Maryland Results of Voting for Directors at Three Previous Stockholders Meetings: A Comprehensive Overview In Maryland, stockholders' meetings play a crucial role in the governance and decision-making processes of companies. One important aspect of these meetings is the election of directors, which significantly impacts the direction and leadership of the organization. This detailed description aims to delve into the results of voting for directors at three previous stockholders' meetings in Maryland, highlighting key keywords related to this subject. 1. Relevant Keywords: — Maryland: The geographic jurisdiction where these stockholders' meetings and director elections take place. — Results: The outcomes of the voting process reflecting stockholders' preferences and decisions. — Voting: The method used by stockholders to select directors, either by paper ballots, proxy voting, or electronic voting systems. — Directors: The individuals elected by stockholders to serve on the company's board, responsible for overseeing strategic decisions and corporate governance. — Stockholders: The individuals or entities owning shares in the company, lending them the right to participate in decision-making through voting. — Meetings: Gatherings where stockholders come together to discuss company affairs, ask questions, and cast their votes. — Stockholders' Meetings: Formal assemblies of stockholders, typically held once a year, to elect directors, approve corporate actions, and receive financial reports. — Corporate Governance: The framework, rules, and processes that guide how companies are managed and directed, ensuring transparency and accountability. 2. Types of Maryland Results of Voting for Directors: a. High Turnout Voting Results: In some instances, stockholders' meetings witness a high level of participation through increased voter turnout. This can be an encouraging sign of stockholders' engagement, showcasing their interest in the board's composition and the company's future. The analysis of high turnout voting results explores the voting preferences and preferences of the diversified stockholder base, shedding light on possible patterns or trends. b. Proxy Voting Results: Proxy voting allows stockholders to cast their votes in absentia, empowering designated representatives (proxy holders) to vote on their behalf. Studying the proxy voting results at Maryland stockholders' meetings unveils how various stockholders entrusted their voting rights to proxies, examining their choices and their potential impact on the board composition. c. Competitive Director Elections: In some cases, the director elections at Maryland stockholders' meetings witness intense competition among eligible candidates. The competitive nature of these elections calls for an in-depth analysis of the candidates' qualifications, background, and campaign strategies, highlighting the implications of the results on the company's dynamics and direction. d. Incumbent vs. Challenger Directors Results: When stockholders' meetings feature a mix of incumbent directors seeking re-election and new candidates challenging their positions, analyzing the outcomes can reveal noteworthy insights. This analysis examines the stockholders' level of satisfaction with the existing board members and their willingness to embrace potential changes or fresh perspectives. e. Independent Director Elections: Maryland Results of voting for independent directors highlight the importance of their role, particularly in providing unbiased judgment and representing the interests of minority stockholders. Examining the outcomes of these elections illuminates the stockholders' priorities in terms of corporate governance and reinforces the principles of Independence, transparency, and accountability. In conclusion, understanding the Maryland Results of Voting for Directors at three previous stockholders' meetings involves a comprehensive analysis of various aspects, including voter turnouts, proxy voting, competitive elections, incumbent vs. challenger dynamics, and the appointment of independent directors. By examining these types of results, companies can gain valuable insights into stockholder sentiment, corporate governance priorities, and potential impacts on the organization's strategic direction.

Maryland Results of voting for directors at three previous stockholders meetings

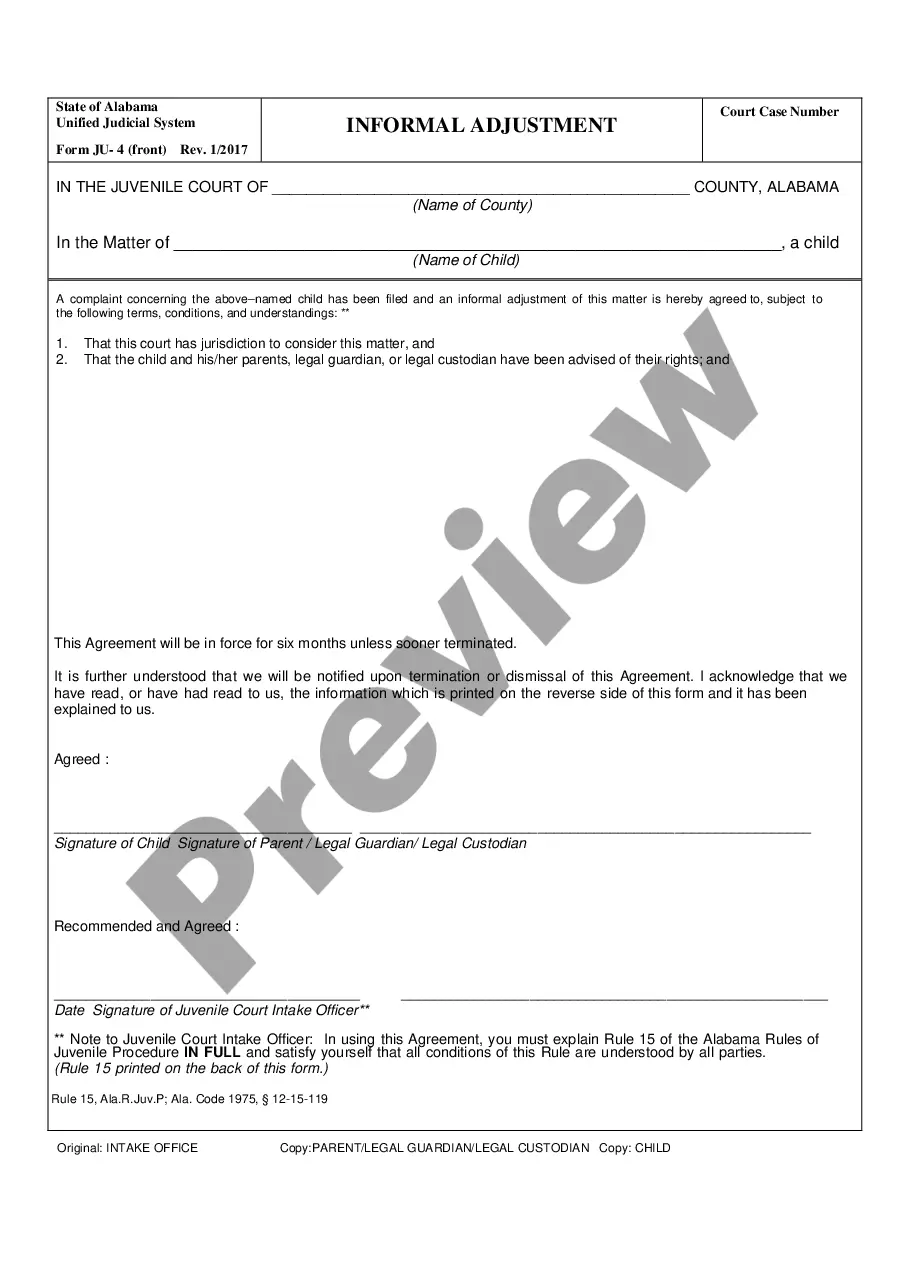

Description

How to fill out Maryland Results Of Voting For Directors At Three Previous Stockholders Meetings?

If you need to complete, download, or produce authorized document layouts, use US Legal Forms, the most important assortment of authorized types, that can be found on the web. Make use of the site`s easy and practical search to obtain the papers you will need. Different layouts for company and specific reasons are sorted by types and claims, or search phrases. Use US Legal Forms to obtain the Maryland Results of voting for directors at three previous stockholders meetings within a few mouse clicks.

In case you are presently a US Legal Forms client, log in to your accounts and click the Download option to find the Maryland Results of voting for directors at three previous stockholders meetings. Also you can gain access to types you earlier acquired inside the My Forms tab of your respective accounts.

Should you use US Legal Forms initially, follow the instructions beneath:

- Step 1. Ensure you have selected the shape for that appropriate area/nation.

- Step 2. Utilize the Preview option to check out the form`s content. Don`t overlook to read through the explanation.

- Step 3. In case you are not happy together with the develop, use the Lookup discipline towards the top of the screen to discover other models of the authorized develop template.

- Step 4. When you have discovered the shape you will need, click on the Buy now option. Select the prices strategy you prefer and add your qualifications to sign up for an accounts.

- Step 5. Procedure the deal. You can use your bank card or PayPal accounts to finish the deal.

- Step 6. Find the format of the authorized develop and download it on your system.

- Step 7. Total, revise and produce or indicator the Maryland Results of voting for directors at three previous stockholders meetings.

Each authorized document template you purchase is yours forever. You might have acces to each and every develop you acquired inside your acccount. Go through the My Forms area and select a develop to produce or download again.

Contend and download, and produce the Maryland Results of voting for directors at three previous stockholders meetings with US Legal Forms. There are millions of specialist and condition-distinct types you can use to your company or specific requires.

Form popularity

FAQ

As long as you own at least one share of the company's stock, you are eligible to attend and vote. If you own shares through a brokerage account, you'll likely receive information about the meeting from your broker.

Voting Rights of Common Stock Ownership Some companies grant stockholders one vote per share, thus giving those shareholders with a greater investment in the company a greater say in corporate decision-making. Alternatively, each shareholder may have one vote, regardless of how many shares of company stock they own.

Shareholders typically vote for the board of directors at the annual meeting of shareholders. In most cases, shareholders can vote in person at the meeting or by proxy, which allows them to appoint someone else to vote on their behalf. Some companies may also allow shareholders to vote by mail or online.

Shareholders are able to both enter into an agency agreement to support the lodgment of a resolution as well as cast their vote in respect to the resolution at a company AGM. If you can't attend a company AGM you may choose to appoint a proxy to attend and vote on your behalf.

Registered Shareholders: Shareholders who own shares directly in their names and are listed as the owner in the company's register of shareholders have the right to participate in the annual meeting and vote.

Shareholder have the right to vote on corporate actions, policies, board members, and other issues, often at the company's annual shareholder meeting.

If clear terms are available, it is possible to remove any shareholder. While a shareholder agreement cannot resolve an entrenched deadlock, it can be a valuable tool in helping to shift focus and resolve conflict.

Cumulative voting is a type of voting system that helps strengthen the ability of minority shareholders to elect a director. This method allows shareholders to cast all of their votes for a single nominee for the board of directors when the company has multiple openings on its board.