Maryland Investment Advisory Agreement of Equity Strategies Fund, Inc. and EQSF Advisors, Inc.

Description

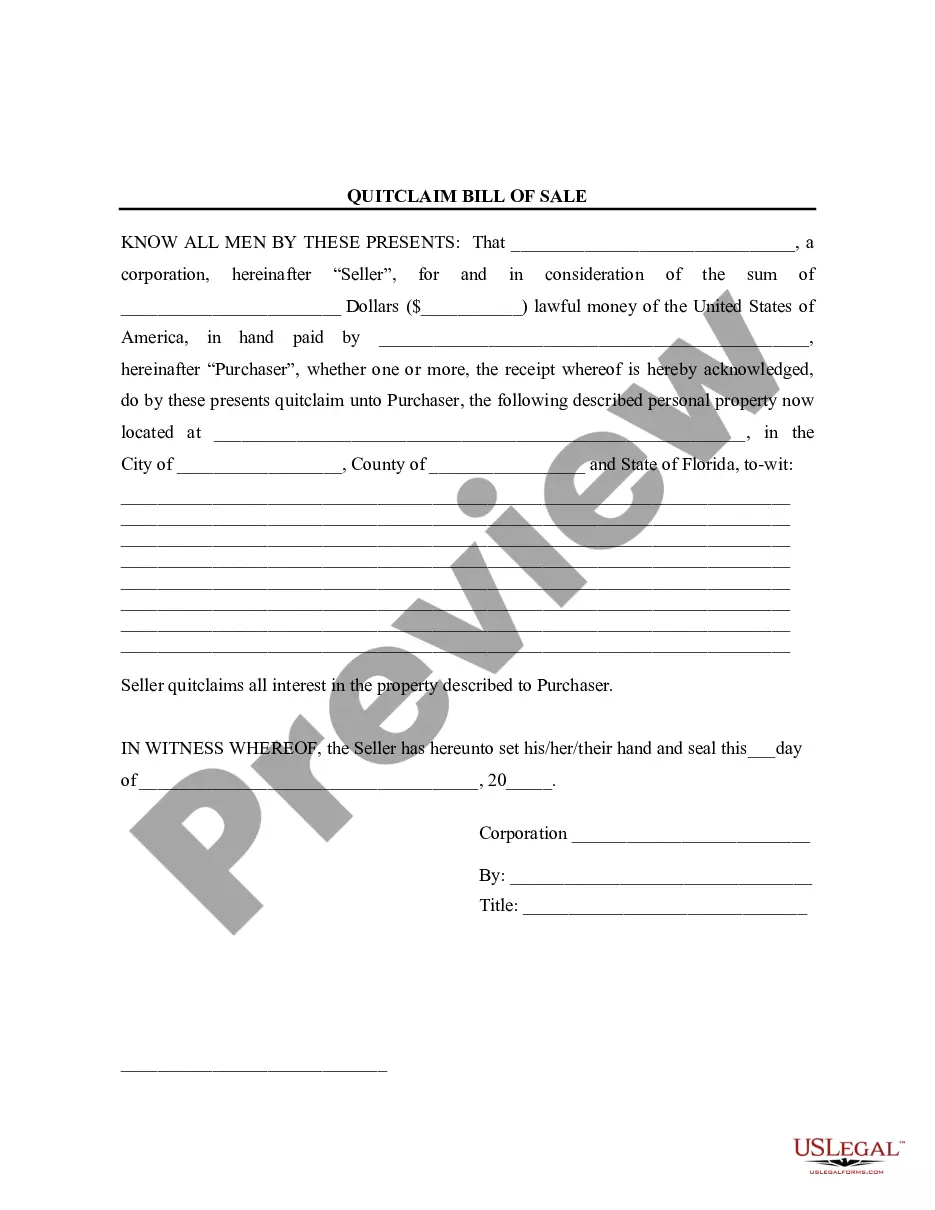

How to fill out Investment Advisory Agreement Of Equity Strategies Fund, Inc. And EQSF Advisors, Inc.?

If you have to total, obtain, or produce lawful file web templates, use US Legal Forms, the greatest collection of lawful kinds, that can be found on-line. Utilize the site`s simple and hassle-free search to obtain the files you require. A variety of web templates for organization and personal purposes are sorted by classes and suggests, or keywords. Use US Legal Forms to obtain the Maryland Investment Advisory Agreement of Equity Strategies Fund, Inc. and EQSF Advisors, Inc. within a few click throughs.

In case you are presently a US Legal Forms consumer, log in for your accounts and click on the Acquire option to get the Maryland Investment Advisory Agreement of Equity Strategies Fund, Inc. and EQSF Advisors, Inc.. Also you can gain access to kinds you previously delivered electronically inside the My Forms tab of your own accounts.

If you use US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the form for your proper metropolis/country.

- Step 2. Make use of the Preview solution to look through the form`s information. Do not forget to see the description.

- Step 3. In case you are not satisfied with all the kind, make use of the Lookup industry towards the top of the display to find other types in the lawful kind template.

- Step 4. After you have found the form you require, go through the Acquire now option. Select the rates prepare you prefer and put your accreditations to sign up for the accounts.

- Step 5. Procedure the deal. You can utilize your credit card or PayPal accounts to accomplish the deal.

- Step 6. Select the file format in the lawful kind and obtain it in your gadget.

- Step 7. Full, change and produce or signal the Maryland Investment Advisory Agreement of Equity Strategies Fund, Inc. and EQSF Advisors, Inc..

Each and every lawful file template you buy is yours permanently. You possess acces to each and every kind you delivered electronically in your acccount. Go through the My Forms section and pick a kind to produce or obtain yet again.

Compete and obtain, and produce the Maryland Investment Advisory Agreement of Equity Strategies Fund, Inc. and EQSF Advisors, Inc. with US Legal Forms. There are millions of expert and status-particular kinds you may use to your organization or personal needs.

Form popularity

FAQ

This agreement is meant to be a blueprint of sorts for you as the client because it spells out both what the financial advisor will do you for you, such as provide general advice or recommend specific investment moves for your portfolio, as well as what your responsibilities are.

The Investment Advisers Act (IAA) was passed in 1940 to monitor those who, for a fee, advise people, pension funds, and institutions on investment matters.

They provide clear guidelines of what is expected of each party in order for your needs to be met. Investment advisory agreements typically include terms related to the advisors fee structure, investment methodology, level of risk a client is willing to take, and more.

An advisor agreement is a legal document used between a company and an advisor they have hired. The legal agreements outlines the expectations and obligation between the two parties, including the role and responsibilities of the advisor, their compensation, confidentiality, and assignment of work.