Maryland Adoption of incentive compensation plan

Description

How to fill out Adoption Of Incentive Compensation Plan?

If you want to total, down load, or print lawful file web templates, use US Legal Forms, the largest collection of lawful kinds, which can be found on the Internet. Take advantage of the site`s easy and hassle-free lookup to get the files you need. Different web templates for company and individual reasons are categorized by groups and claims, or keywords. Use US Legal Forms to get the Maryland Adoption of incentive compensation plan with a couple of clicks.

When you are previously a US Legal Forms client, log in in your profile and then click the Acquire key to have the Maryland Adoption of incentive compensation plan. You may also gain access to kinds you formerly saved in the My Forms tab of your own profile.

Should you use US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the form to the proper metropolis/region.

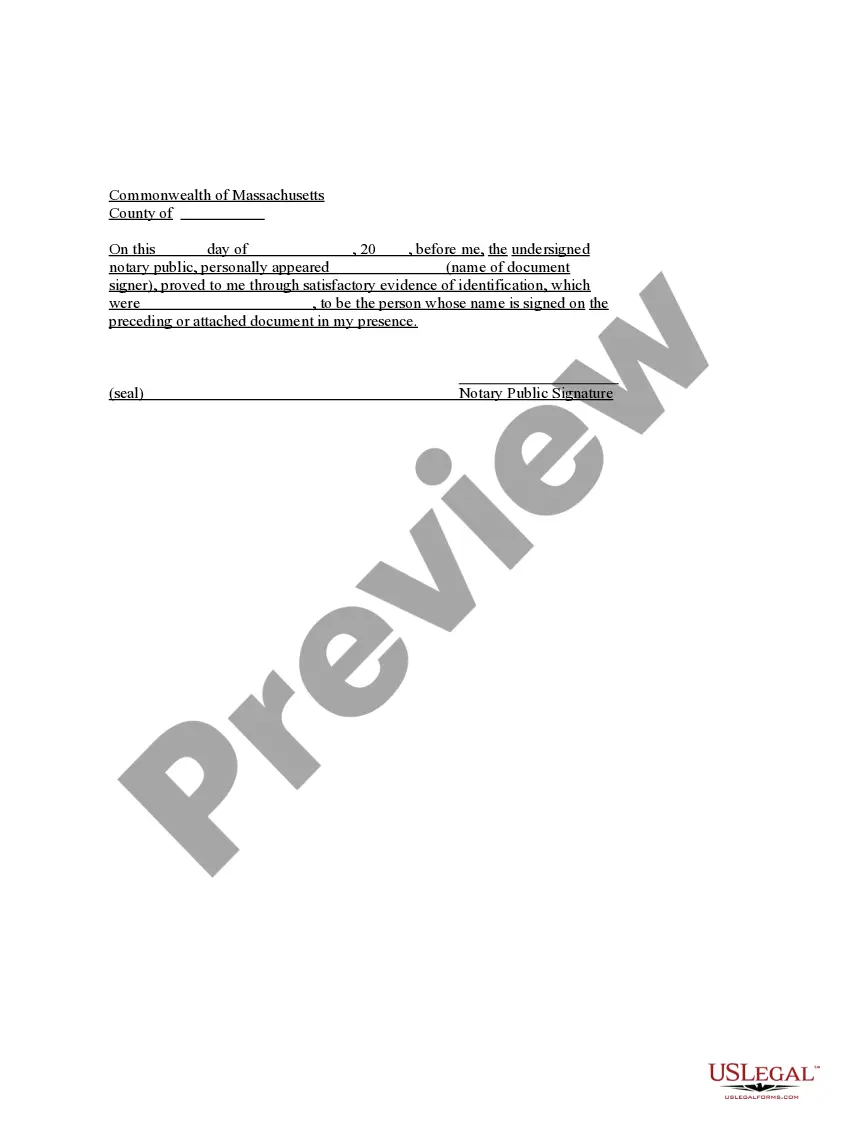

- Step 2. Make use of the Review choice to look over the form`s content material. Do not overlook to read the explanation.

- Step 3. When you are not happy with the develop, use the Research industry towards the top of the screen to find other variations in the lawful develop template.

- Step 4. Once you have located the form you need, go through the Purchase now key. Pick the pricing strategy you like and put your accreditations to register for the profile.

- Step 5. Method the deal. You can utilize your credit card or PayPal profile to complete the deal.

- Step 6. Pick the formatting in the lawful develop and down load it on your product.

- Step 7. Complete, revise and print or indication the Maryland Adoption of incentive compensation plan.

Each and every lawful file template you buy is the one you have forever. You have acces to each develop you saved in your acccount. Select the My Forms area and select a develop to print or down load once more.

Compete and down load, and print the Maryland Adoption of incentive compensation plan with US Legal Forms. There are thousands of professional and status-specific kinds you may use for your company or individual needs.

Form popularity

FAQ

Financial Assistance: Financial and medical help to support a child's adoptive placement is called Adoption Assistance. Regardless of your income, if you adopt a child with special needs, you may receive monthly adoption assistance payments and/or medical assistance for the child.

The program encourages noncustodial party (NCP) to make consistent child support payments by: Reducing state-owed arrears by half if the NCP makes full child support payments for a year. Eliminating the balance owed if the (NCP) makes full child support payments for two years.

It is illegal to pursue adoption for compensation or profit. You do not get paid to do adoption in Maryland. As long as it's completed both ethically and legally, though, adoptive families can help you with the costs of your pregnancy should you need financial assistance.