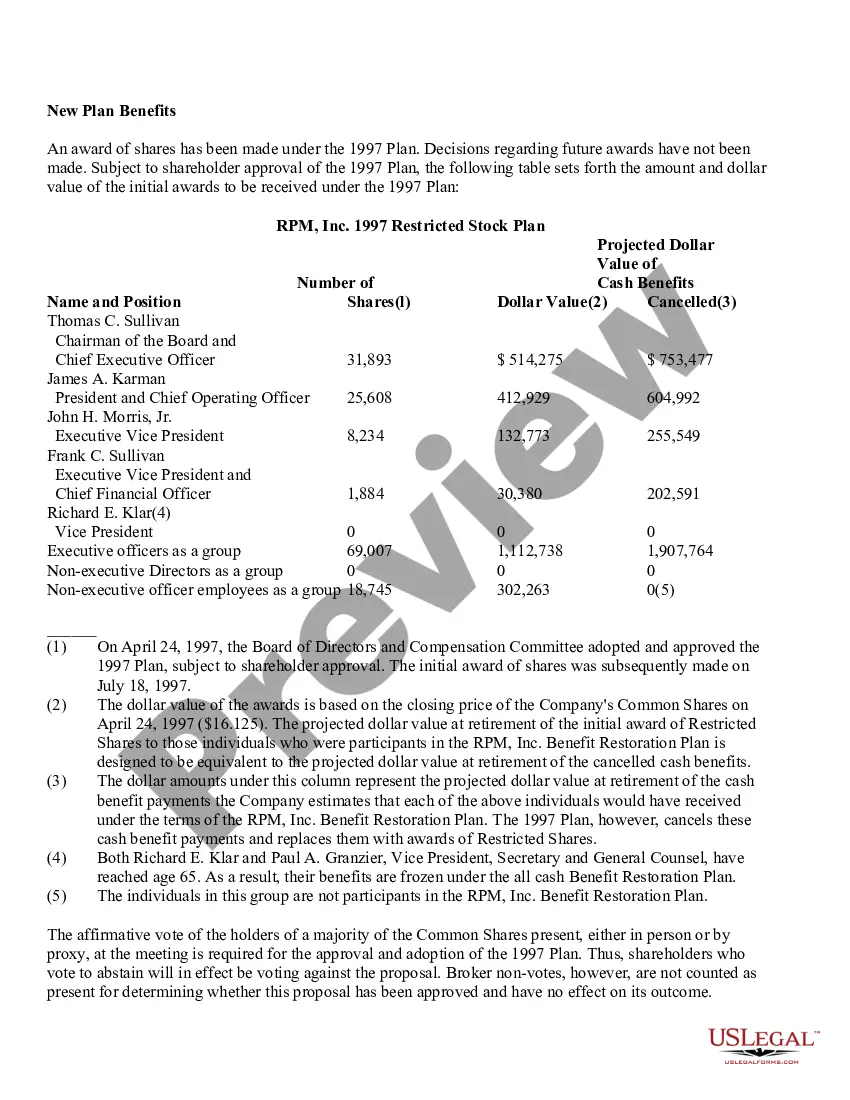

Title: Maryland Adoption of Restricted Stock Plan of RPM, Inc. — A Comprehensive Overview Introduction: The Maryland Adoption of Restricted Stock Plan (RSP) of RPM, Inc. is a corporate program designed to incentivize employees through the distribution of restricted stock. This comprehensive description aims to provide a detailed understanding of RPM, Inc.'s restricted stock plan and its various components, rules, and benefits. 1. Meaning and Purpose of the Maryland Adoption of Restricted Stock Plan: The Maryland Adoption of Restricted Stock Plan is a formal document that outlines the terms and conditions for granting restricted stock to RPM, Inc. employees. The plan serves as a means to attract and retain talented individuals within the organization by offering a valuable form of long-term compensation. 2. Types of Restricted Stock Plans under Maryland Adoption of Restricted Stock Plan of RPM, Inc.: a) Time-Based Restricted Stock: Also known as time vesting, this type of plan grants employees a specified number of shares based on their duration of service with RPM, Inc., subject to certain restrictions. These restrictions protect the company's interests by ensuring employees stay committed to the organization for a predetermined period. b) Performance-Based Restricted Stock: This plan awards restricted stock based on the achievement of predetermined performance goals or targets. It motivates employees to excel and contribute to the company's success, as the stock grant is contingent upon meeting specific performance metrics. 3. Eligibility Criteria: The Maryland Adoption of Restricted Stock Plan may specify eligibility requirements for RPM, Inc. employees participating in the program. Common criteria may include tenure with the company, job position, performance evaluation, or a combination of factors. 4. Granting and Vesting of Restricted Stock: The plan describes the process of granting restricted stock to eligible employees and the vesting schedule associated with it. The vesting schedule outlines the period over which the restrictions on the stock lapse, providing employees with ownership rights. 5. Restrictions and Conditions: Maryland Adoption of Restricted Stock Plan imposes specific restrictions and conditions on the granted stock. These may include limitations on stock transferability, forfeiture provisions upon termination, or a requirement to remain employed with RPM, Inc. during the vesting period. 6. Stock Valuation and Tax Implications: The plan may highlight the valuation method used to determine the fair market value of restricted stock at the time of grant. Additionally, it may include information regarding the tax implications for both the company and the grantees. 7. Rights and Benefits: Employees participating in the Maryland Adoption of Restricted Stock Plan are entitled to certain rights and benefits, such as dividends, voting rights, and the ability to sell or transfer vested shares after restrictions have lapsed. Conclusion: The Maryland Adoption of Restricted Stock Plan of RPM, Inc. offers a valuable employee incentive program that aligns individual efforts with the company's long-term success. By granting and vesting restricted stock, RPM, Inc. aims to foster loyalty, motivate performance, and reward its employees. Understanding the different types of plans and their intricate details ensures a transparent and successful adoption of this beneficial compensation strategy.

Maryland Adoption of Restricted Stock Plan of RPM, Inc.

Description

How to fill out Maryland Adoption Of Restricted Stock Plan Of RPM, Inc.?

Are you currently in the placement the place you require paperwork for sometimes organization or person reasons nearly every day time? There are a variety of authorized file templates available online, but finding ones you can trust isn`t straightforward. US Legal Forms offers a huge number of form templates, such as the Maryland Adoption of Restricted Stock Plan of RPM, Inc., that happen to be written to fulfill federal and state specifications.

If you are already informed about US Legal Forms internet site and also have a merchant account, merely log in. Afterward, it is possible to download the Maryland Adoption of Restricted Stock Plan of RPM, Inc. design.

Should you not offer an bank account and need to begin to use US Legal Forms, adopt these measures:

- Get the form you require and ensure it is for the correct area/county.

- Make use of the Review button to analyze the form.

- Browse the description to ensure that you have chosen the appropriate form.

- If the form isn`t what you`re searching for, take advantage of the Look for field to discover the form that meets your needs and specifications.

- When you get the correct form, just click Buy now.

- Select the rates prepare you would like, fill out the desired information to generate your account, and purchase your order using your PayPal or charge card.

- Select a hassle-free paper file format and download your backup.

Locate all the file templates you might have bought in the My Forms menu. You can aquire a extra backup of Maryland Adoption of Restricted Stock Plan of RPM, Inc. any time, if needed. Just select the essential form to download or print the file design.

Use US Legal Forms, one of the most comprehensive variety of authorized forms, to save some time and steer clear of errors. The service offers skillfully produced authorized file templates that can be used for a selection of reasons. Make a merchant account on US Legal Forms and start producing your lifestyle a little easier.