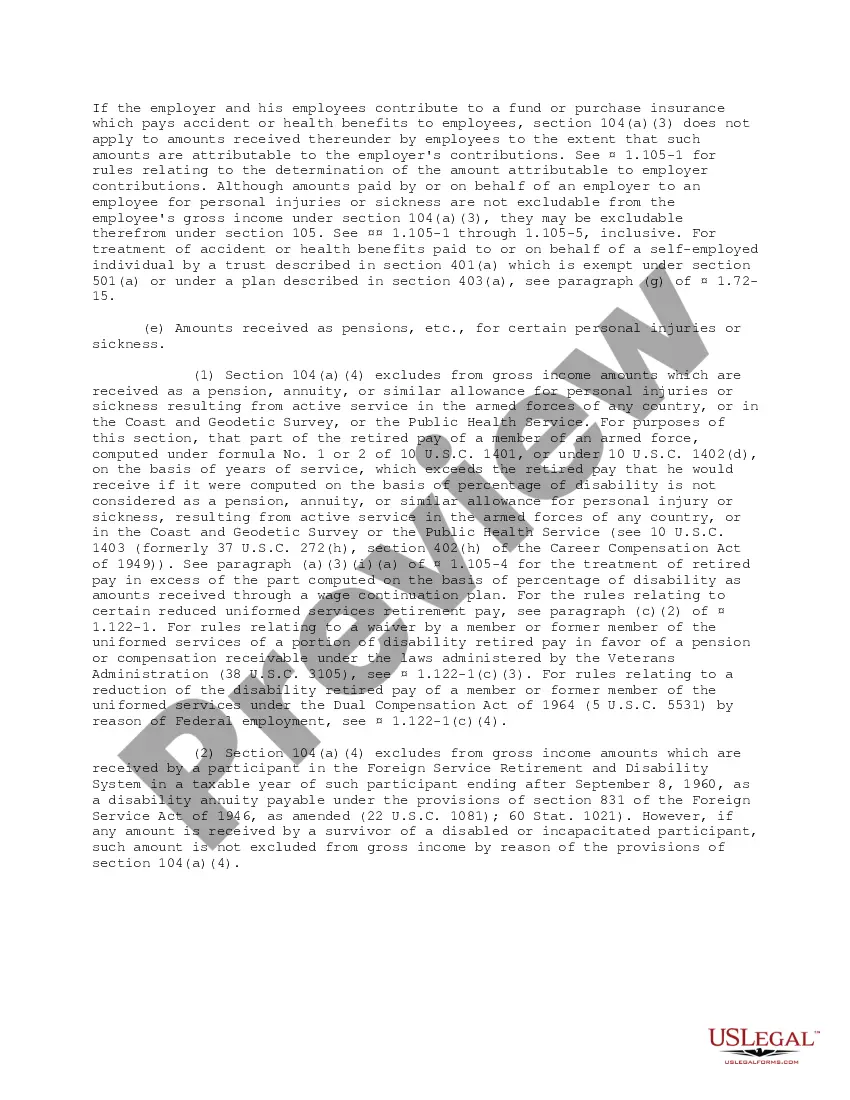

Statutory Guidelines [Appendix A(2) Tres. Reg 104-1] regarding compensation for injuries or sickness under workmen's compensation acts, damages, accident or health insurance, etc. as stated in the guidelines.

Maryland Compensation for Injuries or Sickness Treasury Regulation 104.1 is a crucial provision that outlines the tax treatment of compensation received by individuals for injuries or sickness. This regulation, enforced by the Maryland Department of Labor, specifies the guidelines and requirements for reporting and taxing such compensations. Under Maryland Compensation for Injuries or Sickness Treasury Regulation 104.1, there are different types of compensations that may be subject to taxation or exempt from it, based on the circumstances of the injury or sickness: 1. Workers' Compensation: This type of compensation is typically provided to workers who suffer work-related injuries or illnesses. Maryland Compensation for Injuries or Sickness Treasury Regulation 104.1 provides a framework for determining the tax ability of these payments, ensuring compliance with state tax laws. 2. Personal Injury Settlements: When an individual receives a settlement or award due to personal injuries sustained outside the workplace, Maryland Compensation for Injuries or Sickness Treasury Regulation 104.1 sets guidelines on how to report and tax these funds appropriately. 3. Social Security Disability Insurance Benefits (SDI): In some cases, individuals may receive SDI benefits due to a disability or injury that prevents them from working. Maryland Compensation for Injuries or Sickness Treasury Regulation 104.1 outlines the tax treatment of these benefits, helping taxpayers understand their reporting obligations. 4. Long-term Disability Insurance Payments: Individuals with long-term disability insurance who receive disability payments may also fall under the purview of Maryland Compensation for Injuries or Sickness Treasury Regulation 104.1. It explains the tax implications of these payments and assists taxpayers in complying with state tax regulations. 5. Veterans' Benefits: This regulation may also touch upon the tax implications of veterans' benefits received by individuals due to injuries or sickness incurred during military service. Maryland Compensation for Injuries or Sickness Treasury Regulation 104.1 clarifies the tax treatment for both federal and state tax purposes. It is important for individuals who receive compensation for injuries or sickness in Maryland to consult this regulation and understand the applicable tax implications. Adequate compliance with Maryland Compensation for Injuries or Sickness Treasury Regulation 104.1 ensures accurate reporting and helps avoid any potential tax penalties or disputes.

Maryland Compensation for Injuries or Sickness Treasury Regulation 104.1 is a crucial provision that outlines the tax treatment of compensation received by individuals for injuries or sickness. This regulation, enforced by the Maryland Department of Labor, specifies the guidelines and requirements for reporting and taxing such compensations. Under Maryland Compensation for Injuries or Sickness Treasury Regulation 104.1, there are different types of compensations that may be subject to taxation or exempt from it, based on the circumstances of the injury or sickness: 1. Workers' Compensation: This type of compensation is typically provided to workers who suffer work-related injuries or illnesses. Maryland Compensation for Injuries or Sickness Treasury Regulation 104.1 provides a framework for determining the tax ability of these payments, ensuring compliance with state tax laws. 2. Personal Injury Settlements: When an individual receives a settlement or award due to personal injuries sustained outside the workplace, Maryland Compensation for Injuries or Sickness Treasury Regulation 104.1 sets guidelines on how to report and tax these funds appropriately. 3. Social Security Disability Insurance Benefits (SDI): In some cases, individuals may receive SDI benefits due to a disability or injury that prevents them from working. Maryland Compensation for Injuries or Sickness Treasury Regulation 104.1 outlines the tax treatment of these benefits, helping taxpayers understand their reporting obligations. 4. Long-term Disability Insurance Payments: Individuals with long-term disability insurance who receive disability payments may also fall under the purview of Maryland Compensation for Injuries or Sickness Treasury Regulation 104.1. It explains the tax implications of these payments and assists taxpayers in complying with state tax regulations. 5. Veterans' Benefits: This regulation may also touch upon the tax implications of veterans' benefits received by individuals due to injuries or sickness incurred during military service. Maryland Compensation for Injuries or Sickness Treasury Regulation 104.1 clarifies the tax treatment for both federal and state tax purposes. It is important for individuals who receive compensation for injuries or sickness in Maryland to consult this regulation and understand the applicable tax implications. Adequate compliance with Maryland Compensation for Injuries or Sickness Treasury Regulation 104.1 ensures accurate reporting and helps avoid any potential tax penalties or disputes.