Maryland General Partnership for Business

Description

How to fill out General Partnership For Business?

Are you in a circumstance where you frequently require documents for either organizational or personal reasons on a near daily basis.

There are numerous legal document templates accessible online, but finding ones you can trust isn't easy.

US Legal Forms offers thousands of template forms, including the Maryland General Partnership for Business, which are designed to comply with federal and state regulations.

Once you find the correct form, click Purchase now.

Choose your pricing plan, fill out the required information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Afterward, you can download the Maryland General Partnership for Business template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it’s for the correct city/county.

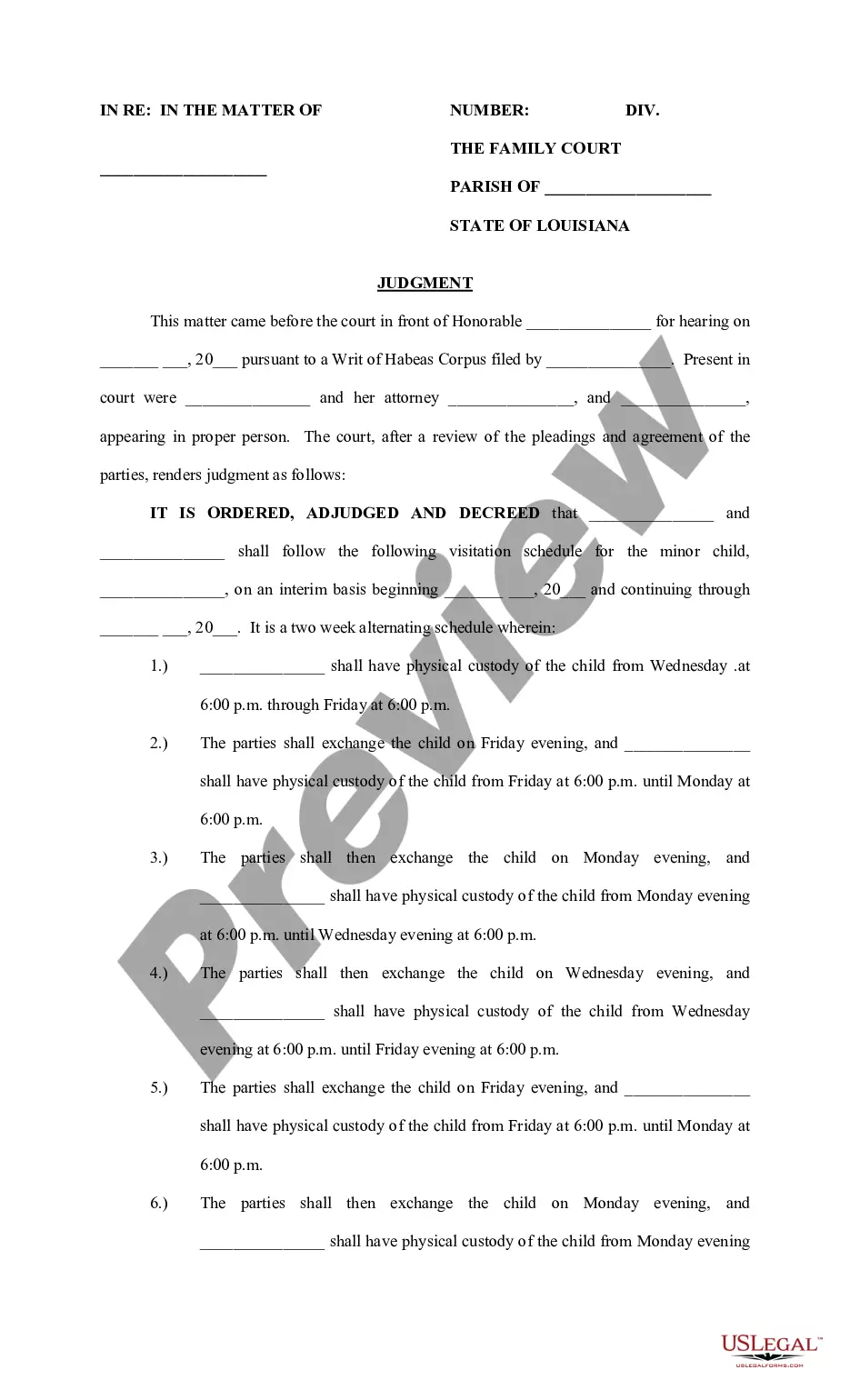

- Utilize the Preview feature to review the document.

- Check the summary to confirm you have selected the right form.

- If the form isn't what you are looking for, use the Search box to find the form that fits your needs.

Form popularity

FAQ

Example of a General Partnership For example, let's say that Fred and Melissa decide to open a baking store. The store is named F&M Bakery. By opening a store together, Fred and Melissa are both general partners in the business, F&M Bakery.

Steps to Create a Maryland General PartnershipDetermine if you should start a general partnership.Choose a business name.File a DBA name (if needed)Draft and sign partnership agreement.Obtain licenses, permits, and clearances.Get an Employer Identification Number (EIN)Get Maryland state tax identification numbers.

A general partnership is a business entity made of two or more partners who agree to establish and run a business.

A general partnership is an unincorporated business with two or more owners who share business responsibilities. Each general partner has unlimited personal liability for the debts and obligations of the business. Each partner reports their share of business profits and losses on their personal tax return.

A general partnership is a business entity made of two or more partners who agree to establish and run a business.

To properly form a Maryland partnership, there are a number of important steps that have to be taken before the business can open its doors.Step 1: Select a business name.Step 2: File trademark on business name.Step 3: Complete required paperwork.Step 4: Determine if you need an EIN, additional licenses or tax IDs.More items...

Aside from formation requirements, the main difference between a partnership and an LLC is that partners are personally liable for any business debts of the partnership -- meaning that creditors of the partnership can go after the partners' personal assets -- while members (owners) of an LLC are not personally liable

Example of a General Partnership For example, let's say that Fred and Melissa decide to open a baking store. The store is named F&M Bakery. By opening a store together, Fred and Melissa are both general partners in the business, F&M Bakery.

Are you looking to run a business with one or more partners in the state of Maryland? The simplest way to do this is to form a Maryland general partnership, which at its core is essentially just a handshake agreement between two (or more) people to operate a business together.

In general, an LLC offers better liability protection and more tax flexibility than a partnership. But the type of business you're in, the management structure, and your state's laws may tip the scales toward partnership.