Maryland Current Income of Individual Debtors - Schedule I - Form 6I - Post 2005

Description

How to fill out Current Income Of Individual Debtors - Schedule I - Form 6I - Post 2005?

Are you currently in a placement where you need to have documents for possibly enterprise or personal purposes just about every day? There are plenty of legal document layouts accessible on the Internet, but locating ones you can depend on is not straightforward. US Legal Forms delivers a huge number of type layouts, much like the Maryland Current Income of Individual Debtors - Schedule I - Form 6I - Post 2005, that are composed in order to meet state and federal demands.

Should you be presently knowledgeable about US Legal Forms site and have your account, simply log in. After that, you may down load the Maryland Current Income of Individual Debtors - Schedule I - Form 6I - Post 2005 format.

If you do not offer an bank account and want to start using US Legal Forms, abide by these steps:

- Find the type you require and ensure it is for your proper city/county.

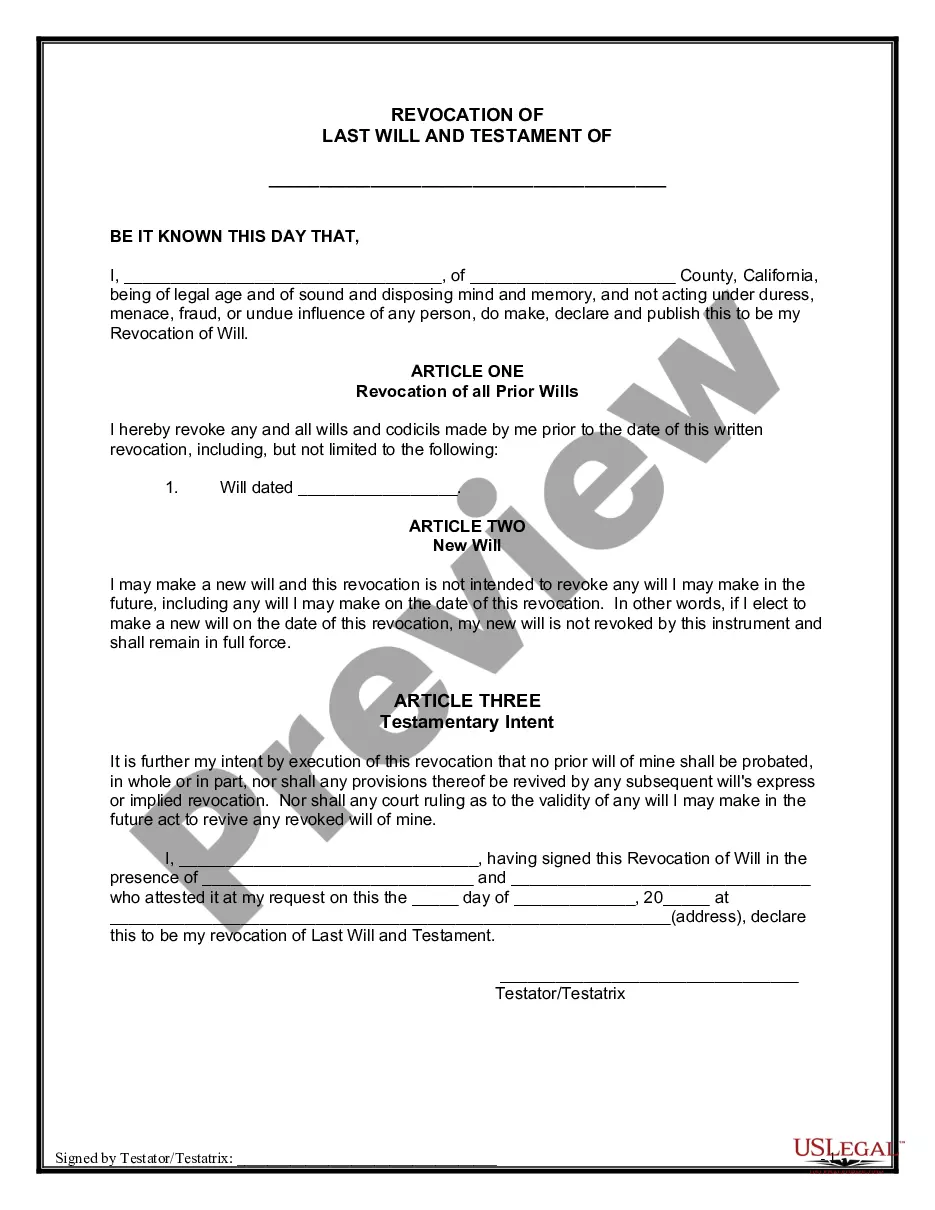

- Use the Preview switch to examine the shape.

- See the information to ensure that you have chosen the correct type.

- If the type is not what you are searching for, use the Lookup industry to obtain the type that meets your requirements and demands.

- Whenever you find the proper type, click on Purchase now.

- Pick the prices plan you want, complete the desired info to produce your account, and pay for an order making use of your PayPal or bank card.

- Choose a practical document format and down load your duplicate.

Locate every one of the document layouts you possess purchased in the My Forms food list. You can aquire a further duplicate of Maryland Current Income of Individual Debtors - Schedule I - Form 6I - Post 2005 at any time, if possible. Just go through the required type to down load or printing the document format.

Use US Legal Forms, probably the most comprehensive variety of legal varieties, in order to save time and stay away from mistakes. The service delivers skillfully created legal document layouts which can be used for a range of purposes. Make your account on US Legal Forms and begin producing your life easier.

Form popularity

FAQ

This is an Official Bankruptcy Form. Official Bankruptcy Forms are approved by the Judicial Conference and must be used under Bankruptcy Rule 9009. Declaration About an Individual Debtor's Schedules - U.S. Courts uscourts.gov ? forms ? individual-debtors uscourts.gov ? forms ? individual-debtors

Key Takeaways. Debtors are individuals or businesses that owe money, whether to banks or other individuals. Debtors are often called borrowers if the money owed is to a bank or financial institution, however, they are called issuers if the debt is in the form of securities.

A creditor schedule is a statement that details the balances of the creditor control account and compares them with the individual creditor balances. A debtor schedule compares the individual customer balances with the balances of the debtor control account.