Maryland Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus

Description

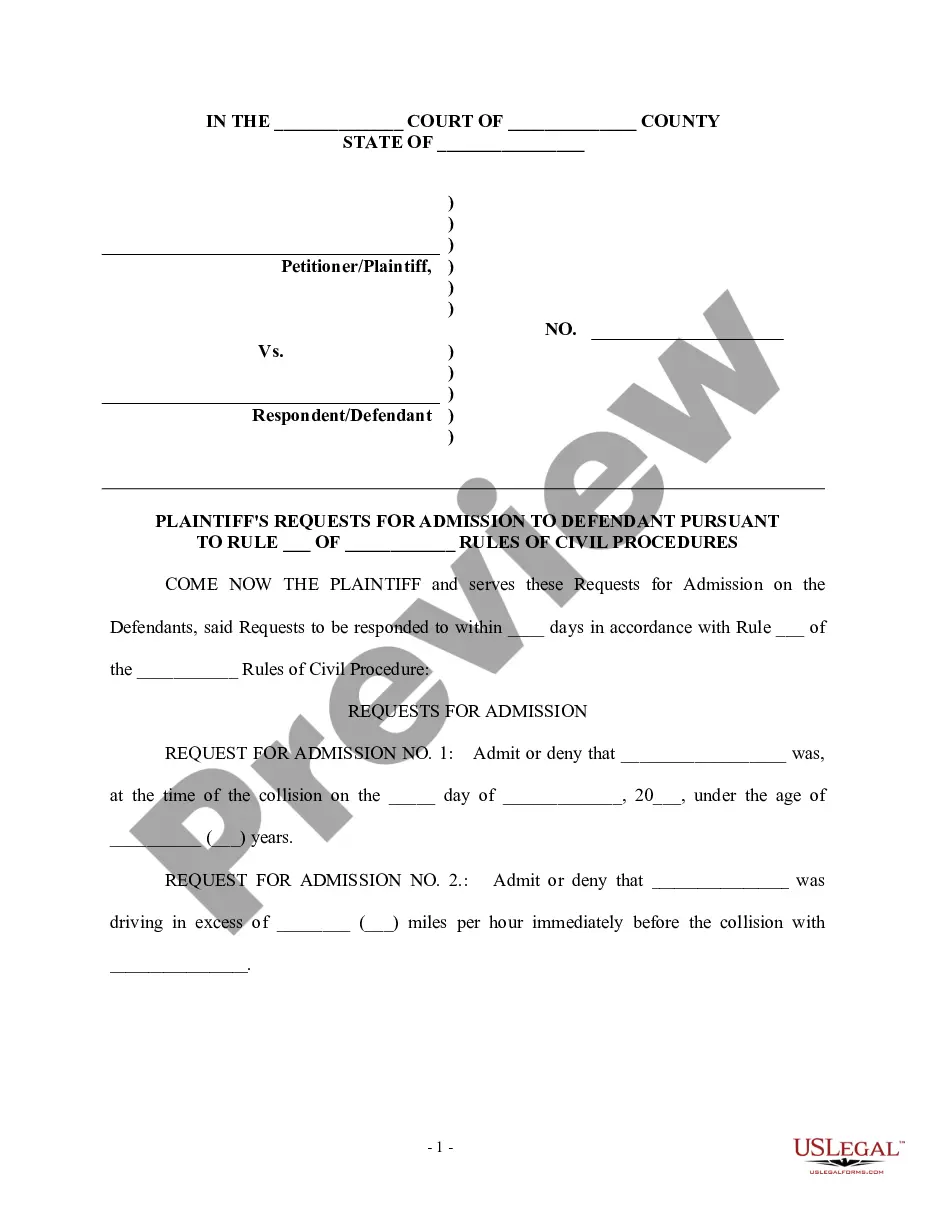

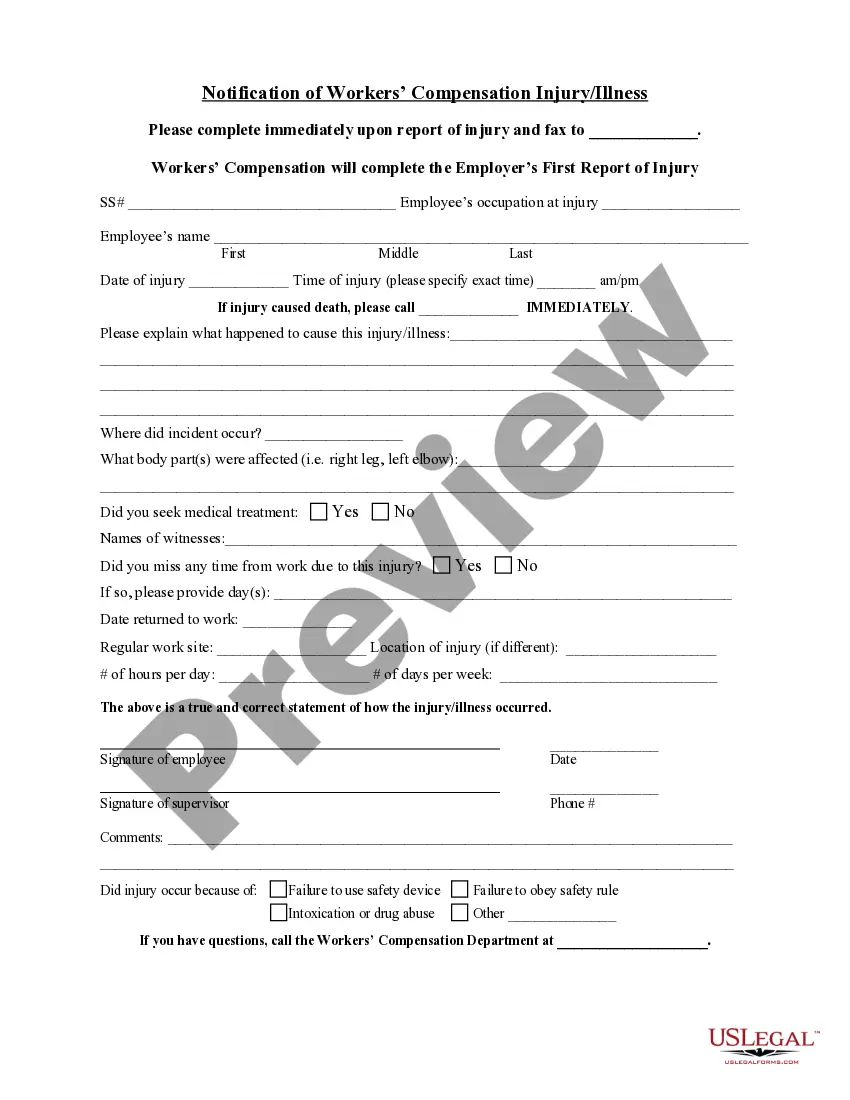

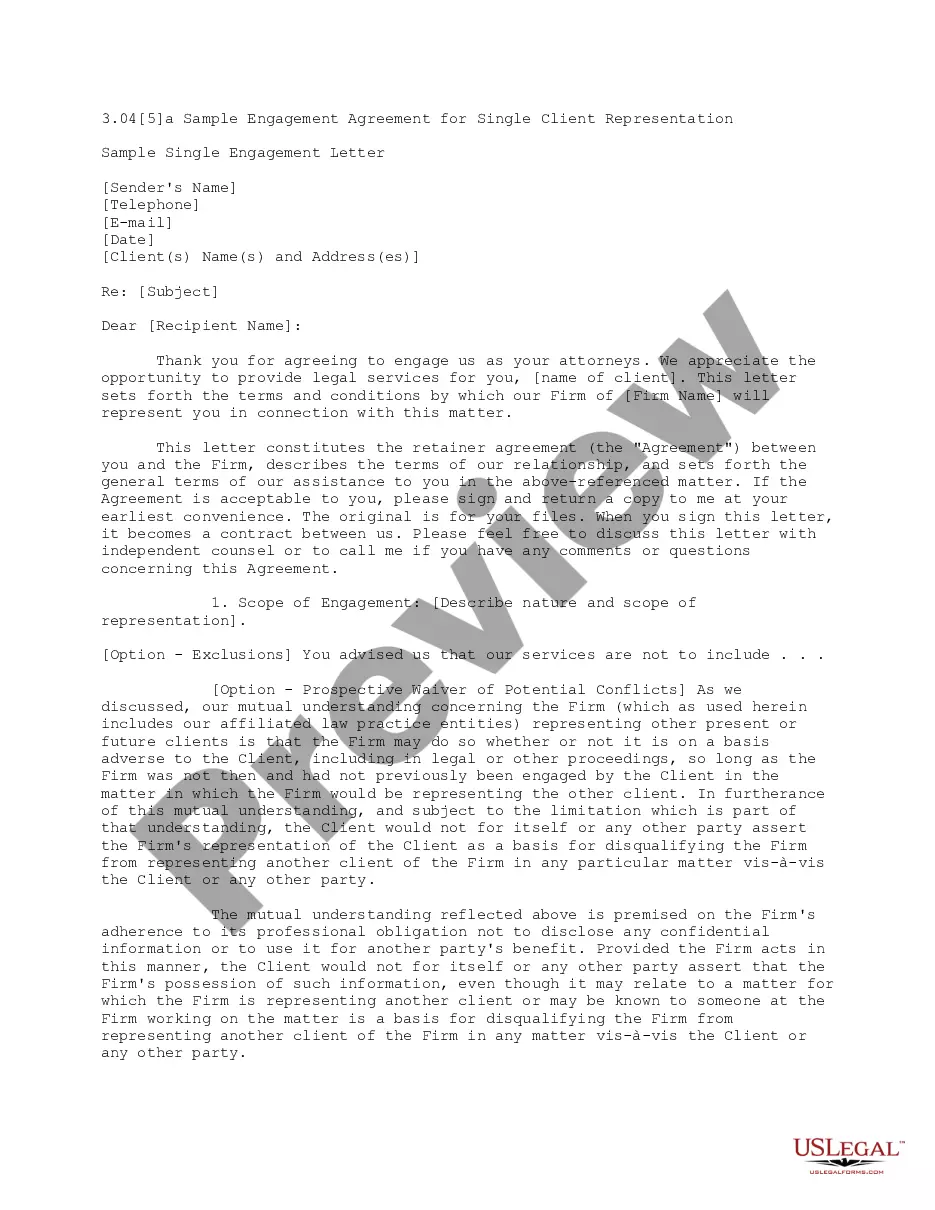

How to fill out Approval Of Amendment To Articles Of Incorporation To Permit Certain Uses Of Distributions From Capital Surplus?

If you wish to comprehensive, acquire, or printing lawful file templates, use US Legal Forms, the greatest selection of lawful types, that can be found on the web. Utilize the site`s basic and hassle-free search to discover the papers you require. A variety of templates for organization and personal reasons are categorized by types and claims, or key phrases. Use US Legal Forms to discover the Maryland Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus within a couple of clicks.

If you are previously a US Legal Forms buyer, log in in your account and click on the Obtain option to find the Maryland Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus. You can also access types you formerly acquired inside the My Forms tab of your account.

If you work with US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Ensure you have selected the shape to the appropriate town/land.

- Step 2. Take advantage of the Preview solution to examine the form`s information. Don`t forget to see the information.

- Step 3. If you are not satisfied using the form, make use of the Lookup discipline near the top of the monitor to discover other versions in the lawful form web template.

- Step 4. When you have found the shape you require, click the Buy now option. Select the costs program you favor and include your credentials to sign up for the account.

- Step 5. Process the purchase. You can utilize your credit card or PayPal account to complete the purchase.

- Step 6. Find the format in the lawful form and acquire it on the gadget.

- Step 7. Comprehensive, change and printing or sign the Maryland Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus.

Each lawful file web template you get is your own for a long time. You might have acces to every form you acquired with your acccount. Go through the My Forms area and pick a form to printing or acquire yet again.

Contend and acquire, and printing the Maryland Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus with US Legal Forms. There are thousands of skilled and express-particular types you may use for your personal organization or personal needs.

Form popularity

FAQ

What must be included in the articles of incorporation? the corporation's name and business address. the number of authorized shares and the par value (if any) of the shares. the name and address of the in-state registered agent. the names and addresses of its incorporators.

Incorporation involves drafting "articles of incorporation," which lists the primary purpose of the business and its location, along with the number of shares and class of stock being issued if any. A closed corporation, for instance, would not issue stock. Companies are owned by their shareholders.

Articles of incorporation are the legal documents that a corporation files to establish itself as a legal business organization. These documents are important because they provide legal recognition, tax advantages, the ability to issue stock and reduced owner liability.

An amendment to your corporation's Articles of Incorporation is filed when you need to update, add to, or otherwise change the original content of your articles. Amendments are important corporate filings as they are required to modify essential corporate information, such as changes to stock information.

The names and addresses of the incorporators are not included in the Articles of Incorporation. One or more persons may form a corporation.

Articles of Incorporation refers to the highest governing document in a corporation. It is also known known as the corporate charter. The Articles of Incorporation generally include the purpose of the corporation, the type and number of shares, and the process of electing a board of directors.

You must first make sure the name you want is available. Then, you need to amend your business's formation documents by filing an Amendment to your Articles of Formation for your LLC or an Amendment to your Articles of Incorporation for your Corporation with the Maryland Secretary of State.

To amend your Maryland corporations charter, just file Articles of Amendment by mail or in person with the Maryland State Department of Assessments and Taxation (SDAT).