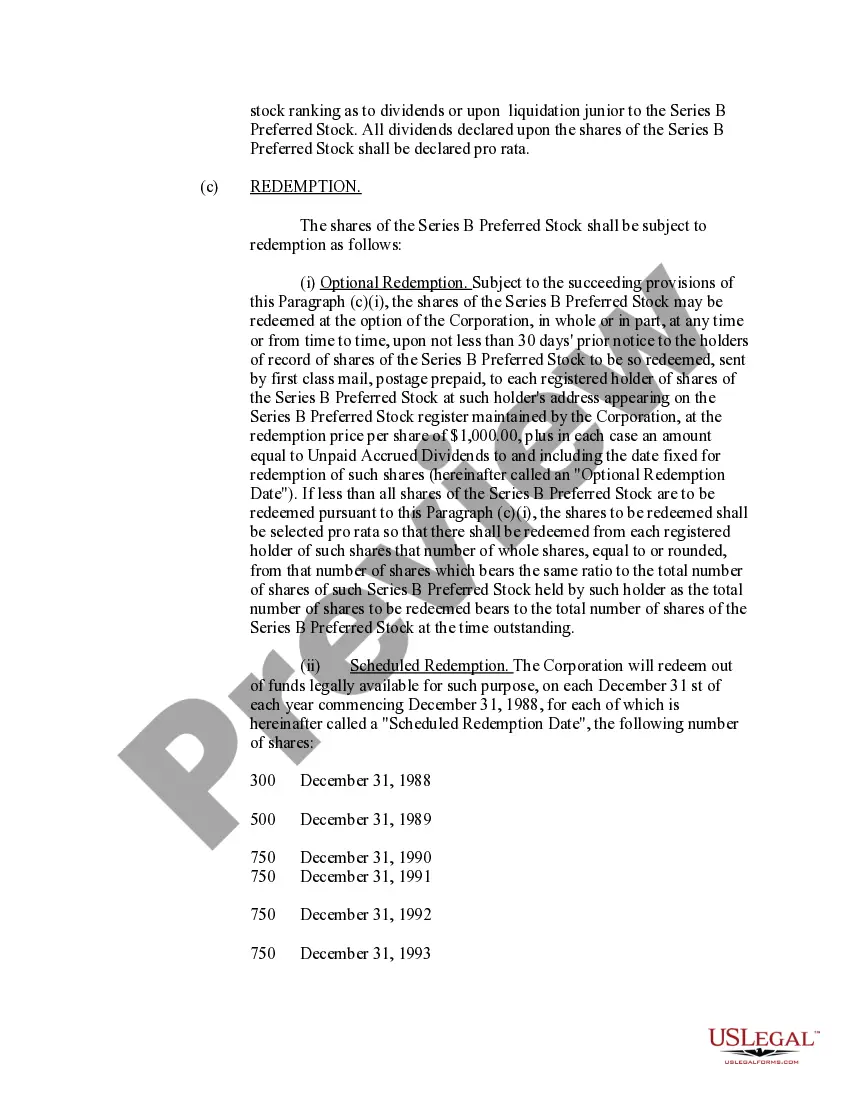

Maryland Amended and Restated Certificate of Incorporation of CMI Corporation

Description

How to fill out Amended And Restated Certificate Of Incorporation Of CMI Corporation?

Are you within a placement the place you need to have documents for either enterprise or individual purposes virtually every day? There are tons of lawful papers layouts available online, but getting types you can trust is not straightforward. US Legal Forms provides thousands of form layouts, much like the Maryland Amended and Restated Certificate of Incorporation of CMI Corporation, which are composed in order to meet state and federal specifications.

Should you be previously acquainted with US Legal Forms site and have an account, merely log in. Afterward, it is possible to acquire the Maryland Amended and Restated Certificate of Incorporation of CMI Corporation web template.

Should you not provide an profile and would like to begin using US Legal Forms, adopt these measures:

- Obtain the form you want and make sure it is for that proper city/area.

- Use the Preview switch to examine the shape.

- Read the explanation to actually have chosen the appropriate form.

- If the form is not what you`re searching for, use the Search discipline to obtain the form that meets your needs and specifications.

- If you get the proper form, click on Acquire now.

- Pick the prices program you desire, submit the required information to create your account, and buy the transaction with your PayPal or Visa or Mastercard.

- Pick a practical file formatting and acquire your duplicate.

Discover each of the papers layouts you have purchased in the My Forms food list. You can get a more duplicate of Maryland Amended and Restated Certificate of Incorporation of CMI Corporation at any time, if possible. Just click the necessary form to acquire or produce the papers web template.

Use US Legal Forms, by far the most extensive variety of lawful forms, in order to save time as well as avoid mistakes. The services provides skillfully made lawful papers layouts which can be used for an array of purposes. Generate an account on US Legal Forms and initiate making your daily life easier.

Form popularity

FAQ

To amend your Maryland corporations charter, just file Articles of Amendment by mail or in person with the Maryland State Department of Assessments and Taxation (SDAT).

To transfer ownership of a Maryland LLC to someone else, you must first file articles of dissolution or amendment with the Maryland Department of Assessments and Taxation. Additionally, any other specific provisions or requirements in the LLC's operating agreement must be followed.

How to Amend Articles of Incorporation Review the bylaws of the corporation. ... A board of directors meeting must be scheduled. ... Write the proposed changes. ... Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.

To amend your Maryland corporations charter, just file Articles of Amendment by mail or in person with the Maryland State Department of Assessments and Taxation (SDAT).

You must first make sure the name you want is available. Then, you need to amend your business's formation documents by filing an Amendment to your Articles of Formation for your LLC or an Amendment to your Articles of Incorporation for your Corporation with the Maryland Secretary of State.

How Do I File Maryland Articles of Incorporation? Create a Maryland Business Express Account. In the portal, select ?Register Your Business? and ?Create Account.? Enter your name, phone number and email, and choose a username and password. ... Answer Questions About Your Company. ... Pay the Fee.