Maryland Self-Employed Independent Contractor Employment Agreement: Commission for New Business A Maryland Self-Employed Independent Contractor Employment Agreement is a legally binding contract that defines the working relationship between a self-employed independent contractor and a company or individual hiring their services. This agreement specifically focuses on the commission structure for new business brought in by the contractor. Here are the key elements and clauses that are typically included in this type of agreement: 1. Contractor Details: This section contains the contractor's full name, address, contact information, and any business license or registration details necessary to operate legally in Maryland. 2. Company Details: This section outlines the name, address, and contact details of the company or individual hiring the contractor's services. 3. Purpose: This clause establishes the purpose of the agreement, which is to outline the terms and conditions under which the contractor will generate new business for the company in exchange for a commission on those sales. 4. Commission Structure: This is perhaps the most critical section of the agreement, as it specifies how the contractor's commission will be calculated and paid. The structure typically includes details such as the commission percentage, basis for calculation (gross or net sales), any thresholds or bonuses, and the frequency of commission payments, which could be monthly, quarterly, or annually. 5. New Business Acquisition: This clause defines what constitutes "new business" and outlines the responsibilities and obligations of the contractor regarding lead generation, client acquisition, marketing efforts, or any other relevant activities to secure new customers for the company. 6. Non-Compete and Non-Solicitation: In some cases, the agreement may include clauses prohibiting the contractor from engaging in competitive activities or soliciting the company's clients for a specified period after the agreement's termination or expiration. 7. Term and Termination: This section specifies the duration of the agreement and the conditions under which either party can terminate the contract before its natural expiration. It may include provisions for notice periods, early termination penalties, or rights to terminate for cause. 8. Confidentiality and Intellectual Property: If applicable, this clause ensures that the contractor maintains the confidentiality of any sensitive company information and acknowledges the company's ownership rights to any intellectual property created during the collaboration. Types of Maryland Self-Employed Independent Contractor Employment Agreements: 1. Sales Representative Agreement: Specifically designed for individuals or entities hired to promote and sell a company's products or services, often in a commission-based arrangement. 2. Marketing Consultant Agreement: Tailored for contractors hired to provide marketing expertise and support, focusing on bringing in new business through strategic campaigns. 3. Referral Agreement: This type of agreement is used when the contractor's primary responsibility is to refer potential customers or clients to the company, often in exchange for a commission based on successful conversions. 4. Business Development Agreement: This agreement is geared towards contractors responsible for identifying and developing new business opportunities and partnerships for the company. These are just a few examples of the different variations of Maryland Self-Employed Independent Contractor Employment Agreements — commission for new business. The specific type of agreement will depend on the nature of the services provided by the contractor and the goals of the hiring company.

Maryland Self-Employed Independent Contractor Employment Agreement - commission for new business

Description

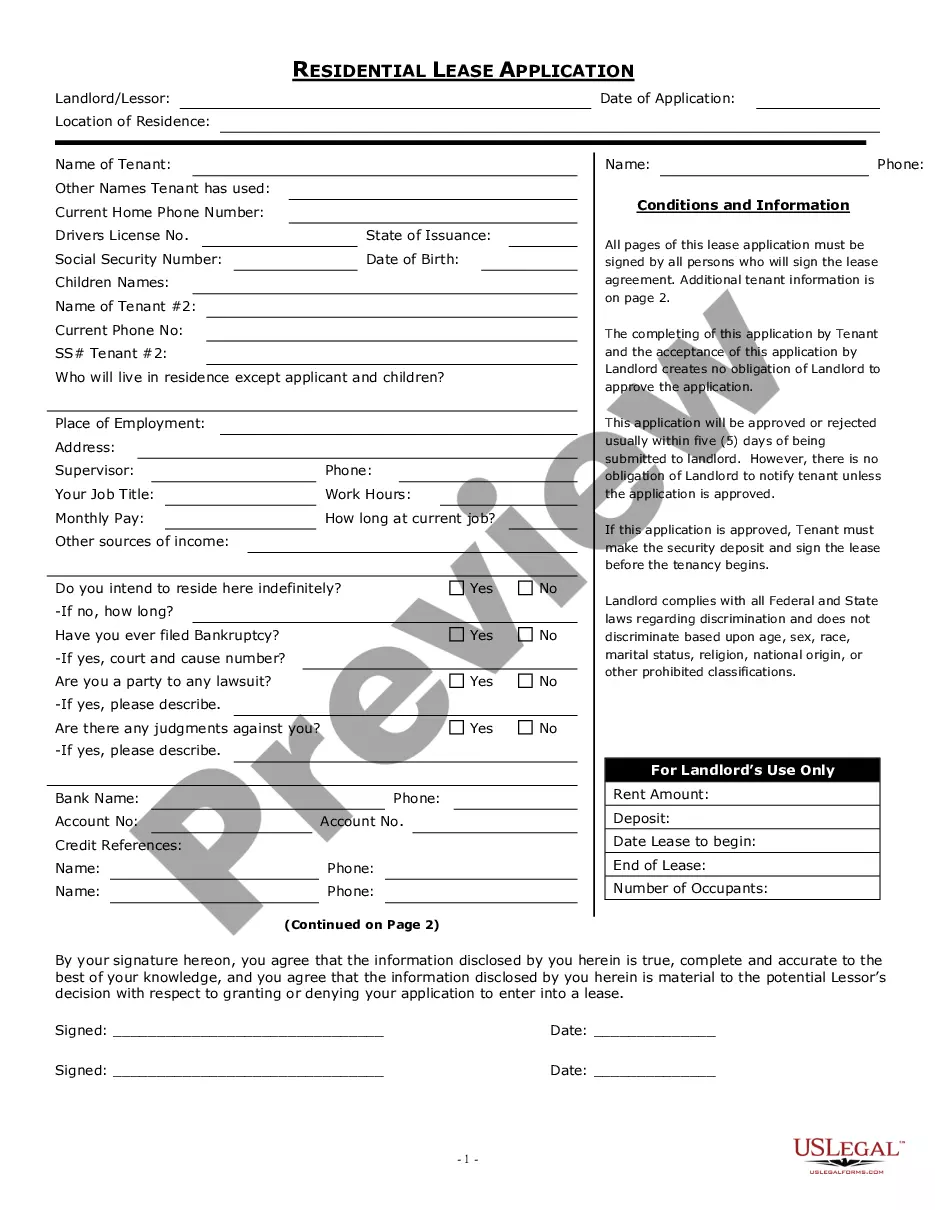

How to fill out Maryland Self-Employed Independent Contractor Employment Agreement - Commission For New Business?

If you need to comprehensive, download, or produce legal file web templates, use US Legal Forms, the greatest selection of legal kinds, that can be found on the web. Utilize the site`s simple and convenient research to get the papers you want. A variety of web templates for enterprise and specific uses are sorted by categories and says, or keywords. Use US Legal Forms to get the Maryland Self-Employed Independent Contractor Employment Agreement - commission for new business with a number of mouse clicks.

If you are already a US Legal Forms consumer, log in to your bank account and click the Acquire button to obtain the Maryland Self-Employed Independent Contractor Employment Agreement - commission for new business. Also you can gain access to kinds you in the past saved in the My Forms tab of your respective bank account.

If you use US Legal Forms the first time, refer to the instructions under:

- Step 1. Be sure you have selected the shape for your right area/country.

- Step 2. Utilize the Review option to look through the form`s content. Never forget to read through the information.

- Step 3. If you are not happy using the form, make use of the Lookup field near the top of the screen to locate other types in the legal form design.

- Step 4. Upon having found the shape you want, select the Get now button. Choose the costs strategy you like and add your credentials to sign up for an bank account.

- Step 5. Method the transaction. You should use your Мisa or Ьastercard or PayPal bank account to accomplish the transaction.

- Step 6. Find the formatting in the legal form and download it in your system.

- Step 7. Complete, change and produce or indicator the Maryland Self-Employed Independent Contractor Employment Agreement - commission for new business.

Every single legal file design you buy is yours forever. You possess acces to every single form you saved in your acccount. Click on the My Forms portion and pick a form to produce or download again.

Be competitive and download, and produce the Maryland Self-Employed Independent Contractor Employment Agreement - commission for new business with US Legal Forms. There are many professional and condition-particular kinds you can use for the enterprise or specific demands.

Form popularity

FAQ

How much does it cost to get a business license in Maryland? There is a $100 fee for new businesses and those changing their name, so be sure to bring this amount with you when filing any necessary forms.

In Maryland, a contractor license is required if you wish to work on home improvement projects or do electrical, plumbing, or HVACR work.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

If you operate two or more retail stores under the same general management or ownership in Maryland, you must have a chain store license. However, the term "store" does not include an automobile service station where the principal business is the sale or distribution of motor fuel.

Workers in Maryland who are independent contractors are not entitled to unemployment benefits if their contract expires or the company or individual who hired them lets them go.

Often Independent Contractors are completely unaware that they are not Employees as defined in South African labour legislation and therefore unprotected by labour legislation.

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.

The state of Maryland does not require general contractors to obtain a license to do business. It is not necessary to have a license if you are doing electrical, plumbing, or HVACR work or are working on home improvement projects. A license is issued by the Department of Labor, Licensing and Regulation (DLLR).

To be declared an independent contractor the individual (1) must be free from control and direction over his work both in fact and pursuant to the contract between the employer and contractor; (2) must be customarily engaged in independent business or contracting; and (3) the work must be outside the usual course of

Employees in South Africa are entitled to certain minimum employment benefits, while independent contractors are not. Subject to some exclusions, all employees are entitled to a number of statutory minimum entitlements and basic conditions of employment.

More info

SPanierSugarSellerSaaStrategistSendingCards See more.