Maryland Employment Form

Description

How to fill out Employment Form?

Are you in a situation where you require documents for either business or personal purposes almost constantly.

There are numerous legal document templates accessible online, but acquiring forms you can rely on is not simple.

US Legal Forms provides thousands of form templates, such as the Maryland Employment Form, that are designed to comply with state and federal regulations.

Choose the payment plan you prefer, fill in the required information to create your account, and complete the transaction using your PayPal or credit card.

Select a suitable paper format and download your copy. Retrieve all the document templates you have purchased from the My documents section. You can obtain an additional copy of the Maryland Employment Form at any time, if necessary. Just select the desired form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal documents, to save time and avoid errors. The service provides professionally crafted legal document templates that can be utilized for a variety of purposes. Create your account on US Legal Forms and begin simplifying your life.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Maryland Employment Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

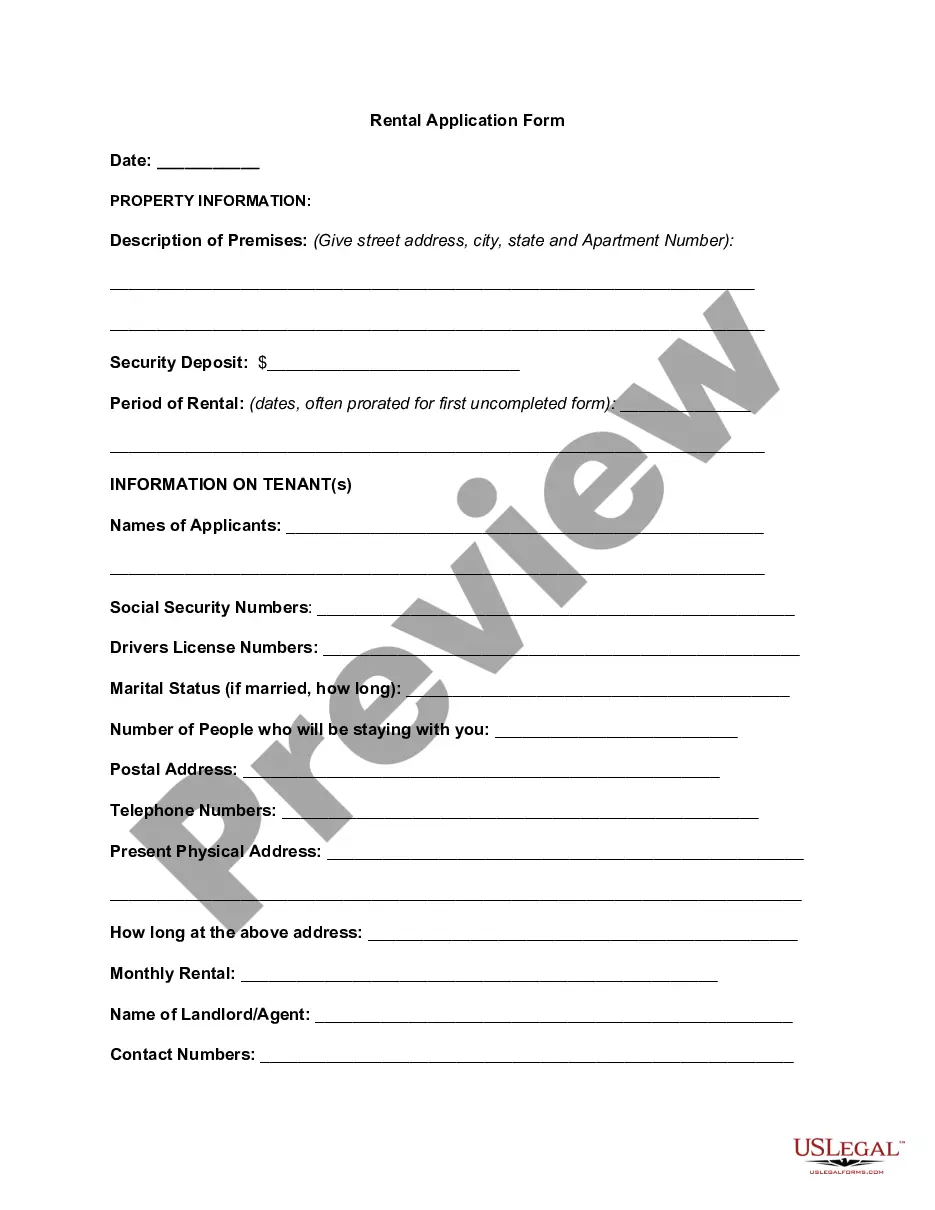

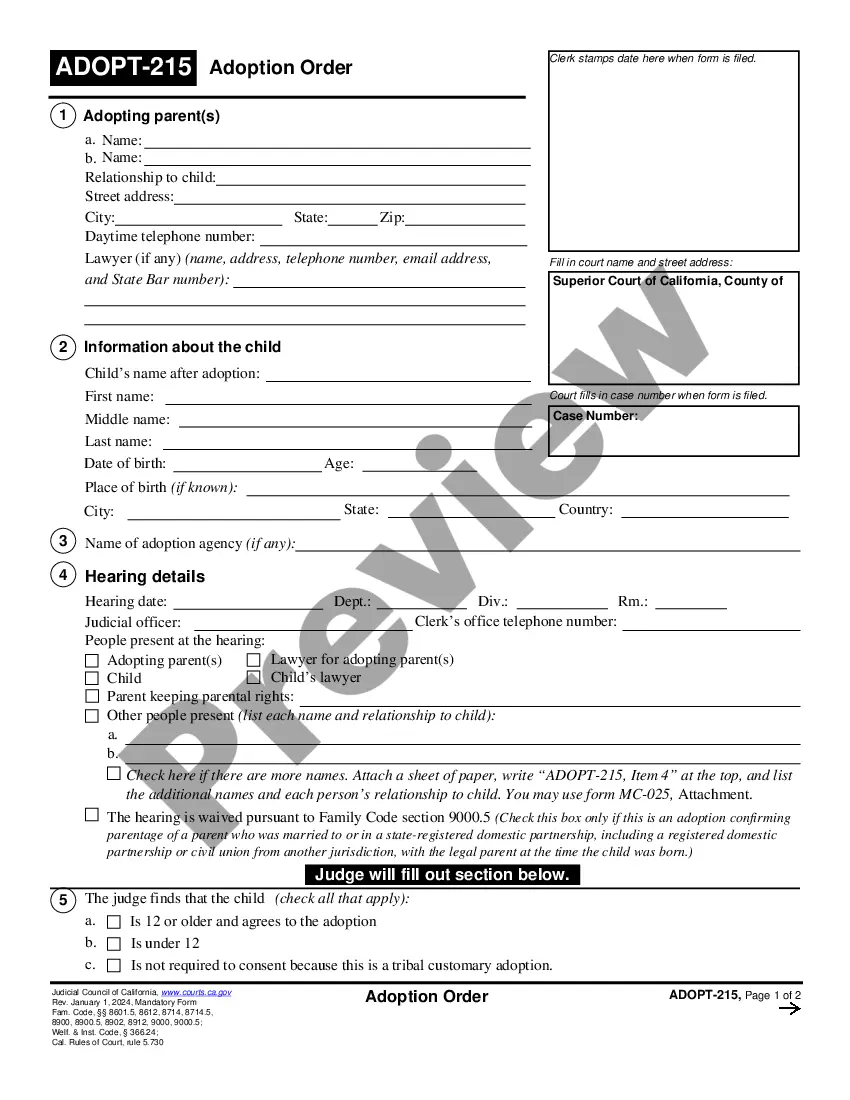

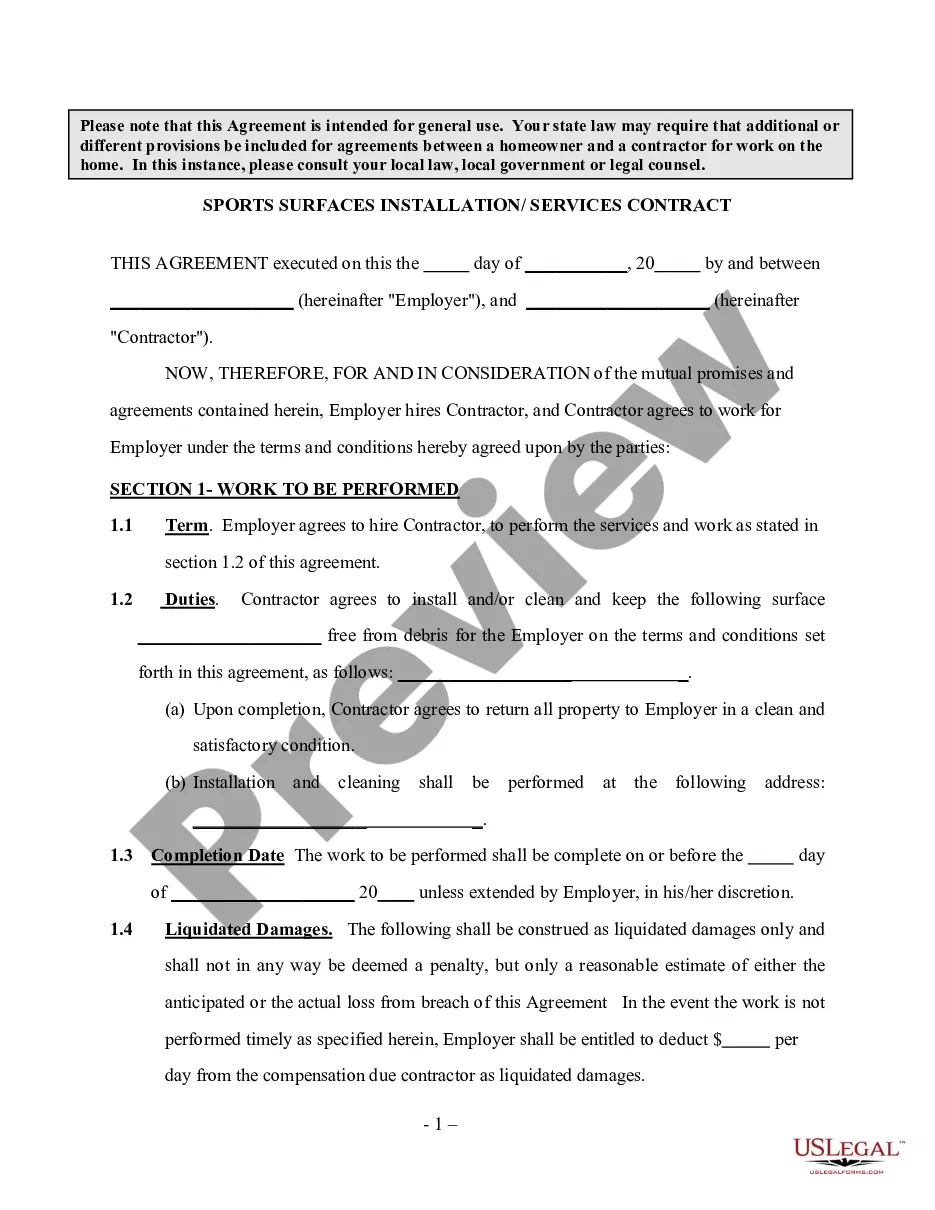

- Utilize the Preview feature to review the document.

- Read the description to confirm you have selected the right form.

- If the form is not what you are looking for, use the Search bar to find the document that suits your needs and requirements.

- Once you find the correct form, click Get now.

Form popularity

FAQ

Yes, there is a difference between state W-4s and federal Form W-4. Every employee in the U.S. will fill out a federal Form W-4, yet not every employee will fill out a state W-4. Your state tax withholdings and form requirements will vary depending on the state you reside in.

The following states opted to create their own state W-4 forms: Delaware, Idaho, Nebraska, Oregon, South Carolina, and Wisconsin whereas Colorado, New Mexico, North Dakota, and Utah will adopt the new inputs that the 2020 Federal W-4 put forth.

MW507. Employee's Maryland Withholding Exemption Certificate. Form used by individuals to direct their employer to withhold Maryland income tax from their pay.

The law requires that you complete an Employee's Withholding Allowance Certificate so that your employer, the state of Maryland, can withhold federal and state income tax from your pay.

On the W-4 Form complete the following and write legibly.Section 1 Payroll System RG Regular. Agency Code: 220100.Section 2 Federal Taxes Complete line 3; and then either line 5 or line 7.Section 3 State Taxes -- Marital status and then line 1, or 3, or 4, or 5.Section 4 Sign and date the form.

Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay. Consider completing a new Form MW507 each year and when your personal or financial situation changes.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

The Maryland Form MW 507, Employee's Maryland Withholding Exemption Certificate, must be completed so that you know how much state income tax to withhold from your new employee's wages.

The W-4 is a form that you complete and give to your employer (not the IRS) for federal tax and the equivalent form for state tax withholding. The W-4 communicates to your employer(s) how much federal and/or state tax you - and your spouse if s/he works - wish to have withheld from each paycheck in a pay period.

On the W-4 Form complete the following and write legibly.Section 1 Payroll System RG Regular. Agency Code: 220100.Section 2 Federal Taxes Complete line 3; and then either line 5 or line 7.Section 3 State Taxes -- Marital status and then line 1, or 3, or 4, or 5.Section 4 Sign and date the form.