Maryland Directors and officers liability insurance

Description

How to fill out Directors And Officers Liability Insurance?

You can devote hrs online looking for the authorized file template which fits the state and federal demands you need. US Legal Forms offers thousands of authorized varieties that are evaluated by specialists. You can actually acquire or printing the Maryland Directors and officers liability insurance from our services.

If you already possess a US Legal Forms bank account, you may log in and then click the Down load key. Next, you may full, revise, printing, or indication the Maryland Directors and officers liability insurance. Every single authorized file template you buy is your own property for a long time. To obtain one more backup of the bought form, visit the My Forms tab and then click the corresponding key.

If you are using the US Legal Forms web site for the first time, stick to the simple recommendations below:

- Initial, make sure that you have selected the correct file template for the area/area of your liking. See the form explanation to make sure you have chosen the proper form. If available, make use of the Review key to check throughout the file template as well.

- If you want to discover one more edition in the form, make use of the Look for industry to get the template that meets your requirements and demands.

- Once you have discovered the template you want, click Acquire now to move forward.

- Find the prices strategy you want, type in your qualifications, and sign up for your account on US Legal Forms.

- Total the transaction. You can utilize your Visa or Mastercard or PayPal bank account to cover the authorized form.

- Find the structure in the file and acquire it for your system.

- Make modifications for your file if required. You can full, revise and indication and printing Maryland Directors and officers liability insurance.

Down load and printing thousands of file themes utilizing the US Legal Forms site, which offers the greatest assortment of authorized varieties. Use specialist and condition-certain themes to handle your organization or personal requires.

Form popularity

FAQ

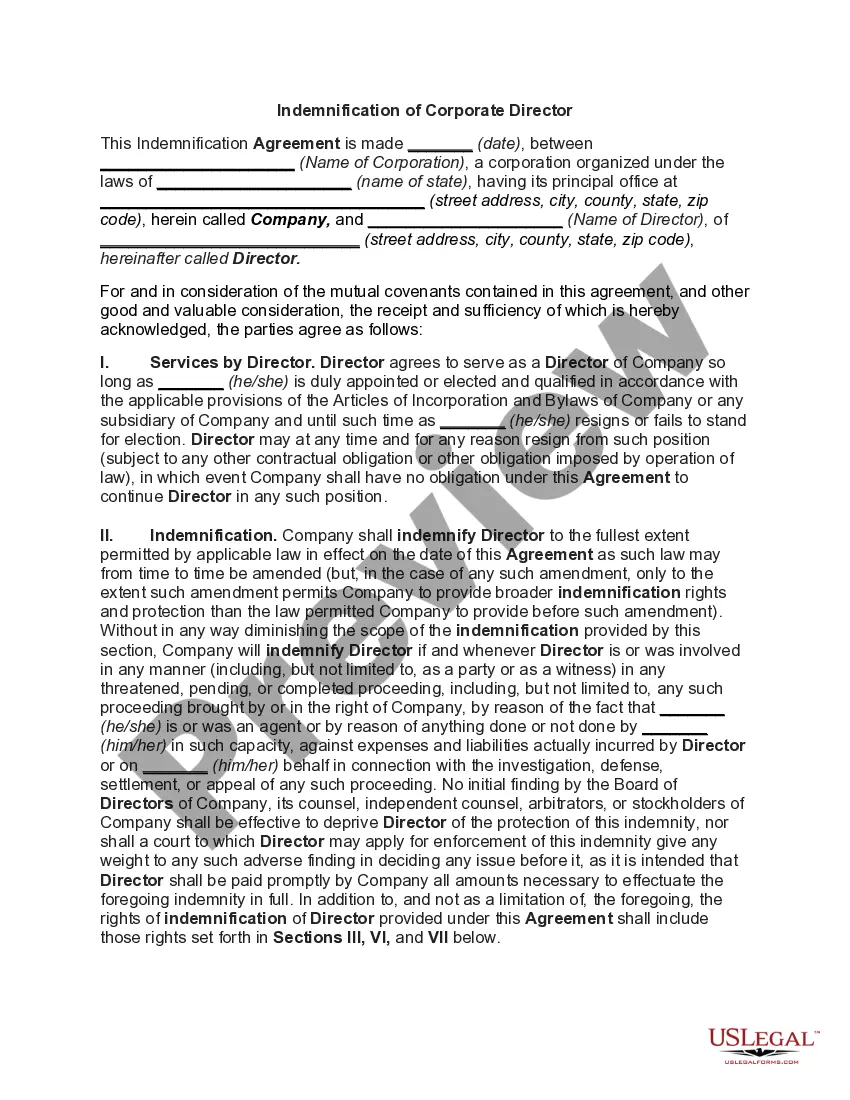

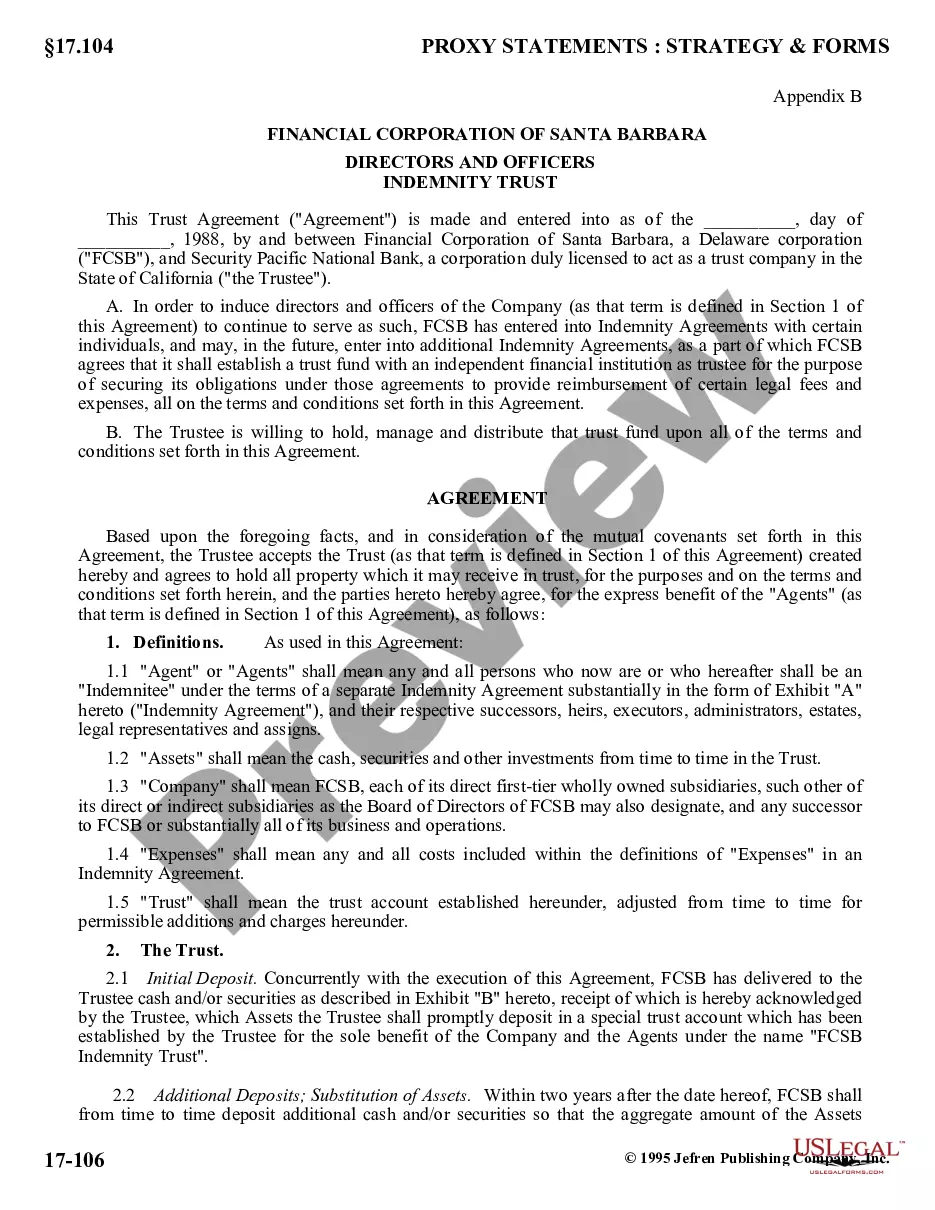

Is directors' and officers' insurance the same as a fidelity bond? No, they are not the same thing. D&O insurance will cover claims made against directors and officers of a company for acts such as neglect, breach of trust, making misleading statements or breach of duty.

Directors and officers (D&O) liability insurance protects the personal assets of corporate directors and officers, and their spouses, in the event they are personally sued by employees, vendors, competitors, investors, customers, or other parties, for actual or alleged wrongful acts in managing a company.

Liability under federal securities laws In publicly traded corporations, officers and directors are also subject to liability for violations of the extensive anti-fraud and disclosure requirements of the federal securities laws ? particularly the Securities Act of 1933 and the Securities Exchange Act of 1934.

Directors & Officers (D&O) Liability insurance is designed to protect the people who serve as directors or officers of a company from personal losses if they are sued by the organization's employees, vendors, customers or other parties.

However, D&O is a product designed to protect the personal assets of company directors and officers in the event they were sued while acting in their capacity as a director or officer. Management liability protects the company as well as its directors and officers against legal liabilities and statutory obligations.

D&O insurance typically covers legal fees, settlements, and financial losses when the insured is held liable. Common allegations covered include breaches of fiduciary duty, failure to comply with regulations, lack of corporate governance, creditor claims, and reporting errors.