Maryland Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement

Description

How to fill out Disclosure Of Distribution Agreement, Services Agreement And Tax Sharing Agreement?

Are you presently in the placement in which you need paperwork for sometimes company or individual reasons almost every day? There are a variety of authorized record web templates available on the Internet, but locating versions you can trust is not effortless. US Legal Forms delivers a huge number of develop web templates, like the Maryland Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement, that happen to be published to fulfill state and federal specifications.

In case you are currently familiar with US Legal Forms web site and also have an account, merely log in. Next, you may obtain the Maryland Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement template.

If you do not come with an bank account and want to begin using US Legal Forms, follow these steps:

- Find the develop you require and ensure it is for the right city/region.

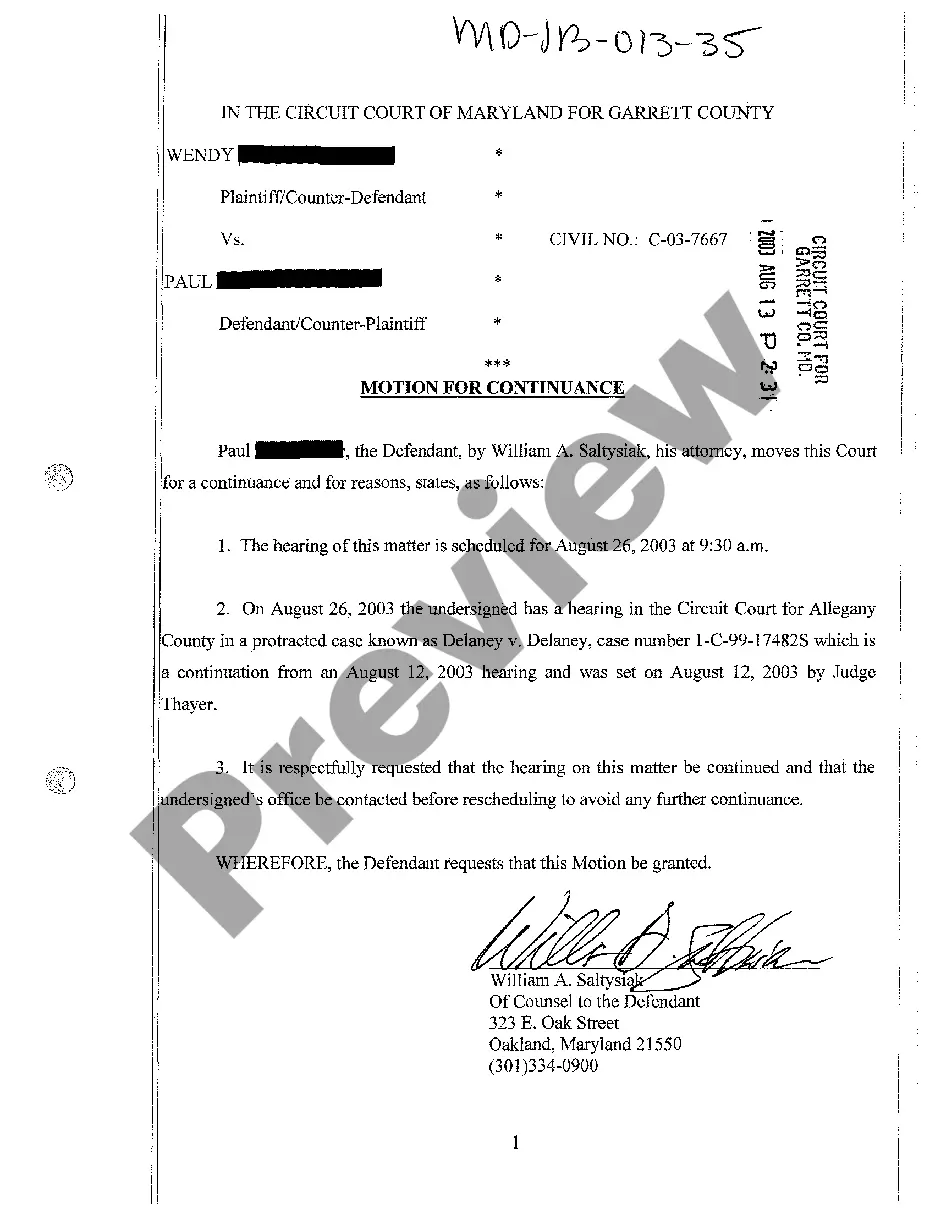

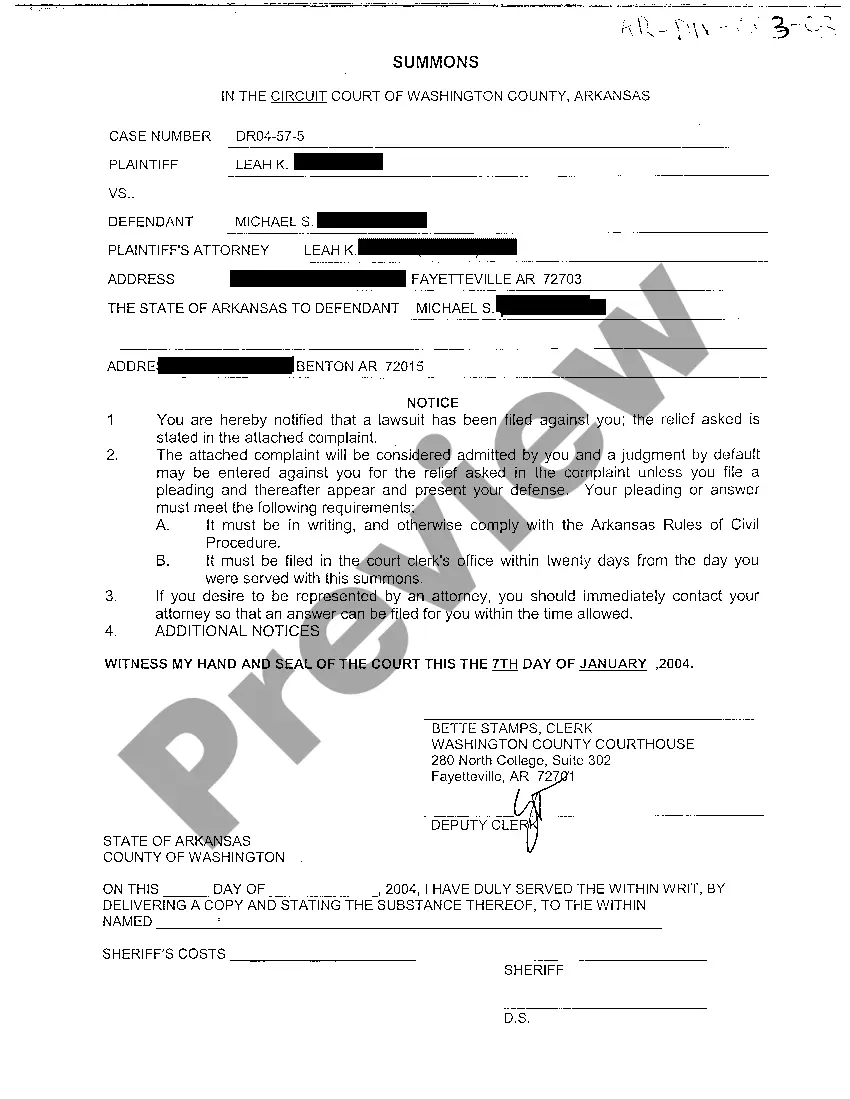

- Make use of the Review option to review the shape.

- See the outline to ensure that you have chosen the right develop.

- When the develop is not what you are looking for, make use of the Research discipline to get the develop that suits you and specifications.

- If you obtain the right develop, just click Acquire now.

- Select the costs program you desire, complete the specified information and facts to make your account, and pay for the order utilizing your PayPal or bank card.

- Decide on a convenient file format and obtain your version.

Get each of the record web templates you have bought in the My Forms food list. You can get a extra version of Maryland Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement at any time, if necessary. Just go through the required develop to obtain or printing the record template.

Use US Legal Forms, one of the most extensive selection of authorized types, in order to save time as well as steer clear of faults. The assistance delivers skillfully made authorized record web templates that can be used for a selection of reasons. Create an account on US Legal Forms and start creating your way of life a little easier.

Form popularity

FAQ

An important difference between a distribution agreement and a purchase agreement is that the purpose of the purchase agreement is to transfer ownership of a product, while the distribution agreement is aimed at a long-term collaboration between the parties to resell the products.

Typical elements of a distributor agreement The basic elements of a distribution agreement include the term (time period for which the contract is in effect), terms and conditions of supply and the sales territories covered by the agreement (regions within the U.S. and/or international markets).

What to include in your distribution agreement Duration of the contract (when it starts and when it ends) The supplier's products in question & how much they will cost the distributor. Relevant duties and responsibilities of either party. Minimum sales or quantity of goods. Whether or not the contract is exclusive.

Under the statute, a consolidated group can elect one of three main methods for allocating the group's tax liability for calculating the E&P of each member ? (1) based on the ratio of separate company taxable income to consolidated taxable income, (2) based on the percentage of total tax of the member versus all ...

Tax Sharing and Allocation Agreements are contracts that describe and coordinate the allocation of tax responsibility and benefits among the named parties for a particular transaction or for a specific taxable period. Depending on the context, they may be called different names.

Broadly, tax sharing agreements: prevent joint and several liability arising by ?reasonably? allocating the group's income tax liability to group members.

Advantages of Filing a Consolidated Tax Return The deferment of taxable losses or taxable sales becomes realized with the ultimate sale to a third party. Capital losses and gains can also be spread out across affiliates. The income associated with one affiliated corporation can also be used to offset any losses.

The agreement calculates and allocates the tax consequences attributable to a specific member or group that are reported in a consolidated return. A TSA happens when two or more corporations are consolidated or combined into a single tax filing.