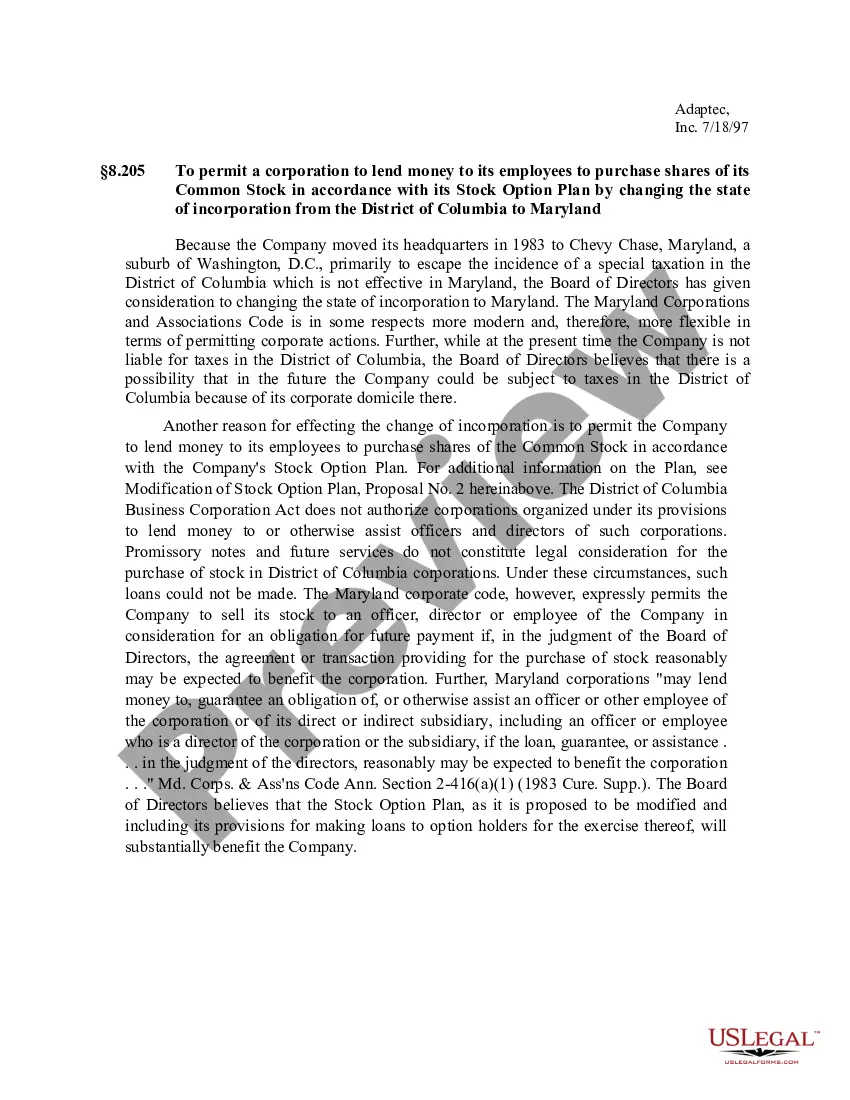

Maryland Changing state of incorporation

Description

How to fill out Changing State Of Incorporation?

US Legal Forms - among the greatest libraries of legitimate forms in the States - offers a wide array of legitimate papers layouts you may obtain or printing. While using web site, you can get a large number of forms for company and person uses, categorized by types, says, or keywords and phrases.You will find the most up-to-date variations of forms much like the Maryland Changing state of incorporation in seconds.

If you already have a registration, log in and obtain Maryland Changing state of incorporation in the US Legal Forms library. The Obtain switch will show up on each and every form you view. You have accessibility to all formerly delivered electronically forms inside the My Forms tab of the bank account.

In order to use US Legal Forms for the first time, here are simple recommendations to help you get started out:

- Be sure you have chosen the best form to your town/state. Click on the Review switch to examine the form`s content material. Read the form explanation to ensure that you have selected the appropriate form.

- In the event the form does not fit your demands, take advantage of the Research area on top of the screen to obtain the the one that does.

- When you are satisfied with the shape, confirm your choice by clicking on the Buy now switch. Then, pick the pricing prepare you favor and supply your accreditations to sign up for the bank account.

- Method the purchase. Utilize your charge card or PayPal bank account to accomplish the purchase.

- Choose the file format and obtain the shape in your product.

- Make alterations. Fill out, revise and printing and indication the delivered electronically Maryland Changing state of incorporation.

Every format you put into your account does not have an expiry time and is also the one you have permanently. So, in order to obtain or printing yet another duplicate, just go to the My Forms area and click in the form you want.

Gain access to the Maryland Changing state of incorporation with US Legal Forms, by far the most comprehensive library of legitimate papers layouts. Use a large number of expert and condition-certain layouts that meet up with your company or person needs and demands.

Form popularity

FAQ

File form to apply for S corp status The IRS requires that you complete and file your Form 2553: Within 75 days of the formation of your LLC or C corporation, or no more than 75 days after the beginning of the tax year in which the election is to take effect.

You can use Form 109-I to notify the Comptroller of Maryland that you have changed your home mailing address.

You can use Form 109-B to notify the Comptroller of Maryland that you have changed your business mailing address. If you have changed both your home and business mailing addresses, submit Form 109-B along with Form 109-I. Note: this form will only change/update your physical address and mailing address in our system.

Maryland State S Corporation, Partnership Corporation, and Limited Liability Companies should not file a corporation income tax return. These businesses must file as pass-through entities using Form 510 Maryland Pass-Through Entity Income Tax Return.

To change your resident agent in Maryland, you must complete and file a Change Resident Agent form with the Maryland State Department of Assessments and Taxation (SDAT), Charter Division.

To transfer ownership of a Maryland LLC to someone else, you must first file articles of dissolution or amendment with the Maryland Department of Assessments and Taxation. Additionally, any other specific provisions or requirements in the LLC's operating agreement must be followed.

You must first make sure the name you want is available. Then, you need to amend your business's formation documents by filing an Amendment to your Articles of Formation for your LLC or an Amendment to your Articles of Incorporation for your Corporation with the Maryland Secretary of State.

To amend your Maryland corporations charter, just file Articles of Amendment by mail or in person with the Maryland State Department of Assessments and Taxation (SDAT).