A Maryland Commercial Lease Agreement for Tenant is a legally binding contract that establishes the terms and conditions for renting a commercial property in the state of Maryland. This agreement is designed specifically for tenants who wish to lease commercial spaces such as offices, retail stores, warehouses, or industrial facilities. It covers various aspects of the tenancy, including the rental amount, lease duration, rights and responsibilities of the tenant and landlord, and other important provisions. The Maryland Commercial Lease Agreement for Tenant outlines all the essential details that both parties must agree upon before entering into the lease. It clearly identifies the parties involved, including the landlord, who owns or manages the commercial property, and the tenant, who will occupy and utilize the space for business purposes. It also provides a comprehensive description of the leased premises, specifying the address, size, and any additional amenities or restrictions. Regarding the rent, this agreement outlines the amount to be paid by the tenant, the frequency of payments (e.g., monthly, quarterly), and the due dates. It may also mention any additional charges, such as common area maintenance fees, utilities, or property taxes, which the tenant may be responsible for. The lease agreement may specify whether the rent amount is fixed throughout the lease term or subject to periodic adjustments. Furthermore, the Maryland Commercial Lease Agreement for Tenant highlights the duration of the tenancy, including the lease start and end dates. It may also include provisions for renewal options, allowing the tenant to extend the lease for an additional term, subject to mutually agreed-upon terms and conditions. Additionally, this agreement covers the rights and responsibilities of both the tenant and landlord. It may address issues such as maintenance and repairs, alterations or improvements to the premises, insurance requirements, and dispute resolution procedures. It commonly includes clauses related to a security deposit, which is paid by the tenant to protect the landlord against potential damages or breaches of the lease. In Maryland, there may be different types of commercial lease agreements for tenants, tailored to meet specific business needs and property types. These may include: 1. Gross Lease: In this type of lease, the tenant pays a fixed rental amount, while the landlord assumes responsibility for most of the operating expenses, such as property taxes, insurance, and maintenance costs. 2. Net Lease: This lease structure requires the tenant to pay a base rent plus additional costs such as property taxes, insurance, and maintenance expenses. There are three common types of net leases: — Single Net Lease (N Lease): Tenant pays rent plus property taxes. — DoublReleasingNN Lease): Tenant pays rent plus property taxes and insurance. — Triple Net Lease (NNN Lease): Tenant pays rent plus property taxes, insurance, and maintenance costs. 3. Percentage Lease: Typically used for retail spaces, this lease structure involves the tenant paying a base rent along with a percentage of their gross sales. This arrangement allows the landlord to benefit from the tenant's success while providing a lower base rent. 4. Modified Gross Lease: This type of lease combines elements from both gross and net leases. The tenant pays a base rent, while the landlord covers certain operating expenses. Other costs, such as utilities or janitorial services, may be split between the parties or paid separately by the tenant. In conclusion, a Maryland Commercial Lease Agreement for Tenant is a crucial legal document that outlines the rights, responsibilities, and provisions agreed upon between a landlord and tenant when leasing a commercial property in Maryland. It ensures that both parties understand the terms of the lease, offering protection and clarity throughout the tenancy period.

Maryland Commercial Lease Agreement for Tenant

Description

How to fill out Maryland Commercial Lease Agreement For Tenant?

Discovering the right authorized papers design can be quite a have difficulties. Of course, there are a lot of templates available on the Internet, but how will you obtain the authorized develop you need? Take advantage of the US Legal Forms site. The support offers a large number of templates, such as the Maryland Commercial Lease Agreement for Tenant, which you can use for business and personal needs. Every one of the varieties are checked by experts and meet state and federal demands.

In case you are previously listed, log in for your profile and then click the Down load option to find the Maryland Commercial Lease Agreement for Tenant. Utilize your profile to look through the authorized varieties you might have ordered in the past. Check out the My Forms tab of the profile and acquire another backup of the papers you need.

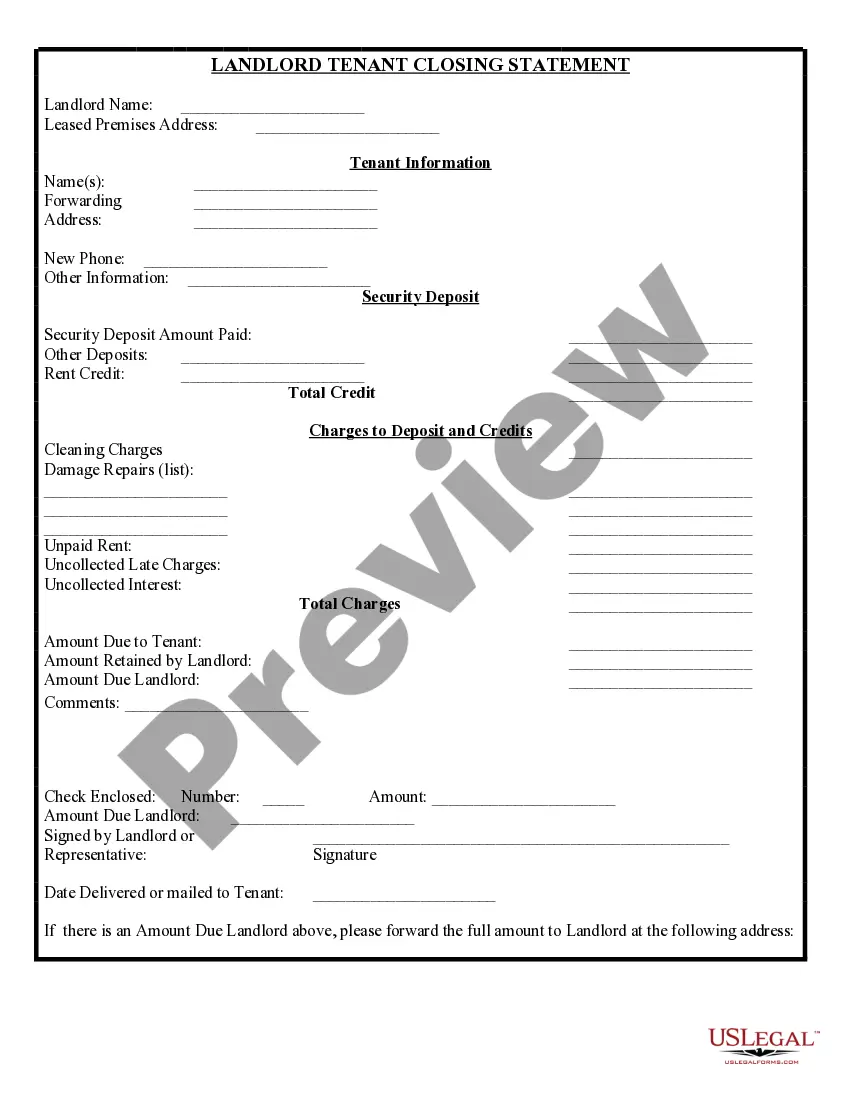

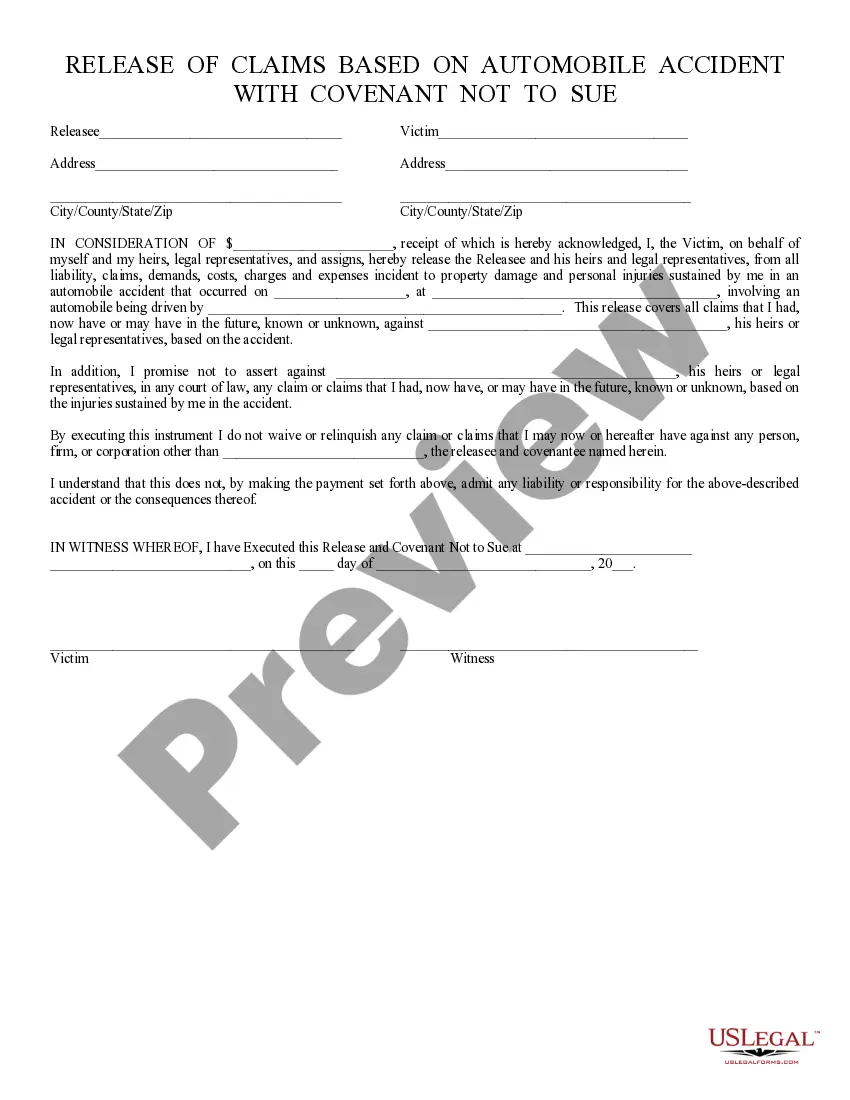

In case you are a brand new consumer of US Legal Forms, listed here are simple instructions so that you can adhere to:

- First, make certain you have selected the right develop for the city/area. You are able to look through the form while using Review option and study the form information to ensure this is basically the best for you.

- If the develop is not going to meet your needs, make use of the Seach industry to get the proper develop.

- When you are certain the form would work, go through the Get now option to find the develop.

- Pick the pricing program you would like and enter the required information. Make your profile and purchase an order utilizing your PayPal profile or charge card.

- Opt for the document file format and download the authorized papers design for your system.

- Complete, change and print and indicator the acquired Maryland Commercial Lease Agreement for Tenant.

US Legal Forms will be the biggest collection of authorized varieties in which you will find different papers templates. Take advantage of the service to download appropriately-made paperwork that adhere to express demands.

Form popularity

FAQ

A Commercial Tenancy Agreement, also known as a Business Lease or a Commercial Lease, is used when the owner of a business property wishes to rent space to another business owner. Both parties may either be individuals or corporations.

Landlords are normally responsible for any structural repairs needed to maintain commercial properties. This includes exterior walls, foundations, flooring structure and the roof.

This lease structure makes the tenant responsible for the majority of costs. Specifically, the tenant pays the base rent, property but also taxes, insurance, utilities, and maintenance. This even includes standard property repairs associated with the commercial space being occupied.

Your landlord is responsible for any aspects of health and safety written in the lease (eg in communal areas). You must take reasonable steps to make sure your landlord fulfils these responsibilities. If you get into a dispute with your landlord, you need to keep paying rent - otherwise you may be evicted.

Commercial Tenants:Tenants must pay their rent on the due date agreed on in the lease with the landlord. Tenants cannot hold back rent because a landlord has failed to fulfill their obligations as outlined in the lease. Tenants must fulfill their obligations as outlined by the lease agreement.

A commercial lease is a contract made between a business tenant and a landlord. This commercial lease contract grants you the right to use the property for commercial or business purposes. Money is paid to the landlord for the use of the property.

No, lease agreements do not need to be notarized in Maryland. As long as they are agreed upon, or written leases are signed by both parties, a lease is a valid contract. The landlord and tenant can request to have the lease notarized if they wish, but it is not required in order for the lease to be binding in Maryland.

Commercial tenants may have the protection of the Landlord and Tenant Act 1954. The Act grants Security of Tenure to tenants who occupy premises for business purposes. The tenancy will continue after the contractual termination date until it is ended in one of the ways specified by the Act.

The responsibilities of landlord and tenant will be clearly set out in the lease. Normally commercial landlords are responsible for any structural repairs such as foundations, flooring, roof and exterior walls, and tenants are responsible for non-structural repairs such as air conditioning or plumbing.

A Commercial Tenancy Agreement, also known as a Business Lease or a Commercial Lease, is used when the owner of a business property wishes to rent space to another business owner. Both parties may either be individuals or corporations.