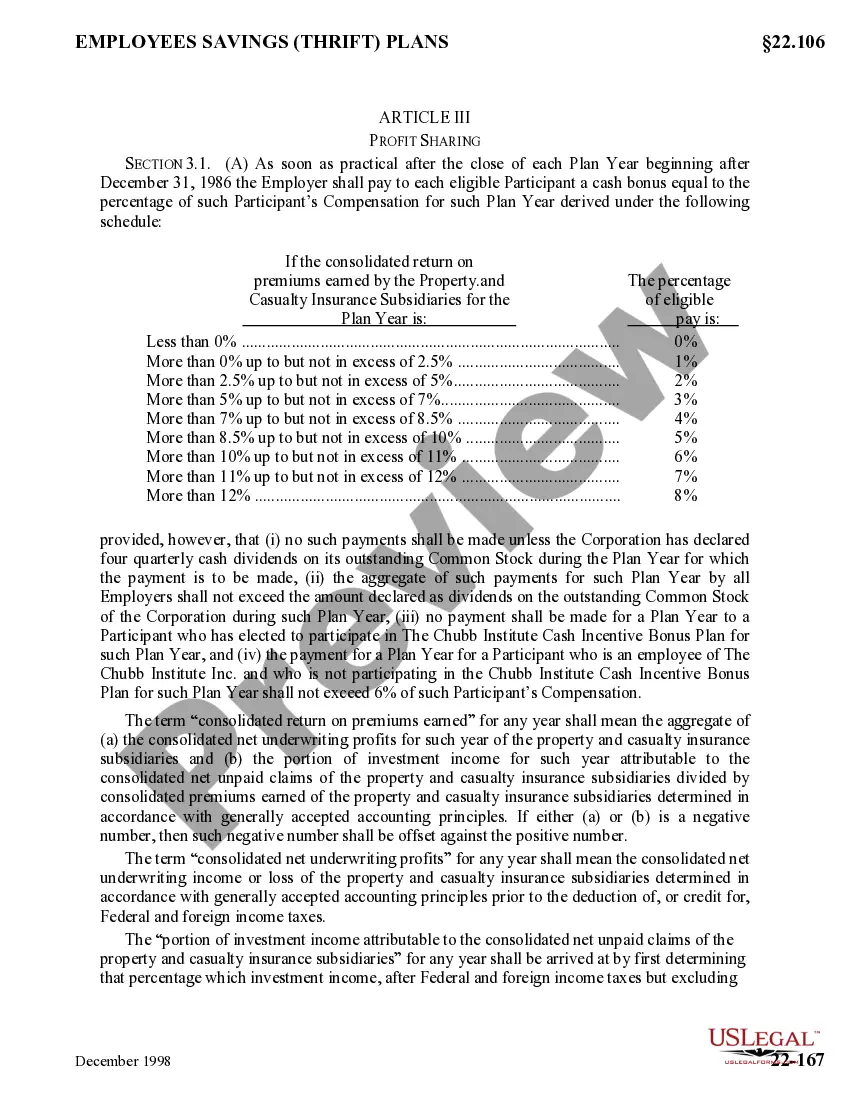

Maryland Profit Sharing Plan: A Comprehensive Overview The Maryland Profit Sharing Plan is a retirement savings vehicle specifically designed for businesses in the state of Maryland. It offers employers the opportunity to share their company's profits with eligible employees, providing them with a valuable financial benefit for their dedicated service. This plan functions as a tax-advantaged retirement program, allowing employers to contribute a portion of their profits directly to their employees' retirement accounts. The contributions made by the employer are generally discretionary and can vary from year to year, depending on the financial performance of the business. There are different types of Maryland Profit Sharing Plans that employers can choose from, depending on their specific needs and objectives. These include: 1. Traditional Profit Sharing Plan: This is the most common type of profit sharing plan, where employers distribute profits to employees based on a predetermined formula. The formula can be based on various factors, such as employee salary or length of service. 2. Age-Weighted Profit Sharing Plan: This type of plan takes into account both the employee's age and compensation when allocating profits. Older employees and those with higher salaries may receive a larger share of the profits, as they are closer to retirement age. 3. New Comparability Profit Sharing Plan: This plan allows employers to allocate contributions based on different employee groups, such as executives, managers, and non-management staff. Each group may have a different contribution percentage, enabling employers to reward certain positions or levels of responsibility. 4. Integrated Profit Sharing Plan: This type of plan combines profit sharing with a defined benefit pension plan. The employer's profit sharing contributions are integrated with the benefits provided by the pension plan, resulting in higher retirement benefits for eligible employees. Key benefits of the Maryland Profit Sharing Plan: 1. Tax Advantages: Contributions made by employers are tax-deductible, reducing their taxable income. Additionally, investment gains within the plan are tax-deferred until withdrawn during retirement. 2. Employee Attraction and Retention: A profit sharing plan can be an effective tool for attracting and retaining top talent. The promise of sharing in the company's profits can serve as a powerful incentive for employees to stay committed to the organization. 3. Enhanced Employee Retirement Savings: The Maryland Profit Sharing Plan supplements employees' retirement savings, allowing them to build a substantial nest egg for their post-retirement years. 4. Flexibility and Control: Employers have the flexibility to determine the contribution amount each year based on the financial performance of their business. This enables them to adjust contributions according to profitability. In conclusion, the Maryland Profit Sharing Plan is a valuable retirement savings option for businesses operating in the state. With various plan types available, employers can choose the most suitable plan that aligns with their objectives and employee demographics. The tax advantages and ability to attract and retain talented employees make this plan an attractive choice for businesses looking to reward their employees while fostering long-term loyalty.

Maryland Profit Sharing Plan

Description

How to fill out Maryland Profit Sharing Plan?

It is possible to commit hrs on-line searching for the legitimate record format that suits the state and federal needs you need. US Legal Forms provides 1000s of legitimate types that happen to be evaluated by pros. You can actually obtain or printing the Maryland Profit Sharing Plan from your services.

If you currently have a US Legal Forms bank account, it is possible to log in and click the Download key. After that, it is possible to full, edit, printing, or indication the Maryland Profit Sharing Plan. Every legitimate record format you buy is the one you have forever. To have yet another copy for any obtained kind, visit the My Forms tab and click the corresponding key.

If you use the US Legal Forms internet site the very first time, stick to the simple guidelines below:

- Initially, make sure that you have chosen the right record format for the area/town of your choosing. Browse the kind description to make sure you have selected the proper kind. If available, use the Review key to check with the record format at the same time.

- If you wish to find yet another model from the kind, use the Research discipline to obtain the format that fits your needs and needs.

- After you have located the format you desire, just click Purchase now to proceed.

- Pick the pricing program you desire, type in your accreditations, and register for your account on US Legal Forms.

- Complete the purchase. You may use your charge card or PayPal bank account to purchase the legitimate kind.

- Pick the file format from the record and obtain it in your system.

- Make adjustments in your record if required. It is possible to full, edit and indication and printing Maryland Profit Sharing Plan.

Download and printing 1000s of record templates utilizing the US Legal Forms Internet site, that provides the most important assortment of legitimate types. Use professional and status-particular templates to deal with your small business or individual demands.

Form popularity

FAQ

Retirement eligibility at age 65 with at least 10 years of service, or age 60 with at least 15 years of service at a reduced benefit. Receive service credit for unused sick leave (visit the MSRPS website for more information)

Summarized details. The change in required minimum distribution (RMD) age from IRAs and qualified employer sponsored retirement plans (QRP) such as 401(k), 403(b), and governmental 457(b). The RMD age increases to age 73 in 2023 and to age 75 in 2033. If you turn age 72 in 2023, your RMD is not due until 2024.

401(k) The key difference between a profit sharing plan and a 401(k) plan is that only employers contribute to a profit sharing plan. If employees can also make pre-tax, salary-deferred contributions, then the plan is a 401(k).

Retirement Tax Elimination Act of 2023 This bill creates a subtraction modification against the State income tax for 100% of the income received by an individual who (1) is receiving old age or survivor Social Security benefits or (2) is at least age 65 and is not employed full time.

Members with at least 10 years of eligibility service become eligible for normal service retirement at age 65.

The SECURE Act 2.0 changes the age for when savers must begin taking required minimum distributions (RMDs) from retirement plans, not once but twice. The age to start taking RMDs has now become 73, as of 2023, up from age 72. Then starting on Jan. 1, 2033, the age for beginning to take RMDs jumps to 75.

Retirement eligibility at age 65 with at least 10 years of service, or age 60 with at least 15 years of service at a reduced benefit. Receive service credit for unused sick leave (visit the MSRPS website for more information)

Maryland employers who have been in business for at least two calendar years, employ at least one person and use an automated payroll system are required to register for MarylandSaves.