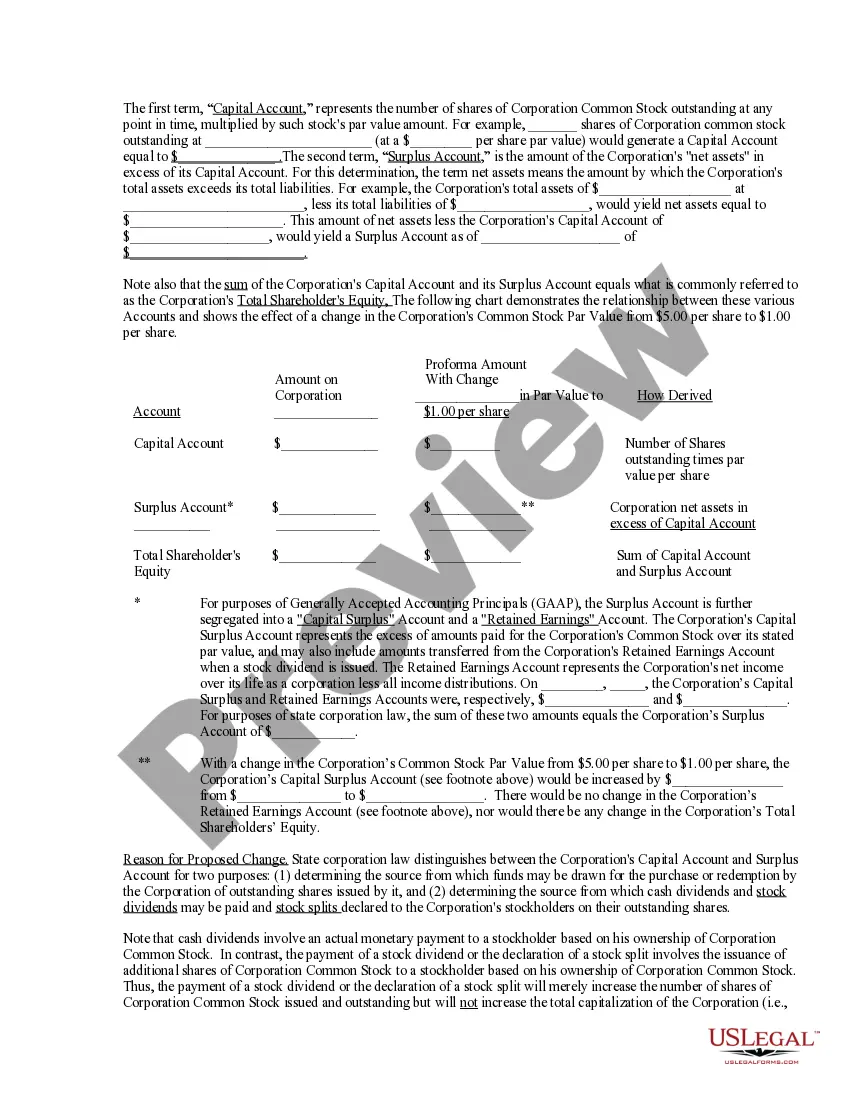

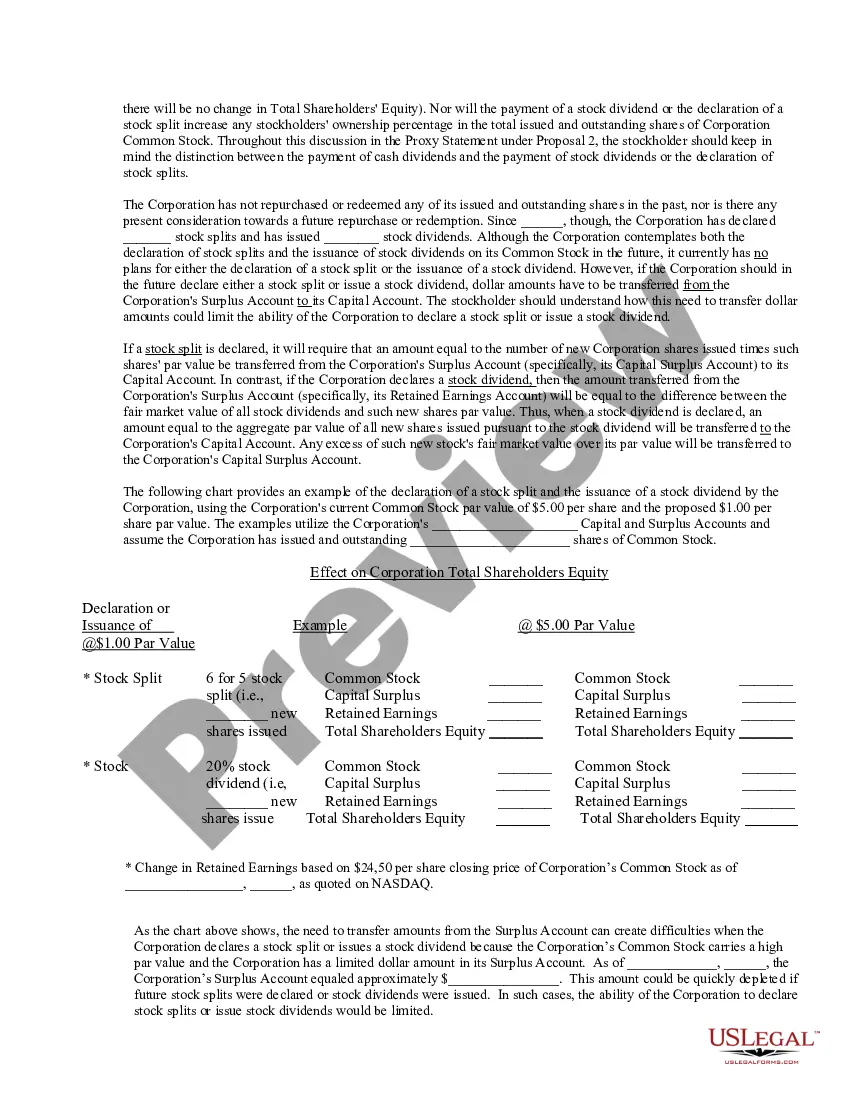

Maryland Amendment of Common Stock Par Value: A Comprehensive Overview In Maryland, the Amendment of Common Stock Par Value refers to the process by which a company incorporated in the state decides to change the par value of its common stock. Par value represents the nominal value assigned to each share of stock by the company at the time of incorporation. It serves as a reference point for determining the financial rights and obligations of shareholders. The decision to amend the par value of common stock is crucial for various reasons. It allows companies to adjust the financial structure of their shares, potentially facilitating capital-raising activities or corporate restructuring. However, it is important to note that the par value of common stock is distinct from its market value, which is determined by the forces of supply and demand. The Maryland Amendment of Common Stock Par Value involves a formal procedure that must adhere to the provisions outlined in the Maryland General Corporation Law (MCL) and the company's articles of incorporation. To initiate this amendment, the company's board of directors typically drafts a resolution stating the proposed changes and the rationale behind them. Once the board of directors approves the resolution, it must be presented to the company's shareholders for their consent. The proposed amendment is typically included in the agenda of an Annual General Meeting (AGM) or a special shareholders' meeting. Shareholders have the opportunity to discuss and vote on the proposed changes. The specific voting requirements may vary depending on the company's articles of incorporation. If the shareholders approve the amendment, the next step involves filing the necessary paperwork with the Maryland State Department of Assessments and Taxation (SEAT) and paying any applicable filing fees. The filing typically includes the amended articles of incorporation or a certificate of amendment, which must detail the changes made to the common stock's par value. It is important to note that there are no specific types of Maryland Amendments of Common Stock Par Value. However, companies may opt for different kinds of changes to their par value, such as: 1. Increase in Par Value: This type of amendment raises the nominal value assigned to each share of common stock. It can potentially increase the company's financial standing and create a perception of higher value among investors. 2. Decrease in Par Value: This type of amendment reduces the nominal value assigned to each share of common stock. It may be beneficial in scenarios where companies want to make their shares more affordable or align with market trends. 3. Elimination of Par Value: In some cases, companies may choose to eliminate the par value of their common stock altogether. This amendment allows for greater flexibility in determining the value of shares, as they are no longer bound by a fixed nominal value. In conclusion, the Maryland Amendment of Common Stock Par Value is a significant process that allows companies in the state to modify the nominal value assigned to their common stock. It involves adhering to the legal requirements outlined in the MCL, obtaining shareholder consent, and filing the necessary paperwork with the SEAT. By understanding the different types of amendments, companies can make informed decisions regarding their capital structure and financial goals.

Maryland Amendment of common stock par value

Description

How to fill out Maryland Amendment Of Common Stock Par Value?

Discovering the right authorized papers web template can be quite a struggle. Obviously, there are tons of templates available on the net, but how will you get the authorized form you need? Take advantage of the US Legal Forms website. The support provides 1000s of templates, including the Maryland Amendment of common stock par value, which can be used for business and private requires. Each of the forms are examined by professionals and satisfy federal and state requirements.

Should you be already listed, log in to the profile and click on the Obtain button to find the Maryland Amendment of common stock par value. Utilize your profile to look through the authorized forms you possess acquired formerly. Proceed to the My Forms tab of your respective profile and obtain an additional copy from the papers you need.

Should you be a brand new end user of US Legal Forms, here are simple directions so that you can follow:

- First, ensure you have selected the right form for the metropolis/region. You can examine the shape making use of the Preview button and look at the shape outline to make sure this is basically the best for you.

- In case the form is not going to satisfy your expectations, use the Seach area to discover the proper form.

- Once you are sure that the shape would work, click on the Get now button to find the form.

- Pick the rates program you want and type in the needed info. Make your profile and buy your order using your PayPal profile or Visa or Mastercard.

- Pick the submit file format and obtain the authorized papers web template to the system.

- Total, edit and produce and signal the acquired Maryland Amendment of common stock par value.

US Legal Forms is definitely the greatest catalogue of authorized forms in which you can find various papers templates. Take advantage of the company to obtain skillfully-created paperwork that follow state requirements.