Maryland Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company

Description

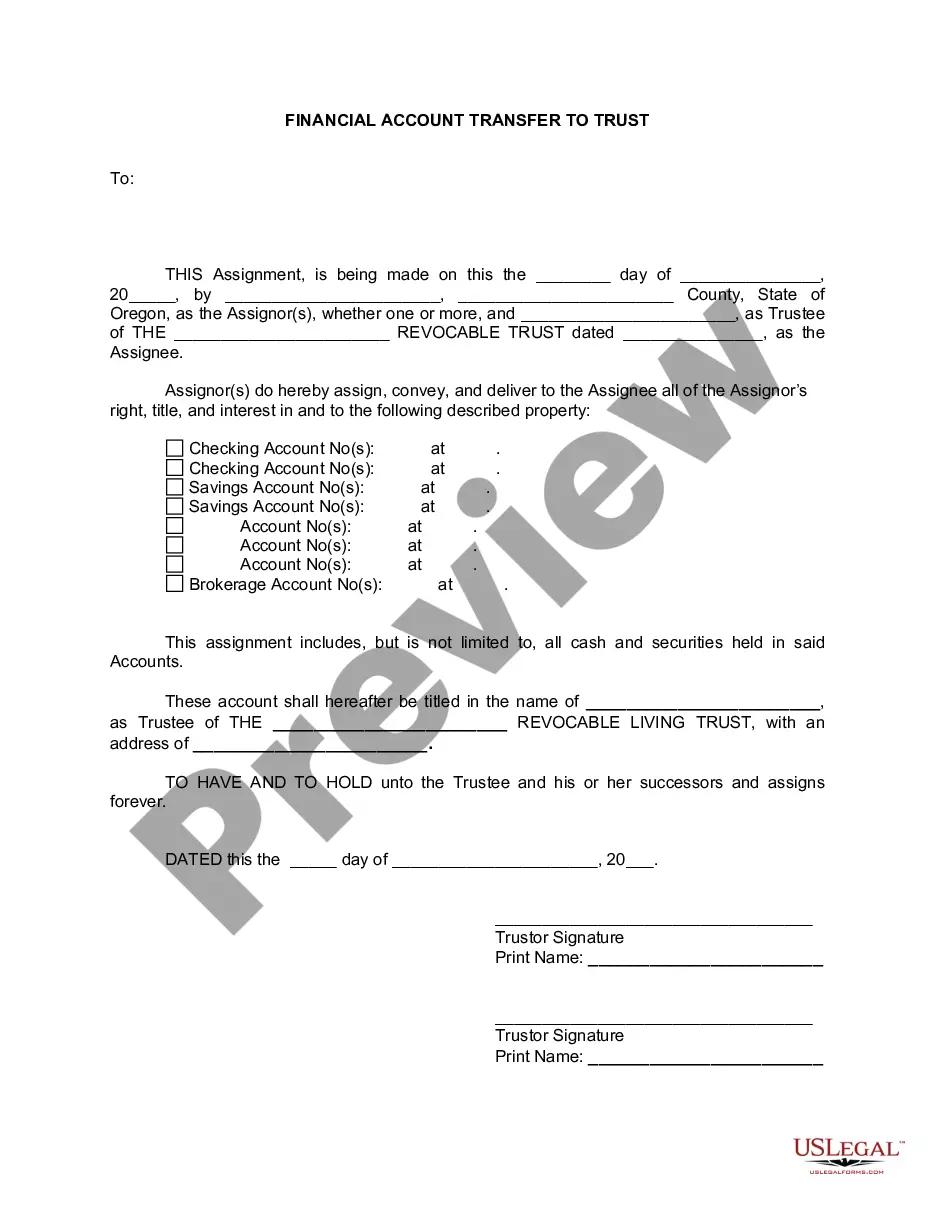

How to fill out Standstill Agreement Of Grossmans, Inc. - Internal Agreement Regarding Shareholders Of Single Company?

Finding the right legitimate record design can be quite a battle. Of course, there are tons of templates accessible on the Internet, but how will you get the legitimate form you will need? Make use of the US Legal Forms website. The service delivers a huge number of templates, like the Maryland Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company, that you can use for business and private demands. All the forms are inspected by specialists and meet federal and state needs.

In case you are already authorized, log in to the account and click the Download key to find the Maryland Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company. Make use of account to check with the legitimate forms you might have ordered previously. Visit the My Forms tab of your account and have another version of your record you will need.

In case you are a fresh consumer of US Legal Forms, listed here are basic recommendations that you can stick to:

- Very first, make certain you have selected the correct form for your town/area. You may check out the form making use of the Preview key and read the form information to guarantee this is the best for you.

- When the form is not going to meet your preferences, use the Seach discipline to discover the appropriate form.

- When you are positive that the form is proper, click on the Acquire now key to find the form.

- Choose the costs plan you want and enter in the essential information and facts. Design your account and purchase the transaction using your PayPal account or credit card.

- Choose the file format and acquire the legitimate record design to the device.

- Complete, edit and produce and indication the attained Maryland Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company.

US Legal Forms will be the largest collection of legitimate forms that you can find a variety of record templates. Make use of the service to acquire expertly-made documents that stick to status needs.

Form popularity

FAQ

A standstill agreement prevents a party from issuing proceedings during the currency of that agreement. As such a standstill agreement is a voluntary contractual arrangement between the parties to pause limitation for an agreed length of time (typically 3-6 months).

Standstill agreements to extend or suspend a limitation period have become a regular feature of civil litigation. They enable the parties to focus on the pre-action protocol requirements without worrying about limitation. They can also save the cost of the court issue fee if the dispute settles pre-action.

A standstill agreement is a contract that contains provisions that govern how a bidder of a company can purchase, dispose of, or vote stock of the target company. A standstill agreement can effectively stall or stop the process of a hostile takeover if the parties cannot negotiate a friendly deal.

A standstill agreement prevents a party from issuing proceedings during the currency of that agreement. As such a standstill agreement is a voluntary contractual arrangement between the parties to pause limitation for an agreed length of time (typically 3-6 months).