Maryland Employee Stock Option Plan (ESOP) is a beneficial employee benefit program offered by Texas American Ranchers, Inc. It allows employees of the company to purchase company stock at a discounted price as a part of their compensation package. By owning company shares, employees become stakeholders and can benefit from the company's success. The Maryland Employee Stock Option Plan offered by Texas American Ranchers, Inc. provides employees with the opportunity to acquire company stock through stock options. This incentive program promotes employee loyalty, engagement, and alignment with the company's long-term growth. By granting stock options, the company aims to empower and reward its employees for their contribution and dedication. The Texas American Ranchers, Inc. Maryland ESOP program may include various types of stock options, such as: 1. Non-Qualified Stock Options (NO): These stock options are typically offered to employees without the restrictions of qualifying for special tax treatment. The employee can exercise them at any time after they vest. 2. Incentive Stock Options (ISO): These stock options are subject to specific requirements outlined by the Internal Revenue Code. They often come with favorable tax treatment, but the employee must meet eligibility criteria and hold the shares for a minimum period before selling. 3. Restricted Stock Units (RSU): As an alternative to stock options, RSS may be granted to employees. RSS represents a promise to deliver shares in the future, usually after a vesting period. They do not require the employee to purchase shares; instead, the company grants them directly. 4. Performance Shares: This type of stock option is granted based on predetermined performance criteria set by the company. The employee receives shares if specific performance goals are met within a defined timeframe. Texas American Ranchers, Inc. believes that the Maryland Employee Stock Option Plan is an effective tool in attracting and retaining talented employees. It aligns the interests of employees and shareholders, as both benefit from the company's success. The stock options granted under the plan provide employees with an opportunity to share in the company's growth and prosperity. Moreover, the ESOP supports a culture of ownership, loyalty, and dedication among employees, thereby fostering a collaborative and motivated workforce. Overall, the Maryland Employee Stock Option Plan offered by Texas American Ranchers, Inc. demonstrates the company's commitment to recognizing the contributions of its employees and working together towards achieving long-term success.

Maryland Employee Stock Option Plan of Texas American Bancshares, Inc.

Description

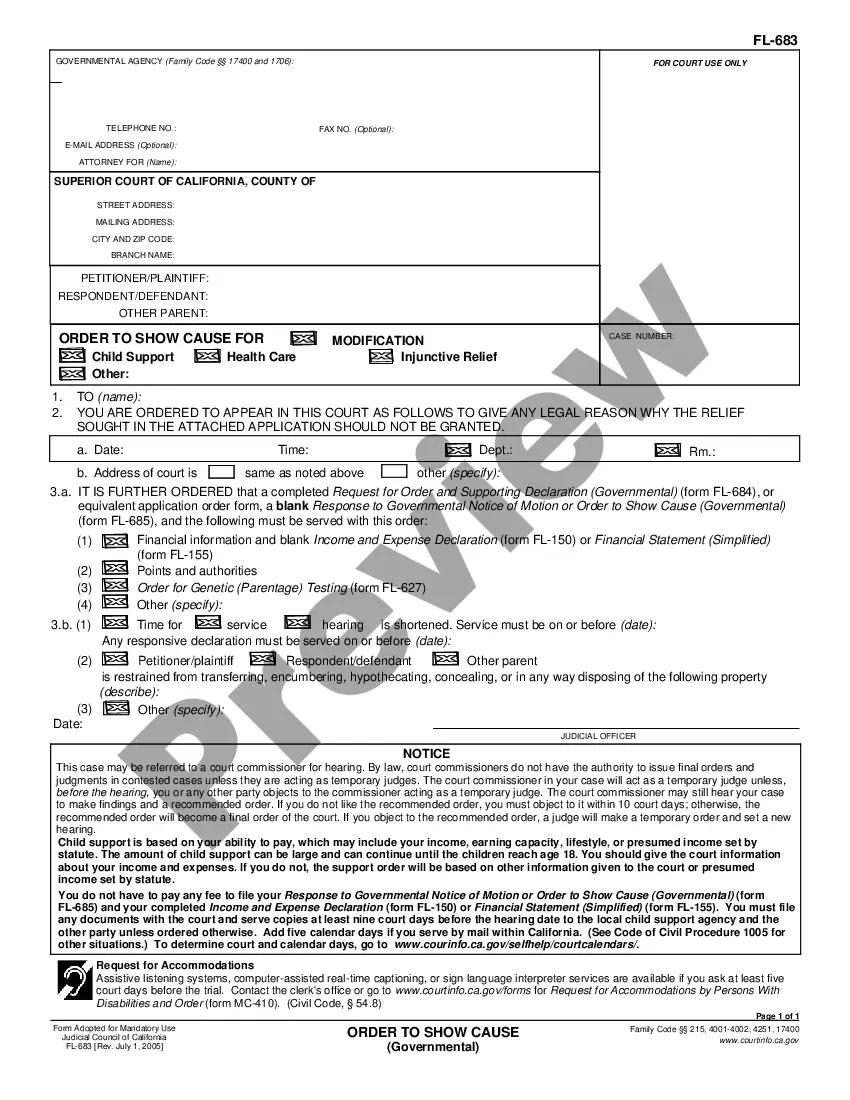

How to fill out Maryland Employee Stock Option Plan Of Texas American Bancshares, Inc.?

Are you currently within a situation that you require files for sometimes organization or person purposes virtually every day? There are plenty of lawful document layouts available on the net, but discovering types you can rely is not easy. US Legal Forms provides 1000s of form layouts, much like the Maryland Employee Stock Option Plan of Texas American Bancshares, Inc., which are written to meet federal and state needs.

When you are presently familiar with US Legal Forms website and also have an account, basically log in. Afterward, it is possible to down load the Maryland Employee Stock Option Plan of Texas American Bancshares, Inc. web template.

Unless you come with an bank account and would like to start using US Legal Forms, follow these steps:

- Obtain the form you need and make sure it is for that right metropolis/area.

- Use the Review button to check the form.

- Look at the explanation to ensure that you have selected the proper form.

- If the form is not what you are looking for, take advantage of the Search field to obtain the form that suits you and needs.

- When you discover the right form, simply click Purchase now.

- Pick the prices program you would like, fill in the required information and facts to produce your bank account, and purchase an order using your PayPal or Visa or Mastercard.

- Decide on a convenient data file file format and down load your duplicate.

Locate all the document layouts you might have bought in the My Forms food selection. You can get a more duplicate of Maryland Employee Stock Option Plan of Texas American Bancshares, Inc. any time, if possible. Just click on the needed form to down load or printing the document web template.

Use US Legal Forms, by far the most substantial assortment of lawful types, to conserve time and steer clear of errors. The support provides professionally produced lawful document layouts which you can use for an array of purposes. Create an account on US Legal Forms and commence generating your way of life a little easier.

Form popularity

FAQ

Your ESPP will have set offering and purchase periods, while a stock option grant has a set term in which you can exercise the options after they vest. The purchase price of stock under a tax-qualified Section 423 ESPP is typically discounted in some way from the market price at purchase.

The difference between an ESOP and a stock option is that while ESOP allows owners of tightly held businesses to sell to an ESOP and reinvest the revenues tax-free, as long as the ESOP controls at least 30% of the business, as well as certain requirements, are met.

ESOPs are designed for prolonged, sustained growth by a business, and for a business that intends to operate for 10, 20, or more years into the future. An Equity Incentive Plan, in contrast, is geared more toward a change of control and exit from the business by service provider employees in 3-5 years (or less).

The purchase price of stock under a tax-qualified Section 423 ESPP is typically discounted in some way from the market price at purchase. A nonqualified ESPP may have a discount, a match, or other features. By contrast, the purchase price of stock under a stock option plan is the fair market value on the date of grant.

The difference between an ESOP and a stock option is that while ESOP allows owners of tightly held businesses to sell to an ESOP and reinvest the revenues tax-free, as long as the ESOP controls at least 30% of the business, as well as certain requirements, are met.

The most notable difference between an ESOP vs ESPP is in how the employee receives the stock and when they can sell the stock. ESOPs provide the stock or shares at no cost to employees. ESPPs require participants to contribute funds to purchase shares of stock, though at a discounted rate.

Stock options are an employee benefitthat grants employees the right to buy shares of the company at a set price after a certain period of time. Employees and employers agree ahead of time on how many shares they can purchase and how long the vesting period will be before they can buy the stock.