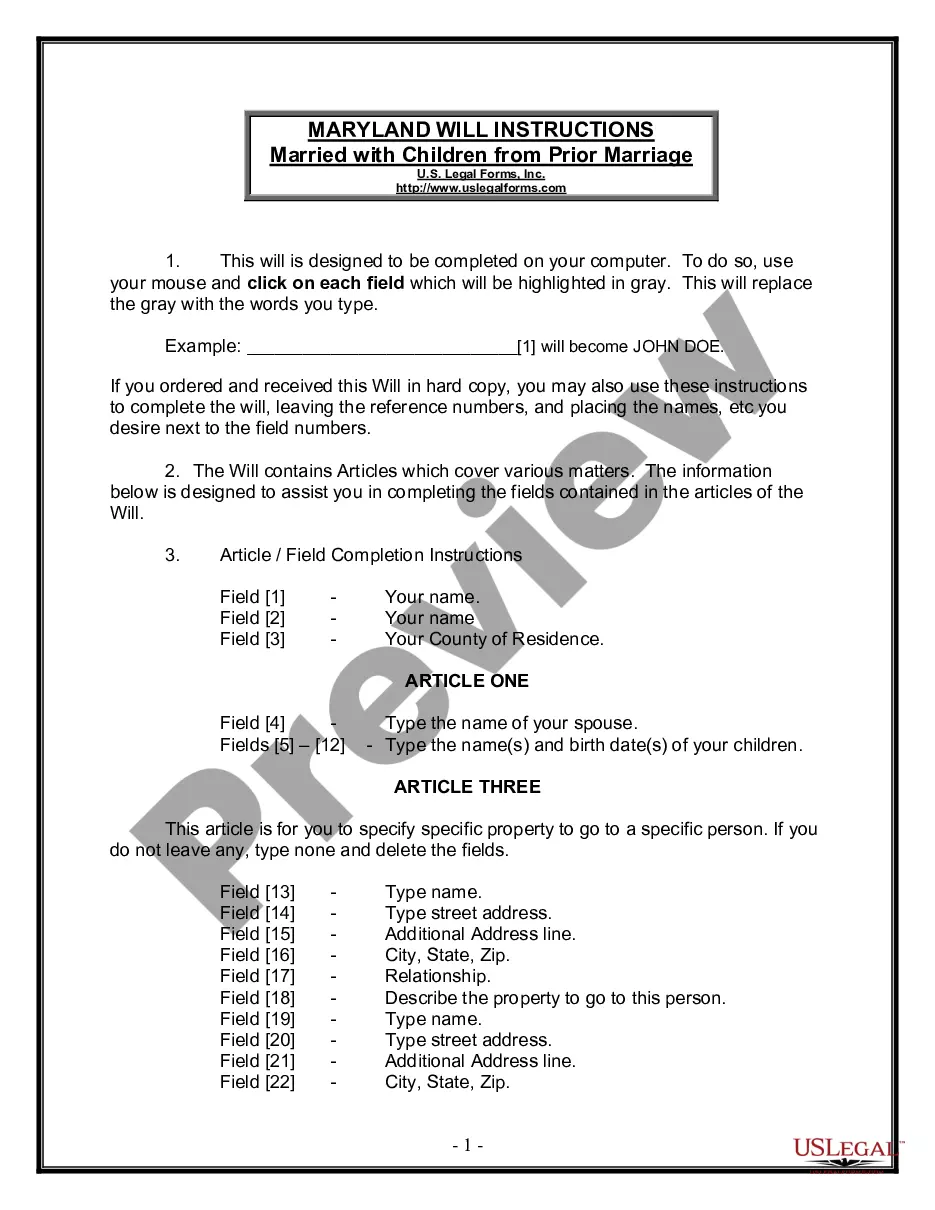

How to fill out Maryland Application For Work Or Employment - Clerical, Exempt, Executive, Or Nonexempt Position?

You may commit time on the Internet attempting to find the legitimate file format which fits the federal and state demands you need. US Legal Forms gives a huge number of legitimate forms that happen to be examined by professionals. You can easily acquire or print the Maryland Application for Work or Employment - Clerical, Exempt, Executive, or Nonexempt Position from our services.

If you have a US Legal Forms accounts, you may log in and then click the Obtain button. Afterward, you may complete, revise, print, or indicator the Maryland Application for Work or Employment - Clerical, Exempt, Executive, or Nonexempt Position. Each legitimate file format you purchase is your own permanently. To obtain one more backup for any obtained kind, go to the My Forms tab and then click the corresponding button.

If you are using the US Legal Forms site initially, keep to the easy recommendations listed below:

- Initially, make certain you have selected the proper file format for that county/metropolis of your liking. Look at the kind information to make sure you have chosen the appropriate kind. If offered, use the Review button to search with the file format at the same time.

- If you would like locate one more variation in the kind, use the Look for field to obtain the format that meets your requirements and demands.

- Once you have located the format you desire, click Purchase now to move forward.

- Select the prices prepare you desire, type in your references, and register for your account on US Legal Forms.

- Total the deal. You may use your credit card or PayPal accounts to pay for the legitimate kind.

- Select the formatting in the file and acquire it for your system.

- Make modifications for your file if possible. You may complete, revise and indicator and print Maryland Application for Work or Employment - Clerical, Exempt, Executive, or Nonexempt Position.

Obtain and print a huge number of file layouts making use of the US Legal Forms web site, that offers the most important variety of legitimate forms. Use specialist and status-distinct layouts to handle your company or specific requirements.

Form popularity

FAQ

Tips For Drafting Job Descriptions for Exempt EmployeesAccuracy is King. The job description must be accurate.Accuracy Does Not Mean Exhaustion.Strong Verbs, Clear Impact.Focus on Exempt Functions.Don't Shy Away From Degree Requirements.Assist With Can Diminish a Role.Consider Requiring Acknowledgement.

Simply put, an exempt employee is someone exempt from receiving overtime pay. It is a category of employees who do not qualify for minimum wage or overtime pay as guaranteed by Fair Labor Standard Act (FLSA). Exempt employees are paid a salary instead of hourly wages and their work is professional in nature.

Who is eligible for overtime pay? To qualify as an exempt employee one who does not receive overtime pay staff members must meet all the requirements under the duties and salary basis tests.

An exempt employee is not entitled overtime pay by the Fair Labor Standards Act (FLSA). These salaried employees receive the same amount of pay per pay period, even if they put in overtime hours. A nonexempt employee is eligible to be paid overtime for work in excess of 40 hours per week, per federal guidelines.

Exempt employees do not receive overtime pay, nor do they qualify for minimum wage. When an employee is exempt, it primarily means that they are exempt from receiving overtime pay. Exempt employees stand in contrast to nonexempt employees.

Salaried employees, who fit the description of "Executive," "Administrative" or "Professional," are generally exempt under the law from receiving overtime, regardless of the number of hours they are required to work in a week.

With few exceptions, to be exempt an employee must (a) be paid at least $23,600 per year ($455 per week), and (b) be paid on a salary basis, and also (c) perform exempt job duties. These requirements are outlined in the FLSA Regulations (promulgated by the U.S. Department of Labor).

In short, the executive exemption means employees whose primary duties comprise managerial tasks are not eligible for FLSA coverage like overtime pay. The roles that typically fall under the executive exemption include CEOs, mid-level managers, and shift managers.

Exempt employees refer to workers in the United States who are not entitled to overtime pay. This simply implies that employers of exempt employees are not bound by law to pay them for any extra hours of work. The federal standard for work hours in the United States is 40 hours per workweek.

An exempt employee is not entitled overtime pay by the Fair Labor Standards Act (FLSA). These salaried employees receive the same amount of pay per pay period, even if they put in overtime hours. A nonexempt employee is eligible to be paid overtime for work in excess of 40 hours per week, per federal guidelines.