Maryland Proposal Approval of Nonqualified Stock Option Plan

Description

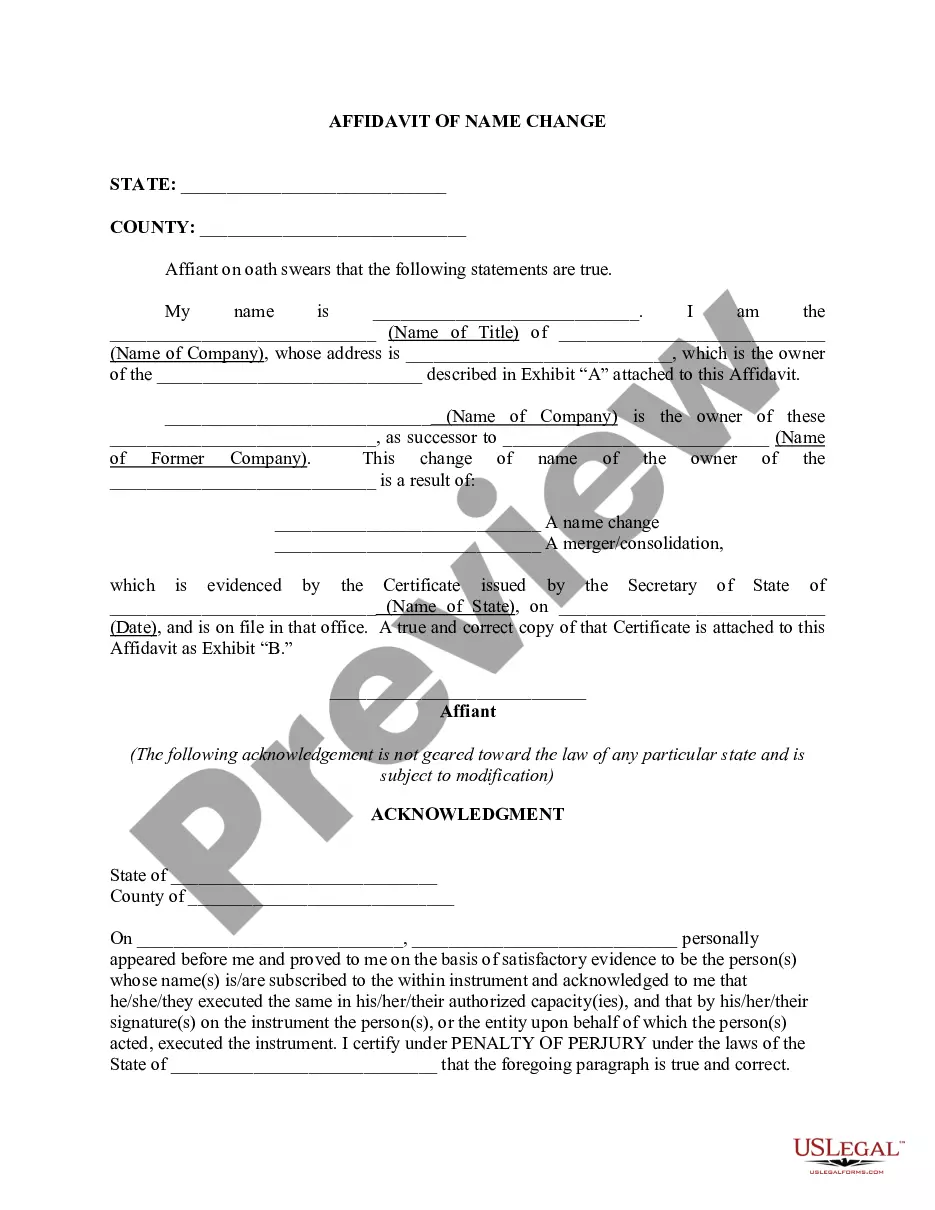

How to fill out Proposal Approval Of Nonqualified Stock Option Plan?

You can commit hours on-line looking for the legal record format that fits the state and federal specifications you need. US Legal Forms gives a huge number of legal kinds which are reviewed by professionals. It is possible to down load or print out the Maryland Proposal Approval of Nonqualified Stock Option Plan from the support.

If you have a US Legal Forms account, it is possible to log in and click the Download button. After that, it is possible to complete, change, print out, or sign the Maryland Proposal Approval of Nonqualified Stock Option Plan. Every legal record format you buy is the one you have for a long time. To acquire one more version for any obtained kind, visit the My Forms tab and click the related button.

If you use the US Legal Forms internet site the very first time, follow the straightforward instructions below:

- Very first, ensure that you have chosen the proper record format for your county/metropolis of your choice. See the kind information to ensure you have selected the right kind. If accessible, take advantage of the Review button to look throughout the record format at the same time.

- If you would like find one more version in the kind, take advantage of the Research field to get the format that meets your requirements and specifications.

- When you have discovered the format you desire, click Purchase now to continue.

- Choose the rates strategy you desire, type your references, and sign up for your account on US Legal Forms.

- Complete the deal. You can utilize your bank card or PayPal account to cover the legal kind.

- Choose the structure in the record and down load it to your system.

- Make adjustments to your record if necessary. You can complete, change and sign and print out Maryland Proposal Approval of Nonqualified Stock Option Plan.

Download and print out a huge number of record templates using the US Legal Forms Internet site, that provides the biggest collection of legal kinds. Use specialist and express-specific templates to deal with your organization or individual requirements.

Form popularity

FAQ

The option plan must be approved by the stockholders within 12 months before or after the plan is adopted (see also Explanation: §423, Shareholder Approval Requirement) (IRC § 422(b)(1); Reg. §1.422-3).

The US federal tax laws do not generally address the level of approval required for equity awards, but the tax rules that govern the qualification of so-called incentive stock options require that the options be granted under a shareholder-approved plan.

The income related to the option exercise should be included in the Form W-2 you receive from your employer or 1099-NEC from the company if you are a non-employee. Any capital gain or loss amount may also be reportable on your US Individual Income Tax Return (Form 1040), Schedule D and Form 8949 in the year of sale.

Once approved by the stockholders, an ESPP does not need to be approved by the stockholders again unless there is an amendment to the ESPP that would be considered the ?adoption of a new plan.? As a practical matter, this means a change in the number of shares reserved for issuance or a change in the related ...

If you exercised nonqualified stock options (NQSOs) last year, the income you recognized at exercise is reported on your W-2. It appears on the W-2 with other income in: Box 1: Wages, tips, and other compensation. Box 3: Social Security wages (up to the income ceiling)

Once you have a plan in place, you can simply make amendments to increase the number of shares in the option pool on an as-needed basis. The initial plan and any expansions must be approved by your board of directors and then by shareholders.

A stock option plan must be adopted by the company's directors and, in some cases, approved by the company's shareholders.

Non-qualified stock options (NSOs or NQSOs) are a type of stock option that does not qualify for tax-advantaged treatment for the employee like ISOs do. NSOs can also be issued to other non-employee service providers like consultants, advisors, and independent board members.